-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ & Yields Higher Post Local Data Beats

EXECUTIVE SUMMARY

- BIDEN FACES DOUBTS FROM DEMOCRATS ABOUT HIS 2024 RE-ELECTION - RTRS

- POWELL - FED WANTS MORE CONFIDENCE ON DISINFLATION - MNI BRIEF

- AUSTRALIAN RETAIL SALES JUMP, BOOSTING CASE FOR RBA HIKE - BBG

- CHINA SERVICES EXPANSION COOLS TO WEAKEST IN EIGHT MONTHS - BBG

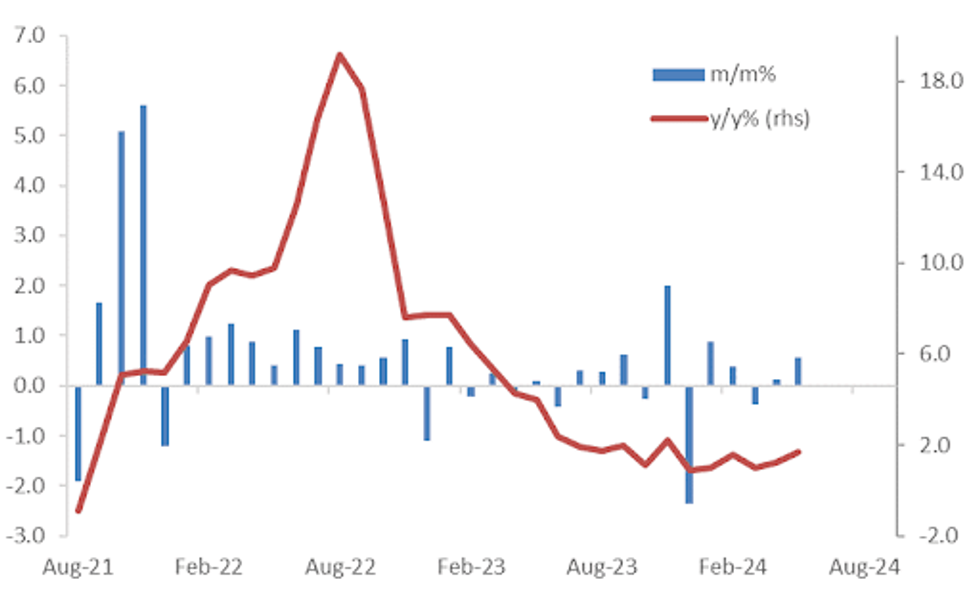

Fig. 1: Australian Retail Sales Stronger Than Forecast In May

Source: MNI - Market News/Bloomberg

UK

ELECTION (BBC): “Party leaders are reinforcing their core messages to voters, as they prepare to enter the last full day of general election campaigning. Prime Minister Rishi Sunak told a Conservative Party rally he would "fight for every vote", saying that the result of Thursday's poll was not a "foregone conclusion".”

EUROPE

FRANCE (BBG): “Marine Le Pen’s National Rally is trying to outmaneuver rivals that are pulling out well-worn tricks to keep the far-right out of power in the final round of legislative elections on Sunday.”

FRANCE (BBC): “The deadline for declarations in the French elections ended Tuesday, with large numbers of left and centre candidates standing aside in order to try to block the far-right National Rally (RN). With no official list yet released, French media reported that between 214 and 218 third-placed contenders had pulled out of the race in their constituencies. It means there will now be around 108 three-way races.”

ECB (MNI BRIEF): Eurozone headline inflation was lower in June but the path to the 2% target in the second half of 2025 remains bumpy, with services inflation still appearing sticky, European Central Bank President Christine Lagarde said Tuesday.

ECB (MNI BRIEF): The European Central Bank needs to deliver price stability, which entails financial stability, ECB President Christine Lagarde said on Tuesday, when asked what the Governing Council would do if markets reacted badly to French national elections.

POLAND/GERMANY (EURONEWS): “German Chancellor Olaf Scholz and his Polish counterpart Donald Tusk met in Warsaw to discuss security and Poland's eastern border for the first time in six years. After the meeting Tusk reiterated to reporters that Germany should be a leading country in "reference to European and Polish security."”

US

POLITICS (RTRS): “Some elected Democrats loyal to President Joe Biden raised fresh questions on Tuesday about his 2024 re-election bid, with one calling for him to step aside, a shift after many defended him in the wake of last week's shaky debate performance.”

POLITICS (BBG): “ President Joe Biden’s favorability numbers plummeted after his debate performance last week in “the largest single-week drop” in nearly three years, according to a leaked memo from a pollster that was published Tuesday by the news site Puck.”

POLITICS (BBG): “Donald Trump’s sentencing in his New York hush-money case was delayed two months until Sept. 18 so the judge can review the impact of a landmark US Supreme Court ruling about presidential immunity.”

FED (MNI BRIEF): U.S. inflation appears to be making additional progress in cooling toward the Federal Reserve’s 2% target but policymakers need more confidence the process will be sustained before cutting interest rates, Fed Chair Jerome Powell said Tuesday.

FED (MNI INTERVIEW): Dec Fed cut doubtful if Trump wins -Obstfeld

FED (BBG): “Federal Reserve Bank of Chicago President Austan Goolsbee said policymakers should cut interest rates if US inflation continues to fall back to the 2% target.”

OTHER

AUSTRALIA (BBG): “Australian retail sales rose by more than expected in May with spending largely driven by discounts in the face of elevated borrowing costs, an outcome that further strengthens the case for an interest rate hike this year.”

NEW ZEALAND (BBG): “New Zealand’s working-age population increased at a slower pace in the second quarter, suggesting that the surge in foreign workers entering the country has passed its peak.”

MEXICO (BBG): “Mexico President-elect Claudia Sheinbaum to announce more cabinet members at an event on July 4 in Mexico City, according to a statement from her campaign.”

CHINA

GEOPOLITICS (BBG): Chinese and Russian companies are developing an attack drone similar to an Iranian model deployed in Ukraine, European officials familiar with the matter said, a sign that Beijing may be edging closer to providing the sort of lethal aid that western officials have warned against.

SERVICES (BBG): “ China’s services activity expanded at the slowest pace in eight months in June, a private gauge showed, a slowdown that may add to worries over the economy’s outlook.’

FISCAL (NATIONAL BUSINESS DAILY): “China will promote a new round of fiscal and taxation reform, said Finance Minister Lan Fo’an as he delivered a report on the 2023 central government final accounts, National Business Daily reported.”

AUTOS (CADA): Car dealers have reported less than 20% of customers inquire about the old-for-new trade in policy, with an actual transaction rate of less than 10%, according to Fan Yu, a senior leader at the China Automobile Dealers Association.

LOGISTICS (SECURITIES DAILY): China's logistic industry prosperity index reached 51.6 in June, marking the fourth consecutive month of expansion, according to the China Federation of Logistics and Purchasing (CFLP). He Hui, chief economist of CFLP, said growth was balanced across China, with the expected business activity index for railway, aviation, and loading sectors reaching more than 54.

CHINA MARKETS

MNI: PBOC net drains CNY248 bln via Omo weds; rates unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY248 after offsetting the CNY250 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:38 am local time from the close of 1.7905% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Tuesday, compared with the close of 42 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1312 on Wednesday, compared with 7.1291 set on Tuesday. The fixing was estimated at 7.2631 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUNE JUDO BANK SERVICES PMI 51.2; MAY 52.5

AUSTRALIA JUNE JUDO BANK COMPOSITE PMI 50.7; MAY 52.1

AUSTRALIA MAY RETAIL SALES +0.6% M/M; EST. +0.3%; PRIOR +0.1%

AUSTRALIA MAY BUILDING APPROVALS +5.5% M/M; EST. +1.6%; PRIOR +1.9%

AUSTRALIA MAY PRIVATE-SECTOR HOME APPROVALS +2.1% M/M; PRIOR -0.3%

JAPAN JUNE JIBUN BANK COMPOSITE PMI 49.7; MAY 52.6

JAPAN JUNE JIBUN BANK SERVICES PMI 49.4; MAY 53.8

NEW ZEALAND JUNE ANZ COMMODITY PRICES +1.5% M/M; PRIOR +1.1%

CHINA JUNE CAIXIN SERVICES PMI 51.2; EST. 53.4; MAY 54.0

CHINA JUNE CAIXIN COMPOSITE PMI 52.8; MAY 54.1

SOUTH KOREA JUNE FOREIGN EXCHANGE RESERVES $412.21B; PRIOR $412.83

MARKETS

US TSYS: Tsys Futures Steady Ahead Of Busy Data Session, Fed Minutes

- Treasuries futures are slightly lower today and we trade near session lows. Ranges have been very light while volumes have been below recent averages. TUU4 is -0-00⅞ at 102-01, while TYU4 is-0-01 at 109-14.

- Volumes: TU 35k, FV 38k, TY 54k

- The cash treasury curve is slightly flatter today, with yields +/-1bp. The 2Y is +1bps at 4.752%, 5Y +0.4bp at 4.398%, while the 10Y is +0.2bp at 4.434%, the 2s10s is -0.624 at -32.006.

- APAC markets: ACGB yields are 2-4bps higher, the 10-15yr tenors slightly outperforming, NZGB are flat to 3.5bps higher, curve has bear steepened, while JGB yields are +/-1.5bps, curve has flattened.

- Looking ahead, MBA Mortgage Applications, ADP Employment Change, Jobless Claims, Trade Balance, S&P Global US PMI, Factory Orders, Durable Goods Orders, ISM Services Index & FOMC Meeting Minutes

JGBS: Subdued Session Ahead Of Key Data, 30Y Supply Tomorrow

JGB futures are stronger, +6 compared to settlement levels, after a relatively subdued local session.

- Outside of the previously outlined Composite and Services PMIs, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 1bp cheaper to 1bp richer in today’s Asia-Pac session, with a slight flattening bias. There is a heavy US data drop in today’s shortened session (floor closes at 1300ET, cash at 1300ET while Globex closes at the normal time of 1700ET): Challenger Job Cuts, ADP Employment, Weekly Jobless claims, ISM Services, Factory/Durables Orders and June FOMC Minutes. Friday's full session sees June Non-Farm Payroll data.

- The cash JGB curve has twist-steepened, pivoting at the 20s, with yields 2bps lower to 1bp higher. The benchmark 10-year yield is 0.2bp lower at 1.084%.

- There was no change in today’s BoJ bond buying as the market awaits more details on the BoJ plans. The central bank is meeting with key stakeholders in the bond market space early next week.

- Swap rates are 1-2bps lower across maturities. Swap spreads are mixed.

- Tomorrow, the local calendar will see weekly International Investment Flow data alongside 30-year supply.

AUSSIE BONDS: Cheaper & Near Worst Levels After Today’s Data Drop

ACGBs (YM -3.0 & XM -3.0) are holding 2-3bps cheaper since today’s stronger-than-expected domestic data drop.

- May retail sales were stronger-than-expected rising 0.6% m/m after +0.1% m/m to be up 1.7% y/y from 1.2%. The ABS notes that spending was boosted by early mid-year sales. The RBA sees consumption as an area of heightened uncertainty.

- The number of building approvals appears to have begun to recover but the trend remains weak. They rose a stronger-than-expected 5.5% m/m in May with the improvement fairly broad-based across states and components. Three-month momentum turned positive for the first time since December last year.

- Cash ACGBs are 3bp cheaper on the day. The AU-US 10-year yield differential is at +1bp versus -3bps earlier.

- Swap rates are 3bps higher on the day.

- The bills strip has shifted cheaper after the data to be -2 to -4.

- RBA Dated OIS is firmer after the data. Pricing now sits 6-29bps firmer across meetings than pre-CPI levels. The market gives a 25bp hike in August a 42% chance. Terminal rate expectations are also dramatically firmer at 4.50% versus 4.37% before the CPI data.

- Tomorrow, the local calendar will see Trade Balance data.

NZGBS: Subdued Dealings Ahead Of Key US Data

NZGBs closed near the session’s worst levels, with benchmarks flat to 3bps cheaper. Nevertheless, with the domestic calendar light, dealings have been subdued ahead of key US data.

- There is a heavy US data drop in today’s shortened session ahead of tomorrow’s 4th of July holiday: Challenger Job Cuts, ADP Employment, Weekly Jobless claims, ISM Services, Factory/Durables Orders and June FOMC Minutes. Friday will see June Non-Farm Payroll data.

- US tsys are little changed in today's Asia-Pac session after yesterday's Powell-induced rally.

- NZ-US and NZ-AU 10-year yield differentials are little changed versus yesterday’s close.

- NZ commodity export prices rose 1.5% from a month earlier in June (+7.4% y/y), with dairy seeing the largest increase (+2.2% m/m, +8.2% y/y).

- The swaps curve has twist-steepened, with rates 2bps lower to 1bp higher.

- RBNZ dated OIS pricing closed 2-4bps softer for meetings beyond July. A cumulative 36bps of easing is priced by year-end.

- Tomorrow, the local calendar will see CoreLogic House Prices and the Government’s 11-month Financial Statements.

- Tomorrow, the NZ Treasury plans to sell NZ$225mn of the 1.5% May-31 bond, NZ$175mn of the 4.25% May-34 bond and NZ$100mn of the 1.75% May-41 bond.

FOREX: A$ Outperforms Post Local Data Beats, AUD/JPY To Fresh highs Since 1991

Dollar trends have been mixed in the first part of Wednesday trade. The A$ has outperformed following better local data, while safe havens are marginally weaker. The BBDXY USD index sits little changed, last near 1269.4.

- For AUD/USD we had better than expected May retail sales and building approvals data. This has supported local yields, with benchmark government yield around 2-3bps higher. RBA hike odds for August have risen, although we remain below last week's highs.

- AUD/USD is right on session highs near 0.6680, with upside focus likely to rest on the 0.6700 level. AUD/JPY hit fresh highs back to 1991, the pair last near 107.95, right on session highs.

- NZD/USD has firmed a touch but continues to lag the A$. NZD/USD was last near 0.6080, while the AUD/NZD cross is pressing towards a 1.1000 test.

- USD/JPY remains within recent ranges but has been supported on dips, the pair last near 161.65.

- In the cross asset space, regional equity markets are higher, which has helped the AUD at the margins, although mainland China indices are lagging. US yields are relatively steady, with moves not stretching beyond 1bps in either direction so far today.

- Looking ahead, we have more central bank speak from the US Fed and ECB at the Sintra conference. In terms of data, US June Challenger job cuts/ADP employment, services ISM/PMI, May final durable orders, trade balance, jobless claims and June FOMC minutes are released. There are also June European services/composite PMIs and May euro area PPI data.

ASIA STOCKS: HK & China Equities Mixed, Tech Higher On Apple Court Request

Hong Kong and China equity markets are mixed today, with HK equities outperforming. Tech and property names have been the focus again today, with tech names are rising following a report that Apple is seeking to modify a Chinese court ruling in its favor. This potential boost in Apple phone sales in China is expected to benefit suppliers and enhance investor sentiment in the region, while property names are higher following data showing the top 100 developers saw sales increased m/m, although are still down y/y. Earlier, China Caixin services PMI came in at 51.2 vs 53.4 est, and down from 54.00 prior, although the headline index is still in expansion territory but back near Oct 2023 levels.

- Hong Kong equities are higher today, property names are the top performing with the Mainland Property Index up 3.45% and the HS Property Index up 2.37%, elsewhere the HSTech Index is up 2.51% and the wider HSI is trading 1.18% higher.

- China equity markets are mostly lower today, although similar to HK markets the property market is the top performing with the CSI 300 Real Estate Index up 2.08%, small-caps are well off their earlier lows with the CSI 2000 down 0.37% and the CSI 2000 down 0.12% at the break, while the wider CSI 300 is down 0.14%.

- Property sales from the top 100 developers increased m/m, although still sit 17% lower y/y. Earlier, China Vanke home sales growth stalled in June, with a 7.9% month-on-month increase, down from 12% in May and 31% lower annually. While Vanke's performance lags behind the 36% m/m rise seen among the top 100 real estate companies, the firm is relying on a sales revival to address its liquidity issues amidst a mixed housing market recovery following a government rescue package.

- Hedge fund exposure to Chinese stocks is near multi-year lows, with global hedge funds being net sellers for the third time in four months, and mutual funds' allocations at their lowest in a decade. This reflects concerns that Beijing will not implement aggressive pro-growth policies, especially with low expectations for the upcoming Third Plenum meeting. Local investors are skeptical about policy effectiveness, despite recent strategies to address property sector issues as per BBG.

- Apple is seeking to have a Chinese court alter its written ruling in a lawsuit the company won, aiming to remove references to its "dominant position" and "unfair pricing" that could affect future regulatory scrutiny. This move underscores Apple's delicate position in China, its largest international market, as it faces competition from Huawei and regulatory challenges globally over its app store fees., as per BBG.

- Looking ahead, we have S&P Global Hong Kong PMI on Thursday

ASIA PAC STOCKS: Asian Equities Head Higher As Tech Stocks Rally On Powell Comments

Asian equities advanced today, led by gains in Korea and Taiwan as technology stocks rallied, tracking a similar move in the US. The MSCI Asia Pacific Index climbed up to 0.6%, marking its fourth straight session of gains, the longest since May, fueled by Federal Reserve Chief Jerome Powell's comments on the resumption of a disinflationary trend in the US. Japanese stocks rose for the fourth consecutive session, the longest streak since March, with equities also up in Hong Kong, Singapore, and Australia. There was a bit of data out earlier, with Japan Jibun Bank PMI composite 49.7 vs 50 prior, while in Australia retail sales came in above estimates at 0.6% vs 0.3% and up from 0.1% prior, while building approvals jumped 5.5% vs 1.6% est and 1.9% prior.

- Japanese equities are higher today with the Nikkei 225 advancing for a fourth consecutive day, marking its longest winning streak since March. This uptrend is bolstered by speculation that the Federal Reserve may consider rate cuts, which has boosted investor confidence in technology shares and large-cap stocks. Specifically, semiconductor-related stocks have shown notable gains, reflecting strong buying interest. Despite cautious optimism, concerns persist regarding global trade tensions and fluctuations in the yen's value. The Topix is 0.22% higher, while the Nikkei is up 1% due to the heavier weighting towards tech stocks.

- South Korean equities are higher today, driven by Federal Reserve Chair Jerome Powell's dovish comments, which alleviated concerns about imminent interest rate hikes. This has bolstered investor sentiment, particularly in sectors like technology and manufacturing. Key stocks such as Hyundai Motor and SK Innovation have seen small gains, while LG Energy Solution and POSCO Holdings have also shown notable increases. However, challenges remain, notably in the semiconductor sector, where stocks like Samsung Electronics and SK hynix face some downward pressure after Nvidia fell 1.30% overnight. The Kospi and the Kosdaq both trade about 0.50% higher.

- Taiwanese equities are higher today, most of the gains can be attributed to TSMC & Hon Hai. The S&P 500 hit new all time highs overnight, while the Philadelphia Semiconductor Index rose 1.24% even though Nvidia fell 1.30%. The Taiex is up 1.10%.

- Australian equities are slightly higher this morning, however have pared some gains after Australian retail sales data for May surpassed expectations, rising 0.6% from the previous month, double economists' forecasts, driven by discounts amidst high borrowing costs. However, annual growth at 1.7% remains subdued compared to early 2023 levels. Building approvals also jumped 5.5% vs 1.8% est. The ASX200 is currently 0.18% higher.

- Elsewhere, New Zealand equities are little changed today after dairy prices plunged overnight although ANZ commodity prices rose 1.5% earlier. While in the EM space, markets are trading well after the slightly dovish Powell overnight, in Indonesia the JCI is up 0.24%, and is now about 3% over the past 5 sessions, The Philippine PSEi is up 0.80%, Singapore Straits Times up 0.32%, Malaysian KLCI is 0.60% higher, India's Nifty 50 is 0.65% higher,

OIL: Crude Higher On Large US Inventory Drawdown, EIA Data Out Later

Oil prices are higher during APAC trading today driven by the industry-reported large US inventory drawdown. Brent is up 0.5% to $86.67/bbl, close to the intraday high of $86.74, while WTI is 0.5% higher at $83.19 after reaching $83.26. The USD index is up slightly.

- Bloomberg reported that US crude inventories fell 9.2mn barrels last week and distillate 740k but gasoline rose 2.5mn, according to people familiar with the API data. The official EIA figures are released later today.

- Geopolitics are worrying markets again but supply/demand fundamentals remain at the fore. They are concerned that Fed easing will be delayed further and weigh on fuel demand and at the same time the driving season is being monitored closely. Upcoming FOMC minutes and payroll data will be important in shaping the outlook. Demand in China, world’s largest oil importer, is also uncertain.

- On the supply side, Bloomberg reported that OPEC output rose in June but the market is also concerned that the hurricane season could impact US output.

- Later the Fed’s Williams speaks at the ECB’s Sintra conference and ECB President Lagarde gives the closing remarks. ECB’s Lane, Cipollone and de Guindos also appear. In terms of data, US June Challenger job cuts/ADP employment, services ISM/PMI, May final durable orders, trade balance, jobless claims and June FOMC minutes are released. There are also June European services/composite PMIs and May euro area PPI data.

GOLD: Steady Ahead Of Key US Data

Gold is little changed in the Asia-Pac session, after closing slightly lower at $2329.46 on Tuesday.

- The yellow metal failed to strengthen after Fed Chair Powell’s relatively dovish comments at the ECB conference in Sintra. Powell stated recent inflation data suggested that "we are getting back on a disinflationary path", with the caveat that more is needed to be more confident that inflation is headed sustainably to 2% before loosening policy.

- Nevertheless, bullion continues to trade in a very tight $2,320-$2,340 range, ahead of key US data.

- There is a heavy US data drop in today’s shortened session ahead of tomorrow’s 4th of July holiday: Challenger Job Cuts, ADP Employment, Weekly Jobless claims, ISM Services, Factory/Durables Orders and June FOMC Minutes. Friday will see June Non-Farm Payroll data.

- According to MNI’s technicals team, a clear break of the 50-day EMA, at $2,319.2, would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/07/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/07/2024 | 0800/1000 |  | EU | ECB's De Guindos chairing MonPol Cycles session | |

| 03/07/2024 | 0900/1100 | ** |  | EU | PPI |

| 03/07/2024 | 0900/1100 |  | EU | ECB's Cipollone chairing Productivty session | |

| 03/07/2024 | 1030/1230 |  | EU | ECB's Lane chairing panel on equilibirum interest rates | |

| 03/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/07/2024 | 1100/0700 |  | US | New York Fed's John Williams | |

| 03/07/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 03/07/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 03/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 03/07/2024 | 1330/1530 |  | EU | ECB's Lagarde closing remarks at ECB Forum | |

| 03/07/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/07/2024 | 1600/1200 | ** |  | US | Natural Gas Stocks |

| 03/07/2024 | 1800/1400 | *** |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.