-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Asia Fades Thursday's Tsy Weakness As Tokyo Returns

- U.S. Tsys firmed a touch, while the USD traded mixed vs. its G10 FX counterparts in a headline-light Asia-Pac session.

- The Nikkei 225 outperformed its regional peers as Japanese participants returned from a national holiday.

- Flash UK GDP & Swedish CPI will take focus in European hours, while the NY docket is headlined by the flash Uni. of Michigan survey (inflation expectations gauges from that survey will be closely watched). Elsewhere, Fed's Barkin ('24 voter) will make a TV appearance.

US TSYS: A Little Richer In Asia

Tsys richened overnight, with desks flagging an apparent regional interest in fading Thursday’s cheapening & steepening given the lack of overt game changing drivers evident yesterday (with position squaring and block flow-driven moves evident in NY hours, as well 30-Year auction concession/reaction).

- Upside options expressions in the form of FVU2 113.00 & TYU2 119.50 calls aided the direction of travel, as did a couple of rounds of screen lifts in TY futures.

- That leaves TYU2 printing +0-05 at 119-08 ahead of London hours, 0-03 off the peak of its 0-12 Asia-Pac range, although volume isn’t particularly firm, running at ~80K lots.

- Cash Tsys sit 1.5-3.5bp richer across the curve, with 20s leading the rally.

- San Francisco Fed President Daly (’24 voter) reiterated her baseline view of a 50bp hike at the September FOMC, although she once again failed to rule out the idea of a 75bp rate hike, stressing the data-dependent nature of monetary policy alongside a need to assess the inflation and labour market data that will cross between now and then.

- Looking ahead, NY hours will see the latest round of UoM sentiment data (with the inflation expectation components eyed) and Fedspeak from Richmond Fed President Barkin (’24 voter).

JGBS: Twisting Flatter As Tokyo Returns

JGB futures generally tracked the broader impetus in core global FI markets during the morning session as Tokyo participants found their feet after yesterday’s holiday. That was before a slowing of activity in the afternoon session, with liquidity diminished owing to the summer holiday period in Japan.

- That leaves the contract off of its session extremes as we work towards the weekend, -6 vs. Wednesday’s settlement. Wider cash JGB trade has seen the curve twist flatten with the major benchmarks running 1bp cheaper to 2bp richer, pivoting around 10s, after the long end more than reversed its modest, early losses.

- The only real domestic headline flow of note saw Japanese PM Kishida revealing that he plans to hold a meeting to discuss ways to curb inflation, with the gathering set to take place this Monday. Rising food prices and wages will seemingly form the focal points of those discussions.

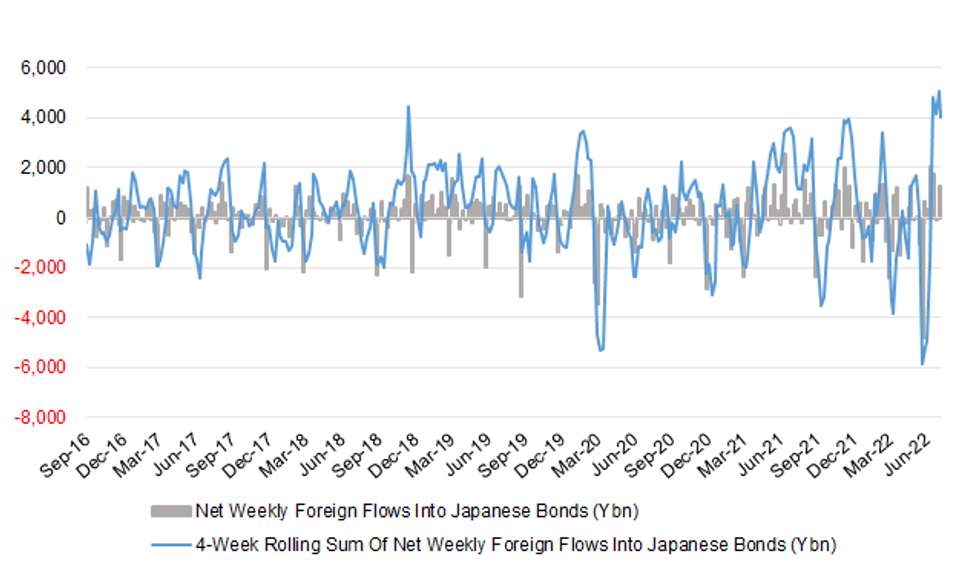

- As we noted elsewhere, the latest round of Japanese weekly international security flow data revealed that last week saw foreign investors buy more than Y1tn of Japanese bonds in net terms for the fourth time in five weeks, with the latest round of purchases likely representing short covering of existing JGB positions, foreign investors looking to take advantage of FX-hedge-related yield pickups, or a mixture of the two.

- Looking ahead, preliminary Q2 GDP data headlines the domestic docket on Monday, with final industrial production data for June also due.

AUSSIE BONDS: Cheaper, But Off Lows

Aussie bonds are off of session cheaps, as a light bid in U.S. Tsys has helped to pull the space back from session lows. The overnight cheapening in futures that stemmed from Thursday’s bear steepening in the Tsy space gained further momentum as YM & XM registered multi-week lows in early Sydney trade, before the aforementioned move away from worst levels. Cash ACGBs run 7.0-13.5bp cheaper across the curve, bear steepening. YM and XM are -8.5 and -12.0, respectively. Bills run flat to 9 ticks cheaper through the reds.

- The latest round of ACGB Sep-26 supply saw firm pricing, aided by the stabilisation away from cycle cheaps in Aussie bonds, with the weighted average yield printing 1.83bp through prevailing mids (per Yieldbroker). On the other hand, the cover ratio moderated to 2.66x from the previous auction’s 3.40x, coming in far below the six-auction average of 4.03x, with international investors still seemingly sidelined amidst lingering uncertainty re: the degree of tightening that will be executed by the RBA in the current cycle. The slightly higher DV01 on offer from the AOFM this week and the marginal richness of the line in micro-RV terms also provided headwinds, limiting demand at the auction.

- The release of the AOFM’s weekly issuance slate provoked little by way of meaningful reaction in Aussie bonds, seeing a smaller A$1.5bn of ACGBs (with a slight step down in the DV01 from this week’s supply) and A$2.5bn of note supply on offer next week.

- The domestic data docket is virtually empty on Monday, with minutes of the RBA’s Aug policy meeting and CBA household spending data expected to provide the first points of interest on Tuesday.

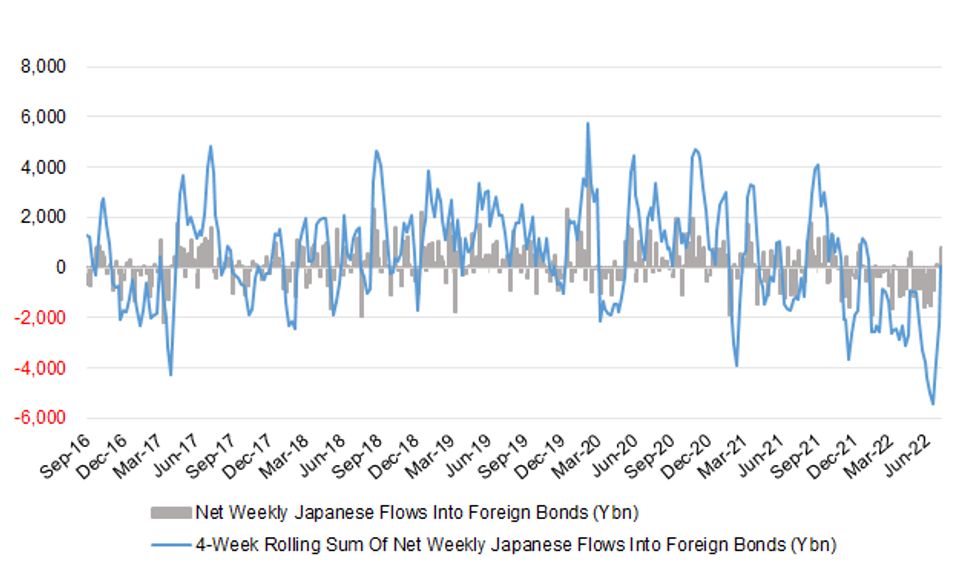

JAPAN: Japan Dips Toes Back Into Foreign Bonds, Foreigners Buy Japanese Bonds

The latest round of Japanese weekly international security flow data revealed that Japanese investors lodged that largest round of weekly net purchases of foreign bonds observed since January, registering a third consecutive week of net purchases in the process. This comes after the market vol. witnessed in May through July, coupled with elevated FX-hedging costs, resulted in a record streak of net sales across the 8 weeks prior to the current run of net purchases.

- Elsewhere, foreign investors bought more than Y1tn of Japanese bonds in net terms for the fourth time in five weeks, with the latest round of purchases likely representing short covering of existing JGB positions, foreign investors looking to take advantage of FX-hedge-related yield pickups, or a mixture of the two.

- When it comes to equities, Japanese investors shed over Y1tn of net exposure to foreign stocks last week, ending a streak of seven consecutive weeks of net purchases, registering the largest round of net weekly sales observed since April in the process.

- Finally, foreign investors were marginal net buyers of Japanese equities last week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 827.0 | 37.8 | 68.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -1036.7 | 355.6 | -129.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1027.5 | 1289.8 | 4055.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 61.0 | -120.9 | 712.7 |

Fig. 1: Net Weekly Japanese Flows Into Foreign Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Fig. 2: Net Weekly Foreign Flows Into Japanese Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Better Sentiment Keeps Lid On Yen, Supports Antipodeans

The risk switch flicked to on, lending support to the Antipodeans and sapping strength from the yen as the working week in Asia was drawing to an end. Both U.S. Tsys and e-mini contracts found poise amid continued assessment of the outlook for Fed tightening campaign.

- USD/JPY ran as high as to Y133.50 before giving back the bulk of its earlier gains as U.S. Tsy yields lost altitude. Risk reversals crept higher, with one-year skews returning above par. The yen remains the worst G10 performer as risk-on impetus seemingly outweighed slight tightening in U.S./Japan yield gap. Note that there is a notable $1.7bn option expiry with strikes at Y133.98-00 due at the NY cut.

- The kiwi dollar paced gains, setting the tone for the outperformance of commodity-tied FX bloc. The kiwi looked past a quarterly survey which showed that inflation expectations of New Zealand households have stabilised.

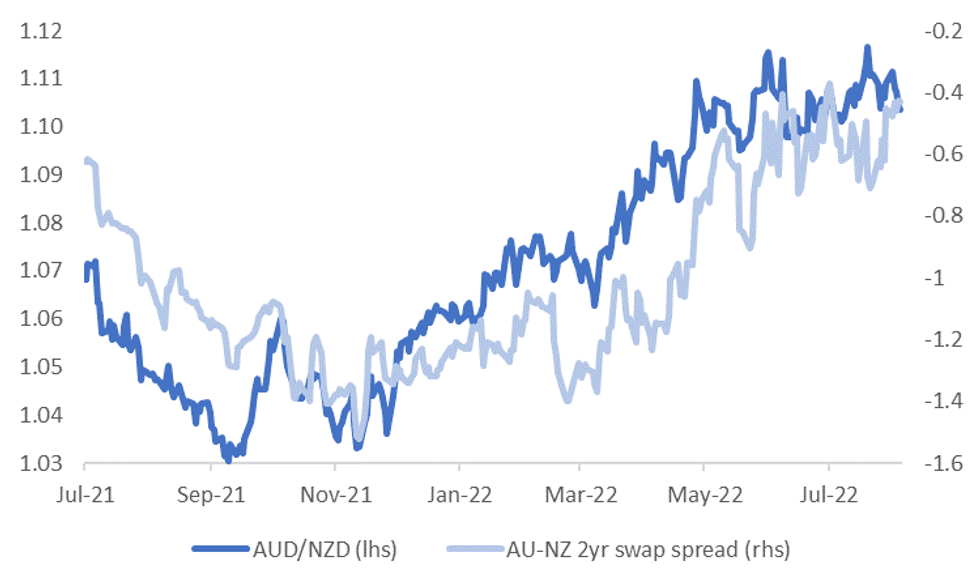

- AUD/NZD went offered in line with a move in Australia/New Zealand 2-year swap spread. The spot rate fell to its lowest point in 10 days, with its 100-DMA now within sight. That moving average has remained intact since Dec 2021.

- The sterling traded on a softer footing ahead of the release of UK data which is expected to show that domestic economy slipped into contraction in the second quarter.

- Flash UK GDP & industrial output, Swedish CPI will take focus in European hours, while the American docket is headline by flash U.S. Uni. of Michigan Survey (inflation expectations gauges from that survey will be closely watched). Fed's Barkin will make a TV appearance.

AUDNZD: Next Week Shapes As An Important One For The Cross

The AUD/NZD cross continues to drift lower, last around 1.1025. We are below the 50-day MA, which comes in at 1.1061, while the 100 day MA (1.1007) is now within sight. While the pair has had plenty of dips below the 50-day MA in recent months, we haven't been below the 100 day MA in a meaningful way since December last year.

- Next week shapes up as an important one for the cross. The broader macro backdrop still suggests dips in the cross should be supported. The relative Citi surprise index trends still remain in AUD's favor. We are slightly down from best levels on this differential but we remain close to historical highs.

- This is still being reflected in relative rate/yield differentials, see the first chart below. To be sure, the recent correction in the AUD/NZD spread puts it back in line with levels of the 2yr AU-NZ swap spread.

- The 2yr spread hasn't been able to get much beyond -40bps this year (we currently sit at -45bps). It's a similar theme in the government bond yield space.

Fig 1: AUD/NZD & 2yr AU-NZ Swap Spread Differential

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Next Wednesday is likely help shape the relative rate outlook, at least from the perspective of domestic event risks. We have both the RBNZ decision in NZ and the Q2 wages outcome in Australia.

- The RBNZ is widely expected to hike by 50bps, taking the policy rate to 3.00%. Focus is likely to rest on the outlook, where the rough consensus looks for the central bank to strike a hawkish tone as it battles to bring down inflation pressures/expectations.

- The Q2 wages outcome in Australia has the market expecting a +0.8% rise in QoQ terms, nudging the YoY pace to 2.7%. Whilst this would be the strongest pace in YoY since early 2014, will it shift the RBA needle? The market still looking for rates above 3.25% by year end (futures based).

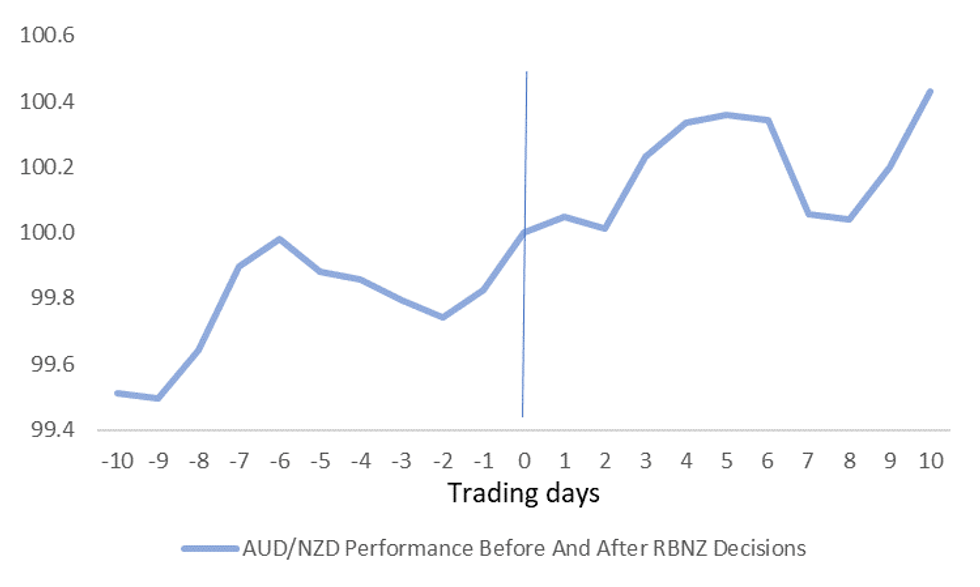

- Interestingly though, the AUD/NZD has tended to rise post RBNZ hikes during this cycle. The second chart below plots average AUD/NZD performance in the 10 days prior to and 10 days after RBNZ hikes (with 0 at the bottom of the chart representing hike days, where AUD/NZD levels are indexed to 100).

- Average gains are 0.4-0.5% in the 5-10 days after the RBNZ has hiked in this cycle, although the trend is volatile. The best gain for the cross post a hike (using closing levels) has been close to 2%, the worst performance, a -1.1% dip.

- Upside in AUD/NZD following RBNZ hikes is likely to reflect the catch up play to better macro backdrop outlined above. Australia's stronger external trade position arguably hasn't hurt either.

Fig 2: AUD/NZD Has Typically Risen Post RBNZ Hikes In This Cycle

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Aug12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0185-00(E812mln), $1.0225-30(E639mln), $1.0300(E1.8bln), $1.0325(E800mln), $1.0350(E766mln), $1.0435-40(E521mln)

- USD/JPY: Y132.00($810mln), Y132.45-50($575mln), Y133.98-00($1.7bln)

- GBP/USD: $1.2300(Gbp576mln)

- AUD/USD: $0.7100(A$593mln)

- USD/CAD: C$1.2700($1.3bln), C$1.2800($880mln), C$1.3135-55($1.5bln), C$1.3200($1.1bln)

- USD/CNY: Cny6.80($899mln), Cny6.85($500mln)

ASIA FX: HKD Away From Weak Side of Peg Band, KRW and IDR Stronger

High beta Asian FX has outperformed the majors in the G10 FX space today. 1 month USD/KRW is back below 1299, closing some of the wedge with stronger equities. USD/IDR has slumped through 14700 on the back of higher commodity prices and continued portfolio inflows. HKD has moved away from the weak side of the band. USD/CNH has edged down to 6.7300. INR and PHP are laggards though.

- CNH: USD/CNH has drifted lower today, albeit within recent ranges. The pair is back close to overnight lows just under 6.7300, last tracking at 6.7315/20. China equities are off a touch, as focus is on worsening domestic covid case numbers, but losses in the equity space are minimal for now.

- KRW: 1 month USD/KRW is down -0.50% and is testing back below 1300 at the time of writing. Korean equities have managed a small gain today, despite negative overnight leads from US markets. This does close some of the gap between the won and onshore equities, with FX still lagging the better equity tone.

- HKD: USD/HKD is down quite sharply to the low 7.8300 region (-0.15% for the session). This shifts the pair away from the top end of the HKMA peg band at 7.8500. Bloomberg notes that the unwinding of option hedges (around 7.81-7.85 strikes) may be playing a role. A sense of peak US inflation and therefore peaking Fed outlook is also likely to be helping at the margin.

- INR: USD/INR is trying to push higher in early trade trade, although some interest is evident above 79.70. We were last at 79.67. Onshore equities are down a touch, with rebounding energy prices likely not helping.

- MYR: USD/MYR is lower, spot back sub 4.4400. Note the 50-day MA comes in at 4.4278. Q2 GDP comfortably beat expectations (+3.5% QoQ versus +1.% expected). BNM stated H2 growth should be even firmer, but stated policy adjustment will remain gradual.

- IDR: Spot USD/IDR has slumped. The pair is back under 14700, over 0.6% down on yesterday's close (last at 14670). The risk backdrop is also unlikely to be underpinning such a notable swing, with U.S. equity benchmarks paring gains late doors Thursday. However, firmer commodity prices may be lending some support to the rupiah. Inflows into local equities and bonds will also be helping.

- PHP: The Peso remains a laggard, spot is around 0.30% weaker. USD/PHP is back to 55.49. Higher energy prices not helping at the margin. Bangko Sentral ng Pilipinas will announce its monetary policy decision next Thursday. Policymakers are hesitating between a 25bp and a 50bp rate rise.

CHINA DATA: Data Could Print Over The Weekend, July Monthly Data Out On Monday

A reminder that the China data calendar could be in focus over the next few days. We are still waiting on aggregate finance/new loan figures from July. The market is expecting a decent step down in the pace of both figures. This data can come out anytime between now and Monday.

- The Bloomberg calendar also states the 1yr MLF rate and lending facility could also print between tomorrow and next Tuesday. The market expects an unchanged MLF rate at 2.85%, while the consensus is for 400bn yuan rolled over. Most uncertainty rests on the roll over amount, given the domestic system is flush with liquidity at the moment.

- Then on Monday we get the monthly data dump for July. IP, retail sales, fixed asset investment (FAI), property investment and the jobless rate.

- All will be in focus given on-going domestic Covid headwinds- the market expects IP growth of 4.4% YoY, versus 3.9% previously. Retail sales are expected to recovery further to 4.9% from 3.1% in June. FAI is expected to be firmer at +6.3% (from 6.1%) but property a laggard (-5.6% forecast, versus -5.4% in June). The jobless rate is forecast to be unchanged at 5.5%.

- The detail in FAI is also likely to be in focus on how much infrastructure is rebounding against a continued drag from the property sector. Headlines have also filtered across the wires in recent weeks around the tough jobs market at the moment.

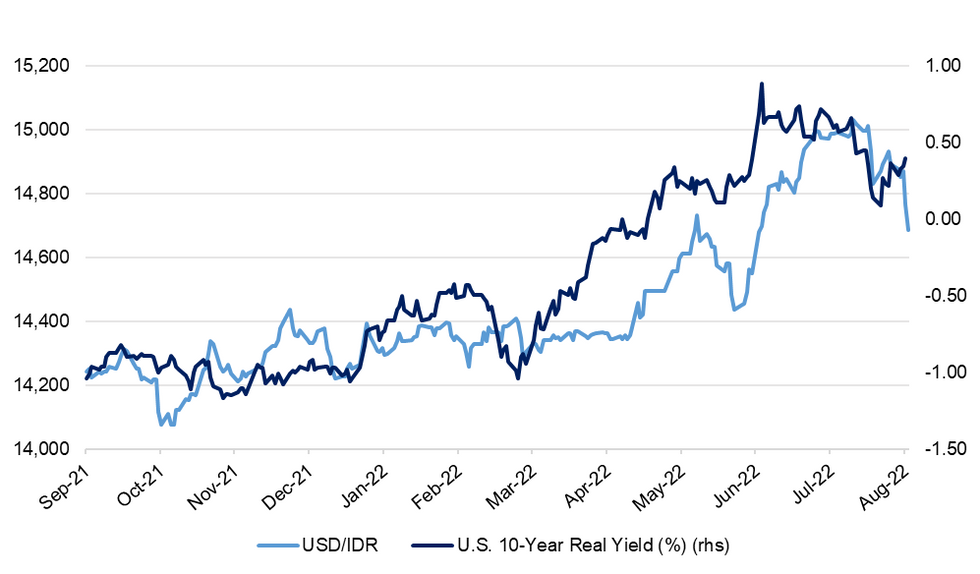

IDR: Rupiah Outplays Emerging Asia Peers

Spot USD/IDR has been in retreat this morning, shedding 80 figs so far to last trade at IDR14,688, as the rupiah became the best performer in emerging Asia both today and on a weekly basis. The rate is narrowing in on its 100-DMA, which intersects at IDR14,651, providing the next bearish target. Note that the pair accelerated losses after crossing its 50-DMA/neckline of a short-term head-and-shoulders pattern (Fig. 1). A rebound above those levels (IDR14,851/14,859) and Aug 4 high of IDR14,939 is needed to give bulls some reprieve.

Fig 1. USD/IDR

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- USD/IDR 1-month NDF last -36 figs at IDR14,693, flirting with its 100-DMA at IDR14,690. A clean breach of that moving average would open up the 200-DMA at IDR14,520. Bulls look for recovery towards the 50-DMA, which kicks in at IDR14,883.

- The spot rate posted a sharp drop despite Thursday's uptick in U.S. 10-year real yield (Fig. 2). The risk backdrop is also unlikely to be underpinning such a notable swing, with U.S. equity benchmarks paring gains late doors Thursday. However, firmer commodity prices may be lending some support to the rupiah (palm oil futures are slightly up on the day and the ringgit is the second best performer in emerging Asia), boding well for Indonesia's already solid trade surplus.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

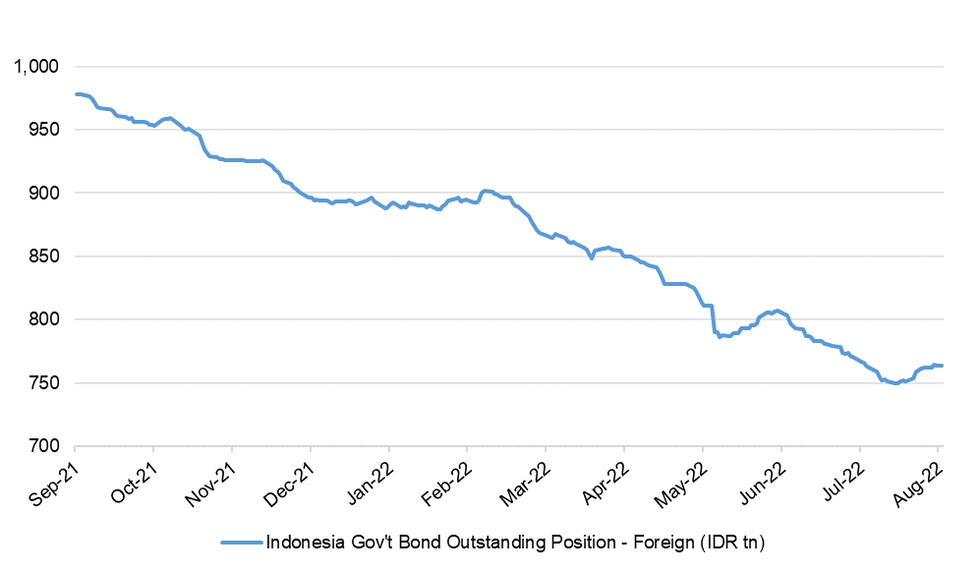

- Bloomberg circulated a note from TD Securities, who argue that the rupiah is set to appreciate on the back of Indonesia's trade surplus and attractive relative yields, which will draw foreign investors to local assets. In the grand scheme of things, the outstanding position of foreign players in Indonesian gov't bonds has already bounced from cyclical lows towards the back end of last month (Fig. 3).

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- From near-term perspective, global funds were net buyers of Indonesian stocks for the sixth consecutive day on Thursday, purchasing a net $45.0mn of equities. They sold a net $56.9mn worth of INDOGBs but it was the first net outflow since Monday. The Jakarta Stock Exchange Composite Index has slipped today, last trading ~0.2% lower on the day.

- Bloomberg reported that surveyed analysts raised their Q3 & Q4 forecasts for Indonesian CPI inflation by a full percentage point to +5.00% Y/Y and +5.15% respectively. The full-year growth estimate remained unchanged at +5.2% Y/Y.

- Next week's data docket is headlined by trade balance (Monday) & BoP current account balance (Friday).

EQUITIES: Mixed In Asia; Japan Plays Catch-Up

Major Asia-Pac equity indices are mixed at writing on a similar showing from Wall St. on Thursday.

- Suppliers of Apple Inc across Asia were bid as BBG sources have pointed to the U.S. tech giant asking suppliers to produce at least as many next-gen iPhones in ‘22 (~90mn) as in ‘21, with some participants likely watching for similar bids in Europe and U.S. listed suppliers later on Friday.

- Japanese stocks outperformed on their first day back from the holiday on Thursday, experiencing a lift as Japanese participants played catch-up to the recent rally in equities on Wednesday’s better-than-expected U.S. CPI print. Large-caps lead the way higher, with the Nikkei 225 dealing 2.4% firmer at typing, ahead of the broader TOPIX index (+1.8%).

- The CSI300 is 0.2% worse off at typing after a brief show above neutral levels, turning the benchmark away from fresh one-week highs made earlier in the session. Relatively shallow gains across most sectors was countered by losses in consumer discretionary and tech stocks, with the ChiNext index trading 0.9% lower at typing.

- The ASX200 sits 0.7% worse off, backing away from nine-week highs made on Thursday amidst weakness across virtually every sub-index, with healthcare and tech contributing the most to losses (S&P/ASX All Tech Index: -1.5%).

- E-minis deal 0.1-0.3% firmer at typing, operating adrift of their respective multi-month highs made on Thursday.

GOLD: Little Changed In Asia; On Track For Higher Weekly Close

Gold sits ~$1/oz weaker, printing ~$1,788/oz at writing. The precious metal operates around the bottom of Thursday’s range at typing, backing away from recently-made five-week highs, but remaining on course to close higher for a fourth consecutive week, drawing support from a continued pullback in the USD (DXY) from cycle highs observed in mid-July.

- While comments from San Fran Fed Pres Daly (‘24 voter) earlier in the session provoked little reaction in gold (with her delivered remarks providing little fresh insight after her FT interview on Thursday), Daly emphasised the need to not get “head-faked” by the recent better-than-expected CPI print, pointing to further employment and inflation data due before the next FOMC due in September.

- Sep FOMC dated OIS now price in ~60bp of tightening, pointing to greater odds of a 50bp hike at that meeting (vs. odds for a 75bp hike), little changed from levels observed a week ago prior to the hot NFP print on Friday.

- From a technical perspective, gold’s recent breach of trendline resistance (~$1,794.6/oz) has signalled a firmer tone for the yellow metal. Initial resistance is located at $1,807.9/oz (Aug 10 high and the bull trigger), while support is seen at $1,754.4 (Aug 3 low, key short-term support).

OIL: A Little Below One-Week Highs

WTI and Brent are ~-$0.50 softer apiece at writing, operating a little below their respective one-week highs made on Thursday. Both benchmarks are on track for a higher weekly close amidst a moderation in demand destruction worry in recent sessions, but remain well short of unwinding last week’s steep selloff, with concern re: tightness in global crude supplies continuing to pull away from recent extremes (Brent’s prompt spread sits at ~$1.27 vs. the ~$2.80 peak witnessed at the beginning of August).

- WTI and Brent closed ~$2 higher apiece on Thursday despite diverging demand forecasts from the International Energy Agency (IEA) and OPEC, with the former highlighting that OPEC+ is unlikely to raise output in the near-term due to severely limited spare capacity, while flagging the potential for further disruptions to Russian crude exports as another risk to supply.

- Turning to the forecasts, the IEA boosted its ‘22 global demand growth projections by 380K bpd while OPEC cut its own ‘22 demand growth forecasts by ~260K bpd later in the session, with the latter also predicting that global oil markets will experience a surplus in Q3 ‘22 on simultaneous supply increases from non-OPEC+ members.

- Elsewhere, crude has also drawn support from news of pipeline and oil & gas field closures in the Gulf of Mexico due to leaks, with Shell expecting the affected pipelines (capacity ~500K bpd of crude) to return to service on Friday, with no timeline given re: restarting production at the fields at writing.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/08/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/08/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/08/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/08/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/08/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/08/2022 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/08/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 12/08/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/08/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/08/2022 | 0900/1100 | ** |  | EU | industrial production |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.