-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Retail Sales & UoM Inflation Exp. Next Yardsticks For Fed

EXECUTIVE SUMMARY

- WALLER BACKS 75 BASIS-POINT HIKE; BIGGER FED MOVE HANGS ON DATA (BBG)

- ST. LOUIS FED PRESIDENT FAVORS 75 BASIS POINT RATE HIKE (NIKKEI)

- FED’S COLLINS SAYS ADDRESSING TOO-HIGH INFLATION IS KEY PRIORITY

- FOCUS TURNS TO TV DEBATES IN RACE TO SUCCEED UK’S BORIS JOHNSON (BBG)

- ITALIAN PRESIDENT ASKS DRAGHI TO STAY IN BID TO AVERT CRISIS (BBG)

- CHINA Q2 GDP MISSES EXPECTATIONS, ANNUAL TARGET MOVING OUT OF REACH

- SHANGHAI ADDS 30 HIGH, MID-RISK AREAS SUBJECT TO LOCKDOWN (BBG)

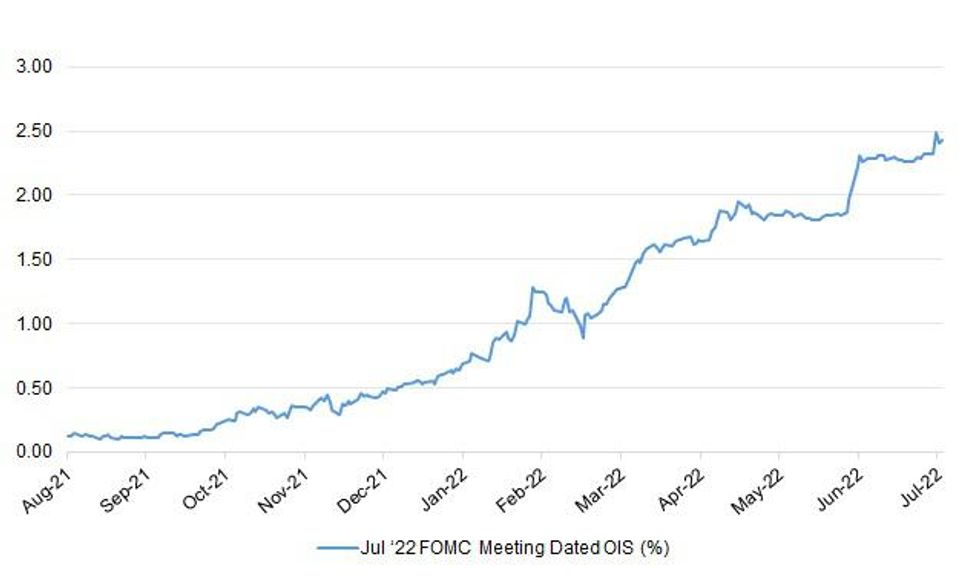

Fig. 1: Jul ‘22 FOMC Meeting Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Contenders in the race to replace Boris Johnson as Conservative leader and UK prime minister will battle it out in their first TV debate Friday, as a three-day pause in voting allows MPs to plot potential deals behind the scenes. (BBG)

POLITICS: UK Foreign Secretary Liz Truss has gained backing from Brexit negotiator David Frost and British lawmaker Suella Braverman in a race to become the next UK prime minister, British media reported on Thursday. (RTRS)

POLITICS: Boris Johnson is urging defeated Tory leadership candidates to back “anyone but Rishi”, The Times has learnt. (The Times)

EUROPE

ECB: The European Central Bank will unveil an unlimited bond-buying tool next week to help markets better adjust to steeper and faster interest-rate increases than previously thought, economists surveyed by Bloomberg say. Almost 80% predict the instrument, known as the Transmission Protection Mechanism, will carry light conditions for governments it’s used to help. Nearly all expect the liquidity its purchases create to be reabsorbed in a process called sterilization. (BBG)

FRANCE: France must quickly learn how to do without Russian gas, as Moscow is using cuts in supplies to Europe as a weapon in its war with Ukraine, French President Emmanuel Macron said on Thursday, urging everyone to rein in their energy consumption. (RTRS)

ITALY: Italian President Sergio Mattarella rejected Mario Draghi’s offer to resign as prime minister on Thursday in a bid to avert a political crisis that would unsettle financial markets and potentially lead to elections in the fall. (BBG)

ITALY: Italy’s Prime Minister Mario Draghi could address lawmakers Tuesday or Wednesday, according to a person familiar with his plans. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after-hours on Friday include:

- Fitch on Luxembourg (current rating: AAA; Outlook Stable)

- Moody’s on Spain (current rating: Baa1; Outlook Stable)

- DBRS Morningstar on Ireland (current rating: AA (low), Stable Trend

U.S.

FED: Federal Reserve Governor Christopher Waller backed raising rates by 75 basis points this month after a hot inflation report, prompting investors to pull back bets officials would hike by 100 basis points, though he said he could go bigger if warranted by the data. (BBG)

FED: St. Louis Federal Reserve president Jim Bullard says he will be in favor of raising the policy interest rate by 75 basis points at the Federal Open Market Committee (FOMC) to be held on July 26 and July 27. (Nikkei)

FED: Federal Reserve Bank of Boston President Susan Collins, in her first public remarks since taking office this month, said inflation is too high and bringing it down is a top priority for the central bank. (BBG)

FED: Controversial trading activities from Federal Reserve Chairman Jerome Powell and former Vice Chairman Richard Clarida didn’t break any rules or laws, the central bank’s Office of Inspector General ruled Thursday. (CNBC)

FED: Federal Reserve officials are worried U.S. financial conditions could tighten more quickly than expected in response to aggressive rate increases and balance sheet runoffs, potentially compromising economic expansion, former central bank officials and researchers told MNI. (MNI)

FED: The Federal Reserve will likely keep raising interest rates even if the economy slows considerably as long as headline inflation remains elevated because the risk of unanchored expectations means it can no longer look through energy price shocks, ex-Fed governor Jeremy Stein told MNI. (MNI)

FISCAL: Sen. Joe Manchin III (D-W.Va.) told Democratic leaders on Thursday he would not support legislation that contains new spending on climate change or new tax increases targeting wealthy individuals and corporations, marking a massive setback for party lawmakers who had hoped to advance a central element of their agenda before the midterm elections this fall. (The Washington Post)

OTHER

GLOBAL TRADE: Senate Majority Leader Chuck Schumer is pushing to move forward with a $52 billion bill to boost domestic semiconductor production to address the chip shortage, according to a source familiar with the matter, but key Republicans who would be needed to advance the plan are pumping the brakes. (CNN)

U.S./CHINA: Chinese Foreign Minister Wang Yi says both US and China agree that the nations’ regular communications are necessary and beneficial at the “crucial moment,” Xinhua reports, citing Wang’s comments on his meeting with US counterpart Antony Blinken during an interview. (BBG)

JAPAN: The Japanese government is considering giving households who conserve 5% of electricity usage the equivalent of 2,000 yen/month in points this winter, FNN reports, without attribution. (BBG)

AUSTRALIA/CHINA: China-Australia relations are facing both challenges and opportunities at the present, and China is willing to "recalibrate" ties in the spirit of mutual respect, said Chinese Foreign Minister Wang Yi. (RTRS)

SOUTH KOREA: South Korean President Yoon Suk-yeol said the financial risks were spreading at a “very fast pace” and called for pre-emptive measures in response, Yonhap news agency reported on Friday. (RTRS)

BOC: The Bank of Canada likely would have started raising rates sooner if it had known a year ago all the things it now knows, Governor Tiff Macklem said in a newspaper interview published on Thursday, the day after the central bank shocked markets with a rare 100-basis-point rate increase. (RTRS)

MEXICO: Non-bank lender Credito Real SAB said a Mexican court has ordered it to liquidate, and hours later filed for Chapter 15 bankruptcy in Delaware, a move that protects its US assets during the Mexican proceedings. (BBG)

BRAZIL: Brazil’s economic team is discussing proposals to change the country’s most important fiscal rule, potentially allowing the next government that takes over in January to boost spending. (BBG)

BRAZIL: Brazil may have deflation in 2023, country’s President Jair Bolsonaro said this Thursday during a ceremony to enact a bill that boost social aid. Bolsonaro said that the law that establishes a ceiling for ICMS tax on fuels and energy will impact in country’s inflation and may cause a deflation. (BBG)

RUSSIA: U.S. Treasury Secretary Janet Yellen condemned Russia's "brutal and unjust war" in Ukraine and said Russian finance officials taking part in a G20 meeting in Indonesia on Friday shared responsibility for the "horrific consequences" of the war. (RTRS)

MIDDLE EAST: Iran said on Thursday that as long as Washington's main goal was to maintain "the fake state of Israel's security," the Middle East will not achieve stability and peace, Iranian state TV quoted Foreign Ministry spokesman Nasser Kanaani as saying. (BBG)

METALS: Rio Tinto said on Friday it was facing labour shortages in the resource-rich state of Western Australia and warned that rising inflation would impact its underlying earnings in the second half. Rising COVID-19 cases at its Pilbara operations have led to "elevated levels of unplanned absences", driving a 2% drop in shipments of the steel-making commodity in the first half, the miner said. Adverse weather conditions also played spoilsport. (RTRS)

OIL: Russia’s government has made a plan to create a national oil benchmark next year, as it seeks to protect itself from efforts by the West to restrict the flow of petrodollars to the country. Key Russian ministries, domestic oil producers and the central bank plan to launch oil trading on a national platform in October, according to a document seen by Bloomberg News. (BBG)

OIL: The new head of Libya’s National Oil Corporation has promised to increase output and end the oilfield blockades that have slashed the Opec member’s exports at a time of global shortages and high prices. (FT)

OIL: Mustafa Sanalla said executives and affiliated companies of Libya’s National Oil Corporation (NOC) still recognise him as chairman after the Tripoli-based government said it had replaced him and installed a new chief in the company headquarters. (RTRS)

CHINA

YUAN: The yuan may come under certain pressure in Q3 but likely strengthen again in Q4, the Securities Daily reported citing Wang Youxin, senior researcher at Bank of China Research Institute. Stimulated by the Fed's continued sharp rate hikes, the U.S. dollar index will still be supported in Q3, but the index may turn around in Q4 amid rising risk of U.S. economic recession, the newspaper said citing Wang. Rising cross-border capital inflows due to international investors’ increased allocation of yuan assets to diversify risks, and a stable trade surplus, will support the basic stability of the yuan, the daily cited Wang as saying. (MNI)

CORONAVIRUS: Shanghai’s latest Covid-19 outbreak appears to be stabilizing, with most new cases already in government-mandated quarantine, but authorities are taking no chances, still locking down areas of the city and housing compounds as infections arise. Still, a further 30 high and mid-level risk areas were subject to lockdown from Friday, officials said. Areas can be defined as single housing compounds to a group of apartment blocks. (BBG)

EQUITIES: Foreign investment will continue to flow into the Chinese stock market as A-shares tend to lead with economic recovery into the second half of the year, the Securities Daily reported citing major foreign financial institutions. The current sentiment in the A-share market has been significantly repaired with liquidity gradually loosening, and its downside risk is less than that of other global markets, the newspaper said citing investment officers from the above institutions. China’s recovery trend is clear and Beijing may add at least CNY1.5 trillion of incremental fiscal funds in H2, either by front-loading next year’s quota of local government special bonds, or asking state-owned enterprises to hand in more profits, the newspaper said citing economists. (MNI)

CHINA MARKETS

PBOC INJECTS CNY100B MLF, CNY3B OMO, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY100 billion via one-year medium-term lending facilities and CNY3 billion via 7-day reverse repos with the rate unchanged at 2.85% and 2.10%, respectively on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY100 billion MLF and CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6645% at 9:41 am local time from the close of 1.5350% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 42 on Thursday vs 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7503 FRI VS 6.7265

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7503 on Friday, compared with 6.7265 set on Thursday.

OVERNIGHT DATA

CHINA Q2 GDP +0.4% Y/Y; MEDIAN +1.2%; Q1 +4.8%

CHINA Q2 GDP YTD +2.5% Y/Y; Q1 +4.8%

CHINA Q2 GDP SA -2.6% Q/Q; MEDIAN -2.0%; Q1 +1.3%

CHINA JUN INDUSTRIAL PRODUCTION +3.9% Y/Y; MEDIAN +4.0%; MAY +0.7%

CHINA JUN INDUSTRIAL PRODUCTION YTD +3.4% Y/Y; MEDIAN +3.5%; MAY +3.3%

CHINA JUN RETAIL SALES +3.1% Y/Y; MEDIAN +0.3%; MAY -6.7%

CHINA JUN RETAIL SALES YTD -0.7% Y/Y; MEDIAN -1.2%; MAY -1.5%

CHINA JUN FIXED ASSETS EX RURAL YTD +6.1% Y/Y; MEDIAN +6.0%; MAY +6.2%

CHINA JUN PROPERTY INVESTMENT YTD -5.4% Y/Y; MEDIAN -4.2%; MAY -4.0%

CHINA JUN RESIDENTIAL PROPERTY SALES YTD -31.8% Y/Y; MAY -34.5%

CHINA JUN SURVEYED JOBLESS RATE 5.5%; MEDIAN 5.7%; MAY 5.9%

CHINA JUN NEW HOME PRICES -0.10% M/M; MAY -0.17%

JAPAN MAY TERTIARY INDUSTRY INDEX +0.8% M/M; MEDIAN +0.5%; APR +0.7%

NEW ZEALAND JUN BUSINESSNZ M’FING PMI 49.7; MAY 52.6

The key sub index values of Production (47.8) and New Orders (47.8) both recorded the same level of contraction, which had a combined negative effect on the overall Index. As mentioned in previous months, a strong and consistent activity level for both these key sub index values will be the only way to push the PMI towards better results. Manufacturers continue to have a more negative mindset, with the June result showing 68.5% provided negative comments. While this was down from 72.7% in May and 70.3% in April, staff retention/shortages continue to plague the sector, as does supply chain issues. (BusinessNZ)

SOUTH KOREA JUN EXPORT PRICE INDEX +1.1% M/M; MAY +3.0%

SOUTH KOREA JUN EXPORT PRICE INDEX +23.7% Y/Y; MAY +23.4%

SOUTH KOREA JUN IMPORT PRICE INDEX +0.5% M/M; MAY +3.8%

SOUTH KOREA JUN IMPORT PRICE INDEX +49.7% Y/Y; MAY +52.6%

MARKETS

SNAPSHOT: Retail Sales & UoM Inflation Exp. Next Yardsticks For Fed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 149.82 points at 26795.06

- ASX 200 down 44.816 points at 6606.7

- Shanghai Comp. down 7.871 points at 3273.873

- JGB 10-Yr future down 4 ticks at 149.19, yield down 0.4bp at 0.234%

- Aussie 10-Yr future unch. at 96.55, yield up 0.2bp at 3.412%

- U.S. 10-Yr future +0-04+ at 118-20+, yield down 1.66bp at 2.943%

- WTI crude up $0.66 at $96.42, Gold down $0.05 at $1709.96

- USD/JPY up 3 pips at Y138.98

- WALLER BACKS 75 BASIS-POINT HIKE; BIGGER FED MOVE HANGS ON DATA (BBG)

- ST. LOUIS FED PRESIDENT FAVORS 75 BASIS POINT RATE HIKE (NIKKEI)

- FED’S COLLINS SAYS ADDRESSING TOO-HIGH INFLATION IS KEY PRIORITY

- FOCUS TURNS TO TV DEBATES IN RACE TO SUCCEED UK’S BORIS JOHNSON (BBG)

- ITALIAN PRESIDENT ASKS DRAGHI TO STAY IN BID TO AVERT CRISIS (BBG)

- CHINA Q2 GDP MISSES EXPECTATIONS, ANNUAL TARGET MOVING OUT OF REACH

- SHANGHAI ADDS 30 HIGH, MID-RISK AREAS SUBJECT TO LOCKDOWN (BBG)

US TSYS: A Touch Firmer In Light Overnight Trade

An early bid in Tsy futures extended on the cash Tsy re-open, with Asia-Pac participants reacting to Thursday’s unwind of some of the post-CPI Fed rate hike premium, which came as two of the more hawkish FOMC voters (Waller & Bullard) outlined their current preference for a 75bp rate hike to be deployed later this month (FOMC dated OIS pricing for the July meeting has eased back to ~83bp of tightening vs. a peak of ~93bp as a result of the comments). TYU2 last deals 0-01+ shy of session highs, +0-04+ at 118-20+, operating in an 0-09 range thus far, while cash Tsys sit 0.5-2.5bp richer across the curve, bull steepening, with the belly outperforming. Note that wider futures volumes are very limited, with TYU2 not even hitting ~35K lots of turnover.

- Soft GDP data out of China would have done the bid no harm, but there was no market reaction to the figures. The post-GDP NBS press conference saw China reaffirm the idea that its economic bounceback from May is not on firm ground, stressing that it will do what is required to make sure that the economy operates “within a reasonable range,” while being a little more explicit re: the challenges it faces (both structural & cyclical). The attainment of the country's annual GDP growth target looks to be a huge challenge at present, with wider recession worries in the U.S. & Europe, coupled with domestic property market headwinds and the country’s zero COVID strategy providing the most obvious obstacles to growth.

- Retail sales data and the inflation expectations component of the latest UoM sentiment survey will headline during NY hours (after Waller and Mester flagged those releases as potential trigger points for a larger rate hike later this month). Fedspeak from Bullard (’22 voter), Bostic (’24 voter) & Daly (’24 voter) is also scheduled, with the potential for further impromptu Fedspeak apparent ahead of the pre-FOMC blackout period, which gets underway on Saturday.

JGBS: Bull Flattening The Order Of The Day

The uptick in wider global core FI markets observed since late morning NY trade on Thursday provided some support for JGB futures during the Tokyo session, with the contract last at unchanged levels, unwinding overnight losses in what has been a fairly sedate end to the week.. Cash JGB trade sees the long end lead the bid (lifers putting cash to work?), with the major benchmarks little changed to ~5bp richer on the day (note that swap spreads are tighter across the curve, meaning that receiver side swap flow has likely been aiding the JGB bid). There hasn’t been much in the way of meaningful domestic news flow to trade off, leaving wider market gyrations at the fore. Looking ahead, BoJ Rinban operations headline locally on Monday.

JGBS AUCTION: Japanese MOF sells Y4.52892tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.52892tn 3-Month Bills:

- Average Yield: -0.1386% (prev. -0.1419%)

- Average Price: 100.0342 (prev. 100.0358)

- High Yield: -0.1317% (prev. -0.1348%)

- Low Price: 100.0325 (prev. 100.0340)

- % Allotted At High Yield: 80.9887% (prev. 36.9235%)

- Bid/Cover: 2.818x (prev. 2.845x)

AUSSIE BONDS: Solid Apr-27 Supply Sees 5s Lead The Bid

ACGBs unwound their earlier twist flattening, with cash ACGBs running 0.5-3.0bp richer across the curve. 5s outperformed after the solid round of ACGB Apr-27 supply, while the maturity of ~A$24.8bn of ACGB Jul-22 today possibly contributed to some richening in the front end as well, as cash is redistributed. YM is +2.0, operating around best levels after bettering its overnight highs, while XM is flat on the day, off best levels after breaching its own post-Sydney highs earlier. Bills run 3 to 5 ticks richer through the reds.

- The latest round of ACGB Apr-27 supply went very well, with the recent stabilisation in the Aussie bond space and previously-flagged micro relative appeal of the line contributing to its smooth digestion. The weighted average yield printed 2.66bp through prevailing mids (per Yieldbroker), with the cover ratio coming in at 3.99x, comfortably above the 3.00x level (a solid cover ratio in post-QE times).

- The AOFM issuance slate announced for next week provoked little reaction in Aussie bonds, with A$1.5bn of ACGBs and A$2.5bn of notes on offer.

- Hiking expectations for the RBA’s Aug meeting have continued to taper from Thursday’s extreme, aided by a similar move in pricing surrounding the July FOMC meeting in the U.S.. STIR markets now price in ~56bp of tightening for the RBA’s Aug meeting, a pullback from the ~64bp peak witnessed on Thursday. TD Securities has joined Goldman Sachs and Nomura in calling for a 75bp hike for August (and 50bp for Sep), while Westpac and CBA both see a 50bp hike on the cards for Aug (followed by a 25bp and 50bp hike in Sep, respectively).

- RBA Governor Lowe is due to speak on a panel over the weekend, although the topic will be CBDCs and cryptocurrencies, limiting the scope for comments surrounding the economy and monetary policy settings.

AUSSIE BONDS: The AOFM sells A$700mn of the 4.75% 21 Apr ‘27 Bond, issue #TB136:

The Australian Office of Financial Management sells A$700mn of the 4.75% 21 Apr ‘27 Bond, issue #TB136:

- Average Yield: 3.1454% (prev. 2.9758%)

- High Yield: 3.1525% (prev. 2.9775%)

- Bid/Cover: 3.9929x (prev. 3.2914x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 38.1% (prev. 71.8%)

- Bidders 41 (prev. 40), successful 4 (prev. 13), allocated in full 2 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 20 July it plans to sell A$800mn of the 1.25% 21 May 2032 Bond.

- On Thursday 21 July it plans to sell A$1.0bn of the 9 September 2022 Note, A$1.0bn of the 21 October 2022 Note, & A$500mn of the 25 November 2022 Note.

- On Friday 22 July it plans to sell A$700mn of the 0.50% 21 September 2026 Bond.

EQUITIES: Mostly Lower In Asia; Alibaba, Mortgage Boycott Pulls Benchmarks Under

Major Asia-Pac equity indices are mostly flat to lower at typing, tracking a similar performance from Wall St.

- The Nikkei 225 bucked the broader trend of losses, dealing 0.6% firmer at writing. Index heavyweights Fast Retailing Co (+7.8%) and Nintendo Co (+2.9%) contributed the bulk of gains in the Nikkei, with the former surging after forecasting record profit for ‘22.

- The CSI300 sits a little below neutral levels at typing, with the miss in Q2 GDP figures provoking little lasting reaction in Chinese equity benchmarks. The financials (-1.4%) and property (-5.1%) sub-indices dragged the index lower for another day as the previously-flagged mortgage boycott in China continues to play out, neutralising outperformance in the consumer staples (+1.3%) and consumer discretionary (+1.7%) sub-gauges.

- The Hang Seng Index brings up the rear amongst regional peers, dealing 1.2% weaker at writing, with the financials (-1.3%) and property sub-indices (-1.2%) leading losses. China-based tech struggled, seeing the Hang Seng Tech Index deal 2.0% lower, with wider sentiment bruised by reports of an ongoing regulatory probe in large-cap Alibaba Group (-3.9%) over a data breach.

- U.S. e-minis sit 0.3% to 0.5% better off at typing, a little shy of their respective best levels made earlier in the session.

OIL: Seeking Direction In Asia; Biden Visits Saudi Arabia

WTI is ~+$0.50 and Brent is ~+$0.90, with both keeping within relatively tight ~$1.40 channels across Asia-Pac dealing. Brent has struggled to make meaningful headway above $100 and remains vulnerable to record a weekly close below $100 for the first time since end-Feb, with crude continuing to show weakness in recent sessions on rising recession worry and a strengthening USD.

- Both benchmarks initially edged a little lower on worry re: reduced Chinese energy demand, with news of Shanghai listing 30 “areas” (single housing compounds or clusters of apartment blocks) within the city to be subject to lockdowns (although lockdowns on 60 areas within the city were lifted on Friday), adding to surge in fresh daily COVID cases countrywide (432 for Thu vs 292 Wed).

- Keeping within the region, a BBG report has highlighted that crude refining margins across Asia are continuing to pull lower, pointing to falling demand for oil products across the region amidst higher energy prices.

- Elsewhere, U.S. President Biden is due to speak with Saudi Prince MBS at approx. 1845 IDT (1645 BST) later on Friday. Expectations for the meeting to see increased Saudi crude production remain low, with analysts having long pointed to limited spare capacity in the Gulf states.

- Separately, progress towards potential caps on the price of Russian oil remains scant (with major importer China remaining on the sidelines), with U.S. Tsy Sec. Yellen proposing on Thursday that the U.S. and the EU could waive bans on shipping insurance and financial services for Russia should the measure be adopted.

GOLD: A Little Higher In Asia; $1,700/oz Remains In View

Gold deals $4/oz firmer, printing $1,714/oz at typing. The precious metal deals a little below session highs made after the release of Chinese data, with a miss in Q2 GDP weighing against largely in-line expectations for industrial production and retail sales. Recent Dollar strength however remains in focus for bullion, which is on track for a fifth straight weekly loss.

- To recap Thursday’s price action, the precious metal hit fresh 11-month lows ($1,697.7/oz) before paring losses to close ~$25 weaker. The decline was facilitated by an uptick in the USD, with the DXY briefly hitting fresh cycle highs above the 109.00 handle, sending the broader commodity space lower as well (silver hit a two-year low on Thursday, while platinum hit a 22-month low).

- Gold’s weakness comes despite a limited unwinding of expectations for a 100bp Fed rate hike in July, with FOMC dated OIS pointing to ~82 bp of tightening priced in for that meeting (down from ~92bp on Thursday) after comments from the Fed’s Waller and Bullard supporting a 75bp move.

- From a technical perspective, gold remains in a downtrend. The move lower on Thursday has broken initial support at $1,706.8/oz (1.618 proj of the Mar 8-29-Apr18 price swing), exposing further support at $1,690.6/oz (Aug 9 ‘21 low). On the other hand, resistance remains situated at $1752.3/oz (Jul 8 high).

FOREX: Greenback, Aussie Show Marginal Weakness

Price action across G10 FX space was rangebound and ultimately non-linear, with the space struggling for a uniform direction amid fairly light headline flow. China's activity indicators were a mixed bag, but Q2 GDP missed expectations and the NBS was downbeat in its commentary on the data.

- Spot USD/CNH took some time to unwind its initial losses and move into positive territory, but yesterday's best levels remain some way of. China's Q2 economic growth missed expectations, industrial production fell roughly in line with forecasts, retail sales topped estimates and unemployment dropped. Despite some incremental positives, meagre growth means it will be difficult for China to meet its +5.5% Y/Y growth target for this year.

- The Aussie dollar underperformed its major peers at the margin. Iron ore consolidated Thursday's sharp losses linked to reports of Chinese homebuyers boycotting mortgage payments.

- The BBDXY index meandered just shy of cyclical highs printed on Thursday, as the dust settles after this week's hawkish Fed repricing. The greenback was among the worst G10 performers.

- U.S. retail sales, industrial output, Empire M'fing & flash Uni. of Mich. Survey take focus on the data front. The list of central bankers due to speak today includes Fed's Bostic, Bullard & Daly as well as ECB's Rehn.

FX OPTIONS: Expiries for Jul15 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9950(E523mln), $1.0150(E564mln), $1.0200(E1.2bln)

- GBP/USD: $1.1890-00(Gbp644mln)

- USD/JPY: Y137.50-60($590mln)

- AUD/USD: $0.6900($1.0bln), $0.7000(A$515mln), $0.7120(A$515mln)

- USD/CAD: C$1.3000($1.3bln), C$1.3100($694mln), C$1.3150($551mln), C$1.3230-50($797mln)

- USD/CNY: Cny6.6500($1.8bln), Cny6.7200($510mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/07/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/07/2022 | - |  | EU | ECB Lagarde & Panetta at G20 CB Meeting | |

| 15/07/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/07/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/07/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2022 | 1245/0845 |  | US | Atlanta Fed's Raphael Bostic | |

| 15/07/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/07/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 15/07/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/07/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/07/2022 | 1400/1000 | * |  | US | Business Inventories |

| 15/07/2022 | 1430/1030 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.