-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: JPY Volatility Likely To Persist

EXECUTIVE SUMMARY

- SUNAK CLEAR FRONTRUNNER AS JOHNSON PULLS OUT OF NO 10 RACE (Guardian)

- JEREMY HUNT’S HALLOWEEN BUDGET COULD HIT HIGH EARNERS WITH GBP20BN OF TAX INCREASES (Telegraph)

- RUSSIA’S SHOIGU HOLDS SECOND CALL WITH U.S. DEFENSE SECRETARY IN THREE DAYS (RTRS)

- NATIONAL CONGRESS DELIVERS XI THIRD TERM IN OFFICE

- CHINA ECONOMY SHOWS MIXED RECOVERY AS UNEMPLOYMENT TICKS UP (BBG)

- JAPANESE OFFICIALS REFUSE TO CONFIRM IF THEY INTERVENED IN FX MARKETS

- TSMC SAID TO SUSPEND WORK FOR CHINESE CHIP START-UP AMID US CURBS (Straits Times)

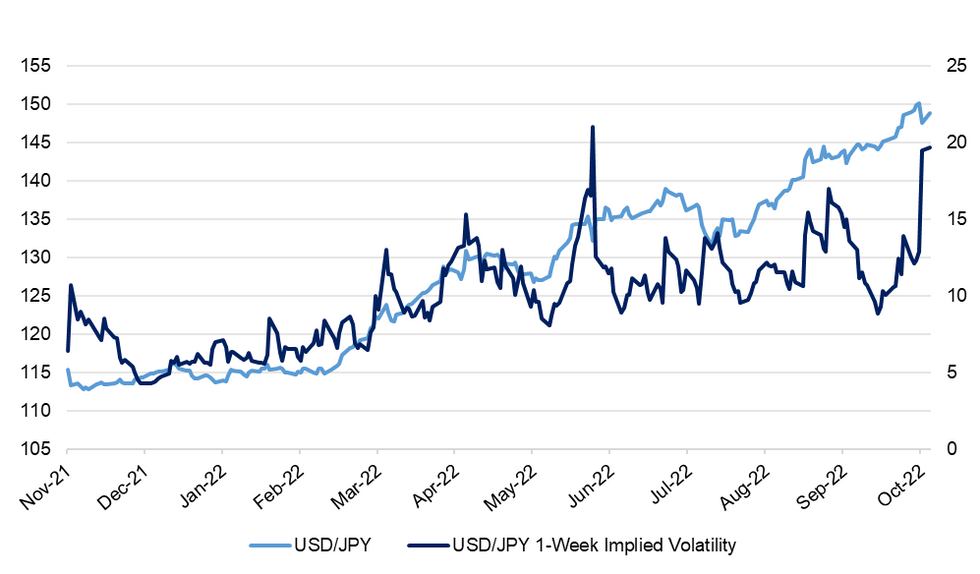

Fig. 1: USD/JPY vs. USD/JPY 1-Week Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson has withdrawn from the race to be Conservative leader, leaving Rishi Sunak as the clear frontrunner to be prime minister. (Guardian)

POLITICS: Sir Keir Starmer has appealed to Tory rebels to put “country before party” and support a general election as he warned that the gravest risk to the economy is “carrying on with this chaos”. (Times)

POLITICS: Sources close to Commons leader Penny Mordaunt have told Sky News she has spoken to Boris Johnson and rejected a request to back him. (Sky)

ECONOMY: Jeremy Hunt is considering up to £20 billion of tax rises in the Halloween budget, with high earners to bear the brunt of his quest to balance the books. (Telegraph)

ECONOMY: Senior Whitehall officials are concerned that Jeremy Hunt now risks going too far in cutting public spending and should delay the Halloween statement outlining his austerity plans, the Observer has been told. (Guardian)

NORTHERN IRELAND: It is “impossible” for the UK and EU to strike a Northern Ireland Protocol deal before Friday’s midnight deadline for fresh Stormont elections, Ireland’s foreign minister has said. (Telegraph)

EQUITIES: More FTSE-listed companies have been forced to issue profit warnings this quarter than at any time since the global financial crisis more than a decade ago as the costs of doing business in the UK has soared. (FT)

EUROPE

FRANCE: French President Emmanuel Macron said Sunday it's up to Ukraine to decide the time and terms of peace with Russia, and he cautioned that the end of war “can't be the consecration of the law of the strongest.” (AP)

ITALY: Foreign Minister and Deputy Premier Antonio Tajani said Saturday that his first act as the head of the foreign ministry will be to call his Ukraine counterpart Dmytro Kuleba to express Italy's "solidarity" as Kyiv fights against Russian invasion forces. (Ansa)

CZECHIA: Czech year-on-year inflation will probably remain high by the end of the year but the central bank doesn’t expect a more significant further increase, board member Karina Kubelkova tells Lidove Noviny newspaper in an interview. (BBG)

SLOVENIA: Conservative candidate Anže Logar appeared poised to win the most votes in Slovenia’s presidential election on Sunday, but he will face his center-left rival in a runoff, partial results suggested. (POLITICO)

HUNGARY: Hungarian Prime Minister Viktor Orban made veiled comparisons on Sunday between the Soviet troops that attacked Hungary during the 1956 revolution and the institutions of the European Union today. (AP)

UKRAINE: U.S. House of Representatives Speaker Nancy Pelosi, the top Democrat in Congress, will attend a forum in Zagreb this week aimed at supporting Ukraine's independence and the return of the Crimean peninsula to Kyiv, her office announced on Sunday. (RTRS)

U.S.

FED: Federal Reserve officials are preparing to roll out another super-sized interest-rate increase in early November, when they will also likely debate tactics for completing the most aggressive tightening cycle in four decades. (BBG)

POLITICS: Polling, spending trends and conversations with leading Democratic and Republican strategists suggest it's now very possible House Republicans win back the majority on Nov. 8 with more than 20 House seats — once the upper range of most analysts' projections. (Axios)

POLITICS: Former President Trump told supporters at a rally in Robstown, Texas, on Saturday that he "will probably have" to run for president again in 2024. (Axios)

POLITICS: Florida Gov. Ron DeSantis (R) topped former President Trump in a new poll asking GOP voters who they trust to guide the party into the future. (Hill)

OTHER

NATO: Hungary’s government supports the NATO membership of Sweden and Finland and has submitted the ratification documents to the National Assembly, Minister Gergely Gulyás told reporters at a briefing on Saturday. (POLITICO)

JAPAN: Japanese authorities are likely to have spent more than $30bn last week in their second intervention in a month to prop up the yen after it fell to a fresh 32-year-low against the dollar, according to estimates by traders. (FT)

JAPAN: Japanese currency authorities declined on Monday to confirm whether the government had intervened in the currency market on Friday, signalling their determination to engage in a war of nerves with traders selling the yen. (RTRS)

JAPAN: It has been revealed that Prime Minister Kishida is considering replacing Yamagiwa's economic revitalization minister over the issue of the former Unification Church. (FNN)

JAPAN/AUSTRALIA: Japan and Australia on Saturday signed a new bilateral security agreement covering military, intelligence and cybersecurity cooperation to counter the deteriorating security outlook driven by China’s increasing assertiveness. (CNBC)

AUSTRALIA: Australia's economic growth is expected to slow sharply next financial year as rising inflation curbs household consumption, according to new forecasts to be unveiled by Treasurer Jim Chalmers in Tuesday's budget. (RTRS)

SOUTH KOREA: South Korea's financial authorities announced plans Sunday to expand liquidity supply programs to at least 50 trillion won (US$34.7 billion) as part of efforts to calm corporate bond market jitters. (Yonhap)

SOUTH KOREA: President Yoon Suk-yeol said Monday no conditions should be attached to his parliamentary budget speech scheduled for this week, as the main opposition Democratic Party threatens to boycott it unless Yoon apologizes for what the party calls suppression of the opposition. (Yonhap)

NORTH KOREA: South Korea's military said Monday it has fired warning shots at a North Korean ship that intruded into the Northern Limit Line (NLL) in the Yellow Sea, the de facto maritime border. (Yonhap)

TAIWAN: Taiwan Semiconductor Manufacturing Co (TSMC) has suspended production of advanced silicon for Chinese start-up Biren Technology to ensure compliance with the latest United States regulations, according to a person familiar with the matter. (Straits Times)

TAIWAN: Taiwan needs to diversify its trade away from China, the island’s finance minister said, citing uncertainties created by Covid Zero and rising geopolitical tensions between Washington and Beijing. (BBG)

PHILIPPINES: Philippine Finance Secretary Benjamin Diokno, who days ago signaled more currency intervention and policy tightening to stem the peso’s drop, said it’s the central bank that will have the final say on these. (BBG)

RUSSIA: Russian Defence Minister Sergei Shoigu spoke with U.S. Defense Secretary Lloyd Austin on Sunday for the second time in three days and held a flurry of calls with three other counterparts from NATO countries. (RTRS)

RUSSIA: Russian Defense Minister Sergei Shoigu on Sunday had telephone calls with his French, British and Turkish counterparts in which he made unfounded claims that Ukraine might be preparing to use a “dirty bomb,” according to Russian readouts of the conversations. (POLITICO)

RUSSIA: Under pressure in the south of Ukraine, Russia fired missiles and drones into Ukrainian-held Mykolaiv on Sunday, destroying an apartment block in the ship-building city near the front and said the war was trending towards "uncontrolled escalation". (RTRS)

RUSSIA: On October 19, the occupation authorities in the Kherson region announced that the Ukrainian Armed Forces were starting a new offensive in their direction. They urged residents to leave, saying the Ukrainian army would be “shelling residential areas.” Occupying authorities themselves evacuated the region. The city of Kherson was not included in initial evacuation orders, but on October 22, Russian authorities ordered residents to leave “immediately.” (Meduza)

GAS: Germany’s gas supply situation will be much better in the winter of 2023/2024 than this winter as more liquified natural gas flows into the country, Handelsblatt cites Economy Minister Robert Habeck as saying in an interview. (BBG)

METALS: China’s copper buying continued to roar ahead last month, while coal imports hit their highest since November, as demand revives for key commodities after the drastic slowdown of earlier in the year. (BBG)

CHINA

POLITICS: The 20th National Congress of the Communist Party of China delivered Xi Jinping a third term as head of the Party and the military and a new batch of both young and experienced cadres were appointed to the Central Committee, the Party-run People’s Daily said in an editorial on Monday. The Party must have a strong and collective leadership to create new great achievements under the complex and severe uncertainties at home and abroad, the newspaper said. It is necessary to improve political judgment and safeguard the authority of the Party with Xi at its core, and unify thoughts and actions into the major decisions and arrangements made at the Congress, forming a strong synergy to realise the Chinese dream together, the newspaper said. (MNI)

POLITICS: The 20th National Congress of China’s ruling Communist Party elected a new 205-person Central Committee made up of officials from the State Council, National People’s Congress, military, armed police force, and party secretaries from 31 provinces, Caixin reported. It includes 167 people born in the 1960s and 38 people born in the 1950s, the first time those born in the 1960s have been the majority, said Caixin. This compares to the 19th Central Committee where the proportion of those born in the 50s and 60s was 80% and 20%. The youngest members include Yin Yong, deputy party secretary of Beijing city, Zhao Gang, deputy party secretary of Shanxi province and Zhao Long, governor of Fujian province, said Caixin. (MNI)

POLITICS: One of the criteria for President Xi Jinping in picking his top team was the candidates’ ability to “struggle” with the West to circumvent sanctions and safeguard national security, according to state news agency Xinhua. (SCMP)

CORONAVIRUS: China suspended in-person schooling and dining-in at restaurants in a district at the center of Guangzhou, stoking concerns about the potential for disruption in the southern Chinese manufacturing hub that’s home to about 19 million people. (BBG)

ECONOMY: China should continue to speed up the use of infrastructure-back local government special bonds and quicken construction work before the weather turns cold, the Securities Daily reported citing analysts. The use of special bonds should also be expanded to fund a wider range of projects and next year’s special bond quota should be front-loaded to provide support for steady growth early next year, analysts were cited as saying. Infrastructure investment is expected to grow about 10% y/y this year, playing a driving role in stabilising economic growth, with a total CNY3.69 trillion of special bonds being issued as of October 23, the newspaper said. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY8BN VIA OMOS MONDAY

The People’s Bank of China (PBOC) on Monday injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY8 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7523% at 10:03 am local time from the close 1.6726% on Friday.

- The CFETC-NEX money-market sentiment index closed at 50 on Thursday vs 56 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1230 MON VS 7.1186

The People’s Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1230 on Monday, compared with 7.1186 set on Friday.

OVERNIGHT DATA

CHINA Q3 GDP +3.9% Y/Y; MEDIAN +3.3%; Q2 +0.4%

CHINA Q3 GDP +3.9% Q/Q; MEDIAN +2.8%; Q2 -2.6%

CHINA Q3 GDP YTD +3.0% Y/Y; MEDIAN +3.0%; Q2 +2.5%

CHINA SEP INDUSTRIAL OUTPUT +6.3% Y/Y; MEDIAN +4.8%; AUG +4.2%

CHINA SEP INDUSTRIAL OUTPUT YTD +3.9% Y/Y; MEDIAN +3.7%; AUG +3.6%

CHINA SEP RETAIL SALES +2.5% Y/Y; MEDIAN +3.0%; AUG +5.4%

CHINA SEP RETAIL SALES YTD +0.7% Y/Y; MEDIAN +0.9%; AUG +0.5%

CHINA SEP UNEMPLOYMENT 5.5%; MEDIAN 5.2%; AUG 5.3%

CHINA SEP FIXED ASSETS EX RURAL YTD +5.9% Y/Y; MEDIAN +6.0%; AUG +5.8%

CHINA SEP PROPERTY INVESTMENT YTD -8.0% Y/Y; MEDIAN -7.5%; AUG -7.4%

CHINA SEP RESIDENTIAL PROPERTY SALES YTD -28.6% Y/Y; AUG -30.3%

CHINA SEP TRADE BALANCE +$84.74BN; MEDIAN +80.30BN; AUG +$79.39BN

CHINA SEP EXPORTS +5.7% Y/Y; MEDIAN +4.0%; AUG +7.1%

CHINA SEP IMPORTS +0.3% Y/Y; MEDIAN 0.0%; AUG +0.3%

CHINA SEP NEW HOME PRICES -0.28% M/M; AUG -0.29%

JAPAN OCT, P JIBUN BANK M’FING PMI 50.7; SEP 50.8

JAPAN OCT, P JIBUN BANK SERVICES PMI 53.0; SEP 52.2

JAPAN OCT, P JIBUN BANK COMPOSITE PMI 51.7; SEP 51.0

Latest flash PMI data has pointed to a further improvement in Japan’s private sector economy in October. The recent easing in international border restrictions and the launching of the Nationwide Travel Discount Programme earlier this month boosted activity levels and order book volumes. The manufacturing sector, however, continued to struggle in the face of weak demand conditions and severe cost pressures. In fact, the rate of output price inflation rose to a fresh survey peak in October as firms continued to share increasing cost burdens with their clients. With inflationary pressures remaining elevated across the private sector, business confidence dipped to a six-month low. (S&P Global)

AUSTRALIA OCT, P S&P GLOBAL M’FING PMI 52.8; SEP 53.5

AUSTRALIA OCT, P S&P GLOBAL SERVICES PMI 49.0; SEP 50.6

AUSTRALIA OCT, P S&P GLOBAL COMPOSITE PMI 49.6; SEP 50.9

Australia’s private sector saw renewed contraction in October with the service sector primarily showing signs of stress. A fall in demand for services was underpinned by higher interest rates and prices, altogether reflective of the detriments of aggressive monetary policy tightening and capacity constraints upon business activity. (S&P Global)

MARKETS

US TSYS: Contagion From China Puts Bid Into U.S. Tsys

Core FI caught a fresh bid as Chinese equity benchmarks tumbled. Markets assessed the revamped line-up of Chinese Communist Party leadership, as well as delated data including Q3 GDP and September economic activity indicators. The data were a mixed bag, as China's economy expanded at a faster than expected clip and industrial output grew more than forecast, but retail sales underwhelmed, unemployment ticked higher and new home prices extended decline.

- T-Notes struggled to make much headway beyond last Friday's high before the spillover from Chinese markets spoiled the mood. TYZ2 advanced, printed a session peak at 110-06+ and stabilised. The contract last deals +0-10+ at 110-03+. Eurodollars run up to +8.0 ticks through the reds.

- The yield curve shifted lower in cash Tokyo trade. When this is being typed, U.S. Tsy yields sit 3.8-5.9bp lower, with belly outperforming.

- E-minis are close to erasing their initial gains, albeit all three still operate in the green.

- Flash readings of S&P Global PMIs & Chicago Fed Nat Activity Index headline the domestic data docket today.

JGBS: JGBs Advance Amid Yen Volatility, Risk Aversion; BoJ Policy Review Eyed

JGB futures started on a firmer footing, rising to 147.90 on the initial upswing, amid heightened JPY volatility. Another round of purchases emerged as broader risk sentiment soured on the back of weakness in Chinese equity space, with participants digesting the outcome of Chinese Communist Party's congress and a mixed bag provided by delayed Chinese activity data.

- JBZ2 last trades at 147.96, up 37 ticks from the prior settlement, printing new session highs. Cash JGB yields are mostly lower, save for 3s & 20s, with 7s leading gains. The yield on 10-Year JGBs tested the 0.25% cap imposed by the BoJ as part of its YCC framework.

- Reminder that Japan's central bank will hold a monetary policy meeting this Friday. The Policy Board has been adamant to stick with its super-dovish stance, even as the market keep putting it to a test. It is expected that the BoJ will keep the main parameters of its policy unchanged this week, remaining the last dovish holdout among major central banks.

- A round of flash Jibun Bank PMI readings caused little stir.

AUSSIE BONDS: Steepening Impetus Intensifies, Futures Turn Bid On Cautious Mood

Deteriorating risk environment lent support to Aussie bonds and their peers from core FI space. Nominations to the top decision-making bodies of the Chinese Communist Party were closely scrutinised, with local equity benchmarks retreating.

- Futures regained strength after paring initial gains. YM last +14.0 & XM +5.0, both are printing session highs. Bills trade 4-12 ticks higher through the reds.

- Initial steepening impetus evident in cash ACGB space deepened as the session progressed. Yields last sit -14.5bp to +4.2bp. 3-Year/10-Year ACGB yield spread widened to 52.5bp, the widest margin since mid-Jul.

- The AOFM sold A$300mn of ACGB Jun '51, drawing a bid/cover ratio of 1.54x (prev. 2.53x), with the price tail widening.

- The weekend saw one of the final rounds of comments from Treasurer Chalmers, who will deliver the budget tomorrow. The official said he has learned his lesson from the market reaction to the UK fiscal plan.

- Elsewhere, RBA Asst Gov Kent said this morning that the central bank is not currently worried by the risk of weak exchange rate amplifying imported inflation.

- Regional activity was limited by a market closure in New Zealand.

AUSSIE BONDS: ACGB Jun-51 Auction Results

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 4.5576% (prev. 3.8973%)

- High Yield: 4.5700% (prev. 3.9000%)

- Bid/Cover: 1.5367x (prev. 2.5333x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 52.5% (prev. 67.7%)

- Bidders 48 (prev. 52), successful 35 (prev. 19), allocated in full 32 (prev. 10)

EQUITIES: HK/China Equity Falls Take Shine Off Rebound

Losses across Hong Kong & China shares have taken the gloss of what looked like a promising start to the week for regional equity markets. US futures opened up strongly, with Eminis above 3800 at one stage but we are now back close too flat (3765/70). This curtailed gains for the major Asia Pac indices. Note several markets have been closed today due to holidays - Singapore, Malaysia, Thailand, India and NZ.

- China related markets were down sharply in early trading. The HSI China enterprise index off more than 5.5, the CSI 300 around 1.75%.

- Markets assessed the revamped line-of the party leadership, as well expectations of a continuation of recent policies, such as the dynamic covid zero policy.

- Higher covid case numbers in Guangzhou, which is a manufacturing hub, has prompted fresh restrictions for this district as well. Q3 GDP for China beat estimates, but retail spending, housing investment & prices disappointed for September.

- The HSI saw negative spill over as well, down 5% for the headline index, -7.7% for the tech sub-index.

- The Kospi (+0.75%) & Taiex (+0.45%) have fared better, following positive leads from US tech names late last week. South Korean markets were also supported by fresh measures to support local credit markets, following a recent payment miss, which unnerved confidence in the sector.

OIL: Demand Fears Again Have Upper Hand In Driving Prices

Supply issues had been driving a recent moderate rally in oil prices but today global demand concerns took over again, as negative sentiment surrounding China and Hong Kong drove markets generally. The release of Chinese data due last week also painted a mixed picture of the Chinese economy and its woes in the property sector remained a concern.

- WTI reached an intraday high of almost $86/bbl before global growth fears took over and is now trading around $84.60/bbl down 0.5%. Brent rose to $94.27 but is now trading just around $93 and is also down 0.5%. Near-term Brent contracts continue to be priced higher than ones further out, which is bullish but consistent with slower growth expectations for 2023.

- The tight supply environment and global demand worries should to continue to drive oil price developments for the foreseeable future. The market is likely to watch if the US takes further measures to increase supply and how compliant OPEC+ is with the production cuts due to take place next month.

GOLD: Edging Lower On a Firmer USD

Gold is down slightly from closing levels at the end of last week, as the USD has recouped some losses from late last week. We were last around $1654, -0.20% for the session so far. We spiked above $1670 early in the session, as the yen rebound led a broad wave of USD selling, before correcting back lower.

- Still, the precious metal has held onto a good proportion of gains from late last week. The dip below $1620 level was supported on Friday evening, and we remained above recent cyclical lows from September 28th.

- The 0.80% gain for gold last week was a little at odds with higher US real yields (the 10yr finished the week down slightly at 1.68%, but this was still +10bps for the week), but it only partially reverses the -3% fall from the week prior.

- Us yield momentum will likely remain key to gold's fortunes over a multi-day horizon.

FOREX: USD Finds Supports As Equity Rebound Falters, GBP Outperforms

The USD has recouped some losses from late last week. The BBDXY is up around 0.30%, to 1340, albeit in a volatile start to the week. Ultimately flows have benefited the USD, as sharp falls were recorded across China related equities, taking the shine off early positive sentiment in Asia Pac markets.

- The early focus started GBP/USD, which surged 1% to +1.1400, as Boris John bowed out of the leadership race, spurring hopes of political stability. This leaves ex-Treasury, Rishi Sunak, as the likely next PM. The pound is back to 1.1335/40, but is still firmer for the session, the only major currency to do so against the USD.

- USD/JPY rose above 149.70, reportedly on buy orders that weren't filled through Friday's session, before slumping near 3% to sub 146.00. This likely reflected intervention flows, but nothing was confirmed by the authorities. We are now back just under 149.00.

- AUD/USD has also performed poorly. We are up slightly from earlier lows, last around 0.6335/40, still -0.60% for the session. Outside of equity headwinds, the preliminary PMI for the services sector slipped into contractionary territory. RBA's Kent also downplayed concerns of a weaker AUD boosting imported inflation.

- Due later is PMI prints across the UK, EU area, along with US readings. Comments are due from BoE's Ramsden, who will testify to parliament for his reappointment.

FX OPTIONS: Expiries for Oct24 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9550(E1.3bln), $0.9600(E1.1bln), $0.9750(E1.3bln), $0.9800-20(E2.1bln), $0.9840-50(E1.6bln), $0.9875(E1.0bln), $0.9970-80(E1.2bln)

- USD/JPY: Y147.35-50($650mln), Y150.00($2.0bln)

- GBP/USD: $1.1445-50(Gbp509mln)

- AUD/USD: $0.6592-10(A$1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/10/2022 | 1300/1400 |  | UK | Deadline for MPs to nominate next Cons leader | |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/10/2022 | 1700/1800 |  | UK | Result of 1st round of MP voting for next Cons leader | |

| 24/10/2022 | 2000/2100 |  | UK | Result of 2nd round of MP voting for next Cons leader |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.