-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS-Ireland Election Preview

MNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI EUROPEAN MARKETS ANALYSIS: Crude Futures Bid Again

- Brent moved above $80.00 for the first time since '18 during Asia Pac hours.

- Chinese commentary surrounding broader policy matters and the current energy usage constraints in the country headlined on the news front.

- A heavy central bank speaker slate headlines the broader docket on Tuesday.

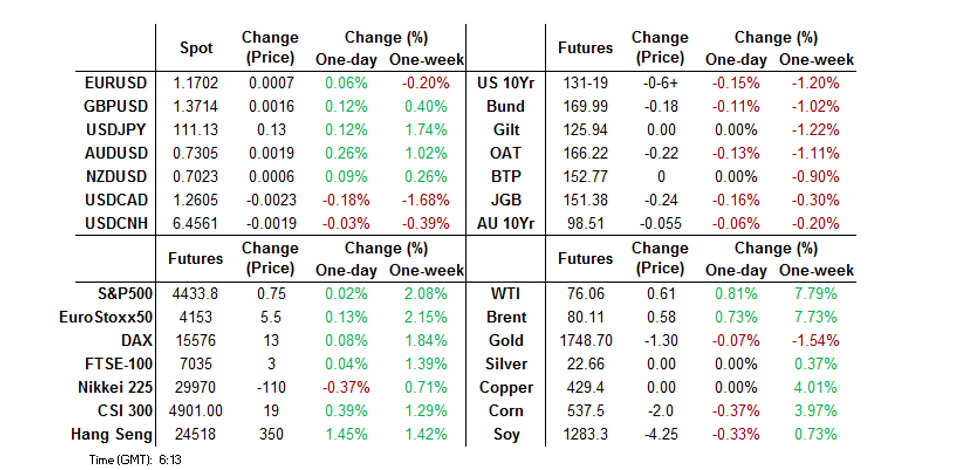

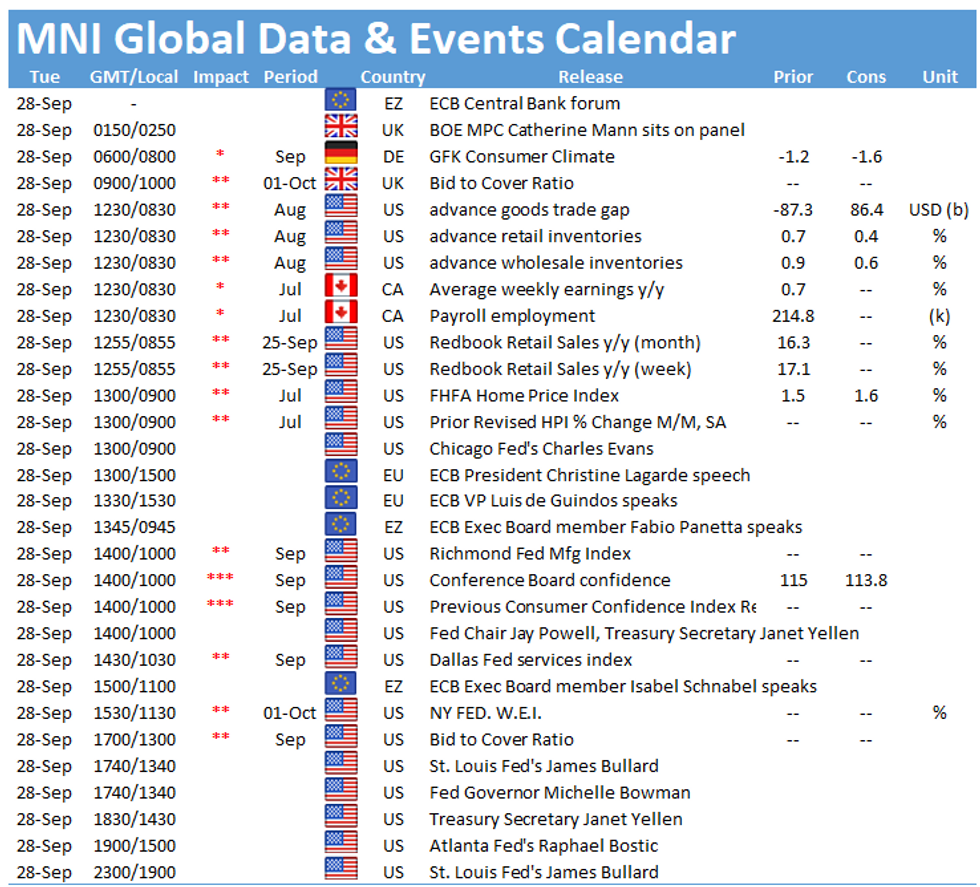

BONDS: Core FI Cheapens Again

Core fixed income markets cheapened during Asia-Pac hours, with spill over from Monday's U.S. Tsy trade and a continued uptick in crude oil futures applying weight to the space. T-Notes last trade -0-06+ at 131-19, just above session lows, with bears now looking to the June 17 low (131-14). Cash Tsys run 1.0-25bp cheaper across the curve, with bear steepening in play. Asia-Pac flow was highlighted by a 2.5K block buy of FVZ1 futures, while the short end saw a relatively heavy round of screen lifts (~22K) in EDZ2. Both rounds of market activity came before the steepening impulse kicked in. Tuesday's docket is headlined by 7-Year Tsy supply, consumer confidence data, Fedspeak from Powell (accompanied by Tsy Sec Yellen, although transcripts have already been released), Bowman, Bostic & Evans, as well as the continued fiscal debate on the Hill.

- JGB futures have moved through technical support to last trade -21 on the day, with bears now switching focus to the April 1 low. Bloated dealer books and worries surrounding the external bond environment may have hindered today's 40-Year JGB supply, with the cover ratio sliding to the lowest witnessed at a 40-Year auction since 2015, while the pricing side wasn't anywhere near as soft, as the high yield met broader dealer expectations (as proxied by the BBG dealer poll). Cash JGB trade has seen twist steepening, with 7s (based on the move in futures) and 40s (on the supply dynamic) providing the weak points on the curve.

- The uptick in oil/weakness in U.S. Tsys seemingly continues to drive price action in Aussie bonds, leaving YM -3.5 and XM -5.0 at typing. XM bears are now looking to the July 6 low (98.495), with any break there set to expose the June 17 low (98.320). The latest round of weakness in the space also triggered some selling of IRZ1.

FOREX: Greenback Continues To Creep Higher

Currencies struggled for decisive direction in Asia, heading into the European open the greenback is in positive territory but off best levels as yields recede from the highest since June 2020.

- AUD/USD is top of the G10 pile, recovering early losses after retail sales data which showed a 1.7% decline Y/Y in August compared to an expected drop of 2.5%. NZD has recovered early losses and hovers around neutral levels.

- JPY is weaker, succumbing to USD strength. Japan EconMin Nishimura said the state of emergency could be lifted as soon as October 1, though FinMin Aso said he doubted demand would surge once the SOE was lifted.

- Offshore yuan is flat, Goldman Sachs earlier cut its China 2021 GDP forecast to 7.8% from 8.2%. In geopolitics China released two captive US citizens who had been held since 2018 which could help thaw relations with the US. Elsewhere industrial profits rose 10.1% in August.

- Oil continued its rally as Brent approached the $80/bbl level, CAD was boosted as crude futures extended gains into a sixth session.

- There is a fairly heavy slate of speakers due in the session on Tuesday, these include ECB's Lagarde and MPC's Mann, followed by FOMC Chair Powell and members Evans, Bowman and Bostic.

FX OPTIONS: Expiries for Sep28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1765-75(E1.5bln), $1.1790-00(E1.5bln), $1.1839-40(E525mln)

- USD/JPY: Y110.00-10($850mln), Y110.40-50($1.2bln)

- GBP/USD: $1.3700-20(Gbp520mln)

- AUD/USD: $0.7235-40(A$620mln), $0.7250-55(A$1.4bln)

- USD/CAD: C$1.2600-15($1.6bln), C$1.2675($1.6bln), C$1.2800-10($1.6bln)

- USD/CNY: Cny6.4500($1.0bln), Cny6.4530($1bln)

ASIA FX: Peso & Ringgit Buck Regional Trend

Currencies struggled for decisive direction in Asia, heading into the European open the greenback is in positive territory but off best levels as yields recede from the highest since June 2020.

- CNH: Offshore yuan heads into the European open flat, Goldman Sachs earlier cut its China 2021 GDP forecast to 7.8% from 8.2%. In geopolitics China released two captive US citizens who had been held since 2018 which could help thaw relations with the US. Elsewhere industrial profits rose 10.1% in August.

- SGD: Singapore dollar is weaker, but off worst levels. There are still some jitters around the coronavirus situation, but the FinMin Wong said yesterday that Singapore is committed to reopening, and that recently reimposed curbs are preemptive.

- TWD: Taiwan dollar is weaker, coming off the strongest levels in almost a week. Markets continue to digest reports yesterday that Taiwan Premier Su Tseng-chang is said to be considering loosening some restrictions on local industries

- KRW: Won is weaker, on the coronavirus front there were 2,289 new cases in the past 24 hours, above 2,000 for the third day, data earlier showed consumer confidence rose to 103.8 in September from 102.5 in August.

- MYR: Ringgit is stronger, data showed the trade surplus widened more than expected as exports more than expected while imports slowed. There were reports that Malaysia is considering reopening the country's borders.

- IDR: Rupiah is weaker, IDR touching a one week low. Markets continue to digest comments from BI Gov Warjiyo that rate hikes would be on hold for most of 2022 due to downside risks to the economic outlook.

- PHP: Peso is higher, picking up from an 18-month low hit yesterday. Markets look ahead to a speech from BSP Go Diokono, he said yesterday that current policy space is not unlimited.

- THB: Baht is lower, declining for a third day. Markets continue to digest news that the government will delay reopening key provinces. Markets look ahead to BoT rate announcement on Wednesday.

ASIA RATES: Indian Borrowing Plan Boost Shortlived

- INDIA: Yields higher in early trade. Short end yields declined yesterday after the government kept borrowing plans unchanged amid speculation of an increase to address local government revenue shortfall due to the pandemic. The government kept the fiscal year borrowing amount unchanged at INR 12.05tn, 2H borrowing will be slightly larger than initially planned at INR 5.03tn, due to lower borrowing in 1H. The unchanged borrowing plan rebuts comments from Finance Minister Sitharaman who said that borrowing could be up to INR 1.6tn higher than initially thought. Bonds could still come under pressure during today's session after US yields hit the highest levels since June while crude futures have continued their rally into a sixth day. Elsewhere markets await an INR 2tn 7-day reverse repo auction today, while Indian finance ministry officials are said to be meeting representatives from Moody's rating agency today and plan to pitch for a sovereign rating upgrade.

- SOUTH KOREA: Futures lower in South Korea, tracking a move lower in US tsys seen on Monday. 3-Year future is down 6 ticks at 109.45, 10-Year future is down 32 ticks at 124.59. The move lower in futures comes despite a broad risk off tone with the KOSPI down around 0.75%. Markets are ignoring a rise in consumer confidence data earlier in the session. The US/SK has narrowed to 106.22bps, down from 134bps hit in early September. Elsewhere markets continue to digest comments from FSC chairman Koh yesterday that there will be additional measures next month to curb household debts.

- CHINA: The PBOC injected CNY 100bn via 14-day reverse repos for the second day, addressing the usual month-end liquidity concerns while the National Day holiday later this week has also increased liquidity demand. Repo rates are higher, the overnight repo rate up 28.25bps at 1.9325%, the 7-day repo rate is up 42bps at 2.52% which is near recent month end peaks. At the end of June the 7-day repo rate briefly spiked to 3.60%. Futures are lower, tracking a move in UST's that has seen bonds in Asia sell off. Elsewhere Sunac's dollar bonds rebounded after the company refuted claims it had asked for government support.

- INDONESIA: Yields higher across the curve, markets continue to digest comments from BI Gov Warjiyo that rate hikes would be on hold for most of 2022 due to downside risks to the economic outlook. Warjiyo also said that the Central Bank will slowly reduce liquidity in the system, and that GDP growth was expected at 4.6%-5.4%, while CPI is expected to remain subdued in 2022.

EQUITIES: Hong Kong Bucks Broadly Negative Trend

Most equity markets in the Asia-Pac time zone lower on Tuesday, taking a negative lead from the US where indices came off intraday highs and the Dow Jones and Nasdaq finished in the red. Markets in Hong Kong buck the trend, the Hang Seng seeing gains of over 1.5%, after the PBOC said it would ensure a healthy property market and protect home buyers' rights amid lingering concerns over Evergrande. In the US futures are mixed, e-mini Dow and e-mini S&P both slightly higher while e-mini Nasdaq dips into minor negative territory, US 10-Year yields have dipped but continue to hover around the highest levels since June.

GOLD: Meandering

Spot gold has been happy to meander through the early part of this week, avoiding a test of the technical parameters that we have outlined over recent sessions, with participants looking to a slew of Fedspeak, as well as U.S. m'fing ISM & PCE data as the major catalysts when it comes to volatility during the remainder of the week. Spot last deals little changed, just above $1,750/oz. Last week's low ($1,738.0/oz) protects the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). While initial resistance is located at the Sep 22 high ($1,787.4/oz)

OIL: Extends Rally

Crude futures have moved higher during Tuesday's Asia-Pac session, reversing early losses as the greenback weakened. The move higher follows a rally yesterday. Brent prices have risen through $80/bbl, in their first foray above the mark since late 2018, as markets continue to price a particularly tight energy market across winter.

- Sep 21 saw Brent futures form a doji candle, signaling scope for a resumption of gains. Bulls now look to $80.37, with any sustained break there set to expose $82.61.

- The expected tightness in the market has become most evident in the UK, with queues and outages becoming common across petrol stations throughout the country. Supply chain constraints are largely being blamed, with ministers quick to reassure that stockpiles are plentiful and once demand subsides normality should follow.

- Later today the OPEC+ group will release its World Oil Outlook.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.