-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA Terminal Rate Pricing Shifts Lower After Hiking Pace Slowed

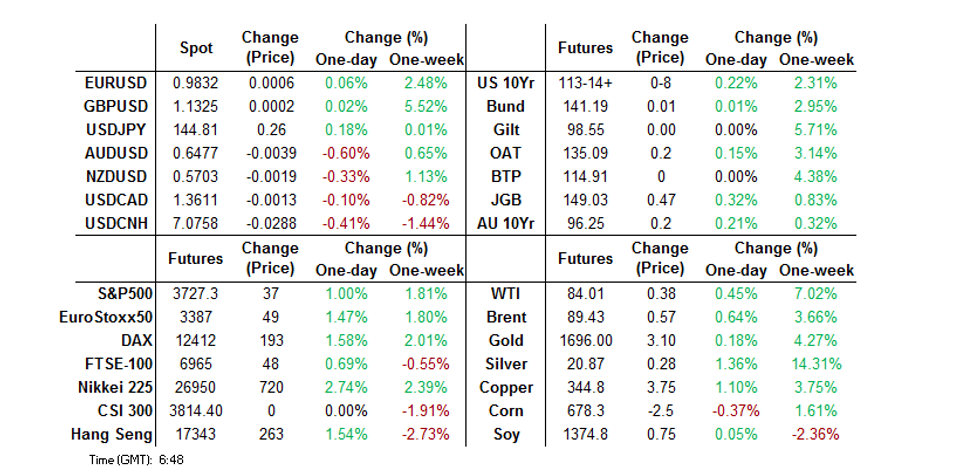

- A surprise 25bp hike from the RBA (~45bp of tightening was priced into dated OIS covering today’s RBA meeting) put an immediate bid into the Aussie fixed income space, with terminal rate pricing reassessed, falling back to ~3.60% vs. the ~4.10% level seen late Friday/early today (some of that was attributable to spill over from the moves in market pricing re: BoE hikes on Monday).

- The AUD found itself at the bottom of the G10 FX table as a result.

- Focus turns to U.S. factory orders & final durable goods orders, as well as comments from Fed's Logan, Williams, Mester, Jefferson & Daly and ECB's Lagarde, de Cos & Centeno.

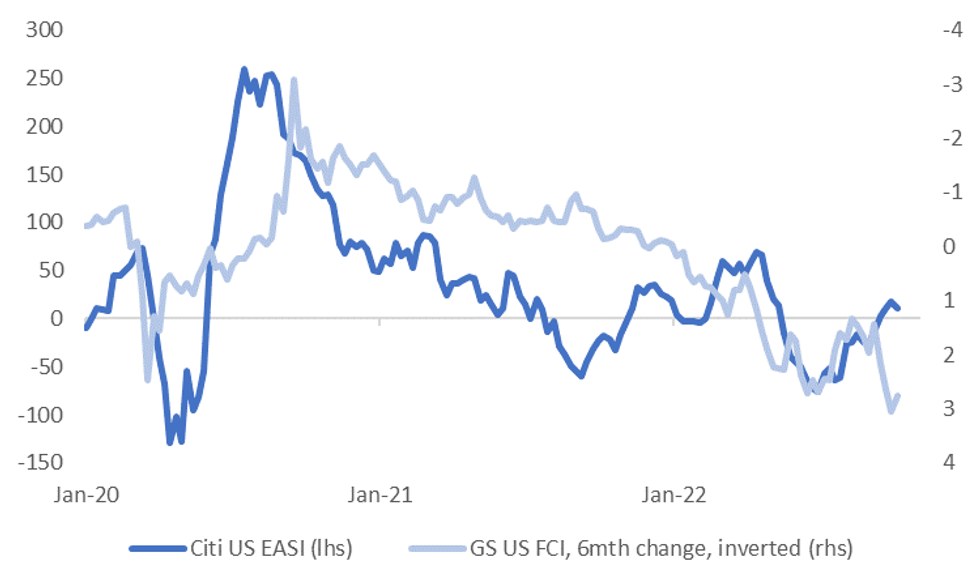

MARKET INSIGHT: Tighter US Financial Conditions To Hurt US Data Momentum?

Softer US data outcomes, underpinned by the overnight ISM reading, has taken the Citi US EASI off its recent highs. The chart below overlays the EASI against the Goldman Sachs financial conditions index for the US. Tighter US financial conditions, which is presented as a 6 month rate of change on the chart, suggests the balance of risks rests with further downside in US data outcomes relative to expectations.

- More data prints are out tonight with factory orders and durable goods data due. The main focus is likely to be on Friday's jobs print though. To date, fresh softness in US data outcomes has been more in survey outcomes rather than hard data.

Fig 1: Citi US EASI Versus Goldman Sachs US FCI

Source: Citi/Goldman Sachs/MNI - Market News/Bloomberg

Source: Citi/Goldman Sachs/MNI - Market News/Bloomberg

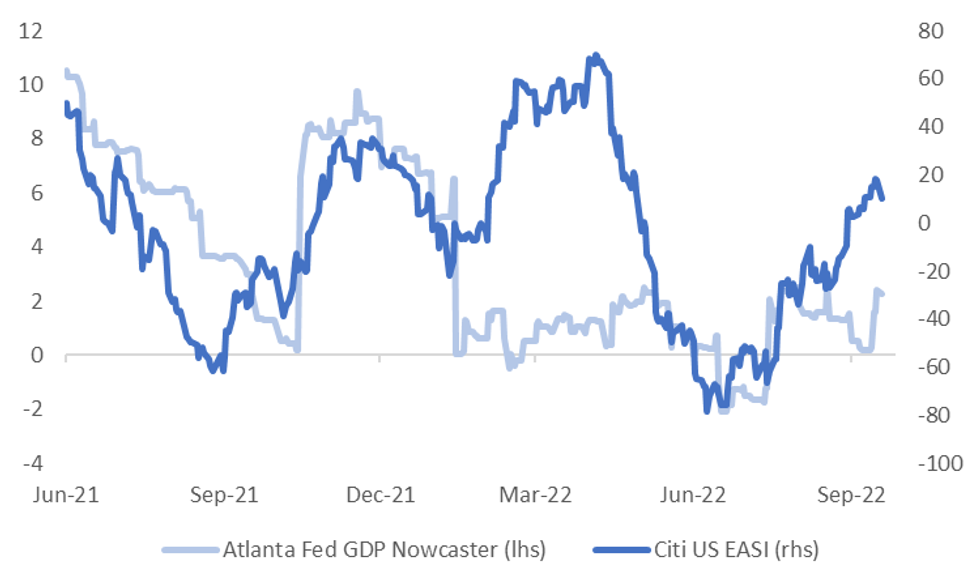

- The second chart overlays the Citi EASI against the Atlanta Fed GDP nowcaster. A weaker period of data momentum should hurt growth expectations, although the EASI is coming off fairly elevated levels.

- If such a scenario does unfold it could weigh further on USD momentum. Arguably lower yielding/safe havens would benefit more thank higher beta plays in the FX space, as fresh downside in US data momentum could heighten global growth fears.

- The DXY is already close to 2.8% off its recent highs though. This is not too far off average peak to trough moves in 2022 amidst what has been a broad USD uptrend. Other factors have also been in play in terms of driving USD sentiment (UK fiscal concerns/EU energy woes).

Source: Citi/Atlanta Fed/MNI - Market News/Bloomberg

Source: Citi/Atlanta Fed/MNI - Market News/Bloomberg

US TSYS: Bull Steepening, Aided By Dovish RBA Surprise

TYZ2 deals +0-10 at 113-16+, 0-03 off the recently printed session high. The contract has operated in a 0-12+ range, on above average volume of ~179K, even with Hong Kong & China observing holidays.

- Early Asia-Pac trade saw Tsys rally on the latest North Korean missile launch, which flew over Japanese airspace. Although the lack of damage to Japanese assets and fact that the missile landed outside of Japan’s EEZ, in the Pacific Ocean, allowed the space to retrace the related bid. The retrace was further aided by a block sale in FV futures (-5.7K).

- A fresh bid came back in later in the session on the back of a dovish surprise from the RBA, as the Bank delivered a 25bp hike vs. the widely expected and largely priced 50bp step.

- This saw all of the major Tsy benchmarks register fresh session lows in yield terms, with the front end continuing to outperform, as it has all session (albeit as the curve flipped between bullish and twist steepening on a couple of occasions). A couple of block sales in TU futures (-1.4K & -1.3K) may have limited the post-RBA uptick.

- Looking ahead, Tuesday’s NY docket will be headlined by final durable goods readings, JOLTS job opening data and Fedspeak from Jefferson, Williams, Mester, Logan & Daly

JGBS: Futures Outperform, 10-Year JGB Supply Goes Well

JGBs have regained some poise in the wake of today’s 10-Year JGB auction. That leaves cash JGBS running unchanged to 4bp richer across the curve, while futures have managed to punch through their overnight high, last dealing +48, just off best levels.

- Futures (and therefore 7s) outperformed all day, while the longer end has unwound the weakness that was observed in the latter rounds of Tokyo morning trade (which came as the Nikkei 225 rallied, and some space was made for the impending round of JGB supply).

- Early Tokyo trade saw a bid on the back of the latest North Korean missile test, which flew over Japan, before landing in the Pacific Ocean, outside of the country’s EEZ, causing no damage. The lack of damage saw JGBs off their morning peaks and allowed the Nikkei 225 to rally further.

- The latest round of 10-Year JGB supply was well received, with the cover ratio jumping to the highest level witnessed at a 10-Year auction since the multi-year high observed in May, as the price tail narrowed and low price matched wider expectations.

- Spill over from the RBA-driven bid in the ACGB space would have helped JGBs during the Tokyo afternoon.

- Local data had no tangible impact on the space, with Tokyo CPI virtually in line with wider exp.

AUSSIE BONDS: RBA Only Delivers 25bp Hike, Triggering Repricing Of Terminal Rate

A surprise 25bp hike from the RBA (~45bp of tightening was priced into dated OIS covering today’s RBA meeting) put an immediate bid into the Aussie fixed income space, with terminal rate pricing reassessed, falling back to ~3.60% vs. the ~4.10% level seen late Friday/early today (some of that was attributable to spill over from the moves in market pricing re: BoE hikes on Monday).

- 3-Year ACGB yields plummeted to near 3.00% vs. the ~3.45% see ahead of the decision, before rebounding to trade around the 3.25% mark into the close. Cash ACGBs run 13-35bp richer across the curve, with 3s leading as the curve bull steepens. YM is +26.0 & XM is +23.

- Bills have surged on the repricing of expectations surrounding the RBA’s terminal rate, running 37-62bp firmer on the day through the reds into the close, off of best levels, with IRH3 & M3 outperforming.

- The Bank noted that it expects to increase interest rates further in the period ahead (previously it flagged in “the months ahead”), while it highlighted the speed of the previously deployed tightening and the deteriorating global conditions in its post meeting statement. Household consumption remains key, and it seems that the lagged impact of monetary policy was integral to the RBA’s thought process when it came to slowing rates, which is understandable given the level of debt in the Australian economy.

- The Bank also dropped the reference to monetary policy not being on a pre-set path.

NZGBS: NZGBs Bull Steepen Ahead Of RBNZ

NZGBs extended their early richening on the back of the latest North Korean missile launch, which crossed Japanese airspace, but ultimately failed to cause any damage to Japanese assets before landing in the Pacific Ocean, outside of Japan’s EEZ.

- The lack of damage allowed core FI to pull away from richest levels of the session, facilitating a similar move in NZGBs.

- The major NZGB benchmarks finished 7-10bp richer, with some light bull steepening in play.

- The latest NZIER QSBO had no real impact on the space, with a notable number of businesses outlining their intentions to deploy further price hikes in Q4.

- Looking ahead, early Wednesday trade will likely be shaped by the trans-Tasman impetus derived from today’s shock RBA decision (25bp hike vs. the consensus 50bp, which triggered a repricing of RBA terminal rate exp.). However, the impact from the RBNZ decision will dominate as we work through Wednesday’s session.

- A reminder that all of those surveyed by BBG look for a 50bp hike to the OCR tomorrow, with such a move fully priced into the OIS strip. The RBNZ’s guidance will be key, with a terminal rate of ~4.65% now priced after a pullback alongside today’s richening in NZGBs/in lieu of yesterday’s pullback in pricing surrounding BoE tightening expectations (this could be adjusted further post-RBA).

FOREX: Aussie Depreciates As RBA Raises Cash Rate Target By Less Than Expected

The Aussie dollar depreciated in reaction to the RBA's decision to raise its cash rate target by just 25bp, although most analysts expected it to hike by twice as much, after four straight 50bp moves. The Bank said it expects to keep pushing interest rates higher, while tipping hat to the speed of previously deployed tightening and the deteriorating global conditions. Failure to tighten monetary conditions by the expected increment put a firm bid into ACGBs, while market pricing surrounding the terminal rate shifted lower.

- AUD/USD bounced off its post-RBA lows ($0.6451) amid apparent profit-taking, but the recovery proved short-lived. The rate now hovers just above its worst levels of the day. The kiwi retreated on trans-Tasman contagion, becoming the second-worst G10 performer.

- Selling pressure hit AUD/NZD in sync with a sharp move lower in Australia/New Zealand 2-year swap spread. The RBNZ is broadly expected to raise its key policy rate by 50bp at its interim monetary policy review tomorrow.

- North Korea fired an intermediate-range ballistic missile (IRBM) over Japan, triggering an alert system which issued "duck-and-cover" warnings in some less populated areas for the first time since 2017. The yen posted a negligible uptick, but USD/JPY appreciated as the session progressed, approaching the Y145.00 mark, seen as the threshold of heightened intervention risk.

- Focus turns to U.S. factory orders & final durable goods orders, as well as comments from Fed's Logan, Williams, Mester, Jefferson & Daly and ECB's Lagarde, de Cos & Centeno.

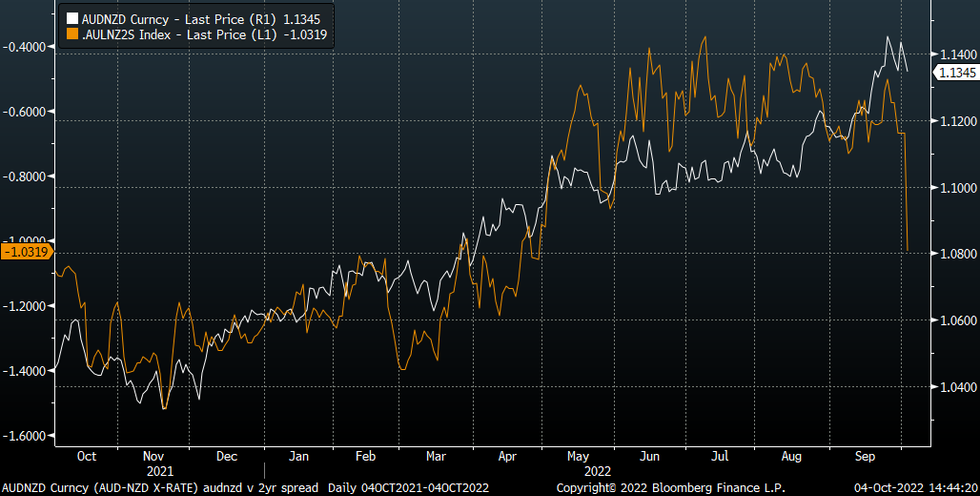

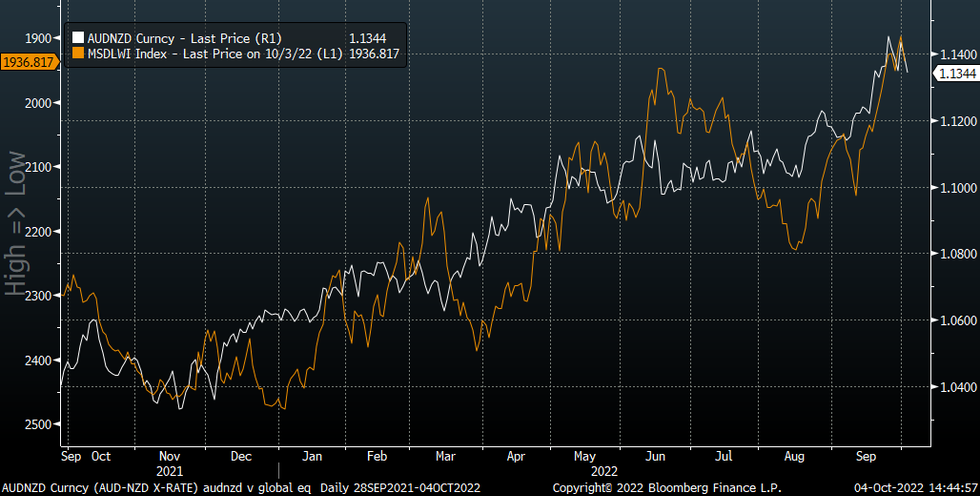

AUDNZD: Dovish RBA Hike May Cap AUD/NZD Cross

Judging by the decline in the AU-NZ 2yr swap spread after today’s RBA hike, down to -107bps, versus -67bps yesterday, the AUD/NZD may see further downside traction. The chart below plots the AUD/NZD cross against this swap spread.

- The cross was 1.1415/20 prior to the print, but we now sit under 1.1340/45. The 1.1320/30 region could offer support, while beyond that is the low 1.1300 and then a number of highs just above 1.1250 from mid September. On the top side, recent highs around 1.1420/40 may offer resistance.

Fig 1: AUD/NZD Versus 2yr Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The clear caveats are we have tomorrow's RBNZ decision. A 50bps move here is widely expected. After today's RBA outcome, the market may be a little nervous on what the central bank delivers, although the RBA was more vocal in the lead up to this meeting around slowing the pace of hikes.

- The other is the generally negative correlation between AUD/NZD and global equities this year, see the second chart below. Note global equities are inverted on the chart.

- NZD has been more sensitive to risk off episodes, likely owing to its much weaker external account position. This is not a factor today but could come back at some stage.

Fig 2: AUD/NZD & Global Equities

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Oct4 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9645-55(E2.1bln), $0.9700(E835mln), $0.9750(E830mln), $0.9800-05(E679mln)

- USD/JPY: Y142.00($546mln), Y145.00($562mln)

ASIA FX: USD Softer, CPI Prints In Focus Tomorrow

Asian FX has gained a positive footing through the early parts of the afternoon session. Liquidity is a little lighter today, with China remaining out, but also joined by Hong Kong today. Still, the positive tone to equities in the region is clearly spilling over to FX to some degree. Regional currencies have outperformed broader USD moves against the majors as well. South Korean, Philippines and Thailand CPI prints are in focus tomorrow.

- USD/CNH is sub 7.0900, through overnight lows, last tracking around 7.0750. We are close to lows from late last week.

- USD/KRW couldn't gain much downside traction early, but is back below 1430 this afternoon (last 1428). We topped out above 1436 on North Korean tensions and a weaker PMI print for September, but firmer equities have helped as the session progressed.

- USD/INR is around 0.55% lower since the onshore open. The pair last traded 81.40/45. Reported intervention flows overnight may suggest some reluctance to see a sharp breakthrough of the 82.00 level. Onshore equities are also up over 2%.

- USD/IDR is lower, -35figs to 15268 last. This is in line with the broader trend seen in the region. We were above 15300 in early trade. Indonesia's headline inflation fell virtually in line with expectations in September, but still printed a seven-year high. Still, Bank Indonesia is focusing on core prices, which grew +3.21% Y/Y and missed the +3.50% median estimate.

- The baht is an outperformer within the region. We are +1% up for the session, partly due to catch up from overnight moves in the USD. We last changed hands at 37.715. Thailand's monthly CPI data will cross the wires tomorrow, with headline inflation expected to have eased to +6.58% Y/Y in September from +7.86% prior. Still, core CPI may have quickened to +3.20% Y/Y from +3.15%, according to a Bloomberg survey of analysts.

EQUITIES: Australian Stocks Outperform On Lower Than Expected RBA Hike

The regional equity space has been quieter today, with China and Hong Kong markets closed. All major indices, that are open, are in positive territory though, following firm leads from US markets overnight. US futures have continued this positive momentum during today's session, up a further 0.80-0.901% across the major futures.

- Australian stocks are a standout, up over 3.50%, for the strongest daily gain since June 2020.

- Markets were already in positive territory but were aided by the lower than expected RBA hike (25bps versus 50bps expected). The major banks led the move higher (+4%), but consumer related stocks have also gained by 4-5%.

- Tech sensitive markets like the Nikkei 225, Kospi and Taiex are the other strong performers. The Kospi has gained just under 2.50%, while the TWSE is +2% for the session so far. Electronic sub-sectors have led the way following strong tech gains in US markets.

- The authorities may launch the Korean stock stabilization fund this month.

- Gains elsewhere have been lower, but still positive. Indian shares are the next best performer, up over 1.8% in the first part of trading.

OIL: Holding Close To Recent Highs

Brent is holding above $89/bbl, slightly firmer than NY closing levels. WTI is just below recent highs above $84/bbl (last $83.70), consolidating following yesterday's +5% gain. This comes ahead of tomorrow's OPEC+ meeting, which will decide production targets for November.

- As we noted last week, the strong sense is a production cut will be announced, it's just a question of how large it will be. This comes after Q3 saw the largest drop in oil prices since Q1 2020.

- Analysts from Goldman Sachs and ANZ have stated a cut of more than 1 million bpd could be realized. This is what RBC stated as a risk last week.

- Such a move, in terms of its actual impact on the supply/demand balance, may be muted though given a number of OPEC+ countries are already producing their current quota.

- The other focus point will be EU looking to finalize fresh sanctions on Russia, including an oil price cap.

GOLD: Consolidates Just Shy Of $1700

Gold has consolidated post yesterday's 2.37% gain. We last sat around $1697, down from earlier highs above $1700, and -0.20% below NY closing levels. This is line with a modestly stronger USD through the course of today's session.

- Yesterday's daily gain in the precious metal was the strongest since March. We also haven't been above the $1700 level since the first half of September.

- On the topside, the 50-day comes in at $1724, which we have spent very little time above since April of this year.

- On the downside, recent highs around the $1685/88 region could offer some support.

- Gold continues to follow broader USD sentiment for the most part. The overnight pull back in US real yields (10yr to 1.43% from 1.68% on Friday) aided sentiment.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2022 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 04/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/10/2022 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 04/10/2022 | 1315/0915 |  | US | Cleveland Fed's Loretta Mester | |

| 04/10/2022 | 1400/1000 | ** |  | US | factory new orders |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/10/2022 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students Event | |

| 04/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 04/10/2022 | 1545/1145 |  | US | Fed Governor Philip Jefferson | |

| 04/10/2022 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 05/10/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.