-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Softens On Lower Yields/Firmer Regional Equities

EXECUTIVE SUMMARY

- FISCAL STANCE MORE RESTRICE THAN RATES - EX RBA - MNI

- AUSTRALIAN LNG WORKERS THREATEN TO STRIKE NEXT WEEK - BBG

- JAPAN’S JOBLESS RATE RISES In NEGATIVE SIGNAL FOR WAGES, BOJ - BBG

- TOKYO TO HALT OPERATIONS AT ALL JAPAN ASSEMBLY PLANTS DUE TO SYSTEM FAILURE - RTRS

- ANALYSTS SAY CHINA MAY CUT RRR TO BOOST MARKET LIQUIDITY- CSJ

- BRITAIN’S FOOD INFLATION COOLS TO LOWEST LEVEL IN ALMOST A YEAR - BBG

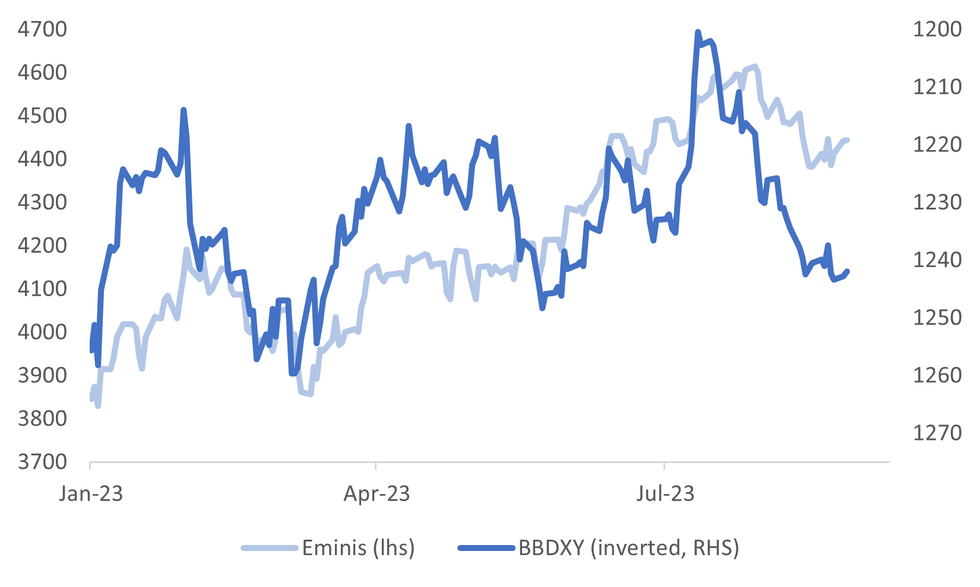

Fig. 1: US Eminis Versus BBDXY (Inverted)

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: The slowest increase in grocery bills in almost a year drove down inflation in British shops in August, relieving some of the pressure on the Bank of England to keep raising interest rate hikes. The British Retail Consortium said that shop price inflation fell sharply again from 6.9% in August from 7.6% the month before. Food price led the decline, particularly for meat, potatoes and cooking oils. (BBG)

POLITICS: Britain’s opposition Labour party is facing a backlash from its left wing after ruling out wealth taxes and promising to cut business regulations as it looks to shore up its economic credentials ahead of a general election expected next year. (BBG)

U.S.

POLITICS: Donald Trump will stand trial in March 2024 for trying to overturn his 2020 presidential election defeat, one day before Republican voters in more than a dozen U.S. states will decide whether to give him a chance to recapture the White House. (RTRS)

US/CHINA: U.S. Commerce Secretary Gina Raimondo discussed concerns about restrictions on American businesses including Intel (INTC.O) and Micron Technology (MU.O) with Chinese Commerce Minister Wang Wentao on Monday in a meeting where the two countries also agreed to start exchanging information on export controls. (RTRS)

US/CHINA: The U.S. State Department has picked veteran diplomat Mark Lambert as its top China policy official, five sources familiar with the matter said, bringing in new leadership for a part of the department that has faced staffing problems and criticism over its handling of China-focused initiatives. (RTRS)

OTHER

JAPAN: Toyota Motor Corp (7203.T) suspended operations at a dozen assembly plants in Japan on Tuesday due to a malfunction with its production system, the automaker said, likely bringing to a halt almost all of its domestic output. (RTRS)

JAPAN: Japan’s unemployment rate rose for the first time in four months in July, while a gauge of labor demand weakened a tad, in a pair of worrisome signals for both the Bank of Japan and the government. (BBG)

JAPAN: The Japanese government highlighted progress toward stamping out deflation after battling it for a quarter century, and urged close cooperation with the Bank of Japan in its latest annual white paper on the economy. (BBG)

JAPAN: Japan’s government and ruling coalition plan to expand gasoline subsidies to keep prices at the pump under 180 yen/liter, Nikkei reports without attribution. (NIKKEI)

SOUTH KOREA: South Korea's government plans to raise budget spending to nearly $497 billion for 2024, but the proposed increase is the smallest in two decades as authorities prioritise fiscal discipline amid weakening tax revenue due to slower economic growth. (RTRS)

AUSTRALIA: Australian fiscal policy remains contractionary and may do more to increase the country’s unemployment rate and slow the economy over next year than interest rates, which will likely hold circa 4.1%, a former Reserve Bank of Australia board member told MNI. (MNI)

AUSTRALIA: Australian consumer confidence climbed in the last week but remains at levels below those seen in some of the worst days of the Covid-19 pandemic. Consumer confidence increased by 2.3 points last week, its sixth straight week in the narrow band between 75 points and 78.5 points, according to a survey by ANZ Bank and pollster Roy Morgan. Even scores of 80 points were seen during the Delta lockdowns that brought the economy to a standstill in mid-2021. (DJ)

NATURAL GAS: Workers at two Chevron Corp.-operated liquefied natural gas export plants in Australia are threatening to begin strike action next week, ratcheting up pressure on negotiations and putting global energy supply at risk. (BBG)

NEW ZEALAND: New Zealand will introduce legislation this week that enables a digital services tax on large multinational companies, though the levy won’t be imposed until 2025. The proposed tax would be payable by multinational businesses that make over €750 million ($810 million) a year from global digital services and over NZ$3.5 million ($2 million) a year from digital services provided to New Zealand users, Finance Minister Grant Robertson said Tuesday in Wellington. (BBG)

CHINA

EQUITIES: Development potential of China’s capital market and effectiveness of policies to support the stock market shouldn’t be solely measured by short-term market performance, Shanghai Securities News said in a front-page commentary Tuesday. (SSN)

FISCAL: According to Xinhua News Agency, the Fifth Session of the Standing Committee of the Fourteenth National People's Congress held its first plenary meeting in Beijing on Monday. At the meeting, Minister of Finance Liu Kun made a report on the implementation of the budget this year, which proposed the next steps Strengthen and improve efficiency, implement a proactive fiscal policy, support the strengthening and improving the real economy, effectively protect and improve people's livelihood, prevent and resolve local government debt risks, and further tighten financial discipline. (Xinhua)

BONDS: China issued 174 new special bonds in August worth CNY476.7 billion, more than double July’s CNY196.2 billion, according to Securities Daily. Wang Qing, chief macro analyst at Dongfang Jincheng, said authorities had postponed issuance of some bonds from July into August under the expectation of lower interest rates. (SECURITIES DAILY)

RATES: China’s central bank may consider cutting reserve requirement ratio for commercial lenders in the fourth quarter of this year to improve liquidity in the financial market, according to a front-page report in the China Securities Journal Tuesday, citing analysts. (CSJ)

ETF FLOWS: Traders pulled $527.2 million from Chinese stocks through ETFs last week, led by withdrawals from Xtrackers Harvest CSI 300 China A-Shares for the week ended Aug. 25, according to data compiled by Bloomberg. The move comes as China unleashes a series of actions that have failed to restore confidence in its economy. (BBG)

CHINA MARKETS

PBOC Net Injects CNY274 Bln Tuesday via OMO

The People's Bank of China (PBOC) conducted CNY385 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY274 billion after offsetting the maturity of CNY111 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8857% at 09:27 am local time from the close of 2.0893% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday, compared with 40 on Friday.

PBOC Yuan Parity Lower At 7.1851 Tuesday Vs 7.1856 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1851 on Tuesday, compared with 7.1856 set on Monday. The fixing was estimated at 7.2764 by Bloomberg survey today.

MARKET DATA

UK AUGUST BRC SHOP PRICE INDEX Y/Y 6.9%; PRIOR 7.6%

JAPAN JULY JOBLESS RATE 2.7%; MEDIAN 2.5%; PRIOR 2.5%

JAPAN JULY JOB-TO-APPLICANT RATIO 1.29; MEDIAN 1.30; PRIOR 1.30

MARKETS

US TSYS: Slight Richening In Early Asia-Pac Dealing

TYU3 is currently trading at 109-24+, +04 from NY closing levels.

- US tsys are sitting near Asia-Pac session highs, with benchmark yields 1-2bp richer. The curve has steepened.

- There has been no news of significance so far in the session.

JGBS: Futures Higher But Off Bests, Rinban Operations for 3- to 25-Year+ JGBs Tomorrow

In afternoon trade, JGB futures are dealing richer, +17 compared to settlement levels, but off session bests.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined jobless rate that surprised on the upside.

- That said, 2-year supply witnessed lacklustre demand, with the low price failing to meet dealer expectations and the cover ratio declining to the lowest observed at a 2-year auction since 2010. It is noteworthy that today’s 2-year JGB auction today was the first 2-year supply since the BoJ's decision to tweak yield curve control (YCC). August’s 5-year supply also saw weak demand.

- The cash JGB curve has twist flattened, pivoting at the 4s, with yields 0.4bp higher to 1.5bp lower. The benchmark 10-year yield is 1.2bp lower at 0.652%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%. The 2-year is 0.1bp higher on the day at 0.01%, after being at 0.003% before the auction result.

- The swaps curve has bull flattened, with rates 0.1bp to 1.0bp lower. Swap spreads are narrower, apart from the 7-20-year zone.

- Tomorrow the local calendar sees Consumer Confidence data for August, along with BoJ Rinban operations covering 3- to 25-Year+ JGBs.

AUSSIE BONDS: Richer, Mid-Range, CPI Monthly Tomorrow

ACGBs (YM +2.0 & XM +2.0) sit in the middle of the Sydney session range ahead of the closely watched CPI Monthly data tomorrow. There was no data or headlines of note today. Accordingly, local participants appear to have been guided by US tsy dealings in the Asia-Pac session.

- US tsys are sitting near Asia-Pac session highs, with benchmark yields 1-2bp richer. The curve has steepened. There has been no news of significance so far in the session.

- Cash ACGBs are 2bp richer, with the AU-US 10-year yield differential unchanged at -7bp.

- Swap rates are 2bp lower, with EFPs slightly wider.

- The bills strip has twist flattened, pivoting at late whites, with pricing -1 to +3.

- RBA-dated OIS pricing is flat to 2bp softer across meetings. A 5% chance of a 25bp hike in September is priced, with terminal rate expectations at 4.21%.

- Speech by RBA Deputy Governor Michele Bullock, “Climate Change and Central Banks” is due today at 0840 BST / 1740 AEST.

- Tomorrow the local calendar sees the CPI Monthly for July, accompanied by Construction Work Done (Q2), Building Approvals (Jul) and Private Sector Credit (Jul).

- Tomorrow the AOFM plans to sell A$700mn of the 2.75% 21 November 2028 bond.

NZGBS: Richer, Outperforms The $-Bloc, Building Permits Tomorrow

NZGBs closed 2bp richer, with benchmarks just off local session bests. Without local catalysts, the direction of the local market was largely set by US tsys dealings in the Asia-Pac session.

- US tsys are 1-2bp richer across benchmarks. The curve has steepened. There has been no news of significance in the session.

- That said, NZGBs have outperformed the $-Bloc today, with the NZ-US and NZ-AU 10-year yield differentials both 2bp tighter. This move partially unwinds the underperformance seen yesterday sparked by NZ fiscal deterioration concerns. The NZ Pre-Election Economic and Fiscal Update (PREFU) is due for release on September 12.

- The International Monetary Fund has published sluggish predictions for NZ's economic growth, tipping higher inflation for longer. The paper makes for grim reading for Kiwis, already in a technical recession, without a pathway back to growth enjoyed in recent years. (See link)

- Swap rates are 4bp lower, with implied swap spreads narrower.

- RBNZ dated OIS pricing is unchanged out to Apr’24 and 1-4bp softer beyond. Terminal OCR expectations sit at 5.65%.

- Tomorrow the local calendar sees Building Permits for July. On Thursday, ANZ Business Confidence is on tap, with ANZ Consumer Confidence on Friday.

FOREX: USD Softens On Lower Yields Firmer Regional Equities

The USD sits further away from recent highs, last near 1241.50, having lost ~0.1% in Tuesday trade to date. A modest drift lower in US yields has weighed, although we are away from session lows. 2yr last around 5.035%, 10yr at 4.19%. Regional equities are tracking with a positive tone as well, which has seen higher beta FX outperform the yen, albeit at the margins.

- USD/JPY got close to Monday session lows (low of 146.31), as US yields softened, before edging back to 146.45 this afternoon. Earlier July unemployment figures unexpectedly ticked higher to 2.7% (2.5% forecast), but this didn't impact sentiment, while we saw a poor 2yr debt auction as well. Broader US-JP yield differentials haven't moved a great deal though.

- AUD/USD is up around 0.30%, tracking near 0.6445/50. The better regional equity tone has helped, along with higher metal prices. Copper is +0.60%, iron ore futures, +0.50%. Highs from last week near 0.6490 beckon the top side, while recent lows rest at 0.6365. Later on, incoming RBA Governor Bullock speaks on 'Climate change and central banks'.

- NZD/USD has risen, but ran into some resistance around the 0.5930 level, we last track near 0.5920.

- GBP/USD has slightly outperformed the other majors, last at 1.2625 (~0.20% firmer).

- Looking ahead we have German consumer confidence, while later the Fed’s Barr speaks about banking services and there are US June house prices, July JOLTS job openings and August consumer confidence & Dallas Fed services.

EQUITIES: Hong Kong Stocks +2%, As Better Earnings Drives Sentiment

The regional equity tone is a positive one for the major indices in Tuesday trade to date. This follows gains in EU/US bourses during Monday trade. At this stage, US equity futures are a touch higher. Eminis last tracked near 4444.50. which is reasonably close to Monday session highs. Nasdaq futures are a tough firmer in (percentage terms), last near 15112.

- Among the strongest performers today have been Hong Kong shares. The HSI is around +2% stronger, just below sessions highs at the lunchtime break. The TECH sub index is +2.61%, building on yesterday's +1.69% gain.

- China EV market BYD rallied on strong Q2 profits, with further earnings due later. The South China Morning Post notes that 56 of 80 HSI members have reported earnings so far, with average earnings growth of 1.9%.

- In China markets initially opened lower, but sentiment has improved as the session progressed. At the break, the CSI 300 is +1.45% and back above 3800 in index terms. Positive spill over from HK moves is helping, while the onshore media stressed patience in terms of better market conditions.

- Japan stocks are lagging somewhat. The Topix +0.20% at this stage. Some chatter is local equities may suffer from China's export seafood ban.

- The Kospi is up 0.35% in South Korea, although offshore investors have sold -$74.4mn of local shares today. The Taiex is also lagging somewhat, last +0.20%.

- In SEA, most bourses are higher, but gains are comfortably under 1% at this stage. Philippine equities continue to lag broader sentiment, down a further 0.2% in the first part of trade today, as markets return from yesterday's holiday.

OIL: Range Trading, Crude Likely To Be Down In August

Oil prices have been in a narrow range during APAC trading. They fell earlier in the session but have bounced back to be unchanged, as supply and demand concerns balance out. Stronger equity markets have provided support. The USD index is down 0.1%.

- WTI is currently just above $80 at $80.05/bbl, close to the intraday high of $80.13. It has been under the key $80 level during the session falling to a low of $79.79. Brent is at $84.42, close to the high of $84.47. The low earlier was at $84.11. It is currently down 1.2% this month and WTI -1.5%.

- Demand from China continues to worry the market. Its largest refiner, Sinopec, expects product demand in H2 to be less than H1.

- On the supply side, futures timespreads continue to point to tight supply given OPEC production cuts and the possibility of their extension. Later today US API inventory data is published. Turkey’s energy minister has said that work on a key Iraqi pipeline is about to be finished.

- Later the Fed’s Barr speaks about banking services and there are US June house prices, July JOLTS job openings and August consumer confidence & Dallas Fed services.

GOLD: Slightly Firmer, US Tsy Yields Lower

Gold is 0.3% higher in the Asia-Pac session, after closing +0.3% on Monday.

- The strengthening in gold was supported by lower US tsy yields on Monday. In a data light session, technical flows dominated US tsy trading as participants eyed Friday's US Non-Farm Payrolls data.

- According to MNI’s technicals team, the trend outlook in bullion remains bearish, however, a short-term correction resulted in a recovery last week. The yellow metal has breached resistance at the 20-day EMA and attention turns to the 50-day EMA, at $1930.8.

- A clear break of this average would strengthen the current bull cycle.

- For bears, moving average studies continue to highlight a dominant downtrend. Key support and the bear trigger has been defined at $1884.9, the Aug 21 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 29/08/2023 | 0600/0800 | * | Aug |  | DE | GFK Consumer Climate | -25.2 | -- | |

| 29/08/2023 | 0600/0800 | *** | Q2 |  | SE | GDP q/q | 0.6 | -1.2 | % |

| 29/08/2023 | 0600/0800 | *** | Q2 |  | SE | GDP y/y | 0.8 | -1.1 | % |

| 29/08/2023 | 0600/0800 | ** | Jul |  | SE | Retail Sales y/y | -4.4 | -- | % |

| 29/08/2023 | 0600/0800 | * | Aug |  | DE | GFK Consumer Climate | -24.4 | -24.5 | |

| 29/08/2023 | 0645/0845 | ** | Aug |  | FR | Consumer Sentiment | 85 | 85 | |

| 29/08/2023 | 1255/0855 | ** | 26-Aug |  | US | Redbook Retail Sales y/y (month) | -- | -- | % |

| 29/08/2023 | 1255/0855 | ** | 26-Aug |  | US | Redbook Retail Sales y/y (week) | 2.9 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | Case-Shiller Home Price Index | 305.15 | -- | |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | FHFA Home Price Index m/m | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | Prior Revised HPI % Chge mm SA | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Q2 |  | US | FHFA Quarterly Home Prices q/q | 0.5 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | FHFA Home Price Index m/m | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | Prior Revised HPI % Chge mm SA | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Q2 |  | US | FHFA Quarterly Home Prices q/q | 0.5 | -- | % |

| 29/08/2023 | 1400/1000 | *** | Aug |  | US | Conference Board Confidence | 117.0 | 116.4 | |

| 29/08/2023 | 1400/1000 | *** | Aug |  | US | Previous Consumer Confidence Index Revised | 110.1 | -- | |

| 29/08/2023 | 1400/1000 | ** | Jun |  | US | JOLTS job openings level | 9582 | -- | (k) |

| 29/08/2023 | 1400/1000 | ** | Jun |  | US | JOLTS quits rate | 3.6 | -- | % |

| 29/08/2023 | 1430/1030 | ** | Aug |  | US | Dallas Fed services index | -4.2 | -- | |

| 29/08/2023 | 1530/1130 | * | 01-Sep |  | US | Bid to Cover Ratio | -- | -- | |

| 29/08/2023 | 1700/1300 | ** | Aug |  | US | Bid to Cover Ratio | -- | -- |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.