-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Flash PMIs to the fore

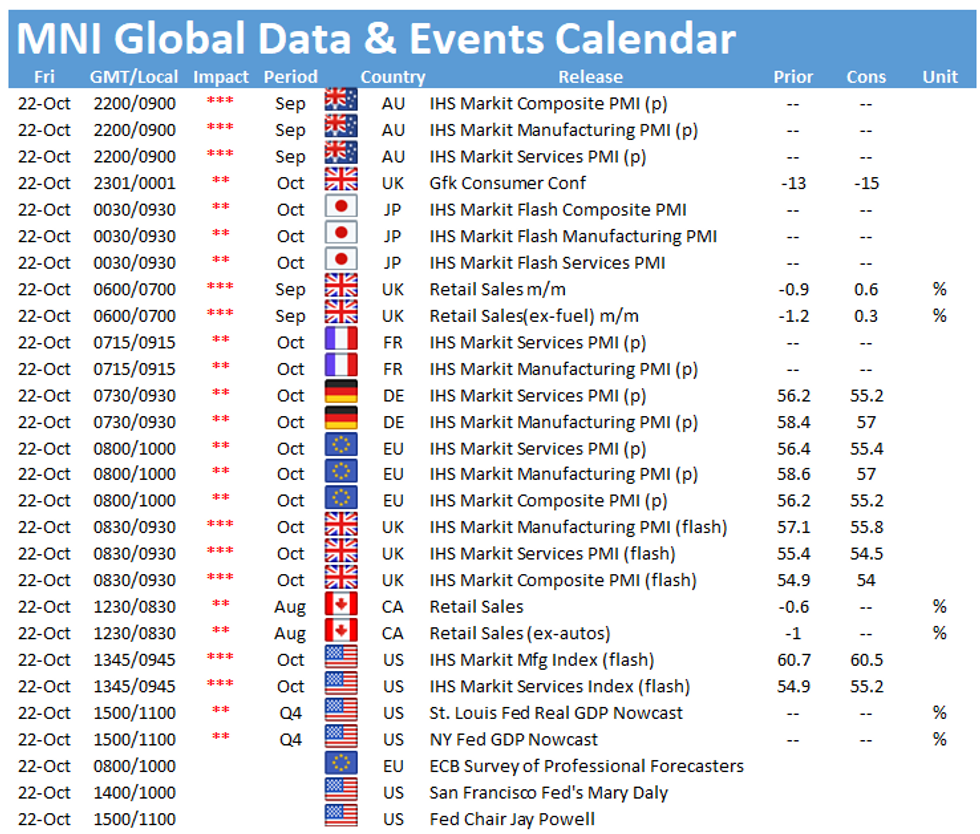

Global flash PMIs will be the eagerly anticipated data Friday, with early looks at the current economy standing across the eurozone, UK and US. The UK consumer also comes into focus.

UK Retail sales higher, but disappointment risk (0700 BST)

UK retail sales likely edged modestly higher in September from the previous month according to City forecasters, but disappointing accounts from industry insiders suggest a degree of downside risk to that outlook, according to MNI's latest Realty Check.

Even a surprise to the upside is unlikely to prevent retailing from exerting a negative influence on overall third quarter output. After falling by 0.9% in August -- extending a 2.8% plunge in July -- sales must rise by an almost-unprecedented 12% in September to keep volumes in the black in the third quarter.

Analysts expect overall sales to rise by 0.6% m/m, with ex-fuel sales up 0.3% m/m. On year, total sales are expected to be 0.4% lower than September 2020, with ex-fuel sales lower by 1.6%.

Petrol sales are a wildcard in the September data. While many drivers – particularly in the southeast – were unable to fill up their tanks, others may have purchased higher volumes than usual following reports of shortages, due to a paucity of HGV drivers.

Furthermore, widespread coverage of shortages may have dampened consumer confidence, according to some industry leaders. That was backed up by overnight data from GFK, which showed UK consumer confidence slump to -17 from -13 in September and -8 in August.

Russia central bank set for hike (1130 BST)

The CBR are likely to opt for a larger rate hike of 50bps this month to face off a near-term inflation spike that's put price rises ahead of the bank's forecasts, MNI's Emerging Markets team write. Analysts are relatively evenly split in forecasting a 25 or 50bps rate rise, but even those that do see smaller 25bps hike also acknowledge the risk of a larger move.

The recent acceleration in inflation makes tightening a near certainty this month, with both headline and core CPI continuing to trend higher across September. Headline and core printed at 7.4% & 7.6% y/y respectively - topping the CBR's forecast for a cyclical peak at 6.9%. Both a 25bps and a 50bps rate hike would likely meet the CBR's pledge to take more standard steps on the policy rate as the bank awaits a moderation of CPI into the second half of next year.

The main speaker on deck Friday id Federal Reserve Chairman Jay Powell, with SF Fed President Mary Daly also set to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.