-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Powell Probably Not In Much Of A Pivoting Mood

- Market participants continue to assess the potential for a Powell pivot during his Friday address, although the recent rounds of Fed messaging seem to have played down the chances of an outright dovish swing (the Fed has already noted that it will slow the pace of tightening at some point, in addition to some expressing worry re: over-tightening via FOMC meeting minutes).

- U.S. Tsys cheapened a touch overnight, unwinding some of Thursday's rally, while the DXY sits atop the G10 FX table.

- Today's economic calendar is heavily U.S.-centric, with Fed Chair Powell set to deliver the aforementioned Jackson Hole keynote (also be on the lookout for plenty of Fedspeak via the usual TV networks). The final reading of Uni. of Mich. Sentiment, flash wholesale inventories as well as monthly personal income/spending figures will take focus on the data front.

US TSYS: Cheaper In Asia As Region Sets Up For Jackson Hole

Fairly skittish Tsy trade was observed in the final Asia-Pac session of the week, with most participants seemingly happy to sit on the sidelines ahead of Fed Chair Powell’s Friday address.

- That has made for narrow ranges, with TYU2 last -0-06+ at 117-28+, 0-00+ off the recently registered session low, while ~50% of that contract’s 78K volume is attributable to quarterly roll activity. Cash Tsys run 1.0-3.5bp cheaper across the curve, with the space unwinding some of Thursday’s richening as 7s lead the weakness.

- Market participants continue to assess the potential for a Powell pivot, although the recent rounds of Fed messaging seem to have played down the chances of an outright dovish swing (the Fed has already noted that it will slow the pace of tightening at some point, in addition to some expressing worry re: over-tightening via FOMC meeting minutes).

- The full Jackson Hole symposium schedule is available here.

- Also be on the lookout for various Fed speakers appearing across the usual TV networks throughout the day, in addition to July PCE data and the final UoM survey for August.

JGBS: Off Best Levels As We Work Through The Day

Bulls failed to test a recovery of the overnight peak in futures, leaving the contract +11 vs. yesterday’s settlement levels as we work towards the Tokyo close. Meanwhile, cash JGBs run little changed to 1bp firmer across the curve.

- The initial richeneing impulse observed in the super-long end has faded a little, aided by a combination of the light cheapening seen in the U.S. Tsy space and the firmer than expected Tokyo CPI prints that we covered earlier.

- Note that the Tokyo CPI excluding fresh food and energy metric is still comfortably below the BoJ’s 2.0% target (printing at +1.4% Y/Y in August), with the Bank continuing to reaffirm its on hold stance as the current inflationary pressures are dominated by cost-push, not demand-pull factors, leaving the Bank pointing to the need for a continued and elongated extension of more notable wage growth.

- Issuance wise, a Y75bn multi-tranche round of samurai paper from Mexico (flagged earlier this week) provided the highlight.

- Looking ahead, Monday’s domestic docket is pretty empty, with only lower tier economic data releases due.

AUSSIE BONDS: Building On Overnight Gains

ACGBs have built on the lead from the overnight richening in Aussie bond futures despite a downtick in U.S. cash Tsys, with the 10-Year AU/U.S. yield spread 6bp narrower on the day as a result, albeit operating well within the confines of the recent ranges

- Cash ACGBs run 8.5-10.5bp richer across the curve, with the 10- to 12-Year zone leading the way higher.

- YM and XM are +9.0 and +10.5 respectively, recording fresh session highs at writing. EFPs have narrowed, with the 3-/10-Year box steepening, while Bills run 1 to 9 ticks richer through the reds.

- The latest round of ACGB Apr-29 supply went smoothly enough, with little reaction seen in ACGB trade.

- Next week’s AOFM issuance slate will see A$1.5bn in ACGBs and A$2.0bn of Notes on offer. Aussie bonds edged higher after the release, possibly on the reduction to the DV01 on offer when compared to this week (A$916K across two ACGB auctions vs. A$1.539mn across three auctions this week).

- Monday will see July retail sales headline the domestic data docket.

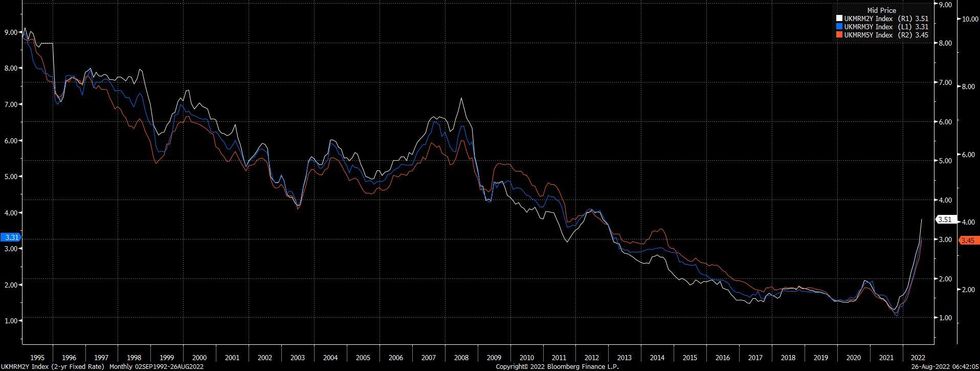

UK: Mortgage Rates Set To Add To Inflation Burden

Inflation isn’t the only headwind facing UK households at present. The swift round of repricing of the BoE hiking cycle and resultant move in swap rates has seen UK mortgage rates double since the turn of the year (based on BoE data covering the period through the end of July), with more pain set to come on this front (note that some industry analysts have flagged that the average 2-Year fixed mortgage rate has now topped 4% for the first time since ’13).

- This, coupled with the UK’s well documented inflation problem poses further upside risk to swap rates creating potential headwinds for the UK property market, adding to the burden of crimped spending power as wage growth lags inflation. Note that some industry participants remain a little more upbeat.

- The BoE doesn’t comment on the wealth effect of house prices with as much frequency as the likes of the RBA, but soaring inflation, higher mortgage payments and the potential for lower housing valuations (albeit from a starting point which equates to record highs) paints a very downbeat picture for the UK economy, with the BoE already projecting a bleak immediate economic scenario.

- Soaring gas prices (the updated UK energy price cap that we discussed earlier this week, will be released at 07:00 London on Friday) already pose a clear upside risk to the BoE’s only recently-released inflation forecasts and could force the terminal rate of the current hiking cycle even higher (with OIS markets currently pointing to a terminal rate of a little over 4% during Q224).

- Also note that an added layer of flows and fixing demand will become evident throughout the next year or so as those who rushed out to buy houses after the initial round of COVID lockdowns were relaxed will start to roll their mortgages (assuming initial 2- to 3-Year fixing periods and that some level of outstanding mortgage remains).

Fig. 1: UK 2-, 3- & 5-Year Fixed Mortgage Rates (%)

Source: MNI - Market News/Bank of England/Bloomberg

Source: MNI - Market News/Bank of England/Bloomberg

FOREX: U.S. Dollar Outperforms Ahead Of Powell Speech, Kiwi Slips After Orr Remarks

The U.S. dollar outperformed at the margin, with all eyes on the upcoming keynote speech from Fed Chair Powell at the central bank's annual economic forum in Jackson Hole. The BBDXY index firmed but held a tight range, with regional players parsing hawkish Fed comments doing the rounds on the eve of Powell's speech.

- USD/JPY added a handful of pips, as U.S. Tsy yields edged higher across the curve, and last trades at Y136.66. Note that $1.4bn worth of options with strikes at Y136.95-10 will roll off at today's NY cut.

- The yen showed limited, if any, reaction to a set of stronger than expected Tokyo CPI figures, a bellwether of national price dynamics. Core prices rose 2.9% Y/Y this month, beating the median estimate of 2.7%. The strong outturn is unlikely to affect the BoJ's thinking as the Policy Board deems the recent intensification in price pressures to be of cost-push nature.

- Growth proxies were generally weaker, with participants wary of taking up more risk ahead of the Powell speech. The kiwi dollar paced losses as Gov Orr suggested that the RBNZ's tightening campaign may soon start slowing amid signs of cooling consumption.

- The PBOC repeated a pushback against yuan depreciation, albeit with diminished resolve. The mid-point of permitted USD/CNY trading band was fixed 56 pips below the expected level, following a 120-pip miss on Thursday. USD/CNH bounced after a reaction dip and last trades ~90 pips better off.

- Today's economic calendar is heavily U.S.-centric, with Fed Chair Powell set to deliver his Jackson Hole speech. The final reading of Uni. of Mich. Sentiment, flash wholesale inventories as well as monthly personal income/spending figures will take focus on the data front.

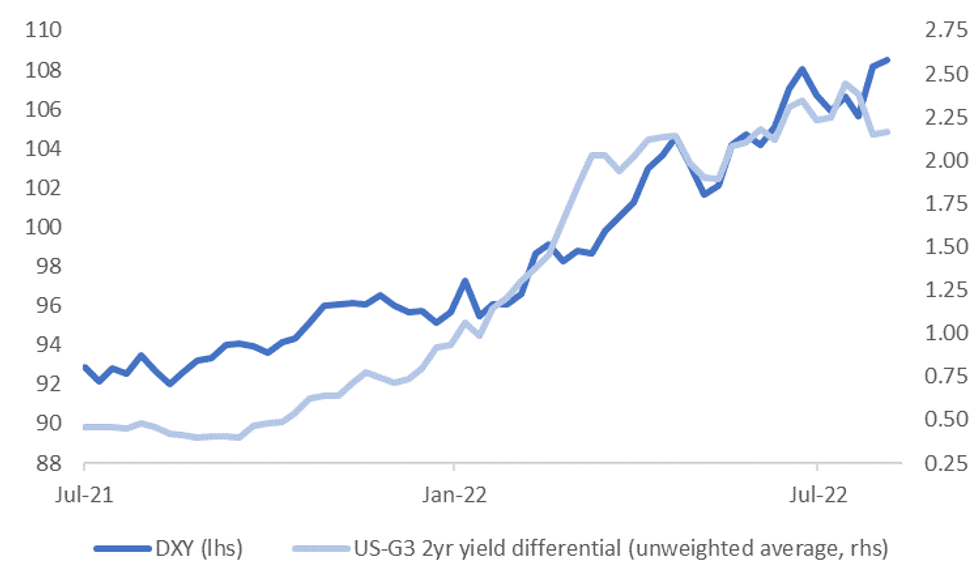

USD: USD Still Outperforming Yield Momentum

The USD FX trend is still outperforming yield differential momentum. The chart below plots the DXY against the US-G3 2yr yield differential (unweighted). Compared to the last update of the chart, the wedge between the two series has grown a little wider.

- Note if we look at the equivalent chart on a swaps basis or in terms of relative monetary policy expectations for end year, the picture doesn't change a great deal, particularly in the context of EUR/USD.

- As we noted earlier in the week, other factors like relative terms of trade are continuing to move in the USDs favor (see this link for more details). Since this update the Citi terms of trade proxies have continued to trend against EUR and JPY relative to the USD.

- Still, we might expect yield differentials to play more of a dominant role in the near term, particularly given Powell's speech at Jackson Hole this evening.

Fig 1: USD DXY Index & US-G3 2yr Yield Differential (Unweighted)

Source: MNI - Market News/Bloomberg

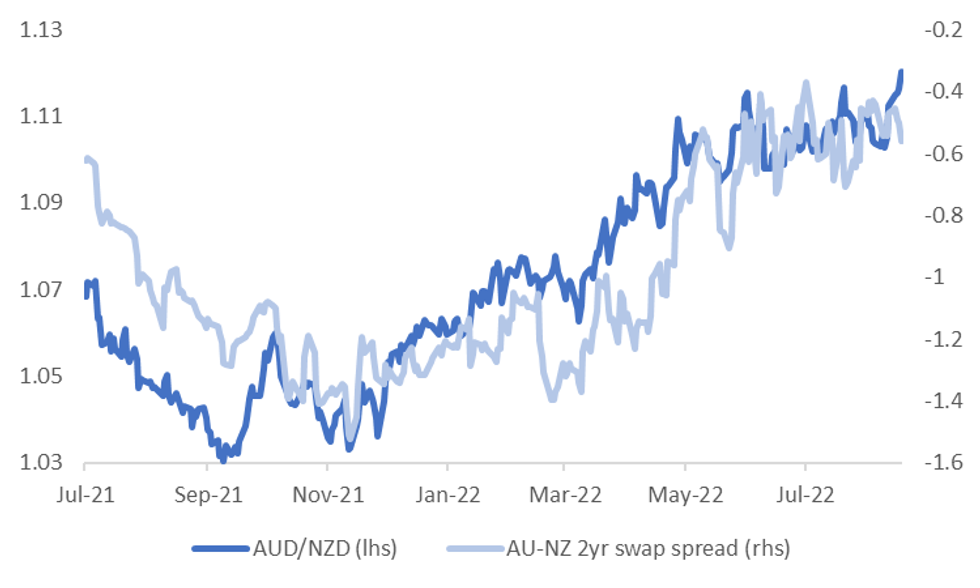

AUDNZD: Above 1.1200, Fresh Multi-Year Highs

The AUD/NZD cross has continued to trend higher, breaking above 1.1200 overnight. We were last at 1.1215/20, fresh highs back to late 2017.

- We noted earlier in the week that the AUD/NZD trend was outperforming relative yield trends. This remains the case, see the updated chart below of AUD/NZD versus the 2yr AU-NZ swap spread.

- Short term correlations (past month) remain around flat, but sit close to 90% for the whole of 2022. At face value this suggests upside AUD/NZD momentum could ease if we don't see yield/swap spreads also push higher.

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The other point we made earlier in the week that the AUD/NZD cross was inversely related to the recent equity dip. We suspected this likely reflected Australia's stronger external current account position relative to NZ.

- Still, while the recent rebound in equities/lower VIX levels has certainly benefited the NZD, AUD has still outperformed, which suggests other factors are at play.

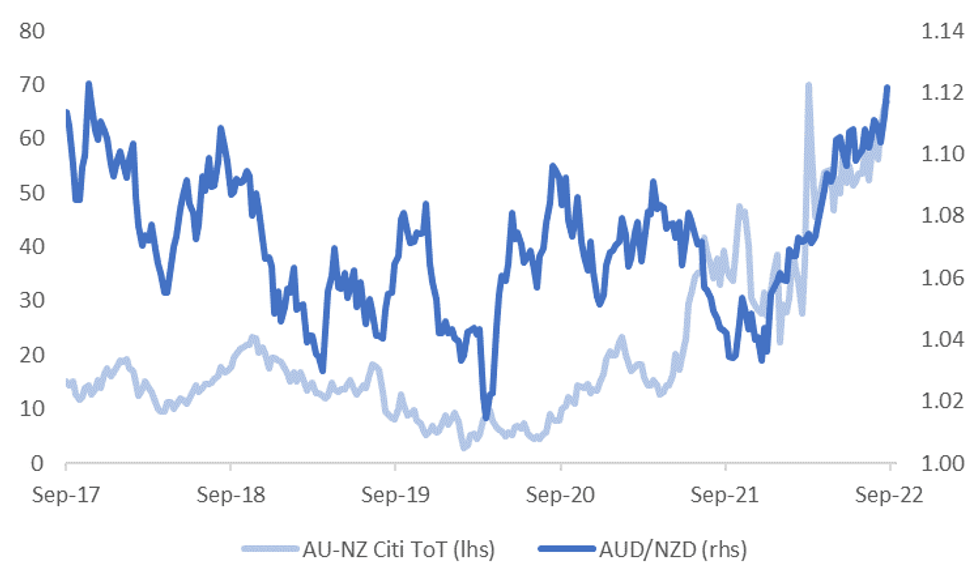

- The recent announcement from Fonterra, which cut its milk price forecast, plays into the continuing divergence in the relative terms of trade trends for both currencies, see the second chart below.

- Again though, correlations between these series are only running at 30% for the past month, below the 69% correlation for the whole of 2022.

- It may also be the case that A$ is benefiting from dividend related inflows, particular from a short term standpoint, a point we highlighted earlier in the AUD bullet.

Fig 2: Citi Relative AU-NZ ToT and AUD/NZD

Source: Citi/MNI - Market News/Bloomberg

Source: Citi/MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Aug26 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9850(E2.3bl) $1.0000(E1.5bln), $1.0049-55(E1.1bln)

- USD/JPY: Y134.00($550mln), Y136.95-10($1.4bln)

- USD/CAD: C$1.2870-85($698mln)

- USD/CNY: Cny6.8500($576mln)

ASIA FX: KRW Outperforms, Tight Ranges Elsewhere

USD/Asia pairs are mixed today ahead of key event risk in the US tonight. KRW is the main outperformer, along with IDR, albeit to a lesser extent. THB is lagging, along with CNH.

- CNH: USD/CNH hasn't strayed too far away from 6.8600. The pair dipped following another stronger CNY fixing but this proved to be short lived. 6.90 calls in USD/CNY, expiring at the end of August may be lending support. While onshore China equities have having close to a flat close at end the week. The broad consensus is that this week's fresh stimulus measures will not be enough to turnaround the growth outlook in the near term.

- KRW: The won has outperformed the broader trend in USD/Asia pairs today. The pair is testing sub 1330, with higher onshore equities helping, although a bigger driver is the rhetoric from South Korean authorities around one sided/herding behaviour in FX markets.

- INR: USD/INR remains sub 79.90 for now tracking within recent ranges, while the 1 month NDF sits above 80.00. Onshore equities are firmer (+0.70%), while bond yields are down on reports J.P. Morgan is consulting with investors around including Indian bonds in one of its main indices. The 10yr is off by 6bps to 7.23, although the trend elsewhere is generally for lower back end yields.

- SGD: USD/SGD has added 16 pips, supported by its 50-DMA. The pair last deals at SGD1.3902, with data on local industrial production eyed later today. Regional currencies (IDR, MYR, SGD) have been the only ones to post weekly gains against the greenback but only the rupiah has managed to extend them today.

- IDR: The rupiah is slightly firmer against the USD. USD/IDR was last at 14818, down 5 figs for the session. The government was set to submit a report on fuel price hike to President Widodo today, which means Jokowi may announce his decision on the matter imminently. The details will matter for Indonesia's inflation outlook.

- THB: USD/THB is pushing higher, back to 35.90, +0.20% above yesterday's closing levels. Sentiment has been hit by a wider than expected trade deficit for July. The figure printed at -$3.66bn (-$1.593bn expected), as exports disappointed. Political risk remains under scrutiny this week as pressure is growing on Prayuth Chan-o-cha to step down as Defence Minister after the court suspended his as Prime Minister pending clarification of his term limit.

CHINA DATA: PMIs In Focus Next Week

Tomorrow delivers China industrial profits data for July. This is unlikely to be a market mover though. Greater focus will rest on August PMI prints, which come out on Wednesday.

- At this stage, the market expects the official manufacturing PMI to rise to 49.3 from 49.0 in July. The services (or non-manufacturing) PMI is expected to ease back to 52.3 from 53.8 last month.

- The relative divergence in expectations is not surprising given August saw a fresh Covid wave hit a number of China cities. No major cities were locked down, but case numbers were still above 3000 by the middle of the month before improving.

- In any case, such a backdrop would be expected to weigh more on the services backdrop relative to manufacturing, although power outages could also impact on this sector. The authorities have stated the current episode isn't as bad as last year's coal shortages.

- The Standard Chartered SME survey, which has already printed for August, eased back in the month to 51.30, from 52.16 in July, suggesting some loss of momentum. Still, we remain comfortably above the May trough of 48.50 for this index.

- The Caixin manufacturing survey prints on Thursday. The market expects a 50.1 print versus 50.4 in July.

EQUITIES: Cautiously Higher Ahead Of Powell

Most Asia-Pac equity indices are in the green at writing, loosely tracking a positive lead from Wall St. Regional equities have regained some poise just ahead of Fed Chair Powell’s address at Jackson Hole, with a gauge of Asia-Pac stocks set to close higher for a second consecutive day after a five session streak of lower closes prior.

- The Hang Seng deals 0.7% firmer after opening higher, just shy of fresh one-week highs. China-based tech followed their U.S. listings higher on news of progress in Sino-U.S. talks to resolve well-documented audit disputes, with the likes of Alibaba (+2.0%) and Baidu (+3.5%) catching a bid (noting that the NASDAQ Golden Dragon China Index closed 6.3% higher on Thursday).

- The CSI300 is virtually unchanged at writing, back from as much as +0.6% earlier. The consumer staples (+0.8%) sub-index contributed the most to gains, offsetting steep declines in energy (-2.3%), with the CSI300 Real Estate Index (-0.6%) showing weakness as well.

- The ASX200 is 1.0% better off, on track to close higher for a third straight session. The major miners outperformed, sitting 1.3-3.0% firmer apiece at writing, adding to a strong showing from the healthcare sub-gauge (+1.3%). On the other hand, high-beta tech has lagged (S&P ASX All Tech Index: +0.1%), with participants likely sidelined ahead of impending event risk from Jackson Hole.

- E-minis are 0.1% worse off apiece at writing, having failed to break above their respective best levels observed on Thursday so far.

GOLD: Back From One-Week Highs; Powell’s Keynote Eyed

Gold operates ~$3/oz weaker to print ~$1,755/oz, extending a pullback from one-week highs ($1,765.5/oz) made on Thursday.

- To recap, gold backed away from best levels amidst remarks from Kansas City Fed Pres George (voter) re: the Fed holding rates above 4%, with the move lower aided by a limited recovery in the USD (DXY), seeing gold ultimately end ~$7 firmer for a third consecutive higher daily close.

- The precious metal is on track to close a little higher for the week, holding on to the bulk of last week’s ~$55 decline ahead of the freshly-commenced Jackson Hole Symposium.

- The conference will provide the key risk event for gold, with focus centred on Fed Chair Powell’s keynote address later on Friday, coming as Sep FOMC dated OIS have priced in roughly even odds of a 50bp vs. 75bp rate hike at that meeting over the past week.

- From a technical perspective, gold has broken initial resistance at ~$1,762.2/oz (20-Day EMA), exposing further resistance at ~$1,777.2/oz (50-Day EMA). On the other hand, initial support is situated at $1,727.8/oz (Aug 22 low).

OIL: Firmer In Asia; Potential OPEC Supply Cut Gains Momentum

WTI and Brent are ~$0.70 better off apiece, building on a move away from Thursday’s session lows at writing. Both benchmarks remain on track to record a higher weekly close, with attention turning to the upcoming speech from Fed Chair Powell.

- To recap Thursday’s price action, both benchmarks reversed gains to close ~$2 lower apiece after hitting fresh, multi-week highs, with the move lower aided by hawkish Fedspeak ahead of the annual Jackson Hole Symposium, exacerbating worry from some quarters re: a Fed-led economic slowdown.

- Elsewhere, the case for cuts to OPEC+ production quotas continues to build, with current OPEC Pres. Itoua expressing support for the move on Thursday in comments to the WSJ. Looking ahead, OPEC+ will next meet on Sep 5.

- The sole remaining mooring point at the Caspian Pipeline Consortium’s (CPC) Black Sea terminal has passed inspection, with the reduced loading capacity nonetheless remaining sufficient for now as major Kazakh oil fields have lowered their output.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/08/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/08/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 26/08/2022 | 0600/0800 | ** |  | SE | PPI |

| 26/08/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/08/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/08/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/08/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/08/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/08/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/08/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 26/08/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell at Jackson Hole | |

| 26/08/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.