-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Bid On Taiwan Worry, AUD Offered As RBA Tweaks Guidance

- JPY outperforms again, with equities generally offered and fixed income better bid in Asia.

- The RBA formally embeds some optionality into its guidance paragraph, resulting in a dovish market reaction.

- The global data docket is light going forward, while central bank speaker slate features Fed's Evans, Mester & Bullard. The market will be on the lookout for any updates on the Taiwan situation.

US TSYS: Off Best Levels But Still Comfortably Firmer In Asia

TYU2 sits +0-17 at 121-28+ hovering a little above the middle of its 0-16+ range, operating on above average volume of ~128K. Meanwhile, cash Tsys run 3-4bp richer across the curve. The latest round of Tsy demand comes after a recent tweet from Global Times commentator Hu Xijin, which noted that “Based on what I know, in response to Pelosi's possible visit to Taiwan, Beijing has formulated a series of countermeasures, including military actions.”

- The early overnight bid in U.S. Tsys came as the Asia-Pac region geared up for what seems to be the inevitable trip to Taiwan for U.S. House Speaker Pelosi, with Sino-U.S. tensions remaining front and centre when it came to the thought process of participants.

- The early bid seemed to run out of some steam after the failure of bulls to challenge the 2.50% level in 10-Year yield terms resulted in a bit of a moderation of strength.

- On the flow side, a round of screen buying through Monday’s high in TYU2 and block lift of the same contract (+1.5K) helped the space higher during the early Asia rally.

- Note that the space looked through the bullish impulse from ACGBs in the wake of the latest RBA monetary policy decision.

- Tuesday’s NY session will see the release of JOLTS job opening data, in addition to several rounds of Fedspeak (Bullard, Evans & Mester). Pelosi’s movements will also be eyed, with reports suggesting she will land in Taiwan somewhere between 15:00-15:50 London time (10:00-10:30 NY).

JGBS: Aggressive Flattening

JGB futures haven’t been able to force a meaningful break above their overnight session high, despite a brief look above the level during the Tokyo morning.

- A fade away from best levels then occurred alongside a pullback in wider core global FI markets, with a poorly received round of 10-Year JGB supply also factoring into that dynamic.

- In terms of auction specifics, the low price saw the cover ratio tumble to levels comfortably below the recent averages, while the low price missed wider dealer expectations. The lacklustre result comes after the BoJ’s recent defence of its YCC parameters and firm insistence on holding its current policy settings as they are. The previously-flagged lack of relative value, coupled with the potential for participants being cognisant of the degree of richening away from the 0.25% yield ceiling that the BoJ permits, likely resulted in soft demand.

- Still, continued worry surrounding the impending journey of U.S. House Speaker Pelosi to Taiwan underpinned the space post-acution, facilitating a recovery in futures (the pullback was relatively shallow), with the contract last dealing +19, a little off best levels. Wider cash JGB trade has seen bull flattening of the curve, with the major benchmarks running little changed to ~6.5bp richer. 10s have underperformed surrounding tenors all day on the back of set up for and in reaction to the previously outlined supply. The bid in the super-long end has accelerated ahead of the close.

- The latest round of BoJ Rinban operations headline the domestic docket on Wednesday.

AUSSIE BONDS: Firmer As RBA Tweaks Guidance Passage To Stress Optionality

The inclusion of the language surrounding the tightening cycle being on no pre-set path in the RBA’s guidance paragraph, shift higher in its inflation track and mark lower in GDP growth expectations has provided a dovish feel to the statement that accompanied the widely expected 50bp rate hike from the Bank. That has allowed the ACGB space to go bid post-decision as YM & XM surged to fresh session highs, with the former +11.0 & XM +13.5, a touch shy of best levels. Cash ACGBs are 1bp cheaper to 10bp richer across the curve, twist flattening, with an element of elongated weekend catch up evident in cash ACGB levels after the NSW holiday observed on Monday. Bills run 6-11bp richer through the reds as a result also just shy of best levels. Note that the OIS strip has unwound the best part of 10bp of tightening when it comes to the Bank’s September meeting, with a touch over 30bp of tightening priced in for that gathering. Further out, ~10bp of tightening has also been taken out of RBA December meeting-dated OIS, which now sits at ~3.00%, with pricing surrounding the terminal cash rate also pulling lower to just below 3.20% (foreseen in February).

- Swings in broader risk appetite drove price action earlier in the session, with the Asia-Pac region setting up for U.S. House Speaker Pelosi’s expected trip to Taiwan.

- Mixed local data, in the form of housing finance and building approvals, had no tangible impact on the space.

- Looking ahead to tomorrow, it will be the Q2 retail sales volumes data and A$800mn of ACGB Nov-32 supply that headlines the domestic docket.

FOREX: Yen Goes Ballistic Amid Taiwan Angst, Aussie Retreats On RBA Guidance Tweak

The yen had another stellar session as U.S. House Speaker Pelosi's touted trip to Taiwan stole the limelight, causing geopolitical angst to radiate across Asia. As things stand, Pelosi is expected to arrive in Taipei around 10pm local time, with Beijing threatening unspecified military response.

- USD/JPY tumbled as low as to Y130.41, bottoming out within touching distance from its 100-DMA, which was last breached in Sep 2021. The rate continued to take out key support levels, leaving with Jun 16 low/61.8% retracement of the May - Jul rally (131.50/34) in the rear-view mirror.

- Despite the yen capitalising on its safe haven allure, relative yield dynamics remained pertinent. USD/JPY moved away from session lows as U.S. Tsys pulled back from highs. Still, U.S. Tsy yields remain lower on the day, which underpins further compression of their gap with Japanese counterparts.

- The Aussie dollar took a beating from the RBA, which raised the cash rate target by the widely expected 50bp increment, but added a mention that "it is not on a pre-set path" when it comes to policy normalisation into the guidance paragraph of the statement.

- Post-RBA Aussie sales rubbed salt into the wounds of regional risk barometer AUD/JPY, sending it to worst levels since May 30. Meanwhile, AUD/NZD dropped in tandem with Australia/New Zealand 2-year swap rate spread.

- USD/CNH unwound its initial foray to the highest point since May 17 and slipped into negative territory. USD/TWD remained elevated, consolidating above the TWD30.00 mark.

- The global data docket is light going forward, while central bank speaker slate features Fed's Evans, Mester & Bullard. The market will be on the lookout for any updates on the Taiwan situation.

AUD: Relentless Sell Off in AUD/JPY Continues

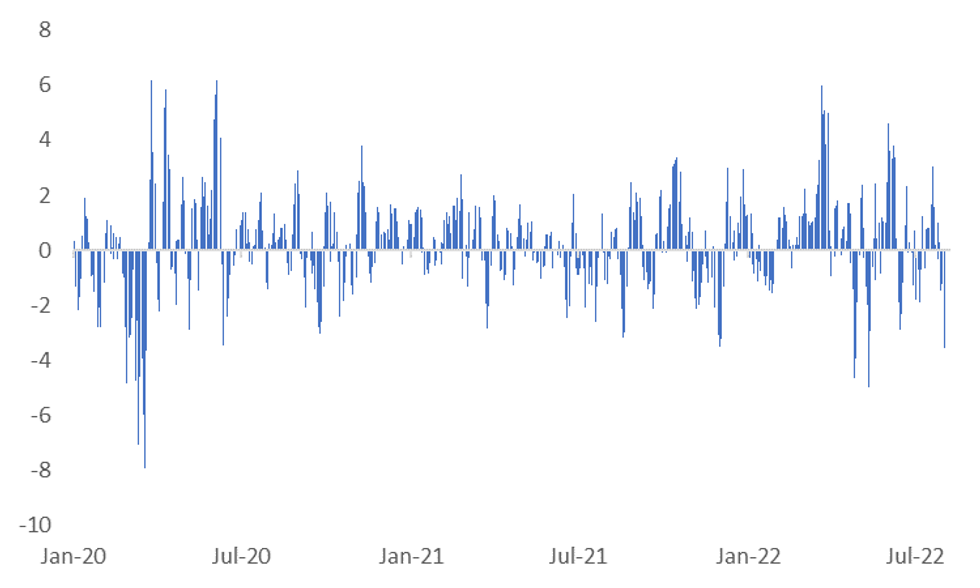

The relentless sell-off in AUD/JPY continues. The pair is down a further 0.88% so far today. Since this time last week, the pair has lost a little over -3.5%, see the chart below. This is the steepest 5 day drop since mid-May. As the chart suggests, outside of the onset of the Covid pandemic, in recent years we don't tend to see weekly falls stretch beyond the magnitude of -4% to -5%. Hence we aren’t too far off these levels.

- In the current context, the pair is close to early July lows around the 91.40/91.50 region (we last tracked 91.65/70 in AUD/JPY). Beyond these levels is the late May highs in the low 91.00 region.

- Weaker equity tones across the region and US futures (-0.50%) are adding to downside momentum in the pair

- The market has largely ignored the mixed Australian housing data from earlier. AUD/USD is down a little from NY closing levels to the low 0.7010/15 region.

- The value of home loans fell -4.4% (versus -3.0% expected), while building approvals only dipped by -0.7%, versus a -5.0% forecast dip.

Fig 1: AUD/JPY: Rolling Weekly Rate Of Change

Source: MNI/ Market News/Bloomberg

Source: MNI/ Market News/Bloomberg

FX OPTIONS: Expiries for Aug02 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E1.0bln), $1.0000(E1.4bln), $1.0240-45(E556mln)

- EUR/GBP: Gbp0.8647-65(E1.2bln)

- EUR/JPY: Y135.85-00(E664mln)

- AUD/USD: $0.7160(A$641mln)

- USD/CAD: C$1.2890-00($647mln)

ASIA FX: Well Behaved Despite Heightened Geopolitical Tensions & Lower Equities

CNH, KRW and TWD have been well behaved today despite negative equity sentiment and heightened tensions between US-China ahead of US House Speaker Pelosi's Taiwan visit. INR has continued to rebound, up a further 0.6% today.

- CNH: USD/CNH tracked above overnight highs in early trade. We got just above 6.7950 before selling interest emerged. The pair dipped as far back as 6.7750 but we are now back above 6.7800. Onshore equities are noticeably weaker amid on-going US-China tensions, as we the market awaits the outcome of Pelosi's trip to Taiwan. The fixing bias is slightly skewed towards weaker CNY levels.

- KRW: USD/KRW has been range bound, finding selling interest close to 1310 in early trade. Onshore equities are lower (-0.55%) but are outperforming the China and Taiwan trends. Earlier, Korean CPI came in as expected in YoY terms at 6.3%.

- TWD: Spot USD/TWD has pushed above 30.00, but is only +0.20% above yesterday's closing levels. The 1 month NDF is back to the low 30.00 region, around 0.45% below NY closing levels. Taiwan equities are weaker, but losses are sub 2% at this stage. China has reportedly curbed food imports from Taiwan effective from mid-night, in an apparent retaliation for Pelosi's trip.

- INR: USD/INR is down sharply today, dipping a further 0.60% to 78.57. The pair is now below the 50 day MA (78.70) for the first time since early May, although this proved to be a false break. Onshore equities are lower today, but not as much as elsewhere in the region.

- IDR: USD/IDR 1-month NDF sits +21 figs at IDR14,879 after finding support in its 50-DMA over the past two days. Inflation figures released out of Indonesia on Monday are unlikely to force the central bank to front-load tightening. Core CPI accelerated to +2.86% Y/Y but matched expectations and stayed below the mid-point of the target range. Following the release, Governor Warjiyo noted that underlying price pressures are "still low," with the central bank seeing "no need to quickly raise interest rates."

CNH: CNY Fixing Still Biased Modestly Weaker

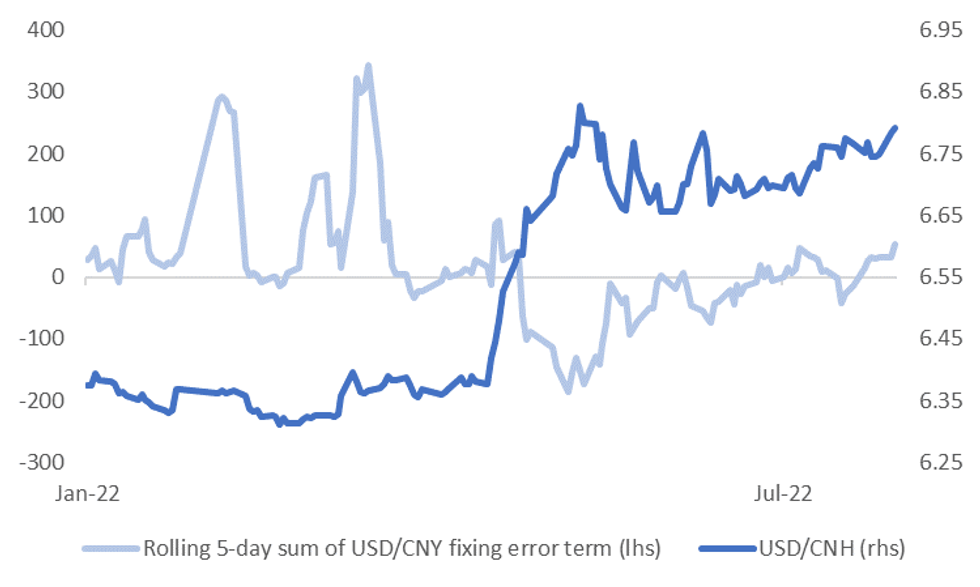

The USD/CNY fix printed at 6.7462, versus a market estimate of 6.7449.

- Today's fix is a +13pip surprise in USD/CNY terms, following yesterday's outcome of a +11pip outcome. The general trend remains towards positive surprises, with 9 out of the last 10 sessions delivering positive surprises in USD/CNY terms.

- The 5-day rolling sum of the error term has pushed up to +54pips, versus +31 pips yesterday. The is fresh highs for the metric going back to late April of this year, see the chart below.

- CNH hasn't reacted a great to deal to the fix. USD/CNH is back sub 6.7900, last tracking around 6.7850. Still, the authorities don't appear to be leaning against depreciation pressures via the fixing mechanism, as the pair threatens to test above 6.8000. The last time USD/CNH was pressing above these levels, the fixing bias was trying to curb such pressures, as the chart below highlights.

Fig 1: USD/CNH & CNY Fixing Error Trend

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia; Chinese Property And Tech Underperform

Asia-Pac equity indices have mostly held on to their earlier, Pelosi-induced lows, with high-beta equities continuing to lead losses across the region despite earlier confirmation that the U.S. House Speaker had landed in Malaysia (with participants continuing to watch for confirmation of earlier Taiwanese media reports that Pelosi may arrive in Taiwan later today).

- The Hang Seng brings up the rear amongst peers, sitting 2.7% worse off, on track for a third consecutive lower daily close with virtually every constituent in the red at typing. China-based tech posed the most drag on the index, with the HSTECH dealing 3.9% weaker at writing, adding to steep sell-offs witnessed in the property (-2.4%) and finance (-2.4%) sub-gauges as well.

- The CSI300 is 2.5% worse off, a little above fresh eight-week lows made earlier in the session. The richly-valued consumer staples and healthcare sub-indices lead the way lower, while elsewhere, tech equities have struggled, with the ChiNext index operating a little above session lows at 2.7% lower as well.

- Chinese property stocks (CSI 300 Real Estate Index: -2.4%) have also extended their recent run of losses, with investors looking through a pledge by the PBOC on Monday to stabilise loan growth and facilitate financing for the country’s property sector.

- The ASX200 is 0.2% worse off, back from lows of as much as 0.7%, and narrowly on track to snap a five-session streak of higher daily closes. Losses in the materials (-1.7%) and energy (-1.0%) sub-indices were largely able to offset shallower gains across other sectors, with the major miners dealing 2.1-3.1% weaker apiece at typing.

- E-minis sit between 0.3-0.4% lower, a little above their respective session lows at typing.

GOLD: Four-Week Highs In Asia; Pelosi Visit Eyed

Gold deals ~$5/oz firmer, printing ~$1,777/oz at typing. The precious metal sits a little below fresh four-week highs ($1,780.5/oz) made after Taiwanese media offered an exact time for U.S. House Speaker Pelosi’s visit to Taiwan, adding to tailwinds from a downtick in the USD (DXY) and nominal U.S. Tsy yields.

- Immediate focus has turned to risks surrounding China’s response to Pelosi’s Taiwan trip, with U.S. Tsys catching a bid alongside defensively-oriented flows observed in the FX space, while regional cash equity indices and e-minis have gone offered.

- To recap, gold closed ~$6/oz firmer on Monday, recording a fourth straight higher daily close, coming as the USD (DXY) has simultaneously notched four consecutive lower closes. The overall move higher in gold also came amidst the backdrop of disappointing data releases out of the U.S. and Europe on Monday as well, contributing to prior recession-related worry.

- From a technical perspective, gold’s recent bounce is still seen as corrective, with focus on initial resistance at ~$1,785.3/oz (50-Day EMA), a break of which would bring $1,812.0/oz (trendline resistance) into view. On the other hand, support is seen at ~$1,745.1/oz (20-Day EMA).

OIL: Lower In Asia; Supply Optimism Rises Ahead Of OPEC+ Meeting

WTI is ~-$0.80 and Brent is ~-$1.00, with the latter sitting a little below the $100 mark after failing to break above that level earlier in the session.

- To recap, both benchmarks closed ~$4-5 lower apiece on Monday on the back of disappointing data prints out of the U.S. and Europe, worsening the energy demand outlook from some quarters amidst prior recession-related worry.

- Looking to OPEC+, a Fox Business news reporter has pointed to sources informing him that Saudi Arabia will “push OPEC+ to increase oil production at their meeting on Wednesday,” although wider news flow re: the matter on the Fox network has not been observed at writing.

- A BBG report has observed that Russian seaborne oil exports have “stabilised” and are little changed from pre-invasion levels, likely underscoring the difficulty the west faces in targeting Russian crude. This comes as FT on Monday noted that the UK continues to hold off on introducing a ban on maritime insurance to ships carrying Russian oil, a measure that was supposed to join a similar move by the EU in May.

- Brent’s prompt spread has narrowed to ~$2.00 at typing, down from over $5.00 observed just a week ago.

- Looking ahead, BP plc will report earnings later today, with the accompanying commentary potentially offering some insight into the outlook for crude supply (coming after recent high-profile earnings beats from Shell, Exxon Mobil, Chevron, and Total Energies).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 02/08/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 02/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/08/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/08/2022 | 1400/1000 |  | US | Chicago Fed's Charles Evans | |

| 02/08/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 02/08/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 02/08/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 02/08/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 02/08/2022 | 2245/1845 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.