-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI Global Morning Briefing

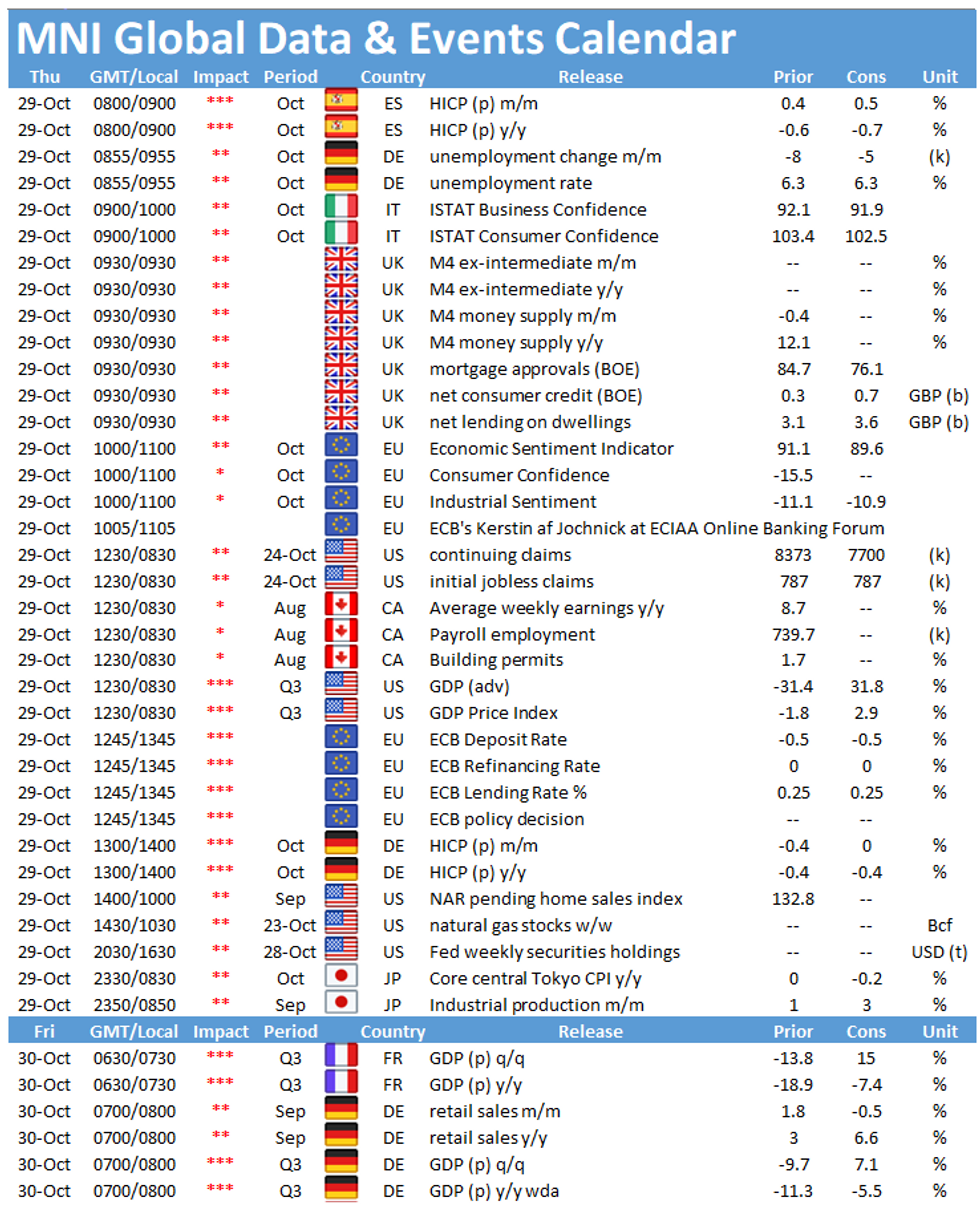

Thursday's calendar sees several interesting data releases throughout the day, including the publication of the European Commission's Economic Sentiment Indicator at 1000GMT. At 1245GMT, the ECB's latest interest rate decision will be closely watched, while in the US the release of the first estimate of Q3 GDP will be in focus at 1230GMT.

EZ ESI seen declining in October

After five consecutive months of increase, the EZ ESI is forecast to ease slightly to 89.6 in October, down from 91.1 recorded in September. The index remained below the pre-crisis level despite the recent upticks. Consumer sentiment is seen in line with the flash result showing a downtick to -15.0 in October. While industrial sentiment is expected to improve further to -10.9, service sentiment is seen deteriorating to -14.2 amid the resurgence of Covid-19 cases. Social distancing measures have been strengthened as a result of rising infections numbers. This weighs heavily on the service sector and therefore on service sentiment. Moreover, the fear of unemployment and the uncertainty regarding the state of the economy keeps consumers remain cautious.

ECB likely to wait before it acts in December

The European Central Bank meets Thursday amid an ever-worsening resurgence of Covid-19 cases and signs the economy has not only slowed in early Q4 but looks in danger of recording another period of contraction. The ECB has two policy meetings left in 2020 and the October meeting comes without the accompaniment of a set of staff projections.

With a slowdown and pick-up in infections already part of the ECB thinking - although perhaps not quite this early into the autumn months - there is still the likelihood policymakers will stand pat in October, leaving the PEPP envelope unchanged at E1.35 trillion. However, there is a growing chance they could signal an increase in the PEPP or APP (or indeed both) at the December meeting to help stave off the slowdown and the growing deflationary risk.

US GDP expected to rebound sharply

The U.S. economy is set to rebound sharply in the third quarter, with markets forecasting Q3 GDP to grow by an annualized 31.8% following a record-setting 31.4% decline in Q2. Growth last quarter likely stems from significant job gains through the summer and savings from government stimulus checks in the spring.

The highlight of the events calendar on Thursday is ECB's Kerstin af Jochnick speaking at ECIAA Online Banking Forum and President Christine Lagarde's press conference following the ECB policy decision.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.