-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Ticks Higher As NFP Comes Into View

EXECUTIVE SUMMARY

- WHITE HOUSE PLANNING FACE-TO-FACE MEETING WITH XI JINPING IN CALIFORNIA - WASHINGTON POST

- TRUMP SAID TO HAVE REVEALED NUCLEAR SUBMARINE SECRETS TO AUSTRALIAN BUSINESSMAN - NYT

- LABOUR DEFEATS SNP TO WIN KEY SCOTTISH BY-ELECTION - BBC

- BOJ TO SCRAP YIELD CURVE CONTROL IN APRIL- MOMMA - MNI

- JAPAN AUG REAL WAGES FALL 2.5% VS. JULY -2.7% - MNI BRIEF

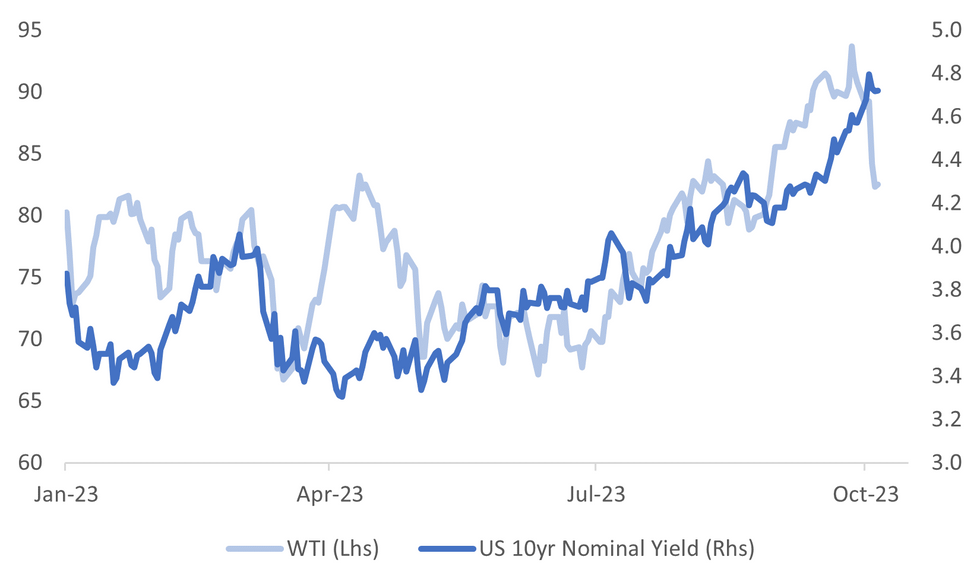

Fig. 1: US 10yr Nominal Government Bond Yield & WTI

Source: MNI - Market News/Bloomberg

U.K:

POLITICS: “Labour has defeated the SNP to win the Rutherglen and Hamilton West by-election. The party's candidate, Michael Shanks, took the Westminster seat with 17,845 votes - more than double the number polled by the SNP's Katy Loudon. The result was a swing of 20.4% from the SNP to Labour.” (BBC)

EUROPE:

ECB: “There are no grounds at present for the European Central Bank to raise interest rates any further, Governing Council member Francois Villeroy de Galhau told Handelsblatt.” (BBG)

GAS: A gas project in the Black Sea is caught up in a diplomatic spat over Austria’s opposition to allowing Romania into Europe’s border-free Schengen area. (FT)

U.S.

US/CHINA: “The White House has begun making plans for a November meeting in San Francisco between President Biden and Chinese leader Xi Jinping — an attempt to stabilize the relationship between the world’s two most powerful countries, according to senior administration officials.” (WASHINGTON POST)

POLITICS: “Soon after leaving office, the former president shared sensitive information about American submarines with a billionaire member of Mar-a-Lago, according to people familiar with the matter.” (NYT)

POLITICS: "Former President Donald Trump endorses Rep. Jim Jordan of Ohio for US House Speaker, he says in a post on Truth Social." (BBG)

MARKETS: “Exxon Mobil Corp. is nearing a deal worth as much as $60 billion to buy shale-focused Pioneer Natural Resources Co., the Wall Street Journal reported, citing unidentified people familiar with the matter.” (WSJ)

GEOPOLITICS: “The United States on Thursday shot down an armed Turkish drone that was operating near its troops in Syria, the Pentagon said, the first time Washington has brought down an aircraft of NATO ally Turkey.” (RTRS)

OTHER

JAPAN: The Bank of Japan is likely to scrap its yield curve control and negative interest rate policies at its April meeting, perhaps in conjunction with a government declaration of victory over deflation, a former BOJ chief economist told MNI. (MNI)

JAPAN: The y/y fall of inflation-adjusted real wages, a barometer of household purchasing power, narrowed to 2.5% in August from a 2.7% fall in July, as inflation slowed, data released by the Ministry of Health, Labour and Welfare showed on Friday. (MNI BRIEF)

JAPAN: “The Bank of Japan could raise its 1% hard cap set for long-term interest rates as its next policy move if the 10-year bond yield threatens to breach that level, Columbia University academic Takatoshi Ito told Reuters in an interview.” (RTRS)

AUSTRALIA: “A growing number of Australian households are in the early stages of financial stress, while lenders remain in a solid position to absorb loan losses if needed, the nation’s central bank said.” (BBG)

SOUTH KOREA: South Korea is not in a situation to increase the level of monetary tightening yet, Ryoo Sangdai, senior deputy governor of Bank of Korea, told reporters. (BBG)

PERU: “Peru cut interest rates for a second straight month Thursday, as inflation cooled more than expected and the country’s recession deepened.” (BBG)

CHINA

COMMODITIES: “China Mineral Resources Group Co., the buying agency set up to increase Beijing’s clout in iron ore, is in negotiations with Rio Tinto Group and other leading miners over next year’s supply, according to people familiar with the matter.” (BBG)

MARKET DATA

SOUTH KOREA SEP FX RESERVES $414.12bn; PRIOR $418.30BN

JAPAN AUG LABOR CASH EARNINGS Y/Y 1.1%; MEDIAN 1.5%; PRIOR 1.1%

JAPAN AUG REAL CASH EARNINGS Y/Y -2.5%; MEDIAN -2.1%; PRIOR -2.7%

JAPAN AUG HOUSEHOLD SPENDING Y/Y -2.5%; MEDIAN -3.9%; PRIOR -5.0%

MARKETS

US TSYS: Treading Water In Asia-Pac Dealings Ahead Of Non-Farm Payrolls Later Today

TYZ3 is currently trading at 107-09+, -0-00+ from NY closing levels.

- Newsflow has been light so far in the Asia-Pac session.

- Cash tsys are dealing with little change across major benchmarks in the Asia-Pac session. Ranges have been modest ahead of US Non-Farm Payrolls data later today. Bloomberg consensus expects +170k in Septmber payrolls versus +187k prior. The unemployment rate is forecast to dip to 3.7% from 3.8% prior.

JGBS: Futures Holding Firmer, Tight Ranges Ahead Of Payrolls, Monday Holiday

JGB futures remain in positive territory at 144.81, +14 compared to the settlement levels, after hitting a session high of 144.85 in morning trade.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined labour and real cash earnings, which printed weaker than expected.

- US tsys are dealing with little change across major benchmarks in the Asia-Pac session so far. Ranges have been modest ahead of US Non-Farm Payrolls data later today. Bloomberg consensus expects +170k versus +187k prior. The unemployment rate is forecast to dip to 3.7% from 3.8% prior. (See MNI’s US NFP preview here)

- Cash JGBs are dealing mixed, with the belly of the curve outperforming. Yields are 2.1bps lower (7-year) to 1.2bps higher (40-year). The benchmark 10-year yield is 1.0bp lower at 0.802%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also below the cycle high of 0.814% set yesterday.

- The swaps curve has bull-steepened out to the 7-year, with rates 0.4bps to 1.5bps lower. Beyond the 7-year, rates are 0.9bp to 1.4bps lower. Swap spreads are generally tighter across maturities.

- The JGB market is closed on Monday for the observance of Health-Sports Day.

AUSSIE BONDS: Richer, At Sydney Session Best Levels, US Payrolls The Focus

ACGBs (YM +4.0 & XM +2.0) are richer and sit at or near Sydney session highs. It has been a light day on the newsflow front, with the RBA’s Financial Stability Report as the highlight.

- (AFR) “A rising number of borrowers are on the brink of financial stress as higher interest payments exceed their incomes and deplete their savings, the Reserve Bank said.” (See link)

- US tsys are dealing with little change across major benchmarks in the Asia-Pac session so far. Ranges have been modest ahead of US Non-Farm Payrolls data later today. Bloomberg consensus expects +170k versus +187k prior. The unemployment rate is forecast to dip to 3.7% from 3.8% prior.

- The cash ACGB curve has bull-steepened, with yields 2-4bps lower. The AU-US 10-year yield differential is unchanged at -16bps.

- Swap rates are 4-5bps lower.

- Bills pricing is +2 to +4 across the strip.

- RBA-dated OIS pricing is 2-5bps softer across 2024 meetings.

- Next week, the local calendar sees Foreign Reserves on Monday, Westpac Consumer and NAB Business Confidence on Tuesday and CBA Household Spending on Wednesday. Also on Wednesday, RBA Assistant Governor (Financial Markets) Christopher Kent delivers a Bloomberg Address in Sydney.

- The AOFM plans to sell A$800m of 2.75% 2027 bond on Wednesday.

NZGBS: Slightly Richer, Narrow Ranges, Awaiting US Payrolls

NZGBs closed flat to 2bps richer, with the 2/10 curve steeper, after dealing within relatively narrow ranges. The local calendar was empty today, with Card Spending data on Tuesday as the next major release.

- NZ-US and NZ-AU 10-year yield differentials closed little changed. Nevertheless, At +80bp and +96bp respectively, the differentials remain close to their widest levels for the year.

- US tsys are dealing flat to slightly cheaper across major benchmarks in the Asia-Pac session so far. Ranges have been modest ahead of US Non-Farm Payrolls data later today. Bloomberg consensus expects +170k versus +187k prior. The unemployment rate is forecast to dip to 3.7% from 3.8% prior.

- The swaps curve has bull-steepened, with rates 2bps lower to flat.

- RBNZ dated OIS pricing is 1-5bps softer for meetings beyond November. Terminal OCR expectations sit at 5.74% (+24bps) for Apr’24.

FOREX: USD Ticks Higher, As the Market Awaits Non-Farm Payrolls

The dollar has ticked modestly higher, as the market awaits the non-farm payroll print later in the US time zone. The BBDXY last close to 1274.20, a touch above NY closing levels from Thursday.

- Cross asset signals have been fairly muted, with US yields back near flat, after rising modestly in the first part of trade. Upticks in oil have generally been sold by the market. It's a similar backdrop for US equity futures, which are close to flat for the major benchmarks.

- USD/JPY sits slightly higher, last near 148.75, close to session highs. Earlier data showed weaker than expected real wages growth, albeit with some offset from better than forecast household spending. Speculation continues on the next BoJ policy shift. The latest piece from the MNI policy team suggests YCC could be scraped by next April (see this link).

- AUD/USD has outperformed modestly, last near 0.6370. A better regional equity backdrop, led by HK has probably helped at the margins. The RBA Financial Stability Review focused on household stress under the higher interest rate burden, but didn't paint an alarming picture.

- NZD/USD was last near 0.596, down slightly, while EUR/USD is around 1.0540 in recent dealings.

- Looking ahead, outside of nonfarm payrolls, German factory orders, Italian retail sales and the Canadian jobs report are also on the docket. Meanwhile, Fed's Waller is set to speak.

EQUITIES: Hong Kong Markets Rebound Ahead Of China's Return On Monday

Most Asia Pac markets are firmer in Friday trade to date. Gains have been led by Hong Kong markets, with more modest gains seen elsewhere. Japan markets are more mixed. US futures have traded relatively tight ranges. Eminis were last near 4289, down slightly, while Nasdaq futures were flat. We do have the US Non-farm payroll print coming up later in the US time zone.

- The HSI is around +1.85% firmer, slightly down on session highs. Gains have been broad based, although liquidity has been quite low. However, there is optimism around the return of China markets next Monday.

- On balance, China data has been better than expected of late, which has seen some sell-side analysts upgrade growth projections. Anecdotes around strong China spending over this week's holiday period is also aiding sentiment. The HS China Enterprise index is up 1.90%.

- Japan stocks are mixed, the Topix is +0.15%, but the Nikkei 225 off -0.30%. Both the Kospi and Taiex are around 0.35% higher at this stage.

- Australia's ASX 200 is +0.50%, buoyed by the materials sector. The large miners are higher after headlines crossed that China's iron ore buying conglomerate (China Mineral Resource Group) is in talks with the companies over next year's supply.

- SEA markets are mostly higher, with Thailand stocks lagging modestly.

OIL: Consolidates Ahead Of NFP, Tracking Sharply Down For The Week

Oil prices have tracked relatively tight ranges in the first part of Friday trade. Brent last near $84.30, after a modest move higher to $84.63/bbl earlier.

- Support was evident in NY trade on dips sub $84/bbl during Thursday trade, but we haven't tested this support point again. At this stage, Brent is tracking 11.5% weaker for the week, with today's modest +0.30% gain on pairing these losses modestly.

- For WTI we got near $83/bbl in early trade, but we sit back at $82.55/bbl in latest dealings. The benchmark contract is -9% down for the week.

- There has been little in the way of fresh macro news on the oil front today. Broadly steady trends in the USD and US rates ahead of the up coming payrolls print, could be keeping trading interest light today.

- For Brent, a break sub $84/bbl could see late August lows near $82/bbl targeted.

GOLD: Steady Ahead Of US Payrolls

Gold is slightly higher in the Asia-Pac session, after closing little changed at $1820.30 on Thursday, as the market awaited US Non-Farm Payrolls later today. Bloomberg consensus expects +170k in September payrolls versus +187k prior. The unemployment rate is forecast to dip to 3.7% from 3.8% prior.

- US Treasuries finished the NY session with a twist-steepening, pivoting at the 20-year, with yields 4bps lower to 3bps higher. There was little selling pressure from another tight reading on jobless claims and a narrower trade deficit, though a dovish tone from the Fed's Daly provided some support.

- SF Fed President Daly said, "If we continue to see a cooling labour market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work".

- According to MNI’s technicals team, the bearish theme in gold remains intact, with the metal trading just above this week’s low. The recent sell-off resulted in a break of support at $1901.1 and this was followed by a breach of $1884.9, the Aug 21 low. This confirmed a resumption of the downtrend that started in early May. The focus is on $1804.9, the Feb 28 low and a key support. On the upside, firm resistance is at $1884.3, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/10/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 06/10/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/10/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 06/10/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 06/10/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/10/2023 | 1230/0830 | *** |  | US | Employment Report |

| 06/10/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 06/10/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.