MNI EUROPEAN OPEN: China Property Stocks Surge On Easier Housing Restrictions

EXECUTIVE SUMMARY

- US EAST COAST PORT STRIKE SET TO START TUESDAY, SAYS UNION - RTRS

- UK’S REEVES TO ATTEND MEETING OF EU FINANCE MINISTERS, FT SAYS

- JAPAN’S INCOMING PM ISHIBA EYES GENERAL ELECTION OCT 27: NHK

- CHINA NEEDS FISCAL STIMULUS - MNI BRIEF

- MAJOR CHINESE CITIES EASE HOMEBUYING RULES IN STIMULUS PUSH - BBG

- CHINA SEP PMI RISES BUT REMAINS BELOW 50 - MNI EM BRIEF

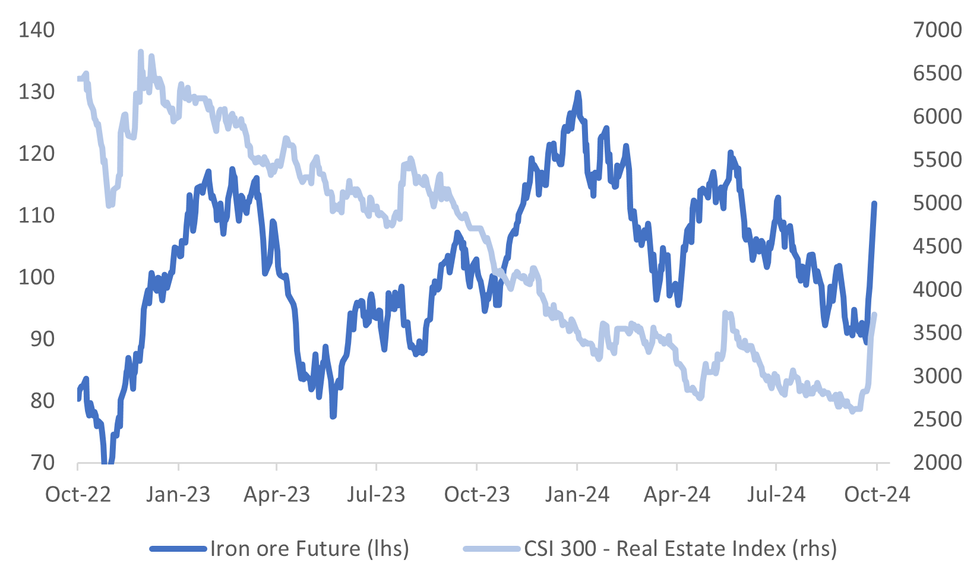

Fig. 1: China Real Estate Stocks & Iron Ore Futures

Source: MNI - Market News/Bloomberg

UK

GEOPOLITICS (FT/BBG): “UK Chancellor Rachel Reeves is aiming to attend a meeting of EU finance ministers before the end of the year, the Financial Times reports. The arrangements are still under discussion, the FT said, citing unidentified people familiar with the matter. Officials see the anticipated meeting as a sign of the UK’s improving relations with the EU, as the two sides attempt to reboot their relationship since Labour took office, the newspaper reports.”

POLITICS (BBG): “A Member of Parliament quit the UK’s governing Labour Party, unleashing a deeply personal attack on Prime Minister Keir Starmer and slamming the “staggering” revelations of hypocrisy under his leadership.”

EU

AUSTRIA (BBG): “ Austria’s traditional political powers are pledging to block the far-right Freedom Party from forming a government following Sunday’s national elections, marking the latest effort to stem the rising tide of populism in Europe.”

ECB (MNI BRIEF): Real interest rates have increased as inflation has decreased, adding to the degree of monetary tightening, Bank of Spain Governor Jose Luis Escriva said in a presentation on Friday.

GERMANY (BBG): “ A Deutsche Bahn AG labor union will try to block the agreed €14.3 billion ($16 billion) sale of subsidiary DB Schenker to Danish freight firm DSV A/S, Frankfurter Allgemeine Zeitung reported.”

FRANCE (BBG): “The French government is weighing fresh taxes on corporates to cut the country’s budget deficit, newspaper Le Monde reported.”

US

SUPPLY (RTRS): “A port strike on the U.S. East Coast and Gulf of Mexico will go ahead starting on Tuesday, the International Longshoremen’s Association union said on Sunday, signaling action that could cause delays and snarl supply chains.”

FED (MNI BRIEF): Federal Reserve Governor Michelle Bowman said Friday recent data show the economy holding up and the labor market is strong. The U.S. unemployment rate at 4.2% is "well below" her estimate of full employment, she said, noting it is also below the Congressional Budget Office's estimate of 4.4%.

JOBS (MNI INTERVIEW): The share of Americans expecting the Fed to lower interest rates over the next year is at a record high and they generally expect those lower interest rates to help stave off any further significant weakening in the labor market, the head of the University of Michigan's Survey of Consumers told MNI.

OTHER

JAPAN (NHK/BBG): “Japan’s incoming Prime Minister Shigeru Ishiba is planning to dissolve the country’s lower house on Oct. 9 and hold a general election on Oct. 27, NHK reports, without attribution.”

IRON ORE (BBG): “ Iron ore spiked almost 11% after three of China’s biggest cities eased curbs on home-buying, bolstering the demand outlook in the world’s biggest consumer of the steel-making ingredient.”

MIDEAST (RTRS): “ Israel said it bombed Houthi targets in Yemen on Sunday in response to missile fire by the Iran-aligned militants at Israel over the past two days, marking another front in fighting in the Middle East.”

ISRAEL (BBG): “A longtime rival of Benjamin Netanyahu said he would join his coalition, diminishing the virtual veto that far-right members have held over Israel’s prime minister amid a year of war. Gideon Saar, a veteran right-wing lawmaker, will become a member of the high-level security cabinet, according to a joint statement by Netanyahu and Saar.

CHINA

FISCAL POLICY (MNI BRIEF): Authorities need to expand fiscal policy to boost infrastructure investment and consumption to ensure the 5% annual growth target is met, following the central bank's recent easing, policy advisors at the Tsinghua PBCSF Chief Economists Forum said on Saturday.

FISCAL (SECURITIES DAILY): “Chinese chief economists expect additional fiscal stimulus after the central bank unveiled monetary easing and the politburo called for increasing countercyclical measures, Securities Daily reports. Authorities are likely to announce more incremental policies to achieve the annual economic and social development goals in Q4, said Chen Li, chief economist at Sichuan Cai Securities.”

ECONOMY (MNI EM BRIEF): China's Manufacturing Purchasing Managers Index rose by 0.7 points to 49.8 in September, but remained below the 50 mark for the fifth consecutive month, as production accelerated and demand improved, data from the National Bureau of Statistics showed Monday.

HOUSING (BBG): “Three of China’s largest cities eased rules for homebuyers, following through on the central government’s latest efforts to prop up the embattled property sector.”

CHINA MARKETS

MNI: PBOC Net Injects CNY52 Bln via OMO Monday

The People's Bank of China (PBOC) conducted CNY212.1 billion via 7-day reverse repos, with the rate at 1.50%. The operation led to a net injection of CNY52 billion after offsetting maturities of CNY160.1 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6100% at 09:28 am local time from the close of 1.8339% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 52 on Sunday, compared with the close of 50 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0074 on Monday, compared with 7.0101 set on Friday. The fixing was estimated at 7.0080 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND SEP ANZ ACTIVITY OUTLOOK 45.3; PRIOR 37.1

NEW ZEALAND SEP ANZ BUSINESS CONFIDENCE 60.9; PRIOR 50.6

AUSTRALIA AUG PRIVATE SECTOR CREDIT M/M 0.5%; MEDIAN 0.5%; PRIOR 0.5%

JAPAN AUG P INDUSTRIAL PRODUCTION Y/Y -4.9%; MEDIAN -1.5%; PRIOR 2.9%

JAPAN AUG P RETAIL SALES Y/Y 2.8%; MEDIAN 2.6%; PRIOR 2.7%

JAPAN AUG DEPARTMENT STORE, SUPERMARKET SALES Y/Y 4.4%; PRIOR 1.1%

JAPAN AUG HOUSING STARTS Y/Y -5.1%; MEDIAN -3.5%; PRIOR -0.2%

CHINA SEP MANUFACTURING PMI 49.8; MEDIAN 49.4; PRIOR 49.1

CHINA SEP NON-MANUFACTURING PMI 50.0; MEDIAN 50.4; PRIOR 50.3

CHINA SEP COMPOSITE PMI 50.4; PRIOR 50.1

CHINA SEP CAIXIN CHINA PMI MFG 49.3; MEDIAN 50.5; PRIOR 50.4

CHINA SEP CAIXIN CHINA PMI SERVICES 50.3; MEDIAN 51.6; PRIOR 51.6

CHINA SEP CAIXIN CHINA PMI COMPOSITE 50.3; PRIOR 51.2

SOUTH KOREA AUG IP Y/Y 3.8%; MEDIAN 1.9%; PRIOR 5.2%

SOUTH KOREA AUG CYCLICAL LEADING INDEX CHANGE -0.1; PRIOR 0.0

MARKETS

US TSYS: Tsys Futures Little Changed, MNI Chicago PMI Later Today

- It has been a very slow session in Asia today for US tsys, ranges have been very tight. TU is -00+ at 104-09⅜ while TY is trading -02+ at 114-21.

- Focus in Asia today has all been on equities with Chinese stocks surging higher after further easing of homebuying restrictions, while Japanese equities have plunged after after Ishiba was elected new prime minister

- The tsys curve is little changed with yields flat to 0.5bps higher. The 2yr is trading near recent lows at 3.563% while the 10yr is trading +0.5bps at 3.754%.

- Friday's data underscored a rise in projected rate cuts into early 2025 gained vs. pre-data levels (*): Nov'24 cumulative -38.5bp (-37.2bp), Dec'24 -76.8bp (-73.9bp), Jan'25 -109.5bp (-104.5bp).

- Looking ahead: relatively quiet start to the week with MNI Chicago PMI later today

JGBS: Cash Bond Bear-Flattener, Labour Market Data & Tankan Report Tomorrow

JGB futures are sharply cheaper and near session lows, -68 compared to settlement levels.

- Outside of the previously outlined IP and Retail Sales data, the market has had news of a general election on October 27th to digest. The new LDP leader Shigeru Ishiba will dissolve the lower house on October 9th (per BBG/NHK).

- Cash US tsys are little changed in today’s Asia-Pac session after Friday’s post-PCE deflator gains. The US calendar this week will see MNI Chicago PMI today, ISMs tomorrow, ADP private employment data on Wednesday, and the September jobs report on Friday.

- Cash JGBs are flat to 4bps cheaper across benchmarks, with a flattening bias. The benchmark 2-year yield is 2.4bps higher at 0.391% after today’s supply.

- The 2-year bond auction demonstrated mixed demand metrics, with the low price meeting dealer expectations, but the cover ratio decreasing to 3.8149x from 5.542x in August. The auction tail was also longer than last month.

- Swap rates are little changed out to the 30-year and 4bps higher beyond. Swap spreads are mixed.

- Tomorrow, the local calendar will see the Jobless Rate, Job-To-Applicant Ratio, and Jibun Bank PMI Mfg data alongside the Q3 Tankan Report.

AUSSIE BONDS: Flat But At Session Cheaps As IO Surges

ACGBs (YM flat & XM -0.5) are flat but dealing at Sydney session cheaps.

- Outside of the previously outlined private sector credit, there hasn't been much by way of domestic drivers to flag.

- (AFR) "Iron ore has surged 10 per cent today after three of China’s largest cities eased rules for home buyers, triggering a rally in mining stocks and helping the ASX set a record high." (See link)

- China's Mfg PMIs were mixed for September. The official index firmed to 49.8 from 49.1 in August (consensus was 49.4), while the Caixin index printed well below analyst forecasts at 49.3 versus 50.5 forecast and 50.4 prior.

- Cash US tsys are little changed in today’s Asia-Pac session.

- Cash ACGBs are flat to 1bp richer, with the AU-US 10-year yield differential at +20bps.

- Swap rates are flat to 1bp higher, with the 3s10s curve steeper.

- The bills strip is little changed.

- RBA-dated OIS pricing is 1-2bps softer across meetings. A cumulative 15bps of easing is priced by year-end.

- Tomorrow, the local calendar will see CoreLogic Home Value, Judo Bank PMI Mfg and Building Approvals data.

- On Wednesday, the AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond.

NZGBS: Slightly Cheaper But Off Best Levels After Strong Bus. Conf.

NZGBs closed slightly cheaper, with benchmark yields 1bp higher. This however masked the sharp reversal cheaper following NZ business confidence data.

- NZ business confidence rose to a fresh 10-year high in September as the prospect of further interest-rate cuts stoked optimism: ANZ. “The economy’s response to lower interest rates could be more vigorous than is generally expected,” ANZ NZ Chief Economist Sharon Zollner said.

- “If confidence about the economic outlook continues to grow rather than petering out, that certainly raises the possibility that investment could recover more quickly than we or the Reserve Bank are anticipating.” (per BBG)

- Cash US tsys are little changed in today’s Asia-Pac session after Friday’s post-PCE deflator gains. The US calendar this week will see MNI Chicago PMI today, ISMs tomorrow, ADP private employment data on Wednesday, and the September jobs report on Friday.

- The NZ-US 10-year yield differential finished 5bps wider at +49bps.

- Swap rates closed 1bp higher.

- RBNZ dated OIS pricing closed little changed. A cumulative 88bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Building Permits and NZIER Business Opinion Survey.

FOREX: Antipodean FX Outperforms Amid Further China Equity Surge

The top performers in the G10 FX space today have been AUD and NZD, which are both up close to 0.45% firmer versus the USD. Further strong China equity gains, coupled with higher metal prices (particularly for iron ore) have been key drivers. This follows the weekend news of easing property restrictions in 3 large China cities. Yen and CHF are weaker, but away from worst levels.

- The BBDXY USD index sits little changed last near 1219.10/15, with all of today's focus in the crosses. US equity futures are close to flat, while US yields are a touch higher.

- USD/JPY got to highs of 142.95, but sits back near 142.25 in latest dealings, only modestly weaker in yen terms.

- New PM Ishiba is expected to call an election for Oct 27th, per onshore media sources. Local equities are sharply lower, with policy continuity seen from Ishiba in the near term (and likely continued BoJ normalization).

- Japan IP data was softer, but is expected to improve from the auto side for the next print. Retail sales were close to expectations and in positive territory.

- AUD/USD was last near the 0.6930/35 level, so just short of recent highs, close to 0.6940. Bulls will target a move towards 0.7000, as China ramps up efforts to boost the economy/property sector. Iron ore has surged higher (last near $112/ton, fresh multi month highs), in line with surging China property equity gains.

- NZD/USD is around 0.6370, just off highs of 0.6375, which marginally breached late Dec highs from 2023. The ANZ business sentiment readings improved further pointing to an improved outlook, although this is more likely for 2025.

- Looking ahead, we have the second UK GDP estimate, along with regional EU inflation details (with German figures out). In the US session, we have the MNI Chicago PMI print, as well as hearing from Fed Chair Powell.

ASIA STOCKS: Chinese Equities Surge Following Further Stimulus Measures

- Asian markets are trading mixed today with Chinese equities have surging again today with property shares experienced a significant rally. The Bloomberg property gauge is up 14% after Shanghai, Shenzhen, and Guangzhou eased homebuying restrictions as part of the government's efforts to stabilize the struggling real estate sector. This follows the announcement of a major stimulus package aimed at addressing the prolonged property slump, with top leaders committing to halt the market's decline.

- The CSI 300 surged more than 6.20%, ChiNext up 11.4%, fueled by recent stimulus measures aimed at tackling China’s property crisis. While in Hong Kong the HSI is up 3.35%, Mainland Property Index is 8.36% higher and the HSTech Index up 7.15%.

- Earlier, China's factory activity contracted for the fifth consecutive month in September, with the Mfg PMI coming in at 49.8 although slightly better than economists' expectations of 49.4.

- Elsewhere Japan’s Nikkei slumped nearly 4.5%, while the Topix dropped over 3%, driven by investor repositioning after Shigeru Ishiba's victory in the ruling party's leadership race. South Korea ( KOSPI -1%) & Taiwan (Taiex -1.50%) have both struggled today with tech stocks lower, while Indian equities are under pressure with the Nifty 50 down 0.5% this has been due to a decline in IT, automotive, and banking stocks. Australia's ASX200 is 0.75% higher, on the back of higher commodity prices after Iron Ore jumped 10%.

OIL: Firmer But Mostly Underperforming Other Commodities

Oil prices are tracking modestly higher in the first part of Monday trade. The active WTI was last near $68.40/bbl, while Brent (for Dec Delivery) was close to $71.90/bbl. This leaves both benchmarks around 0.35-0.45% higher and building on modest gains from Friday's session.

- WTI couldn't get above $69/bbl in earlier trade. recent lows just under $67/bbl remain intact, beyond that lies the earlier September lows near $65/bbl. Hence we remain reasonably close to recent lows.

- Sentiment is likely be aided, at the margins, by positive China related asset gains. This follows last week's stimulus announcements and then the weekend news of easier housing restrictions in 3 major cities. This offset mixed PMI prints from China, with the official manufacturing read improving but still remaining sub 50.0. The Caixin PMI slumped comfortably back below this point.

- Still, oil's gains today compared to more metal related products remains much more modest.

- On-going focus remains on Middle East tensions following Israel's killing of Hezbollah's leader, while Israel also bombed targets in Yemen. The response from Iran will be in focus, although with the conflict nearly coming up to a 1yr anniversary, the market may keep odds of a significant escalation in the conflict as fairly low at this stage.

GOLD: Pullbacks From All-Time High

Gold is 0.2% lower in today’s Asia-Pac session, after closing 0.5% lower at $2658.24 on Friday.

- As a result, bullion currently sits some $30 lower than Thursday’s all-time high of $2685.

- The softer performance for the yellow metal came despite a benign US inflation, consumption, and PCE inflation report underpinned expectations for more rate cuts from the FOMC ahead, including the potential for another -50 bps in November.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, last week’s move 0.9% move higher confirmed a resumption of the primary uptrend, with focus on $2675.5 next, a Fibonacci projection. Firm support lies at $2583.9, the 20-day EMA.

- After reaching its highest level since end 2012 yesterday, silver underperformed on Friday, down by ~1.5%. For silver, bullish conditions remain intact and this week’s climb reinforces this set-up. Clearance of next key resistance at $32.518, would open $33.880, a Fibonacci projection. Firm support lies at $29.69, the 50-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 30/09/2024 | 0600/0700 | *** |  GB GB | GDP Second Estimate |

| 30/09/2024 | 0600/0700 | * |  GB GB | Quarterly current account balance |

| 30/09/2024 | 0600/0800 | ** |  DE DE | Import/Export Prices |

| 30/09/2024 | 0600/0800 | ** |  SE SE | Retail Sales |

| 30/09/2024 | 0700/0900 | ** |  CH CH | KOF Economic Barometer |

| 30/09/2024 | 0800/1000 | *** |  DE DE | North Rhine Westphalia CPI |

| 30/09/2024 | 0800/1000 | *** |  DE DE | Bavaria CPI |

| 30/09/2024 | 0830/0930 | ** |  GB GB | BOE M4 |

| 30/09/2024 | 0830/0930 | ** |  GB GB | BOE Lending to Individuals |

| 30/09/2024 | 0900/1100 | *** |  IT IT | HICP (p) |

| 30/09/2024 | 0900/1100 | *** |  IT IT | HICP (p) |

| 30/09/2024 | 1200/1400 | *** |  DE DE | HICP (p) |

| 30/09/2024 | 1300/1500 |  EU EU | ECB's Lagarde at ECON hearing | |

| 30/09/2024 | 1345/0945 | *** |  US US | MNI Chicago PMI |

| 30/09/2024 | 1430/1030 | ** |  US US | Dallas Fed manufacturing survey |

| 30/09/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for 13 Week Bill |

| 30/09/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for 26 Week Bill |

| 30/09/2024 | 1600/1200 | ** |  US US | USDA GrainStock - NASS |

| 30/09/2024 | 1755/1355 |  US US | Fed Chair Jerome Powell | |

| 30/09/2024 | 2010/2110 |  GB GB | BOE's Greene panellist on 'Perspectives on global MonPol' |