-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI EUROPEAN MARKETS ANALYSIS: Cable Briefly Shows Above $1.12000 As Volatile Trade Continues

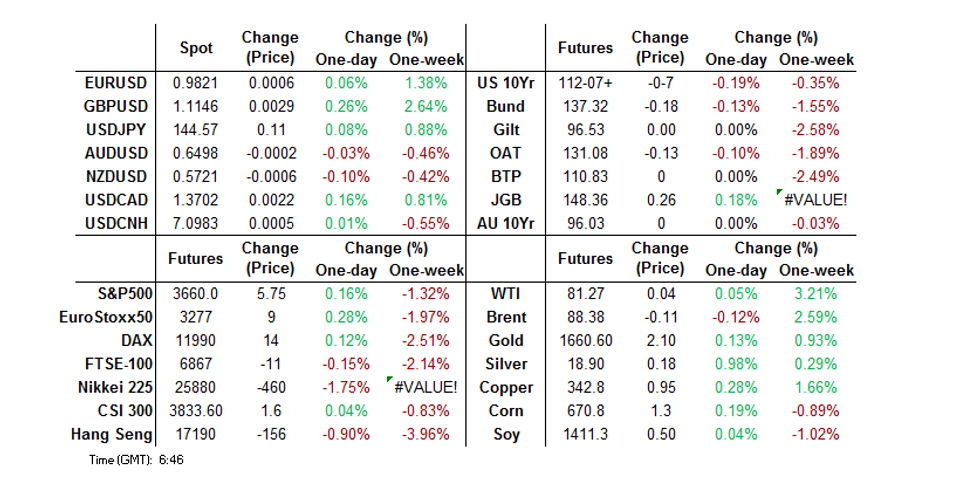

- Core markets lacked meaningful direction in Asia- with two-way USD dealing observed and lack of conviction noted in core FI markets. Cable traded in a ~130 pip range, briefly topping $1.1200 before falling back.

- Speculation surrounding the potential for further loosening measures in the Chinese property market, mixed Chinese PMI readings and the continued fallout from the UK "mini" budget dominated provided the most pertinent news flow.

- Final UK GDP, flash EZ CPI, German unemployment, as well as U.S. PCE readings, MNI Chicago PMI & final Uni. of Mich. Sentiment will take focus after Asia hours. The central bank speaker slate features Fed's Barkin, Brainard, Bowman & Williams, ECB's Elderson, Visco & Schnabel and Riksbank's Ingves & Jansson.

US TSYS: Modest Twist Flattening In Asia

Cash Tsys have seen some light twist flattening in Asia-Pac hours, with a lack of meaningful headline flow to trade off, leaving the major benchmarks running 1.5bp cheaper to 0.5bp richer across the curve, pivoting around 20s.

- TYZ2 trades within the confines of a narrow 0-06 range established early in Asia-Pac dealing, operating around the midpoint of Thursday’s range.

- Fedspeak from Daly (’24 voter) didn’t move the needle, as she flagged her support for the higher for longer mantra adopted at the Fed, alongside its resoluteness in the fight against inflation.

- Elsewhere, mixed Chinese PMI data failed to impact wider markets.

- Gilt trade will once again be eyed as a probable tone-setter during the London morning, as fiscal (and related BoE) matters in the UK continue to dominate.

- NY hours will see PCE readings, the latest MNI Chicago PMI print and the final UoM survey for Sep. Fedspeak will consist of addresses from Brainard, Bowman, Williams & Barkin.

JGBS: Early Flattening Gives Way As Super-Long End Struggles In Wake Of Rinban Details

The early bull flattening on the JGB curve unwound during the Tokyo afternoon, after an early bid in the long end faded in the wake of the publishing of the details of the latest round of BoJ Rinban operations (the offer/cover ratios in the operations covering 10+-Year JGBs weren’t standout, but some desks flagged the operations as potential catalyst nonetheless). Cash JGBs run 1bp richer to 1bp cheaper across the curve, with 7s outperforming on a bid in futures and the 20- to 30-Year zone providing the weak point.

- The early bid was seemingly aided by speculation surrounding the potential upsizing of BoJ bond buying guidance in the quarterly Rinban plan, which will be released after hours today (some expect larger buys in the 10- to 25-Year zone).

- 10-Year JGB yields hover just below the upper limit of the BoJ’s permitted trading band.

- Participants looked through a familiar upsized round of 5- to 25-Year BoJ Rinban ops on Friday.

- Futures held a relatively tight range after showing above their overnight high during the Tokyo morning, before fading to last deal +12.

- The aforementioned Rinban plan will likely set the tone for JGB trade early next week, with the summary of opinions from the BoJ’s latest monetary policy meeting and the quarterly Tankan survey headlining Monday’s docket.

AUSSIE BONDS: Tight Ranges In Play Ahead Of Long Weekend & RBA, Curve Steeper

The ACGB space has held onto the twist steepening impetus derived from overnight futures trade, with generally limited activity observed ahead of the long Sydney weekend.

- That leaves YM +1.5 & XM -1.5, with wider cash ACGBs running 2bp richer to 2bp cheaper, pivoting around 7s.

- Bills run -1 to +2 through the reds.

- The 3-/10-Year EFP box has bear steepened, with 3-Year EFP narrower and 10-Year EFP little changed.

- Participants were seemingly unwilling to deploy fresh risk ahead of Monday’s lower liquidity session (which includes the closure of cash ACGBs owing to a NSW & ACT holiday) and Tuesday’s RBA decision (with ~44bp of tightening priced into OIS and 13/17 surveyed by BBG looking for a 50bp hike).

- A lack of meaningful headline flow also limited participation.

- Participants looked through mixed Chinese PMI data, as well as the latest round of domestic private sector credit readings.

- The latest round of ACGB Nov-28 passed smoothly,, while the AOFM weekly issuance slate was fairly vanilla on the ACGB front, albeit with a bit of an upsizing in Note issuance.

NZGBS: NZGB Steepening Extends Through The Session

The bear steepening pressure derived from Thursday’s Tsy cheapening extended through the NZ session, with the major NZGB benchmarks running 8-15bp cheaper across the curve at the close.

- Local data had no real impact on the space.

- RBNZ OIS continues to more than fully price a 50bp hike at next week’s decision (albeit with a slight pullback to 51bp of tightening from the 54bp seen early on), with terminal rate pricing continuing to hover around the 4.80% mark.

- Westpac became the latest sell-side to up their terminal rate call, and now expect the OCR to peak at 4.50% in the current cycle, with the RBNZ set to hit that level in February, in their view.

- A quick reminder that all of those surveyed by BBG & RTRS look for the RBNZ to deploy a 50bp hike next week, so the tone of the statement that accompanies the decision will be key (assuming the fully priced and expected 50bp hike is delivered).

FOREX: Sterling Volatile Amid Fiscal Plan Turmoil, Greenback Outperforms

Sterling was volatile on the final trading day of the week in Asia, with eyes still on the turmoil caused by the UK government's tax-cut plans. PM Truss refused to walk back on her fiscal proposals, but the press reported that she would hold emergency talks with the fiscal watchdog today, while some speculated that growing backlash among Tory backbenchers and a drop in support for the Conservatives might force the government to change tack.

- These musings put a bid into GBP crosses in early Asia trade, prompting cable to briefly erase its post-mini budget losses. Sterling strength proved short-lived and the pound retreated in the absence of fresh headlines. GBP/USD trades ~20 pips below neutral levels, with EUR/GBP barely changed as we type.

- The greenback regained composure after an initial spell of weakness and took the lead in G10 FX space, with month-/quarter-end flows seen playing a supportive role. Slightly higher U.S. Tsy yields facilitated the move higher in USD.

- USD/JPY climbed over the final Tokyo fix of the month. Worth noting that it was a Gotobi day in Japan. The spreads on U.S./Japan yields were slightly wider, with the BoJ boosting bond purchases at its regular operation.

- Official PMI reading suggested that China's manufacturing sector returned to expansion last month, but the Caixin index tracking smaller, export-oriented enterprises unexpectedly deteriorated. Spot USD.CNH crept higher as the data crossed the wires, before trimming gains.

- Final UK GDP, flash EZ CPI, German unemployment, as well as U.S. PCE readings, MNI Chicago PMI & final Uni. of Mich. Sentiment will take focus after Asia hours.

- The central bank speaker slate features Fed's Barkin, Brainard, Bowman & Williams, ECB's Elderson, Visco & Schnabel and Riksbank's Ingves & Jansson.

FX OPTIONS: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9600(E758mln), $0.9700(E1.1bln), $0.9800(E1.1bln), $0.9850(E644mln), $0.9900(E1.4bln)

- USD/JPY: Y140.00($1.8bln), Y143.00($509mln), Y144.00($645mln), Y144.95-00($1.1bln)

- EUR/GBP: Gbp0.8800(E530mln)

- USD/CAD: C$1.3500($515mln)

- USD/CNY: Cny7.0000($3.0bln), Cny7.0500($851mln), Cny7.1000($1.1bln), Cny7.1500($1.6bln)

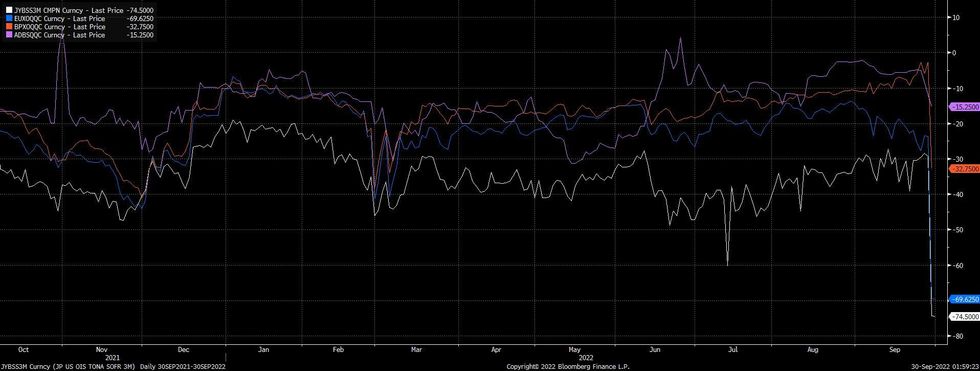

USD: Year-End Dollar Demand Showing Up In X-ccy Basis Markets

Signs of USD demand surrounding year-end turn have shown up in the x-ccy basis space, with the EUR, GBP, JPY & AUD 3-month measures all pulling lower over the last 24 hours as the end of year period falls into that horizon (based on settlement dates).

- Note that most of the 6-month USD x-ccy basis metrics moved notably lower at the end of June (when the year-end turn was captured), with the pull lower in GBP & JPY mostly consolidated, while the EUR measure has registered fresh lows in recent days.

- AUD 6-month was a little more resilient then, and the 3-month measure hasn’t experienced as sharp of a pull lower vs. EUR, JPY & GBP.

- This year’s move is probably being exacerbated by the rapid rate of Fed tightening observed during ’22, alongside broader economic worry re: a hard landing scenario, which has resulted in a particularly strong year for the greenback when it comes to G10 FX trade.

Fig. 1: EUR/USD, JPY/USD, GBP/USD & AUD/USD X-ccy Basis Swaps

ASIA FX: THB & PHP Away From Recent Extremes, RBI Hikes By 50bps

USD/Asia pairs have been mixed today. THB and PHP have rebounded from extremes earlier in the week. USD/CNH has been more rangebound, following the overnight intervention warning. As expected, the RBI hiked by 50bps (to 5.90%). Note South Korean trade figures for September print tomorrow, while China markets are closed for all of next week due to Golden Week celebrations.

- Sentiment in USD/CNH is somewhat calmer. The overnight warning around intervention in offshore markets has kept the pair to within ranges. We got above 7.1300, but we are now back to 7.1100. USD/CNH is trading below onshore USD/CNY. PMI prints were in aggregate weaker than expected for September. Equities are down slightly ahead of next week's Golden week holiday.

- USD/KRW is holding above 1430, albeit off earlier highs. The same applies for equities (-0.29%) after President Yoon stated fresh stabilization measures may be enacted. IP growth was in line with expectations, but chip production fell. Note trade figures for September print tomorrow.

- USD/INR is off recent highs. We last tracked just above 81.60. As expected, the RBI hiked the policy rate by 50bps to 5.90%. Onshore equities are higher though as the central bank governor stated on-going liquidity support, which has improved the outlook for financial stocks.

- USD/IDR spot is back under 15250, while the 1 month NDF remains above this level. Bank Indonesia's executive director for monetary management said it will try to reduce reliance on the USD by allowing transactions in domestic NDFs in other currencies and finalising more local-currency settlement agreements. The official said rupiah weakness should be temporary, after which the exchange rate will return to its fundamental value.

- Spot USD/PHP has moved away from record highs near 59.000 to last trade -0.31 at 58.676. SP Gov Medalla said an off-cycle rate hike "does not seem necessary" at this point, while the Monetary Board stands ready to do what's needed. The central bank last delivered an inter-meeting move in July, raising the key policy rate by 75bp.

- Spot USD/THB trades -0.18 at 37.915, operating close to multi-year highs printed earlier this week. The baht has been the second-worst performer in emerging Asia this week, with the BoT's cautious stance doing little to support the domestic currency.

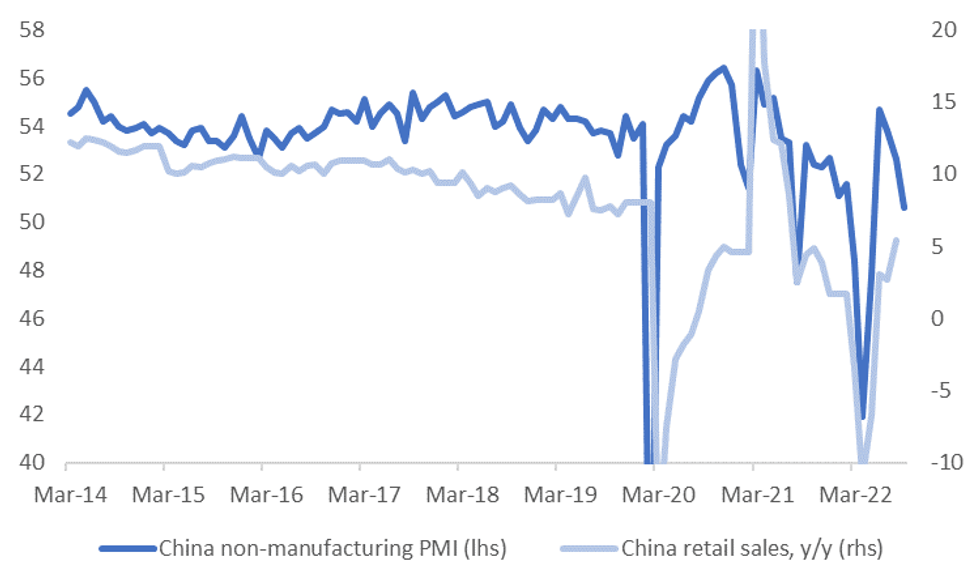

CHINA: PMI Prints Weaker In Aggregate For September

China's official PMI prints for September presented, in aggregate, a softer backdrop. Encouragingly, the manufacturing PMI moved back into expansion territory, albeit just at 50.1 (49.7 expected). However, the Caixin manufacturing PMI slipped deeper into contraction territory at 48.1, well below 49.5 expected. The non-manufacturing PMI (official) fell more than expected as well to 50.6 (52.4 forecast)

- The detail showed output and new orders rising for the manufacturing PMI, but employment only just edged higher to 49.0. New export orders were also down to 47.0, but this remains above earlier lows (41.6 in April).

- The weakness in the Caixin MI still suggests headwinds for the SME sector. The Chengdu lockdown likely weighed on this space through the month

- The non-manufacturing PMI was always at risk of dipping given these Covid related headwinds in September. The chart below plots the headline reading against retail sales y/y.

- The detail was fairly soft in the non-manufacturing PMI, with new orders dipping to 43.1 (from 49.8 last month).

- With Covid cases coming down, there will be hope that conditions improve in October. Still, these updates may still concerns around near term growth momentum, particularly in the services/SME side of th economy.

Fig 1: China Non-Manufacturing PMI Versus Retail Sales Y/Y

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

RBI: Still More Work To Do

As expected, the RBI raised the policy rate to 5.90% (a 50bps increase). The cash reserve ratio was left unchanged at 4.50%. Based off Governor Das's statement the central bank still has more work to do in terms of getting the policy stance to more appropriate levels.

- The near-term inflation outlook, for the second half of the current fiscal year (ending March 2023), is projected at 6%, similar to previous estimates. For the whole of the current financial year the inflation projection was kept at 6.7%, for the next financial, also unchanged at 5%.

- Governor Das noted the real policy rate (-110bps after today's move), tails the 2019 experience. In that year, real rates were strongly positive for much of the year. This suggests that further work will be done to get real rates back close to 0bps. The next RBI meeting is on 7th of December.

- Current market pricing has the policy rate just over 6.5% in 3 months’ time, and near 7% in 6 months’ time.

- On growth, the current financial year forecast was nudged down to 7% from 7.2% previously. Das presented an upbeat domestic outlook though, with external headwinds the main threat.

EQUITIES: Few Positives Outside Of China Housing Related Stocks

Regional equities are ending the week on a softer note, in line with US losses overnight and with futures struggling to stay in positive territory today (last around -0.25-0.30% for Eminis). Losses haven't been as large as earlier this week, in aggregate terms.

- The Nikkei 225 is off 1.9% at this stage, while Taiwan stocks are down by around 1%. Larger tech losses in the US have weighed, with concern around the demand outlook, given recent company announcements (Apple, Micron etc).

- The Kospi is away from worse levels, last (-0.35%). Earlier, President Yoon called for greater vigilance around market volatility and stated stabilization moves could be implemented.

- China main indices are down slightly, the Shanghai composite -0.20%. The property sub-index has rebounded +2% on reports that around 20 cities will be able to cut interest rate on loans for primary residences. Note China markets are closed for all next week due to Golden Week celebrations.

- HSI is around flat, the tech index is right around lows from March of this year.

- The ASX 200 is off by 1.4%. Note that it is a long weekend for this market, with Sydney having a public holiday on Monday.

OIL: Brent Set To Post Largest Quarterly Drop Since Q1 2020, OPEC+ Meeting Next Week

Brent crude is down slightly from NY closing levels. Last around $88.30, after we couldn't hold above $89/bbl through the NY session. Whilst key USD FX indices were lower, slumping equities and rebounding yields dented risk appetite. Brent is still set for a weekly gain (currently +2.6%), the first for September. However, we are comfortably down for the month and quarter (-23%). WTI is holding above $81/bbl, running out of steam above $82/bbl overnight.

- Amidst the largest quarterly drop in Brent since Q1 2020, next week's OPEC+ meeting (October 5), will be in focus around the supply outlook into year end.

- A Bloomberg survey of 19 traders/analysts indicated all but one expected a drop in production. The likes of UBS and J.P. Morgan expect a cut of at least 500k barrels per day, while RBC looks for a drop potentially as big as 1 million barrels.

- On the demand side, US data continues to defy tighter financial conditions.

- While today's China PMI updates were disappointing, in aggregate, and continue to cast a shadow over the growth outlook. Activity in the services/SME sector eased noticeably.

- Still, with the Chengdu lockdown behind, momentum may improve in September. Driving activity in the city has picked up through tail end of this month (see this link for more details).

GOLD: Set For Weekly Gain Despite Higher US Real Yields

Gold is mostly following broader USD direction. We currently sit close to $1664, not far from recent highs. A break above $1665 could pave the way for a move towards $1680, highs from last week. On the downside, yesterday's lows just under $1642 should offer some support, beyond that is Wednesday's lows around $1615.

- If the precious metal holds around current levels, it would put weekly gains at +1.2%, the best performance since mid August.

- Gold is looking a little elevated relative to US real yields, with the 10yr rebounding overnight to 157bps, versus 139bps on Wednesday.

- This may be a constraint in terms of how far the current rebound can extend, but it isn’t driving sentiment today.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/09/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/09/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/09/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/09/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/09/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/09/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/09/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/09/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/09/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/09/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/09/2022 | 1100/1300 |  | EU | ECB Elderson in Discussion at Uni Amsterdam | |

| 30/09/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/09/2022 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 1300/0900 |  | US | Fed Vice Chair Lael Brainard | |

| 30/09/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/09/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 30/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 30/09/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/09/2022 | 1530/1730 |  | EU | ECB Schnabel Panels La Toja Forum | |

| 30/09/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 30/09/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 2015/1615 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.