-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN OPEN: A$ & Local Yields Fall Post RBA 25bps Hike

EXECUTIVE SUMMARY

- RBA LIFTS TO 4.35%, EYES FUTURE DATA - MNI BRIEF

- FED’S KASHKARI SAYS TOO SOON TO DECLARE VICTORY ON INFLATION - BBG

- ISRAEL SAYS IT IS OPEN TO FIGHTING PAUSE FOR AID, HOSTAGES - RTRS

- JAPAN’S NISHIMURA: WANTS 5% PLUS WAGE GAINS TO REGAIN LOST YEARS - BBG

- CHINA’S IMPORTS UNEXPECTEDLY GROW IN OCT, EXPORTS EXTEND DECLINES - RTRS

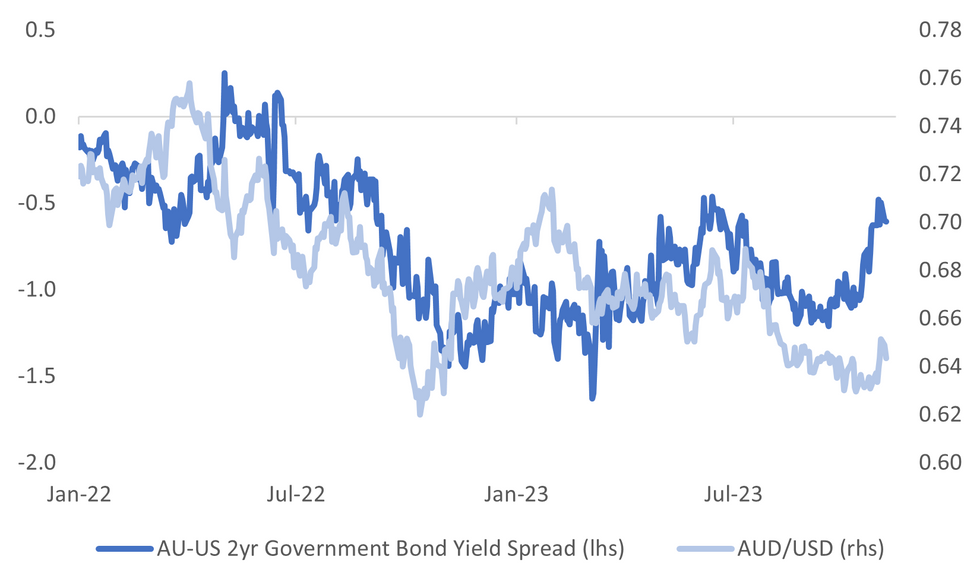

Fig. 1: AUD/USD Versus AU-US 2yr Government Bond Yield Spread

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): Bank of England Chief Economist Huw Pill said UK inflation will soon fall in line with the lower rates seen in the rest of the world, reflecting a drop in energy bills.

RETAIL SALES (BBG): The British Retail Consortium, KPMG in London publish the Oct. retail sales monitor showing total retail sales +2.5% y/y vs Sept. +2.7% y/y

POLITICS (ECONOMIST): The full pageantry of the British state will be on display on Tuesday at the state opening of Parliament, which kicks off the parliamentary year. The king will announce the government’s legislative agenda in probably the last speech before the general election, due by January 2025.

EUROPE

ITALY (BBG): Italy’s Finance Police is seizing about €779 million ($835 million) from the home-sharing company Airbnb Inc. after it allegedly failed to pay some taxes.

GERMANY (BBG): German Chancellor Olaf Scholz’s ruling coalition agreed to help ease the burden on regional and local administrations struggling to cope with rising numbers of refugees and other migrants.

POLAND (BBG): Poland’s president will give the ruling nationalists the first shot at forming a government, delaying Donald Tusk’s bid to take power until late December.

SWITZERLAND (ECONOMIST): On Tuesday UBS reports third-quarter earnings, five months after completing its dramatic acquisition of Credit Suisse. The results mark a return to normal financial reporting for UBS after accounting adjustments caused by the deal heavily distorted its second-quarter results.

U.S.

FED (BBG): Federal Reserve Bank of Minneapolis President Neel Kashkari said it’s too soon to declare victory over inflation, despite positive signs that price pressures are easing.

CORPORATE (BBG): Former high-flying startup WeWork Inc. filed for bankruptcy listing nearly $19 billion dollar of debts, a fresh low for the co-working company that struggled to recover from the pandemic.

OTHER

ISRAEL (RTRS): Prime Minister Benjamin Netanyahu said Israel would consider "tactical little pauses" in Gaza fighting to facilitate the entry of aid or the exit of hostages, but again rejected calls for a general ceasefire despite growing international pressure.

JAPAN (BBG): Japan’s economy needs high levels of wage growth for multiple years to make up for the effects of a few decades of economic stagnation, Yasutoshi Nishimura, the nation’s economy minister, says to reporters on Tuesday.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia board broke its four-month long hiking pause Tuesday to lift the cash rate 25bp to 4.35%, noting inflation had fallen slower than initially expected. Governor Michele Bullock in statement following the decision said, while the central forecast is for CPI to continue to decline, the RBA now expects it to land about 3.5% by the end of 2024 and at the top of the 2-3% target range by the end of 2025.

NEW ZEALAND (BBG): New Zealand First Party leader Winston Peters said talks to form a new center-right government can be concluded within two weeks. “I certainly think that we will have it resolved before the next two weeks, most definitely,” Peters told the NBR business news outlet, according to an audio recording posted on its website Tuesday in Wellington.

CHINA

PROPERTY (BBG): After letting two of the world’s biggest property developers plunge into default, Chinese authorities are attempting to save a third industry giant from following suit.

TRADE (RTRS): China's imports unexpectedly grew in October while exports contracted at a quicker pace, in a mixed set of indicators that showed the recovery in the world's second-largest economy remains uneven amid multiple challenges at home and abroad.

PBOC (YICAI): Authorities will improve the marketisation of mortgage interest rates to better support housing demand, according to the People’s Bank of China (PBOC). The PBOC aims to create a virtuous cycle between finance and real estate by expanding the space for independent pricing of mortgage interest rates and support for city governments to make good use of policies based on city-specific conditions.

CONSUMPTION (YICAI): Officials in China can boost consumption by increasing residential incomes, stimulating car purchases, avoiding a real estate hard landing and lowering the cost of education and healthcare, according to Huang Qifan, vice-president at the China Institute for Innovation & Development Strategy. Residents disposable income should be raised to 52% of GDP from 43% in 2022, Huang added.

BONDS (21st Century Business Herald): Beijing will allocate the recently announced additional CNY1 trillion government bonds according to the quality and maturity of infrastructure projects, instead of directly distributing to provinces, 21st Century Business Herald reported citing unnamed local officials. The central government will provide funding support if quality conditions are met and will not set quotas for each province, an official from a western province explained.

CHINA MARKETS

MNI: PBOC Drains Net CNY259 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY353 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY259 billion after offsetting the maturity of CNY612 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8101% at 10:21 am local time from the close of 1.7691% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 40 on Monday, compared with the close of 39 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1776 Tuesday vs 7.1780 Monday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1776 on Tuesday, compared with 7.1780 set on Monday. The fixing was estimated at 7.2849 by Bloomberg survey today.

MARKET DATA

JAPAN SEP LABOR CASH EARNINGS Y/Y 1.2%; MEDIAN 1.2%; PRIOR 0.8%

JAPAN SEP REAL CASH EARNINGS Y/Y -2.4%; MEDIAN -2.3%; PRIOR -2.8%

JAPAN SEP HOUSEHOLD SPENDING Y/Y -2.8%; MEDIAN -2.9%; PRIOR -2.5%

UK OCT BRC SALES LIKE-FOR-LIKE Y/Y 2.6%; PRIOR 2.8%

CHINA OCT EXPORTS Y/Y -6.4%; MEDIAN -3.5%; PRIOR -6.2%

CHINA OCT IMPORTS Y/Y 3.0%; MEDIAN -5.0%; PRIOR -6.3%

CHINA OCT TRADE BALANCE $56.53BN; MEDIAN $82BN; PRIOR $77.83BN

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 107-25, +0-06, a narrow 0-04+ range was observed on volume of ~64k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- The space has observed narrow ranges in Asia with little follow through on moves.

- Tsys looked through comments from Minneapolis Fed President Kashkari who said it’s too soon to declare victory over inflation, despite positive signs that price pressures are easing.

- There was also little spillover from ACGBs which firmed after a dovish 25bp hike from the RBA.

- German Industrial Production provides the highlight in Europe today. Further out we have Trade Balance and the latest 3-Year Supply. There are a slew of Fed speeches due.

JGBS: Futures Range Bound, Domestic Focus Remains On Wages Growth

JGBs have drifted higher post the lunch time break, but at 144.33, -.09, remain well within this week's range. We have modestly outperformed US Tsy futures, which sit off session highs, but equally have displayed a fairly narrow range for the session.

- The main macro news today was the close to expected September wages data (see this link). The Economic Minister stated the country needs +5% wage growth for a number of years to play catch up after such a long period of deflation (see this BBG link).

- Still, the data won't shift views that the BoJ is unlikely to move away from accommodative policy settings before year end, something that Governor Ueda hinted at yesterday.

- In the cash JGB space, moves have been modest, the 10yr yield not drifting too far from 0.88%. The 20-40yr part of the curve are 1bps lower in yield terms. The 10yr swap rate sits at 1.0625%.

- The MoF sold 10yr inflation linker bonds, but the auction drew the lowest bid-to-cover ratio since 2017.

AUSSIE BONDS: Marginally Richer After RBA Hikes 25bps

ACGBs sit ~1bp richer across the major benchmarks. The space firmed after the RBA hiked the cash rate but revised forecasts including the peak in unemployment and CPI inflation returning to the top of the target band by the end of 2025 rather than “within” it. We were ~4bps cheaper pre announcement.

- Futures have observed narrow ranges with little follow through ticking marginally higher after the RBA meeting. XM and YM are both 0.01 higher.

- RBA dated futures price a terminal rate of ~4.45% in March 24 with 15bps of cuts by Oct 24.

- Pre-RBA the local docket was empty and there was little in the way of meaningful headline flow in a mostly muted session.

- Looking ahead the local docket is empty until Friday the Statement on Monetary Policy crosses.

NZGBS: Short End Firms Into Close

The short end of the NZGB curve firmed into the close on spillover from the RBA's dovish 25bp hike. NZGBs finishing dealing 1bp richer to 4bps cheaper across the major benchmarks, the curve twist steepened pivoting on 5s.

- The 10-Year US NZ Swap Spread remains well within recent ranges, on Tuesday we sit at +55bps.

- RBNZ dated OIS remain stable; a terminal rate of ~5.55% is seen in Feb 24, there are ~35bps of cuts by Oct 24.

- Ranges were narrow for the most part today, little meaningful domestic news flow crossed and the local docket was empty.

- Due tomorrow we have Q4 2-Year Inflation Expectations. There is no estimate and the prior read was 2.83%.

FOREX: AUD Pressured After RBA Hikes Cash Rate 25bps

The AUD has been pressured in Asia today, extending falls after the RBA hiked the cash rate 25bps. The bank revised forecasts which included the peak in unemployment within the time horizon revised down 0.25pp to 4.25% and CPI inflation returning to the top of the target band by the end of 2025 rather than “within” it.

- AUD/USD sits at $0.6440/50 the pair is down ~0.7% today. Despite todays fall technically the corrective cycle has extended. Resistance comes in at $0.6523, high from Nov 6 and key resistance, and $0.6562, 3.0% 10-DMA envelope. Support is at the 20-Day EMA ($0.6378).

- Spillover pressure from the RBA decision has seen Kiwi erase its post-NFP gains, NZD/USD prints at $0.5935/40 ~0.4% lower today. AUD/NZD is ~0.3% lower.

- Yen has ticked away from the ¥150 handle in early dealing this morning. Japan September labor earnings were close to expectations. The nominal outcome at 1.2%, as forecast, and a modest step up from the revised 0.8% pace recorded in August.

- Elsewhere in G-10 the Scandies are lower however liquidity is generally poor in Asia.

- Cross asset wise; lower US Equity futures and regional equities have weighed on risk sentiment. BBDXY is up ~0.2%.

- In Europe today we ahve German Industrial Production and Eurozone PPI.

EQUITIES: Regional Equity Rebound Falters

The recent rebound in regional equity market sentiment has paused today. All the major markets are weaker, while US futures are also down, albeit modestly at this stage. Eminis were last off 0.25% to 4374, Nasdaq futures are off by slightly less, -0.19%. Cash trading was mixed on Monday, US markets finishing a touch higher, but EU markets were mostly down.

- US yields remain a key watch point for equity sentiment. We are slightly lower today in yield terms, but this gives back only part of Monday's gains.

- South Korean markets have been in focus, with the Kospi and Kosdaq both down around 2.5-3% at this stage. This follows yesterday's strong gains inspired in large part by the short selling ban. Today, offshore and institutional investors have been net sellers, but retail investors are buying local shares.

- Elsewhere, Japan markets are off by around 1%, while the Taiex is outperforming at around flat.

- At the break, the HSI is off 1.5%, the CSI 300 down by 0.70%. China October trade figures were mixed, with exports weaker but the import bounce suggesting an improved domestic demand backdrop.

- Earlier the PBoC Deputy Governor stated he isn't too worried about China's current economic state, but that the old growth model driven by property is not sustainable (BBG). Government debt levels are manageably, particularly compared to international standards.

- The ASX 200 is up 0.20%, as the RBA raised rates as expected, although the statement was interpreted as dovish.

- In SEA, markets are down modestly for the most part.

OIL: Crude At Bottom Of Recent Range As Demand Worries At Fore

Oil prices are down moderately today as the greenback strengthened (USD index +0.2%). Demand concerns drove markets with speculation that the Fed isn’t finished and weak China exports in October. There was also a general pullback in risk sentiment.

- WTI is 0.5% lower at $80.41/bbl and while it has trended down throughout the session, it has held above $80. Brent is down 0.6% to $84.69. Prices are at the lower end of the range they have been in November so far. Recent range trading reflects little change in market fundamentals.

- Today Minneapolis Fed President Kashkari, who is on the FOMC this year, said that it is too soon to say that inflation is contained and that more data is needed, thus raising the prospect of further tightening.

- China’s imports of crude rose 14.4% y/y in September YTD. Product exports increased 33.2% y/y and imports +93.6%.

- API data on crude and product inventories are released today. Later the Fed’s Kashkari, Goolsbee, Barr, Schmid, Waller and Logan speak. ECB’s de Guindos, Enria and McCaul also appear. On the data front there is only the September US trade balance and German IP.

GOLD: Bullion Trending Down As War Premium Unwinds

Bullion continued Monday’s trend lower during APAC trading today. Minneapolis Fed President Kashkari raised the prospect of further tightening. Also as the Middle East conflict looks contained to Israel/Gaza, gold’s war premium is gradually unwinding. It is down 0.3% to around $1971.40/oz, close to the intraday low, after falling 0.75% yesterday. The USD index is up 0.2%.

- FOMC member Kashkari said that it is too soon to say that inflation is contained and that more data is needed, thus raising the possibility of further tightening. Any further US rate hikes are likely to weigh on zero yielding gold.

- Bullion continues to trade well above support at $1957.50, the 20-day EMA. The trend outlook appears bullish.

- Later the Fed’s Kashkari, Goolsbee, Barr, Schmid, Waller and Logan speak, with their comments likely to impact gold trading. ECB’s de Guindos, Enria and McCaul also appear. On the data front there is only the September US trade balance and German IP.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2023 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/11/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/11/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2023 | 0835/0935 |  | EU | ECB's de Guindos fireside organised by Deloitte | |

| 07/11/2023 | 1000/1100 | ** |  | EU | PPI |

| 07/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/11/2023 | - | *** |  | CN | Trade |

| 07/11/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/11/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/11/2023 | 1345/0845 |  | CA | BOC Governor Macklem conference opening remarks | |

| 07/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/11/2023 | 1415/0915 |  | US | Fed Vice Chair Michael Barr | |

| 07/11/2023 | 1450/0950 |  | US | Kansas City Fed's Jeff Schmid | |

| 07/11/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/11/2023 | 1500/1000 |  | US | Fed Governor Christopher Waller | |

| 07/11/2023 | 1600/1100 |  | CA | BOC Deputy Kozicki opening remarks for lecture by IMF's Pierre-Olivier Gourinchas | |

| 07/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 07/11/2023 | 1700/1200 |  | US | New York Fed's John Williams | |

| 07/11/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/11/2023 | 1825/1325 |  | US | Dallas Fed's Lorie Logan | |

| 07/11/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.