-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Amamiya Cements Seat As BoJ "Continuity" Candidate

EXECUTIVE SUMMARY

- ECB’S DE GUINDOS ‘RELATIVELY OPTIMISTIC’ ON INFLATION OUTLOOK (BBG)

- ECB MUST ACT DECISIVELY TO ANCHOR INFLATION EXPECTATIONS, NAGEL SAYS (RTRS)

- JAPAN GOVT TO PRESENT BOJ NOMINEES TO PARLIAMENT ON FEB. 14 (RTRS)

- BOJ'S AMAMIYA DOWNPLAYS INCREASED YCC FLEXIBILITY

- U.S. MAY TARGET CHINESE ENTITIES LINKED TO SPY BALLOON (RTRS)

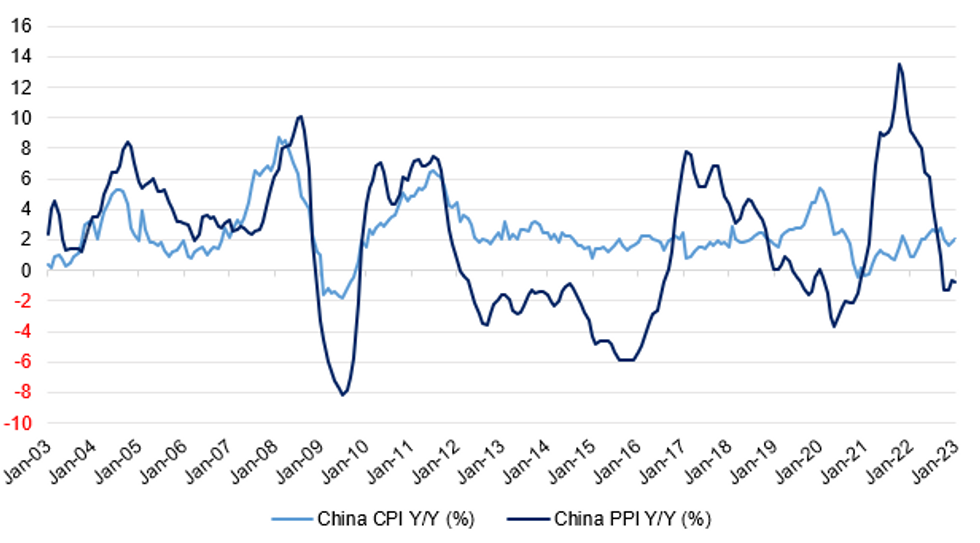

Fig. 1: China CPI & PPI

Source: MNI - Market News/Bloomberg

UK

POLITICS: Labour has held onto its seat in West Lancashire after a by-election was triggered by the resignation of veteran MP Rosie Cooper. (Sky)

POLITICS: Conservative infighting before next month’s budget has intensified as allies of Liz Truss repeated their calls for sweeping tax cuts but other MPs accused the former prime minister of damaging the party with her comeback. (Guardian)

INSURERS: The Treasury is looking to speed up a key post-Brexit reform to unlock £100bn of investment from the UK insurance sector, after growing impatience in the industry and government over the pace of change. (FT)

EUROPE

ECB: European Central Bank Vice President Luis de Guindos said he’s “relatively optimistic” on the outlook for consumer prices, whose growth has begun to ease. (BBG)

ECB: The European Central Bank must act decisively to prevent inflation expectations from rising far above its 2% target, ECB policymaker Joachim Nagel said on Thursday, reaffirming his call for more interest rate increases. (RTRS)

FRANCE: France is considering using funds from depositors in a centuries-old savings account to finance part of a €50bn plan to build six nuclear reactors, one of the world’s most ambitious energy programmes. (FT)

BANKS: Finma says that while Credit Suisse Group's liquidity buffers had a stabilising effect on the bank and are are being rebuilt after outflows, the regulator "monitors banks very closely during such situations." (RTRS)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on Germany (current rating: Aaa; Outlook Stable)

- S&P on Switzerland (current rating: AAA; Outlook Stable)

U.S.

ECONOMY: WSJ Fed reporter Timiraos tweeted the following on Thursday: The Atlanta Fed's wage tracker shows that the pace of growth trended down in January. Pay growth for job switchers ticked down to 7.3% from 7.7% in December (vs 8.5% in July). For job stayers, growth ticked up to 5.4% from 5.3% in Dec (vs 6.1% in June)” (MNI)

POLITICS: Former U.S. Vice President Mike Pence and former national security adviser Robert O'Brien have been subpoenaed by the special counsel leading probes into classified documents found at former President Donald Trump's Mar-a-Lago residence and efforts to overturn the 2020 election result, according to media reports on Thursday. (RTRS)

OTHER

GLOBAL TRADE: Europe must do more to fight back against “massive” hidden handouts doled out by China to its industries, the European Commission president said, as the EU rushes to counter a swath of global subsidies that threaten its competitiveness. (FT)

GLOBAL TRADE: Key American chip equipment suppliers are shifting operations from China to Southeast Asia in a sign that U.S. export controls enacted last October are accelerating the decoupling of tech supply chains between the world's two biggest economies. (Nikkei)

U.S./CHINA: The House passed a resolution Thursday condemning China for its “brazen violation of United States sovereignty” and seeking more information from the White House, the latest development in the spy balloon saga that has gripped Washington since late last week. The resolution passed 419-0. (WSJ)

U.S./CHINA: The United States will explore taking action against entities connected to China's military that supported the flight of a Chinese spy balloon into U.S. airspace last week, a senior State Department official said on Thursday. (RTRS)

U.S./CHINA: The FBI has only recovered very limited physical evidence from a suspected Chinese spy balloon shot down into the ocean on Saturday, and it has not yet been able to get enough information to assess its capabilities, senior bureau officials familiar with the operation said on Thursday. (RTRS)

U.S./CHINA: U.S. Treasury Secretary Janet Yellen said on Thursday that she wants China to move more quickly to support specific debt restructurings for developing countries, especially for Zambia, while leaving broader debt restructuring questions to separate talks. (RTRS)

BOJ: Japan's government will present its nominees for the new central bank governor and two deputies to parliament on Feb. 14, Tsuyoshi Takagi, the ruling Liberal Democratic Party's parliament affairs chief for the lower house, said on Friday. (RTRS)

BOJ: A possible revision to a joint Japanese government and Bank of Japan (BOJ) statement that focuses on pulling the country out of deflation must be discussed with the new BOJ governor, Finance Minister Shunichi Suzuki said. (RTRS)

BOJ: Bank of Japan Deputy Governor Masayoshi Amamiya, who is viewed as a frontrunner to be the next governor, said on Friday that he doesn’t see the need to further increase the flexibility of yield curve control soon. (MNI)

BOJ: BOJ Governor Haruhiko Kuroda on Friday stuck to his view the recent spike in consumer inflation was largely due to surging import prices, and expects a moderation later this year. (RTRS)

BOJ: Bank of Japan officials are alert to the risk that further changes to its yield curve control policy could encourage market participants to target regional financial institutions that lack adequate capital to dispose of unrealised losses on yen-denominated bond holdings, MNI understands. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida will undergo surgery to treat chronic sinusitis on Sat., Chief Cabinet Secretary Hirokazu Matsuno says in a regular press briefing.(BBG)

RBA: The Reserve Bank of Australia repeated its warning of more interest rate rises after lifting its inflation forecasts for 2023 amid elevated price pressures, while also raising its growth forecast for the first half of 2023, according to the Statement on Monetary Policy released Friday. (MNI)

SOUTH KOREA: South Korea's finance minister reaffirmed on Friday his view that consumer prices would ease around the April-May months, a week after data showed the country's annual inflation had unexpectedly ticked up in January. (RTRS)

TURKEY: The World Bank said on Thursday it is providing Turkey with $1.78 billion in relief and recovery financing assistance as the country struggles with the aftermath of an earthquake that has killed over 20,000 people and left hundreds of thousands homeless. (RTRS)

MEXICO: The Bank of Mexico's five-member governing board unanimously voted to hike the benchmark interest rate by 50 basis points to 11.00% on Thursday, above market forecasts, citing "a still complex inflation environment." The decision by Banxico, as the central bank is known, comes hours after data showed consumer prices in Latin America's second largest economy rising in January above December readings and market expectations. (RTRS)

MEXICO: Mexico’s inflation is taking longer than expected to slow, Central Bank Governor Victoria Rodriguez Ceja said after leading a bigger-than-expected interest rate increase that shocked investors on Thursday. (BBG)

BRAZIL: Americanas said its board approved BRL2b in debtor-in-possession financing through an issuance of local bonds, according to a filing. (BBG)

RUSSIA: German Chancellor Olaf Scholz has asked European leaders to deliver the Leopard 2 tanks, which will be needed to send two battalions to Ukraine by the end of March. (BBG)

RUSSIA: French president Emmanuel Macron didn’t rule out sending fighter jets to Ukraine but stressed that logistics would make it impossible to deliver them in the short term. (BBG)

INDIA: The selloff in Adani Group stocks deepened as MSCI Inc. reduced the amount of shares it considers freely tradable in the public market for four companies in its indexes. (BBG)

INDIA: Gautam Adani has hired one of Wall Street’s fiercest activism defence law firms to fight back against claims made by short seller Hindenburg Research, as the Indian billionaire battles to reassure investors about the financial health of his business empire. (FT)

SOUTH AFRICA: South Africa has declared a national state of disaster over the country’s worst-ever spate of rolling blackouts, as the government scrambles to remove obstacles to investing in energy supply outside the broken Eskom power monopoly. (FT)

SOUTH KOREA/CHINA: South Korea to resume issuing short-term visa for Chinese visitors from Sat. after the number of confirmed PCR test cases among incoming Chinese travelers decreased. (BBG)

IRAN: Brazil bowed to U.S. pressure and declined an Iranian request for two of its warships to dock in Rio de Janeiro at a time when Brazilian President Luiz Inacio Lula da Silva was planning his trip to Washington to meet U.S. leader Joe Biden, sources said. (RTRS)

PERU: Peru's central bank maintained its benchmark interest rate at 7.75% on Thursday, as monetary policymakers in the copper-producing Andean nation battle the highest inflation in a quarter of a century. (RTRS)

PERU: Peru's economic outlook is "very uncertain," but strong economic fundamentals could provide a buffer against prevailing risks, the International Monetary Fund (IMF) said on Thursday after an annual visit to the country. (RTRS)

RATINGS: The risk environment for global credit remains challenging despite recent macro data showing continued strength in developed market labour markets, positive demand signals from China and falling headline inflation, Fitch Rating says in a new report. Shallow recessions remain likely as central banks continue to focus on countering underlying inflationary pressures. Sustained downside inflation surprises of sufficient pace and scale could halt monetary policy tightening and even drive a pivot back toward loosening. However, such a pivot is by no means certain nor part of Fitch’s base case. (Fitch)

MARKETS: ICE said it will once again not publish its regular exchange commitment of traders report on Friday in the aftermath of a cyberattack that disrupted derivatives trading last week, according to a circular. (BBG)

METALS: The London Metal Exchange published data showing that Russian metal has been flowing into its network of warehouses in recent months, but said that the increase was in line with its expectations and that consumers were still accepting it. (RTRS)

ENERGY: Germany and Oman are in advanced talks to sign a long-term deal for liquefied natural gas (LNG) lasting at least 10 years as Berlin continues its search for alternatives to Russian fuel supplies, three sources familiar with the matter said. (RTRS)

CHINA

MONEY MARKETS: Funding cost in China’s financial markets has been rising recently, fueling concerns that the central bank has changed its stance toward liquidity management, but such worries are “unnecessary,” according to a Securities Times commentary Friday. (BBG)

MONEY MARKETS: China’s cash squeeze eased, with a gauge of overnight funding costs dropping the most in a week, after the central bank injected some $150 billion into the financial system over three sessions. (BBG)

ECONOMY: Car sales in China will rebound in February following a drop in sales during January, as local governments and car companies increase purchase incentives and Lunar New Year festival disruptions subside, according to the Securities Daily. (MNI)

INFRASTRUCTURE: Next generation infrastructure projects such as 5G networks, smart-parks and green energy transformation will play an important role in stabilising the economy in 2023 and boosting high quality development, according to the Securities Daily. (MNI)

MORTGAGES: The recent boom in homeowners voluntarily increasing their mortgage repayments comes at the expense of boosting consumption in 2023, and this will continue for several months unless measures are taken to incentivise people to save less, according to an editorial by Yicai.com. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY180 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY203 billion via 7-day reverse repos with the rates unchanged at 2.00% on Friday. The operation has led to a net injection of CNY180 billion after offsetting the maturity of CNY23 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0925% at 9:30 am local time from the close of 2.2100% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday, compared with the close of 60 on Wedneday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7884 FRI VS 6.7905 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7884 on Friday, compared with 6.7905 set on Thursday.

OVERNIGHT DATA

CHINA JAN CPI +2.1% Y/Y; MEDIAN +2.1%; DEC +1.8%

CHINA JAN PPI -0.8% Y/Y; MEDIAN -0.5%; DEC -0.7%

JAPAN JAN PPI +9.5% Y/Y; MEDIAN +9.7%; DEC +10.5%

JAPAN JAN PPI 0.0% M/M; MEDIAN +0.3%; DEC +0.7%

NEW ZEALAND JAN CARD SPENDING TOTAL +3.3% M/M; DEC -1.2%

NEW ZEALAND JAN CARD SPENDING RETAIL +2.6% M/M; DEC -2.3%

NEW ZEALAND JAN BNZ-BUSINESSNZ MANUFACTURING PMI 50.8; DEC 47.8

New Zealand’s manufacturing sector saw a positive start to 2023 after three consecutive months of contraction, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI). (BusinessNZ)

MARKETS

US TSYS: Marginally Cheaper In Asia

TYH3 deals at 113-04, +0-03, in the middle of its 0-05+ range on volume of ~86K.

- Cash Tsys sit 0.5-1bp cheaper across the major benchmarks.

- Tsys cheapened in early trade, as local participants reacted to yesterday's late NY weakness triggered by a soft 30-Year auction result and an early Sydney slide in ACGBs. 30-Year yields briefly dealt above Thursdays highs, although the rest of the major benchmarks failed to do the same.

- The space stabilized off session cheaps as ACGBs moved away from lows on the back of the RBA's SoMP.

- Softer than expected Chinese PPI data also facilitated Tsys recovery from session lows.

- In Europe today we have UK GDP, further out there is the Canadian labour market report and UoM consumer sentiment survey. Elsewhere, Fedspeak from Gov Waller and Philadelphia Fed President Harker will cross.

JGBS: BOJ Nominations Officially Scheduled, Amamiya Reaffirms Status As Continuity Candidate

JGB futures tracked wider core global FI, ticking lower, before correcting from worst levels, -16 ahead of close, sticking to the recent range. Cash JGBs run 1.5bp richer to 3bp cheaper, with the curve twist steepening and 10s bumping up near the upper limit of the BoJ’s permitted YCC trading band (the BoJ has announced another 5-Year funding round for Bank’s via its pooled collateral channel as a result). Swap rates are firmer across the curve, with steepening observed there, while swap spreads are mixed. Thursday’s wider FI dynamics likely weighed on the long end.

- Parliamentary officials confirmed that the government will announce its nominations for the BoJ Governor position on 14 February, at 11:00 Tokyo time (02:00 London), with the related parliamentary hearings slated for 24 February.

- BoJ Deputy Governor Amamiya reaffirmed his status as the continuity candidate in the race to succeed Kuroda, showing little want for any change re: the Bank’s inflation target, highlighting a need for continued easing under the current policy settings (“for now”), while underscoring the need for clear communication when it comes to the attainment of its inflation target, when the time comes.

- Finance Minister Suzuki stressed that it is too soon to discuss a potential revision to the BoJ-government accord, pointing to such discussions taking place with Kuroda’s successor.

- Japanese PPI data was a touch softer than expected in January, although remained elevated.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y5.13653tn 3-Month Bills:

- Average Yield -0.1649% (prev. -0.1589%)

- Average Price 100.0443 (prev. 100.0427)

- High Yield: -0.1545% (prev. -0.1489%)

- Low Price 100.0415 (prev. 100.0400)

- % Allotted At High Yield: 0.5526% (prev. 16.2677%)

- Bid/Cover: 3.007x (prev. 3.292x)

AUSSIE BONDS: Curve Bear Flattens, SoMP Digested

Aussie bonds finished off cheapest levels, with YM -8.0 & XM -4.0, while wider cash ACGBs are 4-8bp cheaper as the curve bear flattens.

- Early Friday trade saw Aussie bond futures pull lower, extending on their overnight weakness, as RBA cash rate pricing extended higher and some pre-RBA SoMP hedging took hold.

- The space then pulled away from session cheaps, assumingly on the back of the RBA’s SoMP pointing to underlying inflation returning to the upper end of the target band by the end of next year (albeit a product of a mark higher in this year’s forecast points).

- Softer than expected Chinese PPI data may have also provided some modest support.

- Bills were 4-10 bp cheaper through the reds, with the backend of the whites leading the weakness. RBA-dated OIS now shows a terminal rate of just under 4.15% after pushing closer to 4.20% earlier in the session.

- EFPs were little changed on the day.

- Next week’s domestic data docket sees the release of the monthly labour market report, business and consumer confidence surveys, household spending data from CBA and consumer inflation expectations. We will also hear from RBA Governor Lowe who will appear before the Senate Economics Legislation Committee.

AUSSIE BONDS: ACGB May-28 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.25% 21 May 2028, issue #TB149:

- Average Yield: 3.5188% (prev. 0.7711%)

- High Yield: 3.5250% (prev. 0.7725%)

- Bid/Cover: 5.7000x (prev. 3.9600x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 6.5% (prev. 27.6%)

- Bidders 45 (prev. 42), successful 14 (prev. 14), allocated in full 7 (prev. 8)

- This is the first tap of the line since May 2020, which makes the previous auction metrics pretty much redundant from a comparables standpoint.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 13 February it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

- On Tuesday 14 February it plans to sell A$150mn of the 2.50% 20 September 2030 Indexed Bond.

- On Wednesday 15 February it plans to sell A$700mn of the 4.50% 21 April 2033 Bond.

- On Thursday 16 February it plans to sell A$500mn of the 26 May 2023 Note, A$1.0bn of the 23 June 2023 Note & A$500mn of the 11 August 2023 Note.

- On Friday 17 February it plans to sell A$500mn of the 4.25% 21 April 2026 Bond.

NZGBS: Bear Flattening Again

The NZGB curve bear flattened ahead of the weekend, with the major benchmarks benchmarks going out 2.0-7.5bp cheaper.

- The post-30-Year auction pull lower in Tsys applied some early pressure, with payside flow in swaps and RBNZ-dated OIS then weighing on the front end of the curve, even as long dated paper corrected from cheaps alongside wider core global FI markets, with some focus on softer than expected PPI data out of China and the tweaks made to the RBA’s inflation forecast profile.

- Swap rates were little changed to 8bp higher, with that curve also flattening, leaving swap spreads little changed to a touch tighter. The 2-/10-Year swap spread has generally consolidated in February, after the pull away from cycle extremes (deepest inversion since the GFC) in late ’22.

- RBNZ-dated OIS firmed again today, leaving just over 60bp of tightening priced for this month’s meeting, alongside pricing of a terminal OCR of ~5.40%.

- Local headline flow was dominated by focus on a cyclone that is making its way towards the country (after the recent floods in Auckland, which will impact inflation in the coming months)

- Looking ahead, inflation expectations and REINZ house price data headline next week’s local docket.

EQUITIES: China/HK Reversing Thursday Gains

(MNI Australia) Regional equities are mostly on the back foot to end the week. Much of the focus has been on weakness in HK/China stocks, reversing yesterday's gain, albeit to varying degrees. US futures are lower, but are away from worst levels (Eminis -0.20%, Nasdaq -0.30% at this stage).

- The weakness in China/HK stocks doesn't appear to reflect a specific factor. Some firming in underlying inflation (from a low base) may lower odds of easier policy settings, which may have weighed at the margin. The prospect of further US tech curbs, post the balloon incident is another potential headwind.

- At this stage, the HSI is off around 2%, with the tech sub-index off -4.22%, fully unwinding yesterday's rise. The CSI 300 is down 0.80%, while northbound flows have been negative, -4.1bn yuan so far.

- The Kospi (-0.65%) and Taiex (-0.20%) are tracking lower, while Japan stocks are outperforming modestly (Nikkei 225 +0.20%).

- Indian stocks are lower, off by 0.25% at this stage, with stocks linked to the Adani group still included in MSCI Indexes, although their respective weightings could still be impacted.

GOLD: Testing 50-Day EMA On The Downside

Gold is off a further 0.40% so far today. The precious metal last around the $1854/55 level. For the week we are tracking lower, -0.55% at this stage, after last week's -3.27% fall. Today's move is line with a stronger USD tone, with the dollar indices tracking +0.15% at this stage.

- Gold looks a little too low relative to USD strength, but the divergence isn't excessively large at this stage.

- Still, we currently sit close to the 50-day EMA (1855.5 based of Feb 9 closing levels), which a close below in NY trade later would be a bearish signal from a technical standpoint.

- ETF gold holdings continue to drift lower.

OIL: Weekly Gains Trimmed

Brent crude is slightly below NY closing levels currently, last around $84.35. Ranges have been tight today, and we remain comfortably above the Thursday session low of $83/bbl. Beyond that is lows at the start of the week close to $79/bbl. The 20-day and 50-day EMAs are nearby, but a move above the 100-day ($87.42/bbl) is likely required to re-energize the bulls. For WTI, we currently sit near $77.80/bbl.

- A more cautious tone in the equity space has weighed on broader risk appetite, but oil is still tracking higher for week, Brent +5.5% at this stage. This has arguably been more supply than demand driven though.

- Goldman Sachs has lowered its brent crude forecasts, $6 lower for Q1 ($92/bbl, versus $98/bbl prior), while the bank expects brent to end the year at $100/bbl (-$5 revision). The forecast changes reflect softening supply-demand fundamentals (more supply from US & Russia, less demand from US & EU).

- Looking ahead, next Tuesday delivers the OPEC monthly oil report (along with US CPI). On Wednesday an IEA-IEF-OPEC symposium will take place in Riyadh. The IEA monthly oil report will also print.

FOREX: USD Firms, Softer Equities Weigh On Risk Appetite

The USD is on the front foot in Asia today. Equity sentiment is weaker, with US futures lower and China and Hong Kong reversing some of yesterday's gain. The China CPI print, at the margins, is less supportive of easier policy settings, which may have trimmed risk appetite in the equity space. It was a supporting factor in yesterday's trading amid easing speculation.

- USD/JPY is up ~0.1%, last printing ¥131.65/70. Jan PPI printed below expectations, YoY 9.5% vs 9.7% exp and the MoM read was flat. Parliamentary officials confirmed the government will announce its nominations for BOJ Governor on 14 Feb at 11am Tokyo time (0200 London time).

- AUD/USD is ~0.2% softer, there was little reaction to the RBA's SoMP. The bank noted whilst inflation will rise next year, CPI will return to the target band in 2025. AUD was pressured through the session, before finding support below $0.69. Copper and Iron Ore are both lower today weighing on AUD at the margins.

- NZD/USD is down ~0.3% last printing $0.6310/0.6315. There was little support from improving domestic data; Jan Business NZ Manf PMIs were on the wires, the measure is back in expansionary territory at 50.8 rising from the prior of 47.2. Jan Card Spending rose 3.3% from -1.2% prior.

- EUR and GBP are both down ~0.2% as the greenback strength weighs.

- Cross asset flows are showing a risk-off tone. E-minis are down ~0.2%, the Hang Seng is ~2% softer. DDBXY is up ~0.2%.

- In Europe today we have UK GDP, further out there is the Canadian labour market report and UoM consumer sentiment survey. Elsewhere, Fedspeak from Gov Waller and Philadelphia Fed President Harker will cross.

FX OPTIONS: Expiries for Feb10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0750(E1.2bln), $1.0775-80(E615mln), $1.0800(E921mln), $1.0850-60(E636mln)

- USD/JPY: Y130.00($1.6bln)

- GBP/USD: $1.2150(Gbp529mln)

- EUR/GBP: Gbp0.8800(E506mln)

- AUD/USD: $0.7000(A$505mln)

- USD/CAD: C$1.3400-20($1.4bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2023 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 10/02/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/02/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/02/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/02/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/02/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/02/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 10/02/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/02/2023 | 1400/1400 |  | UK | BOE Pill Panellist at BIS SUERF Workshop | |

| 10/02/2023 | 1400/1500 |  | EU | ECB Schnabel Twitter Q&A | |

| 10/02/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/02/2023 | 1730/1230 |  | US | Fed Governor Christopher Waller | |

| 10/02/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2023 | 2100/1600 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.