-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: First Meaningful Chinese Data Reflecting Re-Opening Sees Upside Surprise

EXECUTIVE SUMMARY

- REOPENING DRIVE PUSHES CHINA NON-MANUFACTURING PMI ABOVE ESTIMATES

- WASHINGTON HALTS LICENCES FOR US COMPANIES TO EXPORT TO HUAWEI (FT)

- BIDEN TEAM WEIGHS FULLY CUTTING OFF HUAWEI FROM US SUPPLIERS (BBG)

- BIDEN SAYS NO F-16S FOR UKRAINE AS RUSSIA CLAIMS GAINS (RTRS)

- GERMANY WANTS TO TAKE ACTION TO CURB RUSSIAN LNG IMPORTS (BBG)

- RUSSIA BANS OIL EXPORTS TO CLIENTS ADHERING TO WESTERN PRICE CAP (BBG)

- IMF FORECASTS UK RECESSION DESPITE OTHER LEADING ECONOMIES GROWING (FT)

- GLOBAL ECONOMY 'LESS GLOOMY' IN 2023, IMF SAYS (MNI)

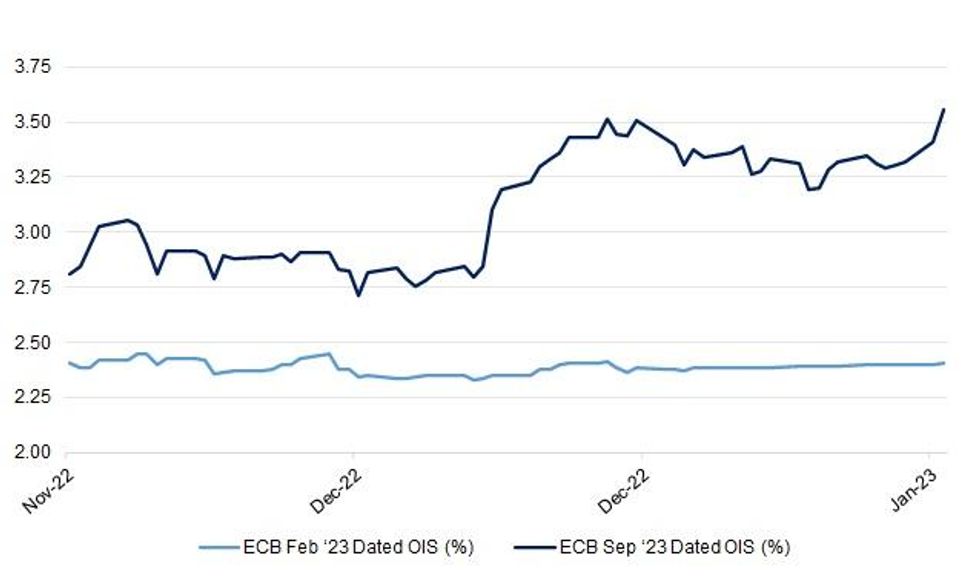

Fig. 1: ECB Feb ‘23 & Sep ‘23 Dated OIS

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS: Support for trade unions is rising even though strike action is bringing public services to a standstill , Sky News polling shows. (Sky)

BREXIT: Rishi Sunak was warned on Monday not to trade off the power to overrule the EU in Northern Ireland in order to strike a deal with Brussels as he vowed to forge ahead with post-Brexit reforms. (Telegraph)

IMF: Britain is the only leading economy likely to slide into recession this year, the IMF said on Tuesday, predicting that UK household spending would falter under the weight of high energy prices, rising mortgage costs and increased taxes. (FT)

EUROPE

ECONOMY: The European Union faces a “year of subdued growth, not of recession,” Economy Commissioner Paolo Gentiloni said on Monday, speaking ahead of the European Commission’s economic forecasts next week. (MNI)

U.S.

INFLATION: US Treasury Secretary Janet Yellen said persistently weak inflation is likely to return as a long-term challenge for the economy and policymakers once pandemic-era distortions behind the recent surge subside and prices cool. (BBG)

FISCAL: The U.S. Treasury Department on Monday announced it expects to borrow USD932 billion in privately-held net marketable debt in the first quarter, USD353 billion more than previously announced in October, and a total of USD1.21 trillion in the first half of the year. (MNI)

CORONAVIRUS: President Joe Biden informed Congress on Monday that he will end the twin national emergencies for addressing COVID-19 on May 11, as most of the world has returned closer to normalcy nearly three years after they were first declared. (AP)

OTHER

GLOBAL TRADE: China told the Netherlands it wants to keep supply chains and trade open, a sign Beijing is trying to find room to maneuver amid a US push to cut it off from advanced chip technology. (BBG)

GLOBAL TRADE: The European Union is seeking to rapidly accelerate production of clean technologies by offering tax credits and domestic subsidies to companies in a bid to catch up with US President Joe Biden’s landmark green package. (BBG)

U.S./CHINA: The Biden administration has stopped providing US companies with licences to export to Huawei as it moves towards imposing a total ban on the sale of American technology to the Chinese telecom equipment giant. (FT)

U.S./CHINA: The Biden administration is considering cutting off Huawei Technologies Co. from all of its American suppliers, including Intel Corp. and Qualcomm Inc., as the US government intensifies a crackdown on the Chinese technology sector. (BBG)

GEOPOLITICS: The U.S. is hoping to reach an agreement this week to open as many as four U.S. military sites in the Philippines in Washington’s latest push to expand its strategic footprint across the region to counter threats from China, U.S. officials said. (WSJ)

GEOPOLITICS/GLOBAL TRADE: China's new foreign minister Qin Gang wants to build stronger ties with Saudi Arabia and set up a China-Gulf free trade zone "as soon as possible", according to a ministry statement published late on Monday. (RTRS)

JAPAN/SOUTH KOREA: Japanese and South Korean officials continued their search Monday for a resolution to the issue of Japan's treatment of wartime laborers, a long-standing dispute that has chilled bilateral relations. "South Korea is seriously considering a solution," a Japanese Foreign Ministry official said of the meeting. "There are things we agree on and things we do not," the official said. (Nikkei)

BOJ: Japanese Finance Minister Shunichi Suzuki says it’s too early to say whether the government’s joint statement with the Bank of Japan pledging to achieve 2% inflation needs to be revised, after a panel of experts called for changing the price target to a long-term goal. (BBG)

BOJ: Two Bank of Japan veterans continue to lead the field to replace Governor Haruhiko Kuroda as investors mull the risk of Prime Minister Fumio Kishida’s choice jolting global financial markets. (BBG)

RBA: The Reserve Bank of Australia has appointed David Jacobs as head of domestic markets following the resignation of Jonathan Kearns last year, the central bank said in a statement. (MNI)

NEW ZEALAND: Senior MP Andrew Little has been demoted and lost his health portfolio while Chris Hipkins has unveiled a new Minister for Auckland in his Cabinet reshuffle. The Prime Minister fronted his post-Cabinet press conference, only his second in the job, hot off two polls published last night that showed a reversal in political fortunes for Labour under his leadership, now just ahead of National. (NZ Herald)

SOUTH KOREA: South Korea seeks to improve dividend payout system so that payouts are finalized before determining shareholders eligible to receive them, Korea Exchange said in a statement. (BBG)

HONG KONG: Chief Executive John Lee Ka-chiu on Tuesday also said the government would soon scrap vaccination and rapid antigen testing requirements for arrivals, as he pledged to focus on the return to full normality and focus on economic development for Hong Kong. Without providing a clear timetable, Lee said the city would also “very soon” axe polymerase chain reaction (PCR) test requirements for travellers going to mainland China, but the present mask mandate would remain for now as the risk of a winter surge in the number of Covid-19 cases remained. (SCMP)

MEXICO: Mexico's finance ministry will work with state-owned oil company Pemex to identify its room to maneuver on debt, Deputy Finance Minister Gabriel Yorio said in a press conference on Monday. (RTRS)

MEXICO: Mexico's public debt stood at 49.4% of the country's gross domestic product (GDP) at the end of last year's fourth quarter, the finance ministry said in a statement Monday. (RTRS)

BRAZIL: Brazil's Finance Minister Fernando Haddad said on Monday that the new central bank monetary policy director could be tapped from the private sector, a closely followed position that should signal the president's relationship with policymakers. (RTRS)

RUSSIA: The United States will not provide the F-16 fighter jets that Ukraine has sought in its fight against Russia, President Joe Biden said on Monday, as Russian forces claimed a series of incremental gains in the country's east. (RTRS)

RUSSIA: U.S. President Joe Biden on Monday said he will visit Poland but does not know when after reports suggested he is considering a trip to Europe to coincide with the Feb. 24 anniversary of Russia's invasion of Ukraine. (RTRS)

RUSSIA: Goldman Sachs agreed a deal last year to transfer a portion of its privately held Russian investments to two of the bank’s former employees, part of the Wall Street firm’s efforts to wind down its operations in the country in the wake of Moscow’s war with Ukraine. (FT)

SOUTH AFRICA: South Africa is considering declaring a national state of disaster as record power cuts cripple the economy. (BBG)

MIDDLE EAST: An Israeli drone strike inside Iran hit an advanced weapons-production facility in an attack that Israel believes achieved its goals, according to people familiar with discussions about the operation. (WSJ)

COLOMBIA: The technical team of Colombia's central bank on Monday revised its inflation projection for this year upward to 8.7%, from a previous 7.1%, amid persistent high prices which have led the bank's board to make sharp increases in borrowing costs. The technical team added in its quarterly monetary policy report that it anticipates a higher interest rate than predicted by the market. (RTRS)

IMF: The global economy faces another challenging year of subpar growth and hot inflation, though some downside risks in China and Europe have moderated, according to the IMF's latest projections. (MNI)

IMF: Inflation remains a big challenge for policymakers worldwide, a top International Monetary Fund official said after the lender raised its global economic growth outlook for the first time in a year. (BBG)

EQUITIES: Samsung Electronics Co. said it would maintain capital spending this year at about the same level as last year, after profit tumbled on a sharp drop in chip demand. (BBG)

METALS: Commodity trader Glencore has delivered 40,000 tonnes of Russian aluminium to London Metal Exchange-approved warehouses in the South Korean port of Gwangyang, two sources with knowledge of the matter told Reuters. (RTRS)

ENERGY: Germany’s government wants to curb imports of Russian liquefied natural gas, adding to efforts to reduce its reliance on the country’s energy supplies, according to a government document seen by Bloomberg. (BBG)

ENERGY: The European Union has appointed gas capacity platform Prisma to calculate countries' collective demand for gas, as the bloc moves ahead with a plan to launch joint gas buying among EU countries.(RTRS)

OIL: Russia’s government banned sales of the nation’s oil to any buyers adhering to a price cap introduced by Western countries, according to a decree published Monday. (BBG)

OIL: EU imports of non-Russian gasoil and diesel rose sharply last week, helping to build up inventories ahead of the bloc's impending embargo on Russian oil products. (Argus Media)

OIL: Asian markets are showing no let up in their demand for Russian oil, absorbing a big rise in seaborne exports of Urals crude this month and helping Moscow cope even as most Western buyers stay away, according to traders’ and Refinitiv Eikon data. (RTRS)

CHINA

ECONOMY/BANKS: China’s banks are offering more cheaper loans to spur domestic consumption, suggesting further monetary easing is possible, official China Securities Journal reports, citing analysts. (BBG)

ECONOMY/PROPERTY/IMF: China's troubled property sector will continue to weigh on growth and will not be an engine of growth until there is some "cleaning up" of the market, the International Monetary Fund's chief economist said on Tuesday. (RTRS)

FISCAL: Fiscal authorities should take measures to support people’s livelihood and counter the reduction in household income that has triggered increasing mortgage defaults, said Sheng Songcheng, previously head of the statistics and analysis department at the People’s Bank of China, in an article on China Business Network. (MNI)

FISCAL: China should not significantly expand the quota of local government special bonds as local authorities have suffered increasing pressures from debt repayments, Caixin Magazine reported citing experts. (MNI)

FISCAL: The leverage ratio of China’s real economy decreased to 272.0% in the fourth quarter, reversing the growth trend in the previous quarters last year. (BBG)

EQUITIES: Foreign capital will continue to flow into China’s A-share market this year as Chinese assets become more attractive as the economy bottoms out and global liquidity is expected to ease, China Securities Journal reported citing analysts. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY170 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY471 billion via 7-day reverse repos with the rates unchanged at 2.00% on Tuesday. The operation has led to a net injection of CNY170 billion after offsetting the maturity of CNY301 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0500% at 9:23 am local time from the close of 2.0666% on Monday.

- The CFETS-NEX money-market sentiment index closed at 55 on Monday, compared with the close of 40 before Chinese New Year holiday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7604 TUES VS 6.7626 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7604 on Tuesday, compared with 6.7626 set on Monday.

OVERNIGHT DATA

CHINA JAN MANUFACTURING PMI 50.1; MEDIAN 50.1; DEC 47.0

CHINA JAN NON-MANUFACTURING PMI 54.4; MEDIAN 52.0; DEC 41.6

CHINA JAN COMPOSITE PMI 52.9; DEC 42.6

CHINA DEC INDUSTRIAL PROFITS -4.0% Y/Y YTD; NOV -3.6%

JAPAN DEC UNEMPLOYMENT RATE 2.5%; MEDIAN 2.5%; NOV 2.5%

JAPAN DEC JOB-TO-APPLICANT RATIO 1.35; MEDIAN 1.36; NOV 1.35

JAPAN DEC, P INDUSTRIAL PRODUCTION -0.1% M/M; MEDIAN -1.0%; NOV +0.2%

JAPAN DEC, P INDUSTRIAL PRODUCTION -2.8% Y/Y; MEDIAN -3.6%; NOV -0.9%

JAPAN DEC RETAIL SALES +1.1% M/M; MEDIAN +0.7%; NOV -1.3%

JAPAN DEC RETAIL SALES +3.8% Y/Y; MEDIAN +3.2%; NOV +2.5%

JAPAN DEC DEPARTMENT STORE & SUPERMARKET SALES +3.6% M/M; NOV +2.4%

JAPAN JAN CONSUMER CONFIDENCE INDEX 31.0; MEDIAN 30.5; DEC 30.3

JAPAN DEC HOUSING STARTS -1.7% Y/Y; MEDIAN +0.4%; NOV -1.4%

JAPAN DEC ANNUALISED HOUSING STARTS 846K; MEDIAN 845K; NOV 842K

AUSTRALIA DEC RETAIL SALES -3.9% M/M; MEDIAN -0.2%; NOV +1.7%

AUSTRALIA DEC PRIVATE SECTOR CREDIT +0.3% M/M; MEDIAN +0.5%; NOV +0.5%

AUSTRALIA DEC PRIVATE SECTOR CREDIT +8.3% Y/Y; NOV +8.9%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 86.8; PREV 85.9

Consumer confidence rose by 0.9pts to 86.8 last week. After a jump at the start of the year, confidence has remained relatively stable over January, within a band of 1.8pts. While confidence remains well below the neutral level of 100, its four-week average is at its highest level since June 2022. Household inflation expectations dropped 0.6pts despite the news last week that annual inflation hit a 32-year high in Q4 2022. This is a signal that household inflation expectations remain somewhat anchored despite accelerating inflation through 2022. (ANZ)

SOUTH KOREA DEC INDUSTRIAL OUTPUT -2.9% M/M; MEDIAN -0.2%; NOV +0.6%

SOUTH KOREA DEC INDUSTRIAL OUTPUT -7.3% Y/Y; MEDIAN -7.1%; NOV -3.4%

SOUTH KOREA DEC CYCLICAL LEADING INDEX -0.5 M/M; NOV -0.2

MARKETS

US TSYS: Marginally Cheaper in Asia, Fed In View

TYH3 deals at 114-11, +0-02, operating within a narrow 0-05 range, on volume of ~70K.

- Cash Tsys sit 0.5-1bp cheaper across the major benchmarks, with some late Tokyo weakness in JGBs applying modest pressure as we head into European hours.

- Tsys firmed in early Asia trade as a bid in ACGB's, in lieu of soft Australian retail sales data, fed through.

- Firmer than expected non-manf PMI data from China the applied some counter (the country's reopening drive and the LNY break were at the fore there), allowing Tsys to retreat from best levels.

- CPI data from France and Eurozone GDP headline during the London morning. Further out we have the house price index, MNI Chicago PMI and conference board consumer confidence, although more focus is set to fall on the ECI print.

JGBS: Sliding Into The Close

JGB futures have faltered into the bell, with participants seemingly unimpressed by the demand for the latest 1tn of 5-Year loans offered to banks via the BoJ’s Funds-Supplying Operations against Pooled Collateral channel (demand was actually a little higher than that seen at last week’s offering, while the average rate applied to the operation was a incrementally lower, ~30bp below prevailing 5-Year swap rates).

- That leaves the contract on the backfoot into the close, recently registering fresh session lows to print -34, while cash JGBs are 2.5bp cheaper to 0.5bp richer as 7s lead the sell off on the weakness in futures, while the curve twist flattens with a pivot around 20s.

- Local data had no tangible impact on the space.

- Local headline flow was dominated by comments from Finance Minister Suzuki, who outlined the government’s agreement with the BoJ view re: the need for more meaningful wage increases, while stressing that it is too early to discuss the idea of a revision to the BoJ-government accord (likely eying the impending departure of Governor Kuroda as the tipping point on that front).

- There was smooth enough digestion of the latest 2-Year JGB auction.

- Final manufacturing PMI data headlines the local docket on Wednesday.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.3581tn 2-Year JGBs:

- Average Yield -0.009% (prev. 0.043%)

- Average Price 110.029 (prev. 99.924)

- High Yield: -0.007% (prev. 0.055%)

- Low Price 100.025 (prev. 99.900)

- % Allotted At High Yield: 88.9171% (prev. 11.0582%)

- Bid/Cover: 3.727x (prev. 3.779x)

AUSSIE BONDS: Twist Steepening As Retail Sales Bounce Fades

YM finished +1.0, while XM was -1.5. Cash ACGBs saw 1bp richening to 3bp of cheapening as the curve twist steepened, pivoting around 5s.

- Aussie bonds firmed in the wake of a much softer than expected outcome for domestic retail sales data, with the Black Friday impact continuing to distort the data at this time of year, while an upward revision to the November reading provided further downward pressure to the December outcome.

- A reminder that the health of the consumer is a focal point for the RBA as the lagged impacts of monetary tightening take hold.

- Bills were 1-4bp richer through the reds at the bell, bull steepening, with RBA dated OIS showing 23bp of tightening for next week’s meeting alongside a terminal cash rate of ~3.70% (the latter came in by ~10bp post-retail sales).

- The space then pulled away from best levels ahead of official Chinese PMI data, which saw the country’s well-documented move away from ZCS and the LNY holiday period combine to provide a much firmer than expected outcome for the non-manufacturing PMI print.

- A late downtick was then observed, probably aided by reports of the scheduling of a telephone call between the Australian & Chinese trade ministers (seemingly for some point next week), as Sino-Aussie relations continue to thaw.

- On the semi-issuance front, A$1.5bn of QTC’s new 4.50% Aug-35 bond was priced.

- Looking ahead, Wednesday will see the finial Judo Bank m’fing PMI print & CoreLogic house price readings, along with A$700mn of ACGB May-34 supply.

NZGBS: Off Session Cheaps

The major NZGB benchmarks cheapened by 4bp on Tuesday, with softer than expected retail sales data from across the Tasman likely allowing the space to correct from early session cheaps.

- The space generally looked through the latest cabinet reshuffle as the incumbent Labour Party looks to garner support ahead of this year’s general election, centring on new PM Hipkins putting his own mark on the ruling party post-Ardern (he named a Minister for Auckland as part of the post-flood rebuild push in the area).

- Swap rates were 2-6bp higher across the curve, with flattening apparent there, resulting in mixed swap spread performance.

- RBNZ dated OIS is showing 61bp of tightening for next month’s meeting, effectively a coin flip between a 50 or 75bp OCR hike. Meanwhile, terminal OCR pricing has edged back above 5.35%.

- Looking ahead, the latest quarterly labour market report headlines domestically on Wednesday. Unemployment is expected to hold steady at 3.3% (per the BG survey), with wage growth set to remain elevated even as Q/Q employment growth pulls back.

EQUITIES: Ending January On A Weaker Note

The regional tone to Asia Pac equities is a weaker one for Tuesday's session. The weaker lead from Wall St through Monday's session didn't help, while China/HK sentiment didn't get a lift from better PMI outcomes, particularly in the services sector. US futures are also lower, failing to hold early positive momentum. Weakness is most evident in the Nasdaq, off -0.35% at this stage.

- HK and China bourses look to be seeing a bout of profit-taking. The HSI is off by near 1.30% so far today, with the tech sub-index down by 1.70% after yesterday's 4.84% fall. The China Dragon index was also down sharply in Monday US trade, -4.1%. Still, the HSI is up 10.15% for the whole of the month.

- The CSI 300 is down by 0.80%, more than unwinding Monday's +0.47% gain. The official services PMI surged to 54.4 (versus 52.0 expected). The detail also suggest further improvement in the outlook. The result didn't drive better sentiment in the equity space.

- The Kospi is off by 0.70% at this stage. A weaker than expected earnings update from Samsung electronics didn't help, while offshore investors have sold around $115mn of local shares today. The Taiex is off by over 1.10%, which comes after yesterday's +3.8% gain and where offshore investors added +$2.5bn to local stocks.

- Philippine shares also continue to track lower into month end, down nearly 4% over the past two sessions (2.8% today). Indian shares also remain on the back foot (Sensex -0.40% at the moment).

GOLD: Bullion In Holding Pattern Ahead Of Fed Meeting

Gold prices have been trading in a tight range during the APAC session ahead of Wednesday’s FOMC meeting. They fell 0.2% on Monday, and are now down 0.1% from the NY close at $1921.30/oz and is close to the intraday low of $1920.91 after reaching a high of $1927.43. The USD fell earlier in the session and is now climbing back up and weighing on gold prices.

- Gold continues to trade between its resistance at $1949.20, January 26 high, and support at $1897, the 20-day EMA.

OIL: Crude Down Again As Waits For Fed And OPEC Outcomes

Oil prices are lower again today after falling 2.4% on Monday, despite positive China data. WTI is down another 0.4% during the APAC session and is currently trading around its intraday low at $77.60/bbl after reaching an intraday high of $78.14. Brent is at $84.85/bbl.

- WTI is around its 50-day simple moving average and Brent its 100-day. WTI broke through support of $78.45 and the next level to watch is $72.74, the January 5 low, and for Brent watch $82.37, the January 12 low. This month global growth fears have outweighed the improved China demand outlook but there is optimism with money managers building net-long Brent positions to their largest in 11 months (bbg).

- US API inventory data are released today, which have recently been showing rising crude stocks. But Bloomberg reported that there could be a gasoline shortage over much of the US East Coast during the summer driving season due to the EU ban on Russian oil products possibly impacting US supplies. Russia has also banned sales of crude to any countries applying the price cap.

- OPEC+ meets Wednesday.

FOREX: USD Supported, AUD & NZD Down On Lower Equities & Commodities

The supportive USD tone has persisted through today's session. The BBDXY index is up only modestly, near +0.05% at this stage, putting the index above 1225.60. However, USD outperformance against higher beta FX has been more noticeably, with AUD and NZD both off by around 0.40% at this stage.

- The better than expected services China PMI did little to lift sentiment, with risk-off flows evident in the equity space for China and HK markets. This looks to be profit taking flows ahead of month end, with one eye also potentially on tomorrow's Fed meeting.

- AUD/USD sits at 0.7030/35 currently, off 0.40% and unwinding all of the post CPI rally we saw from Wednesday last week. The much weaker than expected Dec retail sales print weighed, with AU yields underperforming the firmer core tone. The AU-US 2yr spread is back at -112bps, versus recent highs closer to -102bps. Weaker commodity prices are also weighing, with copper and iron ore off recent highs.

- NZD/USD sits back at 0.6440/45, also around 0.40% off for the session.

- Yen has seen some outperformance, with USD/JPY close to unchanged for the session, last around 130.30/35. Japan data was mixed, while headlines from the Finance Minister didn't shift the needle from a BoJ standpoint.

- Looking ahead, preliminary euro area Q4 GDP is out and in the US Q4 employment cost index, Chicago PMI and November house prices.

FX OPTIONS: Expiries for Jan31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-25(E532mln), $1.0730-50(E591mln), $1.0850-55(E1.5bln), $1.0875-00(E1.7bln), $1.1100(E652mln)

- USD/JPY: Y127.50($500mln), Y130.00($511mln)

- USD/CAD: C$1.3400($1.2bln)

- USD/CNY: Cny6.8000($1.8bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2023 | 0630/0730 | ** |  | FR | Consumer Spending |

| 31/01/2023 | 0630/0730 | *** |  | FR | GDP (p) |

| 31/01/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/01/2023 | 0730/0830 | ** |  | CH | retail sales |

| 31/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/01/2023 | 0745/0845 | ** |  | FR | PPI |

| 31/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/01/2023 | 1000/1100 | *** |  | IT | GDP (p) |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/01/2023 | 1330/0830 | ** |  | US | Employment Cost Index |

| 31/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/01/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/01/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 31/01/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/01/2023 | 1500/1000 | ** |  | US | housing vacancies |

| 31/01/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/02/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.