-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Safe Haven Demand Wanes Further, US 2yr Yield Testing 5% Handle

EXECUTIVE SUMMARY

- US HOUSE PASSES $95BN TO AID UKRAINE, ISRAEL, TAIWAN - BBG

- ECB’S WUNSCH SEES AT LEAST TWO CUTS BY DECEMBER - MNI INTERVIEW

- BOJ SEES RISK OF EARLIER INFLATION REBOUND - MNI POLICY

- CHINA’S APRIL LOAN PRIME RATE UNCHANGED - MNI BRIEF

- NZ INFLATION FALLING, RATE CUT EYED - EX RBNZ - MNI INTERVIEW

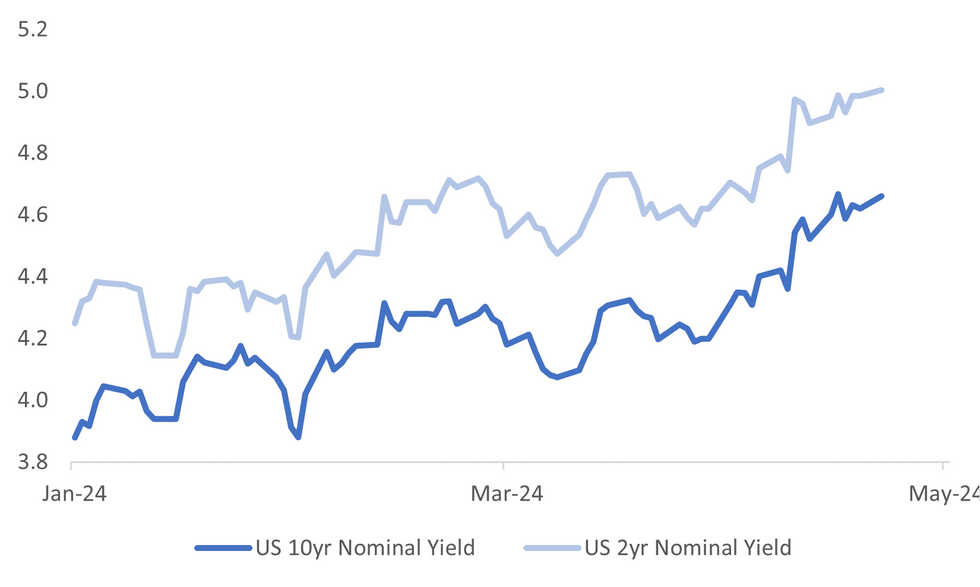

Fig. 1: US 2yr and 10yr Nominal Tsy Yields

Source: MNI - Market News/Bloomberg

U.K.

EU (BBC): The UK has rejected a EU offer that would make it easier for people aged between 18 and 30 to study and work abroad in the wake of Brexit.

HOUSE PRICES (BBG): Asking prices for UK homes rose at the highest annual pace in 12 months, driven by more top-of-the-ladder houses coming to market, according to the online sales portal Rightmove.

EUROPE

ECB (MNI INTERVIEW): The European Central Bank will likely cut interest rates at least twice this year, but it is important to manage market expectations regarding the pace of further easing when faced with upside risks including higher inflation in the U.S., Belgium’s central bank chief Pierre Wunsch told MNI on Saturday.

UKRAINE (BBG): Ukrainian authorities were jubilant at the approval in the US House of more than $60 billion in aid, though the focus is shifting to how quickly assistance can get to the front line and how the package will change Kyiv’s fortunes in its fight against Russia’s invasion.

GERMANY (DW): Germany's chancellor said the decision by US lawmakers to approve more foreign aid for Ukraine was a "strong signal." Western military experts believe the move will cause Russia to intensify its offensive.

EU (ECONOMIST): Foreign ministers of the European Union’s 27 member states meet in Brussels on Monday to discuss conflicts on the continent and beyond. The EU has also promised to broaden sanctions against Iran.

UKRAINE (BBC): Nato will give Ukraine more advanced air defences after urgent Kyiv pleas and deadly Russian attacks, military bloc head Jens Stoltenberg has said. His comments come after a crisis Nato-Ukraine summit on Friday.

U.S.

FISCAL (BBG): The US House passed $61 billion in fresh aid for Ukraine on Saturday, ending a six-month political impasse during which Kyiv’s stockpiles dwindled in its war against Russia.

UKRAINE (POLITICO): The U.S. is considering sending additional military advisers to the embassy in Kyiv, the latest show of American commitment to Ukraine as Russia appears to be gaining momentum in the two-year conflict. The advisers would not be in a combat role, but rather would advise and support the Ukrainian government and military, according to Pentagon spokesperson Maj. Gen. Pat Ryder.

US/CHINA (BBG): The US House on Saturday put legislation forcing TikTok’s Chinese parent ByteDance Ltd. to divest its ownership stake on a fast track to become law, tying it to a crucial aid package for Ukraine and Israel.

US/CHINA (BBG): Secretary of State Antony Blinken will bring a contradictory mission when he visits China next week: Convey the gravity of US concerns regarding Chinese companies’ support for Russia’s war machine, while also making sure the relationship with Beijing doesn’t go off the rails again.

FED (BBG): The Federal Reserve is stuck in a mode of forecasting and public communication that looks increasingly limited, especially as the economy keeps delivering surprises.

OTHER

NEW ZEALAND (MNI INTERVIEW): Headline and core New Zealand inflation are heading in the right direction, despite printing slightly above the central bank’s most latest forecasts, and should reach the 2% mid-point target over the next 12-18 months, potentially allowing a slight reduction of the 5.5% Official Cash Rate

IRAQ (RTRS): At least five rockets were launched from Iraq's town of Zummar towards a U.S. military base in northeastern Syria on Sunday, two Iraqi security sources told Reuters. The attack against U.S. forces is the first since early February when Iranian-backed groups in Iraq stopped their attacks against U.S. troops.

OIL (MNI INTERVIEW): The oil market outlook is largely balanced at the moment with both upside and downside risks to supply from OPEC+ cuts and geopolitical disruptions, Dallas Fed senior business economist Kunal Patel told MNI.

JAPAN (MNI POLICY): Bank of Japan officials believe the weak yen will drive an inflation rebound over the northern summer, sooner than bank economist expectations of an autumn bottom, which could drive the Board to consider raising its policy rate preemptively to keep ahead of the curve, MNI understands.

CANADA (MNI): Bank of Canada Governor Tiff Macklem said Friday this week's inflation report is further evidence price pressures are moving in the right direction, without signaling whether that means he could lower borrowing costs at the next decision in June.

PHILIPPINES (BBG): US and Philippine troops will sail beyond the Southeast Asian nation’s territorial waters for the first time since the joint annual drills started three decades ago, risking further maritime tensions with Beijing.

CHINA

POLICY (MNI BRIEF): China's Loan Prime Rate remained unchanged on Monday according to a People's Bank of China statement, in line with market expectation following the central bank’s decision to hold its policy rate steady as U.S. dollar strength weighs on the yuan and solid Q1 GDP growth reduces the need for monetary easing in the short term.

FDI (SHANGHAI SECURITIES NEWS): China’s commerce ministry and nine other departments have jointly released 16 measures to facilitate and encourage foreign institutions to invest in domestic technology enterprises, Shanghai Securities News reported. Applications for qualified foreign institutional investor (QFII) and RMB qualified foreign institutional investor (RQFII) will be reviewed and approved efficiently.

MARKETS (YICAI): China Securities Regulatory Commission’s latest 16 measures to provide comprehensive support for technology enterprises from listing financing, mergers and acquisitions, bond issuance and private equity investment will likely help normalise IPOs after the authorities tightened listing rules to strengthen market regulations, Yicai.com reported.

HOUSING (ECONOMIC DAILY): China’s real estate credit risk is basically controllable but the industry will still be in a period of adjustment this year, making it essential to stay vigilant over spillover risks, the official Economic Daily reported, citing bank executives.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Mon; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8071% at 09:30 am local time from the close of 1.8775% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Friday, compared with the close of 45 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1043 on Monday, compared with 7.1046 set on Friday. The fixing was estimated at 7.2335 by Bloomberg survey today.

MARKET DATA

UK APR RIGHTMOVE HOUSE PRICE M/M 1.1%; PRIOR 1.5%

UK APR RIGHTMOVE HOUSE PRICE Y/Y 1.1%; PRIOR 1.5%

CHINA APR 5-YR LOAN PRIME RATE 3.95%; MEDIAN 3.95%; PRIOR 3.95%

CHINA APR 1-YR LOAN PRIME RATE 3.45%; MEDIAN 3.45%; PRIOR 3.45%

SOUTH KOREA APRIL FIRST 20 DAYS TRADE DEFICIT $2.647B

SOUTH KOREA APRIL 1-20 DAILY AVERAGE EXPORTS RISE 11.1% Y/Y; PRIOR 11.2%

SOUTH KOREA APRIL 1-20 DAILY AVERAGE IMPORTS RISE 6.1% Y/Y; PRIOR -6.3%

MARKETS

US TSYS: Tsys Futures Edge Lower As Haven Trade Unwinds, Curve Bear-Steepens

- Jun'24 10Y futures have edged lower today, hitting a low of 107-17+ we trade just off these levels now down - 09 + at 107-19+, below Thursday's lows and are eyeing a test of initial support is at 107-13+ (Apr 16 low).

- Cash Treasury curve has bear-steepened today with yields 1-4bps higher, the 2Y yield is +1.6bps at 5.001%, 10Y +3.5bps to 4.656%, while the 2y10y was +1.951 at -34.985.

- Across local rate markets, NZGBs are 6-7bps higher, ACGBs are 5-7bps higher and JGBs are 1-4bps higher, in the EM space INDON & PHILIP yields are 1-5bps higher.

- Projected rate cut pricing held largely steady vs. late Thursday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -13.5% w/ cumulative rate cut -4.5bp at 5.283%. July'24 cumulative at 12.1bp, Sep'24 cumulative -23bp.

- Looking ahead: Chicago Fed Nat Activity Index later Today

JGBS: Swaps Curve Bear-Steepens, US Tsys Continue To Pare Haven Bid, 2Y Supply Tomorrow

JGB futures are weaker and at session lows, -46 compared to the settlement levels.

- The local calendar is empty today, ahead of Jibun Bank PMIs and 2-year supply tomorrow.

- The market’s focus this week, however, is the BoJ Policy Decision on Friday. No policy adjustment is anticipated at the two-day meeting ending on April 26, following last month's decision to raise rates for the first time since 2007.

- (MNI) Bank of Japan officials believe the weak yen will drive an inflation rebound over the northern summer, sooner than bank economist expectations of an autumn bottom. This could drive the Board to consider raising its policy rate pre-emptively to keep ahead of the curve, MNI understands.

- BOJ officials would prefer gradual rate increases over rapid hikes, which would considerably worsen economic activity.

- The Bank estimates underlying inflation at about 1.7%, below its 2% price target, but the weak yen could boost that to 2% via the pass-through to imported goods. (See MNI link)

- Cash US tsys are 2-4bps cheaper across benchmarks, with a steepening bias, as the market continues to pare the rally instigated by Israel’s attack on Iran on Friday.

- Cash JGBs are cheaper across the curve, with the 7-year underperforming (yield +3.6bps). The benchmark 10-year yield is 3.1bp higher at 0.882% versus the YTD high of 0.891%.

- The swap curve has bear-steepened, with rates 1-4bps higher. Swap spreads are mixed.

AUSSIE BONDS: Cheaper, Narrow Ranges, Tracking US Tsys As Haven Bid Fades

ACGBs (YM -8.0 & XM -8.0) are cheaper after dealing in relatively narrow ranges in today’s Sydney session. With the domestic calendar empty, local participants have taken their directional lead from US tsys. In today’s Asia-Pac session, cash US tsys are 2-4bps cheaper.

- The latest round of ACGB Sep-26 supply prints through prevailing mids, extending the recent trend of firm pricing at ACGB auctions. It's noteworthy that the cover ratio saw a noticeable decline. It's essential to recognise, however, that the outright yield was 30-35bps lower than the level in October 2023.

- Optimism regarding the RBA's policy outlook, coupled with the bond's inclusion in the YM basket, likely bolstered demand at today’s auction. However, the looming release of Q1 CPI figures on Wednesday probably exerted a counterbalancing influence.

- Cash ACGBs are 7-8bps cheaper, with the AU-US 10-year yield differential 1bp lower at -33bps, hovering near a cycle low.

- Swap rates are 6-7bps higher.

- The bills strip has bear-steepened, with pricing -1 to -9.

- RBA-dated OIS pricing is 1-7bps firmer for meetings beyond June, with mid-2025 leading. A cumulative 18bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Judo Bank PMIs, ahead of Q1 CPI on Wednesday.

NZGBS: Cheaper But Outperforms Its $-Bloc Counterparts

NZGBs closed on a soft note, with benchmark yields 6-7bps higher. With the domestic calendar empty today, the local market has tracked US tsys’ cheapening in today’s Asia-Pac session.

- Cash US tsys are 2-4bps cheaper across benchmarks, with a steepening bias, as the market continues to pare the rally instigated by Israel’s attack on Iran on Friday.

- Nevertheless, the NZGB 10-year has outperformed its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 4bps and 2bps tighter, respectively.

- Swap rates closed 6-7bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed is 5-11bps firmer for meetings beyond July, with late-2024/early-2025 leading. A cumulative 49bps of easing is priced by year-end.

- The local calendar is empty until Trade Balance data on Wednesday. Also on Wednesday, Australia will release Q1 CPI data.

FOREX: Yen Underperforms Amid Risk Rebound, Equities/US Yields Higher

The BBDXY sits around 0.10% lower in the first part of Monday trade, the index back near 1263. This keeps us within recent ranges for the index. Better risk appetite has weighed on USD sentiment today, as sentiment stabilizes/improves post Friday's dip.

- Lack of fresh military action re Israel/Iran has aided sentiment, while the US house passing a weekend aid bill for Ukraine, Israel and Taiwan, has also been in focus.

- US equity futures opened higher and have stayed in the green. We were away from highs in recent dealings, Eminis last around +0.30%, while Nasdaq futures were +0.45%.

- US yields are higher, +2-4bps firmer across the curve, as Tsys lose the safe haven bid. 2yr yields are pressing marginally above 5%. This has helped drive yen underperformance. USD/JPY was last close to 154.70, although we haven't tested last week's cyclical high at 154.79 yet. There is also a reasonable option expiry at 155.00 for NY cut later ($1.4bn).

- AUD and NZD are both higher, but away from best levels. NZD/USD is up near 0.40%, last close to 0.5915. Earlier highs were at 0.5929. Likewise, AUD/USD rallied to 0.6455 earlier, but we now sit back at 0.6435/40, still +0.30% firmer for the session.

- Looking ahead, the Chicago Fed activity index for March, and the ECB’s Lagarde and BoE’s Benjamin speak. Key US data, including Q1 GDP and March core PCE prices, are released this week.

ASIA EQUITIES: HK Equities Soar After China’s Regulator Pledges Support

Hong Kong and China equity are mixed today with Hong Kong equities outperforming today led higher by the five measured announced by the CSRC on Friday, while Investors are also breathing a sign of relief after seeing no escalation of tensions in the middle east. In the property space Sunac China shares climbed as much as 11% after one of its residential housing projects in Shanghai sold out in one day. There has been little else in the way of market headlines, while China kept the LPR rates steady. Focus this week will turn to corporate earnings, with a light economic calendar for the remainder of the week

- Hong Kong equities are surging higher today with the HSTech Index up 1.95% sellers are still in control with the index trading below all Major EMA levels, while the 14-day RSI sits below 50 although it is off lows, the Mainland Property Index up 1.82%, while the HSI is up 1.74% and is now testing the 100-day EMA with a break here setting up a retest of the 200-day EMA at 17,266. China Mainland equities are underperforming this morning, with the CSI300 down 0.22% the index has been rangebound since early Feb trading between the 100 & 200-day EMA, small-cap indices are mixed with the CSI1000 unchanged while the CSI2000 is down 0.50%.

- China Northbound saw an outflow of 6.48b on Friday, momentum has been decreasing over the past week with the 5-day average at -1.33billion, while the 20-day average sits at -1.36billion yuan.

- The US House passed legislation compelling ByteDance to divest its ownership stake in TikTok, linking it to an aid package for Ukraine and Israel, amidst concerns about data privacy and Chinese propaganda, with ByteDance intending to exhaust legal challenges before considering divestiture.

- China's securities regulator announced five measures to promote Chinese companies listing in Hong Kong, including supporting IPOs by leading firms, loosening stock trading link rules, widening the scope of eligible exchange-traded funds, and supporting the inclusion of yuan-denominated stocks for mainland investors. This move aims to maintain Hong Kong's unique status as an international financial hub and comes after a decline in IPOs last year and questions about its future as a finance center.

- Looking ahead, HK CPI Composite On Tuesday & Trade Balance on Thursday

ASIA PAC EQUITIES: Asian Equities Rebound From Friday's Sell-Off

Regional Asian equities are mostly higher today recovering from Friday's losses triggered by geopolitical tensions in the Middle East eased and a broad selloff in US tech shares, caused by Nvidia's significant decline of 10%. Regional equity benchmark’s month-to-date have declined to less than 5%, while investors will turn their focus to corporate earnings and economic data, with US GDP figures and the Federal Reserve’s preferred measure of inflation due this week and the BoJ holds a policy meeting this week. Indonesian has reported a bigger trade surplus than expected, while Taiwan will released Unemployment data later. In cross-asset, yields have ticked up with the US 2yr now trading back above 5%, while the USD is down against most G10 currencies.

- Japanese stocks bounced back today, recovering from last week's downturn amid easing tensions in the Middle East. The Nikkei 225 index is 0.34% higher to 37,193 and is holding just above the 100-day EMA, while the broader Topix is up 0.80% at 2,648. Toyota Motor and Bank stocks have fueled the Topix's gains. However, caution prevailed, particularly in chip-related stocks, following underwhelming orders at ASML Holdings and a cautious outlook from TSMC, which explains the underperformance by the Nikkei. Investors are also monitoring government actions to support the yen, which has been hovering near its weakest level since 1990 at 154.69.

- South Korean equities are higher today, and now trades unchanged for the year. The Kospi traded below the 200-day EMA for the first time since Mid Jan, however has bounced back up 0.87% to 2,614 today and is now testing the 100-day EMA at 2,619. Focus this week will be on Wednesday when GDP is released.

- Taiwan equities were hammered on Friday and were by far the worst performing market in the region as TSMC forecast and Israel/Iran conflict were the main catalysts for the sell-off. The Taiex has reversed earlier gains to now trade down 0.10%, the index is now off 6.55% from recent highs and is trading below the 50-day EMA. Later today Unemployment and Export Orders are due out

- Australian equities are higher today and have erased all of Friday's sell-off, energy is the only sector lower today after being the top performing sector on Friday while Financials and Mining stocks are the top performers today. The ASX200 is up 0.93% and is now testing the 50-day EMA, looking ahead CPI is due out on Wednesday.

- Elsewhere in SEA, New Zealand Equities are up 0.25%, Singapore equities are 1.38% higher, Malaysian equities up 0.60% and Philippines equities are 0.45% higher, while Indonesia reported a Trade surplus at $4.47b (estimate +$1.225b) in March vs $867m in Feb, equities have traded down 0.70%

GOLD: Lower As Iran Downplays Israeli Attack

Gold is 0.9% lower in today's Asia-Pac session, after closing 0.5% higher at $2391.93 on Friday.

- Early on Friday bullion had spiked to an intra-day high of $2,418/oz following Israel’s missile strike on Iran. That gain was subsequently pared after Iran downplayed the attack.

- That left US Treasuries to focus on ongoing strength in US economic data and the potential for rate cuts to be pushed further out this year. The Fed entered its media Blackout regarding policy on Friday.

- Nevertheless, the yellow metal finished last week up 2.0%.

- US Treasury yields are 2-4bps higher in today's Asia-Pac session.

- According to MNI’s technicals team, the technical outlook for gold is still bullish and the next objective continues to be at $2452.5, a Fibonacci projection. Initial firm support is at $2293.4, the 20-day EMA.

OIL: Crude Lower As Markets See Tensions Easing

Oil prices have eased during APAC trading as risk appetite improved on the back of the assessment that the risk of an escalation in the Middle East has been reduced but markets remain alert to any change in this detente. WTI is down 0.8% to $81.60/bbl, close to the intraday low of $81.43. It reached a high of $82.11 early in the session. Brent is 0.7% lower at $86.65, after a low of $86.45 and high of $87.15.

- New sanctions against Iran were included in the foreign aid bill passed by the US House on the weekend. It will extend measures to include ships and refineries that process and transport Iranian crude. It will also cover all financial transactions for the purchase of oil products between China’s financial institutions and Iranian banks facing sanctions.

- EU foreign ministers will discuss additional sanctions on Iran at their meeting today.

- Later the Chicago Fed activity index for March, and the ECB’s Lagarde and BoE’s Benjamin speak. Key US data, including Q1 GDP and March core PCE prices, are released this week.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/04/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 22/04/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/04/2024 | 1430/1030 |  | CA | BOC market participants survey | |

| 22/04/2024 | 1530/1730 |  | EU | ECB's Lagarde Lecture at Yale | |

| 22/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/04/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.