-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China GDP Beats, Retail Activity Surges

EXECUTIVE SUMMARY

- FED’S BARKIN WANTS MORE EVIDENCE INFLATION IS EASING TO 2% GOAL (BBG)

- SCALISE SAYS HOUSE GOP WILL ROLL OUT DEBT CEILING PLAN TUESDAY (THE HILL)

- ECB CAN REVIEW INFLATION GOAL ONCE IT'S ACHIEVED, LAGARDE SAYS (RTRS)

- RBA WARNS MORE RATE RISES MAY BE NEEDED (AFR)

- CHINA GDP TOPS EXPECTATIONS

- CHINA’S COMMODITIES OUTPUT ROARS AHEAD AS ECONOMY REOPENS (BBG)

- SPR STOCKS HIT LOWEST IN NEARLY 40 YEARS (RTRS)

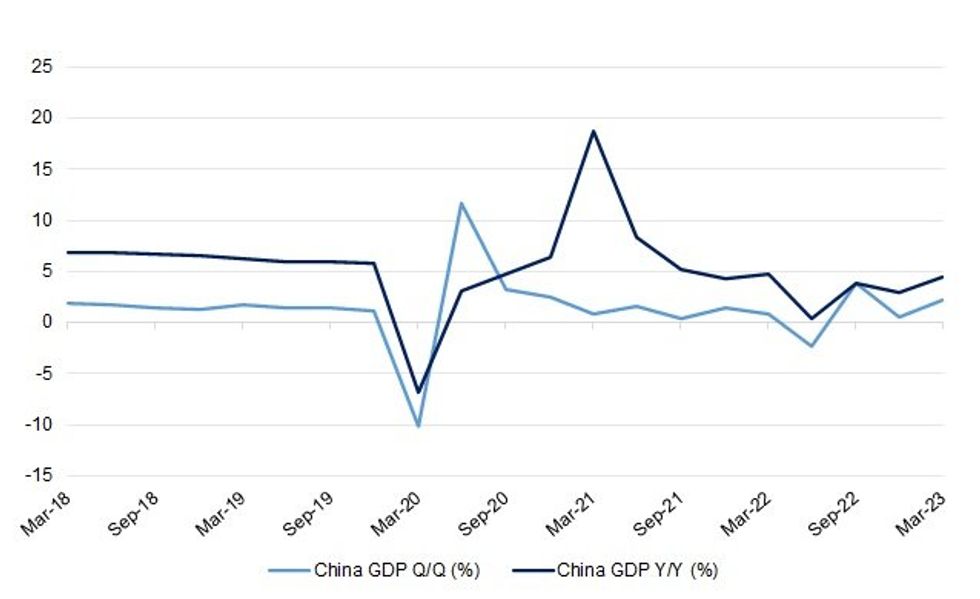

Fig. 1: China Q/Q & Y/Y GDP

Source: MNI - Market News/Bloomberg

EUROPE

ECB: The European Central Bank can discuss changing its 2% inflation goal but only after it brings down inflation to that level, ECB President Christine Lagarde said on Monday. (RTRS)

FRANCE: French President Emmanuel Macron on Monday gave himself 100 days to heal the country after weeks of protests and anger at his unpopular plans to raise the retirement age, asking his government to open talks with unions on a wide range of issues. (RTRS)

U.S.

FED: Richmond Federal Reserve President Thomas Barkin said he wants to see more evidence that US inflation is easing back to the central bank’s goal of 2%. (BBG)

FISCAL: Senate Majority Leader Chuck Schumer (D-NY) warned the United States is “headed for default” in response to House Speaker Kevin McCarthy's (R-CA) debt limit speech at the New York Stock Exchange, calling the speech “theater” during a press conference on Monday. (Washington Examiner)

FISCAL: House Majority Leader Steve Scalise (R-La.) announced on Monday that House Republicans will introduce their plan to address the debt ceiling on Tuesday. (The Hill)

OTHER

U.S./CHINA: Brooklyn federal prosecutors Monday arrested and charged two men with operating an “undeclared overseas police station” in lower Manhattan on behalf of the Chinese government. (POLITICO)

U.S./CHINA/TAIWAN: Taiwan will buy as many as 400 land-launched Harpoon missiles intended to repel a potential Chinese invasion, completing a deal that Congress approved in 2020, according to a trade group’s leader and people familiar with the issue. (BBG)

GEOPOLITICS: The White House offered a sharp rebuke of Brazilian President Luiz Inacio Lula da Silva on Monday for accusing the United States of encouraging the Ukraine war, saying he was "parroting Russian and Chinese propaganda." John Kirby, the White House national security spokesperson, said Lula's comments were "simply misguided." (RTRS)

G7: Foreign ministers from the Group of Seven rich nations on Tuesday condemned Russia's recent talk of stationing nuclear weapons in Belarus as "unacceptable" and called on China to act as a responsible member of the international community. (RTRS)

BOJ: The Bank of Japan purchases sovereign debt to achieve its 2% inflation target, rather than to help finance government spending, Governor Kazuo Ueda says. (BBG)

BOJ: Central banks can always secure profits by issuing sovereign currencies, Bank of Japan deputy governor Shinichi Uchida says in parliament. But it’s important to pay attention to sovereign fiscal health as central banks conduct appropriate monetary policies. (BBG)

RBA: Members of the Reserve Bank of Australia’s board believe there is a strong case for further rate rises, with minutes from the April meeting revealing the central bank contemplated another increase amid concerns that population growth and public sector wage rises could fuel further inflation. While the RBA spared borrowers from an 11th consecutive interest rate rise this month, the minutes of the latest board meeting reaffirm that further interest rate rises may be necessary to tame inflation. (AFR)

NEW ZEALAND/CHINA: The New Zealand government is continuing to pursue a trade-focused trip to China later this year, according to a statement from the office of the prime minister. (BBG)

CANADA: Canadians are souring on Prime Minister Justin Trudeau’s management of public finances, with a new poll showing just 27% trust him most among Canada’s political leaders to support economic growth, down from 35% before the pandemic. (BBG)

TURKEY: Turkey’s central bank has asked local lenders to limit the amount of dollar purchases they make in the interbank market to ease pressure on the lira, according to people with direct knowledge of the matter. (BBG)

TURKEY: Turkish Finance Minister Nureddin Nebati said he expects April inflation to be below 50% and that citizens will feel the impact before they vote in May’s elections. (BBG)

TURKEY: U.S. President Joe Biden's administration notified Congress on Monday of the planned sale to Turkey of avionics software upgrades for its current fleet of F-16 fighter aircraft, a deal valued at up to $259 million. (RTRS)

BRAZIL: Brazilian Finance Minister Fernando Haddad said on Monday the government is going to announce measures to improve credit conditions this week. Talking to reporters, Haddad said that a measure regarding revolving credit card is just one of the actions the ministry is looking at. (RTRS)

RUSSIA: Russian Foreign Minister Sergei Lavrov said on Monday during a visit to Brazil that Moscow wanted the conflict in Ukraine to end as soon as possible. At a news conference with his Brazilian counterpart Mauro Vieira, Lavrov thanked Brazil for its "understanding of the genesis of the situation in Ukraine" and said Russia had "an interest" in the conflict ending as soon as possible. (RTRS)

RUSSIA: Russia saw a gradual increase in consumer prices in the first quarter of 2023, the central bank said in a report on Monday, with inflationary pressure set to continue in the coming months, in part from the weaker rouble. (RTRS)

BIS: BIS Chief Agustin Carstens laid out a grim scenario for central banks including higher-for-longer interest rates that risk more financial turmoil and a clash with indebted governments, while in the long run policymakers must step back from a long era of naively chasing economic growth. (MNI)

BONDS: A Japanese insurer with $65 billion of assets plans to offload all its currency-hedged foreign debt holdings, foreshadowing what may become a renewed wave of selling by some of the biggest investors in global bond markets. (BBG)

EQUITIES: The Hong Kong Stock Exchange plans to make its listed companies quantify and reveal more about their climate-related risks, starting in January. (BBG)

COMMODITIES: China’s energy and commodities output roared ahead in March as producers rushed to feed a revival in economic activity. The increases, which included records for a single month’s data for coal mining, natural gas output and oil refining, broadly tally with a robust set of import figures last week. But it’s clear that for many markets the additional supply is running ahead of actual consumption in what’s proving to be an uneven recovery. Underpinning the gains was a surge in power demand as electricity generation climbed 5.1% on year, according to the statistics bureau on Tuesday. (BBG)

METALS: Chile approved a $3 billion-plus investment in a copper mine owned by Anglo American Plc despite some environmental concerns, a sign of the government’s willingness to boost production of a key raw material in the clean-energy transition. (BBG)

OIL: Iraq's federal government and the Kurdistan Regional Government (KRG) have ironed out technical issues essential to resuming northern oil exports from the Turkish port of Ceyhan to international markets, four sources told Reuters on Monday. (RTRS)

OIL: Russia and India are discussing creating a reinsurance company to provide cover for seaborne oil transportation. (Interax)

OIL: U.S. shale crude oil production in the seven biggest shale basins is expected to rise in May to the highest on record, data from the Energy Information Administration showed on Monday. (RTRS)

OIL: Crude oil stored in the U.S. Strategic Petroleum Reserve fell by 1.58 million barrels last week to its lowest since in nearly 40 years, data from the Department of Energy showed, on a mandated sale of oil from the emergency stash. Stocks in the SPR fell to 368 million barrels in the week to April 14, its lowest level since Oct 1983, based on DOE and Energy Information Administration data. The Biden administration this year has sold 26 million barrels of crude from the reserve through release mandated by Congress in previous years. (RTRS)

CHINA

POLICY: Authorities should implement policy support to boost domestic consumption and ensure China can transition to a dual-circulation model of development, according to an editorial from Yicai. (MNI)

ECONOMY: China’s GDP growth in 2Q may pick up noticeably from the previous quarter, National Bureau of Statistics spokesman Fu Linghui says in a briefing. (BBG)

ECONOMY: China's property investment fell 5.8% from a year earlier in the first three months of 2023, from a 5.7% decline in January-February, official data showed on Tuesday. (RTRS)

ECONOMY: Chinese contract exporters such as wholesale textile manufacturers must transform their business model to develop their own brands and e-commerce businesses, according to Wang Jian, dean of the International Business Research Center at the University of International Business and Economics. (MNI)

ECONOMY: The local government in Changsha, Hunan province capital, will prioritise night time economic support to expand domestic consumption this year, according to the 21st Century Herald. (MNI)

SOES: Some 54 listed Chinese SOEs that have released their annual reports said that combined 2022 profits rose 11.7% y/y to 1.24t yuan, according to Securities Daily, which cited data from the financial information website Eastmoney. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY33 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY38 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY33 billion after offsetting the maturity of CNY5 billion reverse repos and CNY150 billion MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0167% at 10:05 am local time from the close of 2.0571% on Monday.

- The CFETS-NEX money-market sentiment index closed at 47 on Monday, compared with the close of 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8814 TUES VS 6.8679 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8814 on Tuesday, compared with 6.8679 set on Monday.

OVERNIGHT DATA

CHINA Q1 GDP +4.5% Y/Y; MEDIAN +4.0%; Q4 +2.9%

CHINA Q1 GDP +2.2% Q/Q; MEDIAN +2.0%; Q4 0.0%

CHINA MAR INDUSTRIAL PRODUCTION +3.9% Y/Y; MEDIAN +4.4%

CHINA MAR INDUSTRIAL PRODUCTION +3.0% YTD Y/Y; MEDIAN +3.5%; FEB +2.4%

CHINA MAR RETAIL SALES +10.6% Y/Y; MEDIAN +7.5%

CHINA MAR RETAIL SALES +5.8% YTD Y/Y; MEDIAN +3.7%; FEB +3.5%

CHINA MAR FAI EXCL.-RURAL +5.1% YTD Y/Y; MEDIAN +5.7%; FEB +5.5%

CHINA MAR SURVEYED UNEMPLOYMENT RATE 5.3%; MEDIAN 5.5%; FEB 5.6%

AUSTRALIA MAR CBA HOUSEHOLD SPENDING +8.0% M/M; FEB -0.1%

AUSTRALIA MAR CBA HOUSEHOLD SPENDING +3.8% Y/Y; FEB +4.6%

The CommBank Household Spending Intentions (HSI) index for March 2023 rose by 8%/mthin original terms, following declines in January and February. The gains in March were led by a bounce in Transport, Entertainment, Retail and Travel. The increases in March were partly due to the longer monthand seasonal factors, with the HSI index uponly marginally in seasonally adjusted terms. (CBA)

AUSTRALIA ANZ ROY-MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 77.2; PREV 79.3

Consumer confidence fell to its seventh weakest result since the COVID outbreak in March 2020, despite the RBA’s no-hike decision in April, rising housing prices and the low unemployment rate of 3.5%. Though the confidence gap between homeowners with mortgages (the least confident cohort) and other housing cohorts was slightly less than average for the year. (ANZ)

NEW ZEALAND MAR REINZ HOUSE PRICES -12.9% Y/Y; FEB -13.9%

NEW ZEALAND MAR REINZ HOUSE SALES -15.0% Y/Y; FEB -31.1%

The Real Estate Institute of New Zealand’s (REINZ) March 2023 figures show the continuing impacts of the economic climate with median prices and sales counts easing and properties taking longer to sell. REINZ Chief Executive Jen Baird, says there is no denying the current economy is influencing market activity. (REINZ)

MARKETS

US TSYS: Marginally Richer In Asia

TYM3 deals at 114-11, -0-00+, with a 0-04 range observed on volume of ~70k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- In early dealing Asia-Pac participants faded the cheapening seen in NY yesterday after stronger than expected Empire Manufacturing, perhaps using opportunity to close out short positions/enter fresh longs.

- Tsys held richer through the session looking through the RBA minutes, which left scope for further tightening, and firmer than forecast GDP from China albeit ticking away from best levels after a ~2.1k screen sale weighed.

- A block buyer in FV, 3k lots, helped provide support to the space.

- In Europe today we have UK Unemployment and the German ZEW Survey. Further out US House Starts will cross as will Fedspeak from Governor Bowman.

JGBS: Stronger, But Off Session Bests

JGB futures are slightly stronger after the lunch break, sitting at +7, but still off the best levels set in morning trade. There wasn't much in the way of domestic drivers to flag today, outside of the previously outlined JiJi sources piece re: BoJ inflation projections.

- BoJ Governor Ueda went over old ground re: BoJ JGB purchases, playing down desires to finance government spending.

- In the afternoon session, any positive impact from solid demand at the latest liquidity enhancement auction covering off-the-run 5- to 15.5 Year JGBs appeared offset by US Tsys moving away from session bests after China's Q1 GDP beat expectations.

- Cash JGBs are 0.1-1.6bp richer across the curve with the benchmark 10-year yield 0.9bp lower at 0.476%, below BoJ's YCC limit of 0.50%.

- Swap spreads are mixed with the short end marginally tighter and the long end marginally wider.

- Monthly final industrial production readings headline the limited local docket on Wednesday.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 5- To 15.5-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y498.8bn of 5- to 15.5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.012% (prev. -0.037%)

- High Spread: -0.009% (prev. -0.031%)

- % Allotted At High Spread: 25.6892% (prev. 86.0674%)

- Bid/Cover: 4.760x (prev. 3.297x)

AUSSIE BONDS: At Cheaps, RBA Minutes Flag Tightening Risk

ACGBs sit at or near session cheaps (YM -13.0 & XM -11.0) after the RBA Minutes for April make a special point that “monetary policy may need to be tightened at subsequent meetings”. ACGBs were cheaper ahead of the Minutes in sympathy with the weaker lead from US Tsys in NY trade but then added 3-6bp to the cheapening in the post-Minutes trade.

- In the Minutes, the RBA discussed a 25bp hike or pausing but “on balance” decided to leave rates unchanged to have more time to assess the economic outlook and impact of the significant tightening to date.

- Cash ACGBs are 11-12bp cheaper with the AU-US 10-year yield differential +2bp at -11bp.

- Swap rates are 12-14bp higher with the curve 2bp flatter and EFPs 1-2bp wider.

- Bills strip is steeper with pricing -8 to -17.

- RBA dated OIS pricing is 6-10bp firmer for meetings beyond July. A 32% chance of a 25bp hike in May is priced with a cumulative 18bp of tightening priced by August.

- The AOFM announced the launch via syndication of the new Dec-34 bond today with expected pricing tomorrow.

- With the local calendar light until next week, the local market will remain guided by US Tsys which have cheapened for three consecutive sessions.

AUSSIE BONDS: Launch Of New December 2034 Treasury Bond

The AOFM announces “the issue by syndication of a new 3.50% 21 December 2034 Treasury Bond. The initial issue will be of a benchmark size.”

- “Initial price guidance for the issue is a spread of 8.5 to 11.5 basis points over the implied bid yield for the primary ten-year Treasury Bond futures contract.”

- “The issue is expected to be priced on Wednesday, 19 April 2023 and settle on Wednesday 26 April 2023.”

- “Australia and New Zealand Banking Group, Commonwealth Bank of Australia, Deutsche Bank, and National Australia Bank Limited will act as Joint-Lead Managers for the issue.”

- “The AOFM will be mindful of the performance of the bond when considering the timing of future issuance.”

NZGBS: Closed At Cheaps, ACGBs Weaker After RBA Minutes

NZGBs closed at session cheaps with yields 14-15bp higher. A weaker lead from US Tsys saw NZGB yields open higher, but some early Asia-Pac strength in US Tsys helped to contain the early session cheapening. When ACGBs weakened after the RBA Minutes for April made a special point that “monetary policy may need to be tightened at subsequent meetings”, the local market weakened in sympathy. Stronger than expected China Q1 GDP also supported the move.

- At the close, the NZ/US and NZ/AU 10-year yield differentials were respectively 6bp and 3bp wider.

- Swap rates closed 9-10bp weaker with implied swap spreads 5bp tighter.

- RBNZ dated OIS closed 2-8bp firmer across meetings.

- REINZ house prices rose (1.4% M/M) for the first time in 18 months giving some hope that the retreat may have bottomed out.

- The local calendar is light ahead of Q1 CPI on Thursday. With the release yesterday of the final pieces in the CPI forecasting puzzle (March food and rental price data) BBG consensus is expecting a print of +1.5% Q/Q and 6.9% Y/Y after +1.4% and 7.2% in Q4.

- Until then, the local market will remain guided by US Tsys which have cheapened for three consecutive sessions.

EQUITIES: Mostly Down (Ex Japan), China Q1 GDP Beat Fails To Inspire

Regional equities are mostly lower, with Japan markets the only real positive standout. China related shares haven't received much benefit from the Q1 GDP beat, but monthly March activity figures were mixed. US futures have been relatively quiet, but sit down slightly at this stage.

- The China Q1 GDP report showed a beat (4.5% y/y, 4.0% forecast), while Q4 growth was revised up from flat to positive. Still the CSI 300 is only just positive, the Shanghai Composite around flat. Monthly activity indicators for March showed IP and property related investment still trailing expectations. Retail sales provided a solid beat though.

- The HSI popped higher on the data releases but lost traction soon after. We now sit 0.75% lower, with tech and bank related stocks weighing.

- Bank stocks in Japan have helped the main index post a gain, likely reflecting positive spillover from recent US bank earning results. The Topix headline is up around 0.7% at this stage.

- The Kospi is down 0.50%, weighed by automakers, as their EVs were deemed ineligible for a $7500 US tax credit. The Taiex is down 0.6%, in line with a softer SOX tone during Monday's session.

- In SEA, outside of Indonesia stocks (up around 0.60%) we are tracking lower.

GOLD: Bullion Stabilises But Struggling To Hold Above $2000

Gold prices fell 0.5% on Monday due to higher Treasury yields and US dollar following the robust Empire manufacturing index. Today it is 0.2% higher but struggling to hold above $2000/oz. it is currently around $1999.32, below the intraday high of $2001.86. The USD index is down slightly.

- While gold is struggling to rise beyond $2000, it is holding above support at $1981.70, the April 10 low, today. During Monday’s NY session it did break this level briefly reaching an intraday low of $1981.25. It remains well above the 50-day simple moving average.

- Gold has been softer in recent days due to higher US consumer inflation expectations and leading output indicators pointing to further Fed tightening. Recession risk provides support though.

- There are housing starts/permits data for March out in the US later, which are expected to decline on the month after a strong February. The Fed’s Bowman discusses central bank currencies as well.

OIL: Solid Data From China Support Crude As Fed Hike Fears Weigh On Market

Oil prices are off their Monday low but have been moving in a narrow range. Prices are up around 0.2% today after falling around 2% yesterday, supported by data showing solid growth in China following its reopening. Brent is trading around $84.90/bbl and WTI $80.95. The USD index is down slightly.

- WTI rose to a high of $81.22 today after reaching a low of $80.71 earlier. Brent has had an intraday high of $85.20 which followed a low of $84.59. Both are hovering just above their 200-day simple moving averages.

- China’s Q1 GDP rose a higher-than-expected 2.2% q/q to be up 4.5% y/y, the highest annual rate since Q1 2022, after 2.9% y/y in Q4, which is positive for the oil demand outlook. (See Consumers Support Q1 Growrh But Uncertainties Weigh On Outlook)

- On the supply front, Russian oil shipments were back above 3mbd last week, according to Bloomberg. It had said that it would reduce output to the end of 2023. India has said that it will continue to demand Russian crude.

- API US inventory data is released later and given the sensitivity of the market to supply developments is likely to be watched closely. Last week’s data showed a 377k barrel crude build, according to Bloomberg.

- There are housing starts/permits data for March out in the US later, which are expected to decline on the month after a strong February. The Fed’s Bowman discusses central bank digital currencies as well. There is also UK wages/employment data and Canadian March CPI.

FOREX: AUD Firms After RBA Minutes, China GDP

The AUD is the strongest performer in the G-10 space at the margins. The AUD firmed after the minutes of the April RBA meeting left the door open for more tightening, with gains marginally extended as Chinese GDP was firmer than expectations.

- AUD/USD prints at $0.6715/20 ~0.2% firmer today. March Household Spending rose 8.0% up from a fall of -0.1% in February. Bulls target a break of the 50-Day EMA ($0.6736), on the downside support is seen at $0.6620 the low from April 10.

- Kiwi is also firmer, however NZD/USD has been mostly rangebound against USD respecting a $0.6180/95 range in today's Asian session.

- Yen is little changed from yesterdays closing levels. USD/JPY did briefly break Monday's high before gains were pared to sit at ¥134.40/50.

- Elsewhere in G-10 ranges have been narrow with little follow through on moves.

- Cross asset flows remain muted, US Treasury Yields are ~1bp softer and e-minis are flat. BBDXY is also little changed.

- In Europe today we have UK Unemployment and the German ZEW Survey. Further out US House Starts and Canadian CPI will cross.

FX OPTIONS: Expiries for Apr18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0865-70(E1.3bln), $1.1000(E1.5bln), $1.1050-60(E1.4bln)

- AUD/USD: $0.6600(A$686mln), $0.6665-70(A$614mln) $0.6800(A$1.1bln)

- USD/CAD: C$1.3650($889mln)

- USD/CNY: Cny6.7375($1.6bln), Cny6.9500($1.1bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/04/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 18/04/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/04/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/04/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 18/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/04/2023 | 1300/1500 |  | EU | ECB Elderson in Basel Committee on Banking Supervision | |

| 18/04/2023 | 1500/1100 |  | CA | BOC Governor testifies to House of Commons committee | |

| 18/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 18/04/2023 | 1700/1300 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.