-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN OPEN: Japan CPI Close To Expectations Ahead Of Next Week's BoJ

EXECUTIVE SUMMARY

- STICKY CORE INFLATION SEEN MUDDYING RBNZ’S PEAK OCR CALL - MNI

- JAPAN JUNE CORE CPI RISES 3.3% VS. MAY +3.3% - MNI BRIEF

- BRITISH PM SUNAK AVOIDS WIPEOUT IN KEY ELECTIONS - RTRS

- BRITISH CONSUMER CONFIDENCE FALLS FOR FIRST TIME IN SIX MONTHS - BBG

- CHINA RELEASES MEASURES TO BOOST CAR CONSUMPTION - BBG

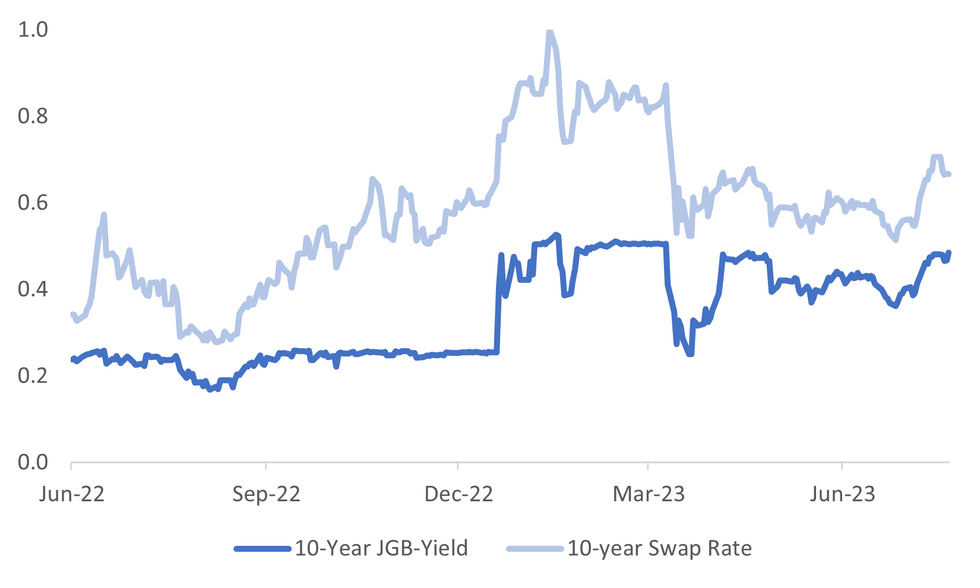

Fig. 1: Japan 10yr Government Bond Yield & 10yr Swap Rate

Source: MNI - Market News/Bloomberg

U.K.

POLITICS: British Prime Minister Rishi Sunak's governing Conservatives lost two strategically important parliamentary seats on Friday but unexpectedly retained Boris Johnson's old constituency in a setback for the main opposition Labour Party. The votes were one of the last electoral tests before a general election expected next year and had been seen as an indicator of the two main parties' prospects. (RTRS)

CONSUMER: UK consumer confidence fell for the first time in six months, interrupting a rapid rebound in sentiment as the reality of soaring prices emerged as a threat to household finances. The market research firm GfK Ltd. said its reading of confidence fell 6 points to minus 30 in July, the sharpest drop in 15 months and the lowest reading since April. Economists had expected a shallower decline to minus 25. (BBG)

U.S.

GEOPOLITICS: The US is sending more troops to the Middle East as tensions with Iran continue to build after several encounters between American and Iranian vessels. Secretary of Defense Lloyd Austin ordered the deployment of an Amphibious Readiness Group/Marine Expeditionary Unit into US Central Command’s area of responsibility, according to a CENTCOM announcement. The deployment will bring additional aviation and maritime assets, as well as U.S. Marines to the region. (BBG)

US/CHINA: The White House on Thursday expressed regret that Henry Kissinger was able to get more of an audience in Beijing than some sitting U.S. officials, after the former top diplomat held talks in China. Kissinger -- an architect of normalizing ties between Washington and Beijing in the 1970s as secretary of state and national security advisor in the administrations of Presidents Richard Nixon and Gerald Ford -- was welcomed warmly as an "old friend" by Chinese President Xi Jinping on Thursday amid efforts by Beijing and Washington to mend frayed ties. (RTRS)

OTHER

NEW ZEALAND: The Reserve Bank of New Zealand could lift its Official Cash Rate one-to-two more times this year from its 5.5% base thanks to sticky core and non-tradeable inflation and despite the central bank’s signal that the rate has peaked, ex-staffers and board members told MNI.(MNI)

NEW ZEALAND: Bank of New Zealand publishes June jobs ads index, based on data from Seek. Job ads index falls 3.5% m/m following a revised 4.6% decline in May. Index drops 21.3% y/y. Ads “have reasserted a downward trend” led by certain industries such as hospitality, tourism, retail. In contrast, ads in construction are trending up. Applications-per-ad measure sends the message that labor market conditions are not nearly as tight as they were last year. (BBG)

NEW ZEALAND: New Zealand’s statistics agency plans to start publishing more components of the Consumers Price Index on a monthly basis as it responds to calls for more timely inflation data. “By about the end of the year we’ll be publishing round about half the components of the CPI on a monthly basis,” Government Statistician Mark Sowden said in an interview Thursday in Wellington. “It won’t be a full monthly CPI, it won’t be anything like that, but it will at least start to give people an indication.” (BBG)

AUSTRALIA: Sydney house prices are poised to rise 6.9 per cent this year, NAB says in its latest forecast, reversing its earlier prediction of a 2.2 per cent decline. The bank is predicting that, by the end of next year, Sydney prices will increase by another 4.9 per cent for a total of 11.8 per cent over two years. (AFR)

JAPAN: Japan's annual core consumer inflation rate rose 3.3% y/y in June, accelerating from May’s 3.2% and staying above the Bank of Japan’s 2% target for the 15th consecutive month, data released by the Ministry of Internal Affairs and Communications showed on Friday. (MNI Brief)

JAPAN: The Bank of Japan is unlikely to make changes to its yield curve control program at next week’s policy meeting, judging from Governor Kazuo Ueda’s recent dovish tone, according to a former top official at the finance ministry. (BBG)

TAIWAN: Taiwan Semiconductor Manufacturing Co. fell the most in more than five months after cutting its outlook and postponing production at its Arizona project to 2025, underscoring the challenges of expanding abroad during a protracted electronics market slump. (BBG)

SOUTH KOREA: South Korea's exports are expected to recover going forward, but at a sluggish pace compared with the past due to a narrower gap in competitiveness against China, the central bank said in a report published on Friday. "Even if the sluggishness of the information technology (IT) industry cycle eases from the second half of this year, exports are not expected to rebound by as much as in the past due to structural changes in the Chinese economy," the Bank of Korea (BOK) said. (RTRS)

VIETNAM: The United States sees Vietnam as a key partner in expanding green energy sources and building more resilient supply chains, U.S. Treasury Secretary Janet Yellen said in a speech to be delivered in the country's capital of Hanoi on Friday. Yellen, continuing her travels in Asia, told the U.S.-ASEAN Business Council that trade between the two countries had been growing at nearly 25% a year for the past two decades, and reached a record high last year. (RTRS)

CHINA

CONSUMPTION: China will support innovations in electronic products to boost consumption, according to measures unveiled jointly by NDRC, MIIT and other ministries. Research institutes and industry players are encouraged to use domestic AI technologies to develop more intelligent electronic products. (BBG)

AUTOMOBILES: China will support local governments to increase the purchase of new energy vehicles in public sectors such as for government use, public transportation and postal services, according to a statement on the National Development and Reform Commission website. (BBG)

RRR: The PBOC will likely cut the reserve requirement ratio in Q3 to support credit expansion and encourage growth, said Feng Lin, senior analyst at Golden Credit Rating. If the PBOC implements the RRR cut, it may keep the medium-term lending facility rate unchanged while lowering the quotation of the Loan Prime Rate, especially for loans with maturities above five years, in order to drive down the rate of mortgages, said Feng. (Securities Daily)

SMEs: China will implement financial support measures to boost the private sector, according to Xu Xiaolan, vice minister at the Ministry of Industry and Information Technology. Speaking at a recent press conference, Xu said China attaches great importance to the development of SMEs and will guide the finance industry to increase credit and loans to the sector. The government can use the National Small and Medium Enterprises Development Fund to focus investment on national strategies. The Ministry of Industry and Information Technology will continue working with other departments to expand specialised SME listings on regional equity markets including Beijing and Zhejiang. (State Council Website)

CHINA MARKETS

PBOC Net Drains CNY7 Bln Via OMOs Friday

The People's Bank of China (PBOC) conducted CNY13 billion via 7-day reverse repos on Friday with the rates at 1.90%. The operation has led to a net drain of CNY7 billion after offsetting the maturity of CNY20 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8696% at 09:36 am local time from the close of 1.8201% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday, the same as the close on Wednesday.

PBOC Yuan Parity At 7.1456 Friday Vs 7.1466 Thursday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1456 on Friday, compared with 7.1466 set on Thursday. The fixing was estimated at 7.1908 by BBG survey today.

OVERNIGHT DATA

SOUTH KOREA JUNE PPI Y/Y -0.2%; PRIOR 0.5%

SOUTH KOREA JULY EXPORTS 20 DAYS Y/Y -15.2%; PRIOR 5.3%

SOUTH KOREA JULY IMPORTS 20 DAYS Y/Y -28.0%; PRIOR -11.2%

SOUTH KOREA JULY TRADE BALANCE 20 DAYS -$1.361bn; PRIOR -$1.607bn

UK JULY GfK CONSUMER CONFIDENCE -30; MEDIAN -25; PRIOR -24

JAPAN JUNE NATL CPI Y/Y 3.3%; MEDIAN 3.2%; PRIOR 3.2%

JAPAN JUNE NATL CPI EX FRESH FOOD Y/Y 3.3%; MEDIAN 3.3%; PRIOR 3.2%

JAPAN JUNE NATL CPI EX FRESH FOOD, ENERGY Y/Y 4.2%; MEDIAN 4.2%; PRIOR 4.3%

MARKETS

US TSYS: Marginally Richer In Asia

TYU3 deals at 112-05+, +0-01, a range of 0-04 has been observed on volume of ~45k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- In early trade Asia-Pac participants faded the cheapening seen in NY, tsys were pressured after the Initial Jobless Claims print was less than expected, perhaps using the opportunity to close short positions/enter fresh longs.

- Flow wise a block seller in FV (3,512 lots) helped cap early gains.

- Narrow ranges were observed for the remainder of the session and little meaningful macro news flow crossed.

- In Europe Retail Sales from the UK headline an otherwise thin docket.

JGBS: Futures Cheaper, Two-Way Trade In Tokyo Session

The two-way trade in JGB futures has continued in the Tokyo afternoon session with JBU3 dealing in the middle of the day’s range at 147.60, -24 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined June national CPI which printed broadly in line with expectations.

- Accordingly, local participants appear to have been content to be on headlines and US tsys watch. Us tsys are holding richer in the Asian session today, however, they have ticked away from session highs. Ranges remain narrow with few follow-on moves. Cash tsys sit 1-1.5bps richer across the major benchmarks, light bull steepening is apparent. There is a dearth of US economic data over the next two sessions, awaiting the latest FOMC policy announcement next Wednesday, July 26.

- Cash JGBs are cheaper across the curve out to the 20-year zone, with the benchmark 10-year the underperformer. The 10-year yield is 1.9bp higher at 0.486%, below BoJ's YCC limit of 0.50%.

- Swaps have shifted weaker in the afternoon session with rates 0.2bp to 0.8bp higher. Swap spreads narrower out to the 20-year and wider beyond.

- On Monday the local calendar sees Jibun Bank PMI and Department Store data. The focus next week will be the BoJ policy decision on Friday.

AUSSIE BONDS: Cheaper, Narrow Range, Post-Jobs Sell-Off Continued

ACGBs (YM -7.0 & XM -8.5) are cheaper after trading in a relatively narrow range in the Sydney session. Today, there have been no local data releases for market participants to analyse, following yesterday's surprisingly strong employment data. As a result, local investors have likely been closely monitoring headlines and observing movements in US tsy yields.

- Tsys are holding richer in the Asian session today, however, they have ticked away from session highs. Ranges remain narrow with few follow-on moves.

- Cash ACGBs are 6-8bp cheaper with the AU-US 10-year yield differential unchanged at +18bp.

- Swap rates are 5-8bp higher with the 3s10s curve flatter.

- The bills strip bear steepens with pricing flat to -6.

- RBA-dated OIS pricing is 1-5bp firmer across meetings. A 62% chance of a 25bp hike is now priced for August.

- Next week the local calendar sees Judo Bank PMI data on Monday ahead of Q2 CPI on Wednesday. Bloomberg consensus expects headline CPI to print +1.0% q/q (5.5% y/y) versus +1.4% q/q (5.6% y/y) in Q1. Trimmed Mean CPI is forecast to print +1.1% q/q (6.0% y/y) from +1.2% (6.6% y/y).

- The AOFM plans to sell A$700mn of the 4.50% 21 April 2033 bond on Wednesday.

NZGBS: Closed On A Weak Note, Post-CPI Sell-Off Continued

NZGBs closed on a weak note with benchmark yields 7-8bp higher. Without domestic drivers, the local market has drifted cheaper through the day in line with development in US tsys and ACGBs. As a result, NZ/US and NZ/AU 10-year yield differentials are little changed on the day. Nevertheless, the post-CPI sell-off currently sits at a cumulative 24bp for the 2-year and 17bp for the 10-year benchmark.

- Swap rates are 2-9bp steeper with the short-end implied swap spread sharply tighter.

- RBNZ dated OIS pricing closed mixed across meetings: flat to 1bp softer out to Feb’24 and 1-3bp firmer beyond. Terminal OCR expectations sit at 5.70%, just off the highest level since early July.

- The BNZ jobs ads index falls 3.5% m/m in June following a revised 4.6% decline in May. The index is down 21.3% y/y.

- Next week the local calendar is relatively light with Trade Balance (Jun) data on Monday and ANZ Consumer Confidence (Jul) on Friday.

- Next week the NZ Treasury plans to sell NZ$225mn of the 0.5% May-26 bond, NZ$225mn of the 1.5% May-31 bond and NZ$50mn of the 2.75% May-51 bond tomorrow.

EQUITIES: Tech Sensitive Indices Lower, But Away From Worst Levels

Regional equities have been mixed today. The early tone was weaker, particularly for tech sensitive indices, but we are generally away from lows for the session. Further China stimulus headlines haven't boosted China equity sentiment a great deal. In the US futures space, we are tracking modestly higher at this stage. Eminis last near 4571, +0.11% firmer for the session. Early lows ahead of 4560 were supported. Nasdaq futures are up by a similar amount.

- The Topix sits close to flat, recouping earlier losses led by the tech sector. The Nikkei 225 is still down around 0.40% at this stage.

- Taiwan shares are down nearly 1%, which is away from session lows, but still the worst performer in the region. TSMC downgraded its revenue outlook and delayed the start of its US investment in Arizona. The SOX was also off more than 3.3% in Thursday US trade.

- South Korea's Kospi opened weaker but now sits +0.15% higher.

- Hong Kong shares have mostly traded with a positive bias, the HSI up 0.72% at the break. More China stimulus related headlines have crossed today in relation to electronics and automobiles. The HSTECH sub index is +1.09% higher, tracking higher for the first time in 5 sessions. China mainland shares have shown less positive impetus. At the break, the CSI 300 is +0.10% higher.

- Indian stocks are tracking ~0.55% weaker in early dealings, with negative tech related sentiment weighing on the broader index.

FOREX: Narrow Ranges In Asia

The greenback has observed narrow ranges in Asia for the most part with little follow through on moves today.

- Kiwi is the weakest performer in the G-10 space at the margins. NZD/USD is down ~0.2% and is holding softer despite a recovery off session lows in regional equities and US equity futures.

- AUD/USD is a touch lower, down ~0.1%. The pair sits a touch above lows seen in yesterday's NY session and last prints at $0.6770/75. Support comes in at $0.6754, the low from 19 July.

- The Yen has pared post CPI gains and USD/JPY sits above the ¥140 handle. June's National CPI printed showing a uptick in headline CPI to 3.3% Y/Y from 3.2%. The Core measure was as expected at 3.3% Y/Y as was the core-core at 4.2% Y/Y.

- Elsewhere in G-10, EUR and GBP are marginally firmer however moves have been limited in Asia.

- Cross asset wise; US Tsy Yields are ~1bp lower across the curve. BBDXY is little changed and e-minis are a touch firmer having been down ~0.2% in early trade.

- There is a thin docket today with UK and Canadian Retail Sales providing the highlights.

OIL: Brent Tracking Higher For The Fourth Straight Week

Brent crude has mostly tracked higher in the first part of Friday dealings. We were last around $80.25/bbl, slightly below session highs near $80.50/bbl. We are ~+0.70% firmer versus Thursday NY closing levels. At this stage we are tracking modestly higher for the week, +0.48% if current levels continue to hold. This would be Brent's fourth straight week of gains if realized. For WTI, we hold near $76.30/bbl, with the benchmark tracking slightly better for the week relative to Brent (+1%).

- At the margin today, further headlines around efforts to boost China consumption of both household electronics and automobiles has likely helped oil sentiment. Although other commodities, such as iron ore, are painting a less upbeat picture for the session.

- Otherwise, it is a familiar supply/demand backdrop for markets. ANZ has stated there is increased evidence of reduced supply from both Saudi Arabia and Russia. The bank suggests ship tracking data points to a 400k drop in Saudi supply through the first half of July, while Russian shipments were the lowest in 6 months for the same period.

- For Brent, early July highs rest near $81.80/bbl, while in the past few weeks we have spent little time sub $78/bbl. Note the 200-day EMA is close to $82.25/bbl. On the downside, the 100-day EMA is back near $78.63/bbl.

GOLD: Resilient Performance From Bullion

Gold is little changed in the Asia-Pac session, after holding up well on Thursday considering USD strength and the scale of the push higher in Treasury yields. Cash US tsys finished 7-11bps cheaper across the major benchmarks with the belly leading.

- The impetus for the move in USD and US tsys was lower-than-expected initial jobless claims data, which printed 228k versus market expectations of circa 240k. The weekly claims data was the latest print to highlight the resilience of the US economy.

- Recently, gold has been supported by indications of a slowdown in price increases, leading traders to speculate about the Federal Reserve's potential pause in interest rate hikes, despite policymakers maintaining a hawkish stance.

- FOMC hike projections gained slightly on Thursday with July running at 96% with an implied rate of +24bp to 5.318%. Terminal rate expectations are holding at 5.42% in Nov'23.

- According to the MNI technicals team, the overnight high of $1987.45 briefly cleared key resistance at $1985.3 (May 24 high), which if sustained in the near term could open $1993.8 (2.0% 10-DMA envelope).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/07/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/07/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/07/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 21/07/2023 | 1230/0830 | ** |  | CA | Retail Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.