-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Post-FOMC Pressure On USD Extends In Asia

EXECUTIVE SUMMARY

- POWELL LEAVES DOOR TO DEC HIKE SLIGHTLY AJAR - MNI FED WATCH

- BIDEN SAYS ISRAEL, HAMAS SHOULD ‘PAUSE’ FOR HOSTAGE RELEASE - BBG

- JAPAN’S KISHIDA ANNOUNCES STIMULUS PACKAGE AS SUPPORT SAGS - BBG

- BANK OF KOREA SEES INFLATION OUTPACING PROJECTION AS RISKS RISE - BBG

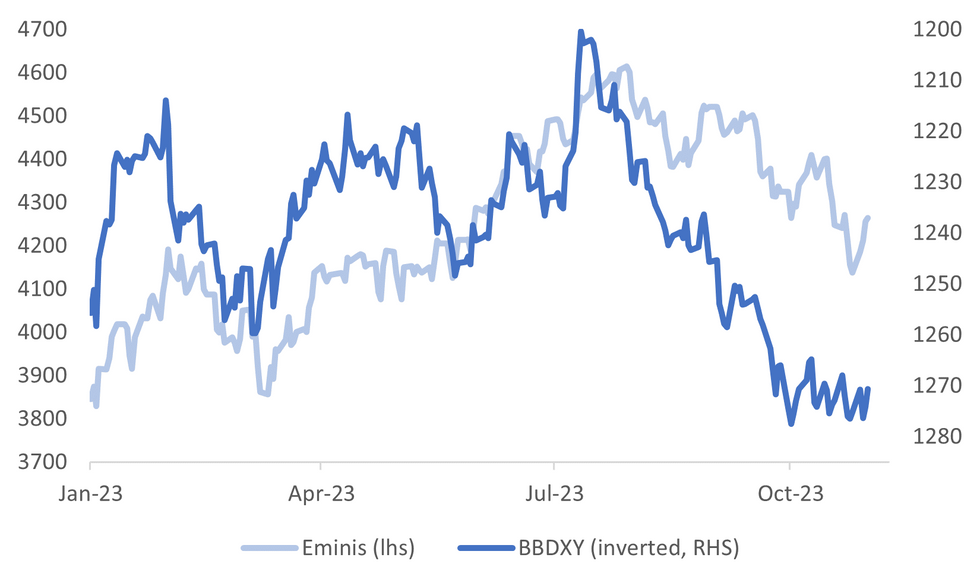

Fig. 1: BBDXY Index (Inverted) & US Eminis

Source: MNI - Market News/Bloomberg

U.K.

BOE (RTRS): The Bank of England looks set to hold borrowing costs at a 15-year high on Thursday and signal that it does not plan to cut them anytime soon as it remains locked in a battle against the most elevated inflation rate among the world's rich economies.

EUROPE:

UKRAINE (ECONOMIST): General Valery Zaluzhny, commander-in-chief of Ukraine’s armed forces, admitted that “there will most likely be no deep and beautiful breakthrough” in the stalemate with Russia.

FRANCE (BBG): Emmanuel Macron is beefing up France’s arsenal of strategic tools to protect vulnerable firms against foreign buyers with deep pockets, with a particular eye on the US and China.

TECH (SCMP): China agreed to work with the United States, European Union and other countries to collectively manage the risk from artificial intelligence (AI) at a British summit on Wednesday aimed at charting a safe way forward for the rapidly evolving technology.

U.S.

FED (MNI FED WATCH): The Federal Reserve held interest rates at a 22-year high on Wednesday and Chair Jerome Powell kept open slightly the possibility of additional monetary tightening. "We haven't made any decisions about future meetings," Powell said in response to a question about whether financial conditions are sufficiently restrictive to get inflation to 2%. "We have not made a determination and we are not confident at this time we have reached such a stance. We are not confident that we haven't or we have."

US/ISRAEL (BBG): President Joe Biden said Wednesday that Israel and Hamas militants ought to “pause” fighting in order to allow time to free hostages held in the Gaza Strip, but stopped short of supporting a full ceasefire.

CORPORATE (RTRS): Walt Disney on Wednesday formally began the process of buying Comcast's one-third stake in Hulu, a deal that will give Disney full ownership of the streaming service and freedom to incorporate it into the Disney+ streaming service.

OTHER

ISRAEL (RTRS): Israeli forces killed another Hamas commander on Wednesday in their second strike on Gaza's Jabalia refugee camp in two days, the military said, as the first group of civilian evacuees from the besieged enclave crossed into Egypt.

JAPAN (BBG): Japanese Prime Minister Fumio Kishida announced a larger-than-expected economic stimulus package that aims to boost growth and help households hit by inflation, as his administration tries to shore up falling support.

HONG KONG (RTRS): The Hong Kong Monetary Authority (HKMA) on Thursday left its base rate charged through the overnight discount window unchanged at 5.75%, tracking a move by the U.S. Federal Reserve to keep rates steady.

SOUTH KOREA (BBG): The Bank of Korea signaled it will adjust its inflation projection higher after prices rose more than expected last month, reinforcing the case to keep its restrictive policy in place for longer to respond to increasing geopolitical and economic uncertainties.

SHIPPING (BBC): The Panama Canal will make more cuts to the number of ships using the waterway due to the worst drought in over 70 years, authorities say. The Panama Canal Authority (ACP) says it has been forced to make the decision due to the driest October since records began in 1950.

CHINA

LIQUIDITY (SECURITIES TIMES/BBG): The abrupt surge in interbank overnight repo rates on Oct. 31 serves as a reminder of liquidity risks to all market participants, even though the spike was caused by a small number of non-bank financial institutions and the transactions were small, the Securities Times said in an opinion piece.

DEBT (SHANGHAI SECURITIES/BBG): China’s pledge to set up a long-term mechanism to resolve local debts at the Central Financial Work Conference shows that the central government is likely to moderately add leverage, enabling it to promote high-quality growth while effectively containing local government debts, the Shanghai Securities News reports, citing analysts.

PROPERTY (BBG): China’s outstanding property loans fell on a yearly basis for the first time on record, underlining stress in the sector despite official assurances of stabilizing declines.

POLICY (SECURITIES TIMES): China wants to work with other countries to increase macroeconomic policy coordination, according to Lei Yao, deputy director at the Financial Research Institute of the People's Bank of China (PBOC). Lei said central banks that pursue different economic and monetary policies had harmed global economic growth and called for more coordination to help global economic and financial resilience.

CHINA/US (FOREIGN MINISTRY): China and the U.S. have agreed to work together to arrange a meeting between the countries presidents in San Francisco, said Wang Wenbin spokesperson for the Ministry of Foreign Affairs. When asked about the U.S. announcing the meeting as confirmed, Wang said the road to San Francisco cannot be carried out on "autopilot" and the two sides should earnestly return to the Bali consensus.

CAPITAL FLOWS (YICAI): Authorities will take measures to attract more foreign financial institutions to invest long-term capital in China, according to Wang Chunying, deputy director and spokesperson at the State Administration of Foreign Exchange (SAFE). Speaking in response to the recent Central Financial Work Conference, Wang said SAFE would keep the yuan exchange rate stable at a balanced level and improve the quality of capital account opening.

CHINA MARKETS

MNI: PBOC Drains Net CNY230 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY194 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY230 billion after offsetting the maturity of CNY424 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8167% at 09:27 am local time from the close of 1.9361% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 40 on Wednesday, compared with the close of 72 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1797 Thursday vs 7.1778 Wednesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1797 on Thursday, compared with 7.1778 set on Wednesday. The fixing was estimated at 7.3030 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA OCT CPI M/M 0.3%; MEDIAN 0.2%; PRIOR 0.6%

SOUTH KOREA OCT CPI Y/Y 3.8%; MEDIAN 3.6%; PRIOR 3.7%

SOUTH KOREA OCT CORE CPI Y/Y 3.2%; MEDIAN 3.1%; PRIOR 3.3%

AUSTRALIA SEP TRADE BALANCE A$6.786BN; MEDIAN A$9.5BN; PRIOR A$10.16BN

AUSTRALIA SEP EXPORTS M/M -1.4%; PRIOR 4.6%

AUSTRALIA SEP IMPORTS M/M 7.5%; PRIOR -0.8%

AUSTRALIA SEP HOM LOANS M/M 0.6%; MEDIAN 1.0%; PRIOR 2.4%

AUSTRALIA SEP OWNER OCCUPIER LOANS M/M -0.1%; PRIOR 2.8%

AUSTRALIA SEP INVESTORS LOANS M/M 2.0%; PRIOR 1.7%

MARKETS

US TSYS: Curve Marginally Flatter In Asia

TYZ3 deals at 107-07+, +0-12, a 0-09 range has been observed on volume of ~166k.

- Cash tsys sit 1bp cheaper to 3bps richer across the major benchmarks, the curve has twist flattened pivoting on 5s.

- Tsys extended their post-FOMC bid in early Asian dealing as local participants digested the FOMC rate hold and Chairman Powell's remarks, this was seen alongside pressure on the USD and a bid in US Equity futures.

- The short end was pressured through the session erasing early gains, perhaps the rise in Oil prices weighed. WTI was up ~1%.

- FOMC dated OIS now price a terminal rate of 5.40% in January with ~70bps of cuts by September 2024.

- The latest monetary policy decision from the Bank of England headlines in Europe, further out we have US factory orders, initial jobless claims and productivity.

JGBS: Futures Remain Stronger But 10YY Higher After Weak Demand Seen At Today’s Auction

JGB futures are holding sharply stronger, +30 compared to settlement levels, but are off the session's best level.

- In addition to the previously outlined international investment flow and monetary base data, the key domestic event today was the latest 10-year supply. The 10-year JGB auction saw mixed demand metrics, with the low price meeting wider but the tail lengthening, and the cover ratio printing the second lowest level seen at a 10-year auction since Aug’22.

- Interestingly, the simultaneous occurrence of a cycle high in the outright yield, a steep 2/10 yield curve, and the relative cheapness of 10-year JGBs versus futures with a 7-year maturity hasn't been sufficient to alleviate investor concerns regarding the BOJ's newly introduced flexible YCC framework.

- The cash JGB curve has maintained its bull-flattening, beyond the 1-year, in the afternoon session, with yields 1.2bp to 3.4bps lower. The benchmark 10-year yield is 3.4bps lower at 0.927% versus yesterday’s cycle high of 0.974% and the BOJ's 1% YCC reference rate. The 10-year is around 1.5bps higher in post-auction dealings.

- The swaps curve has also bull-flattened, with swap spreads wider out to the 20-year and tighter beyond.

- Tomorrow, the local market is closed for the Culture Day holiday.

AUSSIE BONDS: Sharply Higher But Off Bests After Poor 10Y JGB Auction

ACGBs (YM +11.0 & XM +15.0) remain sharply richer but have moved off the session’s best levels in recent dealings. This recent move appears to have been primarily due to higher JGB yields, following underwhelming demand metrics observed at today's 10-year auction. US tsys have also reacted to JGBs, with yields 1bp higher to 3bps lower on the day but 1-2bp higher than earlier levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined trade balance and home loans data.

- Cash ACGBs are 10-15bps richer, with the AU-US 10-year yield differential 4bps wider at +8bps.

- Swap rates are 10-15bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing +2 to +12.

- RBA-dated OIS pricing is 1-7bps softer across 2024 meetings, with Dec’24 leading.

- Tomorrow, the local calendar sees Judo Bank Australia Composite and Services PMIs, and Q3 Retail Sales Ex Inflation data.

- RBA Assistant Governor (Financial System) Jones is a panel participant at The Regulators 2023 (FINSIA) conference.

- The latest monetary policy decision from the BOE headlines in Europe. Further out, the US calendar sees US factory orders, initial jobless claims and productivity.

NZGBS: Very Strong Into The Close, Expected Terminal OCR At 5.55%

NZGBs closed on a very strong note, with yields 11-25bps lower across benchmarks. The move reflected the very strong lead-in from the NY session, with US tsys 14-21bps richer. That move has extended in today’s Asia-Pac session, with yields flat to 3bps lower across benchmarks as local participants digested Fed Chair Powell’s remark that the Fed had come “very far” with the rate hiking cycle.

- Strong demand metrics at today’s weekly bond auctions for the May-30 and May-34 bonds likely assisted today’s move. Cover ratios were 4.65x and 3.96x, respectively. However, the May-51 bond saw subdued demand, with a cover of 2.35x.

- The 10-year JGB has seen its yield rise since the NZ market close, primarily due to underwhelming demand metrics observed at today's 10-year auction. Depending on the developments during the remaining part of the JGB trading session, the local market may react at tomorrow’s opening.

- Swap rates closed 12-20bps lower, with the 2s10s flatter. The implied long-end swap spread was 5bps wider.

- RBNZ dated OIS pricing closed 1-12bps softer across meetings, with Oct’24 leading. Terminal OCR expectations softened to 5.55%.

- Tomorrow the local data calendar is empty, with RBNZ Governor Orr’s speech on Climate Change Response as the highlight.

FOREX: Post-FOMC Pressure On USD Extends In Asia

The pressure seen on the USD post FOMC on Wednesday has extended on Thursday, BBDXY is down ~0.3%. The Antipodeans are leading the bid in the G-10 space. US Equity futures are firmer and Tsy Yields have ticked lower. Regional Equities are also higher, the Hang Seng is up ~1%.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD is up ~0.7% last printing at $0.5885/90. Bull's immediate focus is on holding above the 20-Day EMA ($0.5870) to target the high from 10 Oct ($0.6049).

- AUD/USD is up ~0.6%, firming above the $0.64 handle this morning. The pair has cleared the 50-Day EMA ($0.6404), the next target for bulls is $0.6445 high from Oct 11.

- Yen is ~0.4% firmer, however USD/JPY remains well above the ¥150 handle. Support comes in at the 20-Day EMA ¥149.66.

- Elsewhere in G-10, CHF is up ~0.5%, however liquidity is generally poor in Asia.

- In Europe today the latest monetary policy decision from the Bank of England provides the highlight.

EQUITIES: Eminis Track Higher To 200-day MA, China Real Estate Index Continues To Struggle

Equity sentiment is positive across the Asia Pac region in Thursday trade, although China markets are only modestly firmer at this stage. Most focus has been on digesting the Fed outcome from Wednesday. US equity futures are higher, following positive gains on Wednesday. Eminis sit near 4266, +0.25% in latest dealings. This puts the active contract back to the simple 200-day MA. Nasdaq futures are slightly higher at +0.40%.

- Some of the stand out gains today have been in tech sensitive countries. The Kospi is +1.80%, the Kosdaq +4.2% in South Korea. The Taiex is up 2%. Tech outperformance is in line with sensitivity to US yield movements/Fed outlook.

- In Hong Kong the Tech sub index is +2.30% higher at the break, the headline HSI +1.20%, although this is away from earlier highs. Japan markets are lagging somewhat, but still in positive territory (Topix +0.30%).

- Mainland China shares are a touch higher at the break (CSI 300 +0.1%). This is down from earlier highs. The real estate sub index is down modestly further. This sub-index is at fresh multi-year lows. The PBoC reported outstanding property loans contracted (on an annual basis) for the first time in September (BBG).

- In SEA, Indonesia's JCI is the standout, +1.8%, while Thailand's SET is +1.25%. More modest gains are evident for bourses in Singapore, Malaysia and the Philippines.

OIL: Crude Higher In APAC Trade Supported By Fed Tone

Oil prices are around a percent higher in APAC trading today helped by further dollar softness and better risk appetite following a more dovish Fed press conference. They have been down each of the last three days. The USD index is down 0.3% after -0.2% yesterday. WTI is around $81.24, close to the intraday high of $81.53. Brent is trading at $85.43 after a high of $85.71.

- There are signs that the market is easing with EIA reporting a crude stock build in the US in the latest week and the prompt spread has narrowed. But according to Woodmac data, European inventories are at seasonal decade low. The demand outlook, especially in the US and China, will continue to be a focus while the Middle East conflict seems contained. Attention now turns to Friday’s US payrolls.

- Later the Fed’s Paese gives welcoming remarks. On the data front, US Q3 unit labour costs, September orders and October Challenger job cuts print. Also the ECB’s Lane and Schnabel speak, the BoE decision is announced and European manufacturing PMIs released.

GOLD: Third Day Of Declines Despite Fed Chair Powell’s Hint Tightening May Be Over

Gold is little changed in the Asia-Pac session, after closing 0.1% lower at $1982.53 on Wednesday. Bullion closed lower for the third straight day, despite lower US Treasury yields following Fed Chair Powell’s hint that it may be finished with the tightening cycle.

- When discussing whether every meeting is "live", Chair Powell said, "We are going meeting by meeting, asking ourselves whether we achieved a stance of policy sufficiently restrictive to bring inflation down 2% over time" and "We have come very far with this rate hiking cycle, very far."

- US tsys reacted favourably to Powell’s remarks, rallying 14-21bps across benchmarks.

- Earlier in the NY session, US tsys shifted richer after lower-than-expected ADP private jobs data (113k vs. 150k est, 89k prior). This move extended after weaker-than-expected ISM data: Mfg (46.7 vs. 49.0 est), Employ (46.8 vs. 50.6 est), New Orders (45.5 vs. 49.8 est) and Prices Paid (45.1 vs 45.0 est).

- From a technical standpoint, gold’s current level neither troubles support at $1947.0 (20-day EMA) or resistance at $2009.4 (Oct 27 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/11/2023 | 0730/0830 | *** |  | CH | CPI |

| 02/11/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/11/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 02/11/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 02/11/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 1100/1200 |  | EU | ECB's Lane lectures on EZ monetary policy | |

| 02/11/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/11/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/11/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 02/11/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/11/2023 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/11/2023 | 1230/1230 |  | UK | MPR Press Conference | |

| 02/11/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/11/2023 | 1400/1400 |  | UK | BOE DMP Survey | |

| 02/11/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/11/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/11/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/11/2023 | 1730/1830 |  | EU | ECB's Schnabel presentation at Fed St Louis | |

| 03/11/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.