-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Another Weekend Deadline Hits GBP

HIGHLIGHTS:

- GBP softer ahead of yet another weekend deadline

- Equities making very slow progress

- Congress eyes a working weekend

US TSYS SUMMARY: Drifting Lower As Congress Eyes A Working Weekend

Treasuries have traded within Thursday's ranges and on light volumes so far Friday, coming off session highs as Europe traders came in, with equities reversing Asia-Pac losses. As ever, we await developments on the fiscal front.

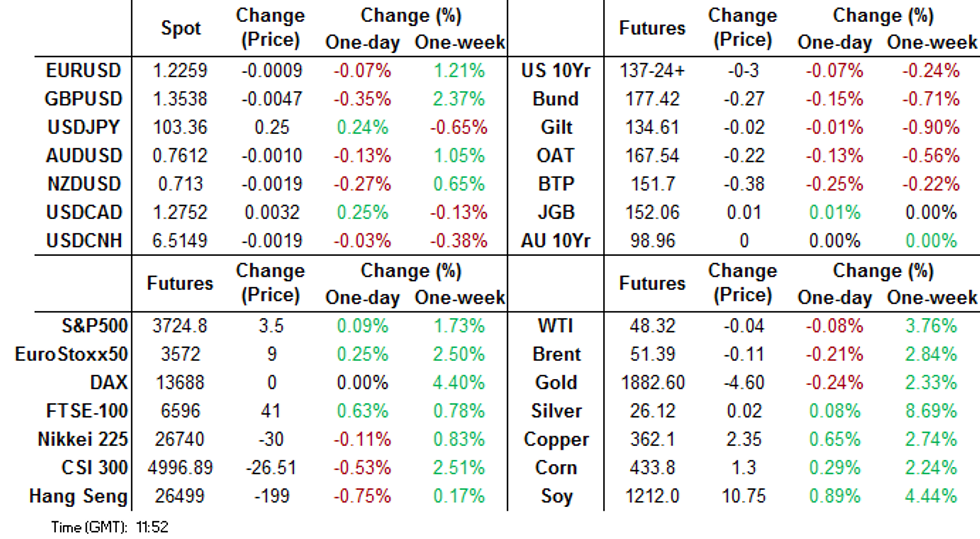

- Very little movement in the curve. The 2-Yr yield is unchanged at 0.121%, 5-Yr is unchanged at 0.3782%, 10-Yr is up 0.7bps at 0.9396%, and 30-Yr is up 0.9bps at 1.6891%.

- Mar 10-Yr futures (TY) down 2.5/32 at 137-25 (L: 137-24 / H: 137-30.5), very light volumes (~153k).

- Fox's Chad Pergram summed up the state of play earlier: "Work continues behind the scenes on coronavirus bill. Still no bill text. Government funding expires tonight at 11:59:59 pm et. Interim bill likely to avert shutdown tonight. Weekend work likely in Congress to finish up"

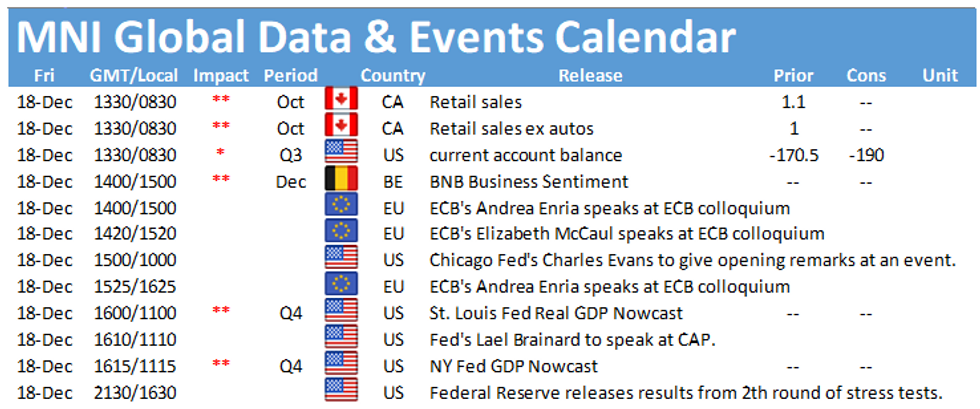

- In Fed speakers, Chicago's Evans speaks at 1100ET (not on econ / mon pol though), Gov Brainard at 1110ET (on "Climate Change and Financial Regulation").

- Limited data slate, with current account (0830ET) and Conf Board leading index (1000ET).

- No supply. NY Fed buys 0-2.25Y Tsys for ~$12.825bn.

EGB/GILT SUMMARY: EGBs broadly weaker

EGBs have broadly traded weaker this morning while gilts have rallied alongside cautious trading in equities.

- Gilt yields are now 2-3bp lower on the day with the curve marginally flatter. The Mar 21 gilt future trades at 134.67, near the middle of the day's range (L: 134.53 / H: 134.82).

- Bunds have traded weaker with yields ~1bp higher across the curve.

- OATs have slightly underperformed bunds on the day.

- BTPs have similarly sold off with cash yields pushing up 2-3bp.

- The EU's chief Brexit negotiator Michel Barnier today warned that there was just hours left to reach a trade agreement with the UK.

- Supply this morning came from the UK (bills, GBP5.0bn).

- The December German IFO data came in slightly above expectations.

EUROPE OPTION FLOW SUMMARY

UK:

LZ1 99.87/100.00/100.12c fly, bought for 3.5 in 1k

LM1 100.12/100.37cs vs LH1 100.00/100.25cs, bought the June for 0.5 in 13k

Eurozone:

IKF1 151/150.5ps 1x2, bought for 1 in 645

DUG1 112.30/112.20ps, bought for 4 in 2k

FOREX: GBP Extending Pullback Ahead of Another Weekend Deadline

After a particularly positive first half of the week, GBP is softer early Friday, extending the pullback that began in late US hours after Boris Johnson warned there was still a distinct possibility of No Deal should the EU not move further on rules surrounding fisheries post-transition. Betting markets have pared the implied odds of a trade deal being struck by the end of the year to 66%, from around 80% mid-week. GBP/USD has mirrored the sentiment, briefly showing below the $1.35 handle pre-NY hours.

The greenback trades somewhat firmer, with the dollar gaining against most others in G10, recovering from the Fed-induced weakness seen throughout the Thursday trading day.

Focus turns to Canadian retail sales, US leading index data and a speech from Fed's Brainard.

Expiries for Dec18 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1850(E765mln), $1.1950(E608mln), $1.2000(E2.6bln), $1.2025(E896mln), $1.2100-05(E1.3bln), $1.2115-25(E1.3bln), $1.2150(E1.6bln), $1.2170-80(E870mln), $1.2200(E875mln), $1.2225-30(E668mln), $1.2250(E2.2bln), $1.2300-10(E880mln)

USD/JPY: Y101.00($550mln), Y101.75($500mln), Y101.90-05($1.0bln), Y103.50-60($655mln), Y104.00($614mln), Y104.15-25($882mln), Y104.50($835mln), Y105.10-15($631mln), Y106.65($1.8bln)

GBP/USD: $1.3450-65(Gbp530mln)

EUR/GBP: Gbp0.9300(E500mln)

USD/NOK: Nok8.50($400mln), Nok8.75($550mln)

AUD/USD: $0.7485(A$526mln), $0.7500(A$1.45bln), $0.7550-70(A$798mln)

USD/CAD: C$1.2675($520mln), C$1.2750-55($1.4bln mixed, $1.35bln USD puts), C$1.2825($605mln), C$1.2950($905mln), C$1.3000($856mln), C$1.3050($648mln), C$1.3150($1.0bln)

USD/CNY: Cny6.50($555mln), Cny6.55($635mln), Cny6.58($760mln)

USD/MXN: Mxn19.50($1.95bln-USD puts), Mxn20.00($2.4bln-USD puts), Mxn20.50($1.3bln)

TECHS: Price Signal Summary - USD Downtrend, Commodity And Equity Uptrend, Intact

- In the FX space, USD outlook remains bearish.

- EURUSD attention is on 1.2293 next, Apr 23 high, 2018.

- Cable is softer as Brexit nerves weigh on the pair. Sterling is likely to remain volatile. Support to watch is at 1.3364, the 20-day EMA.

- EURGBP support at 0.8983, Dec 4 / 17 low has survived a test this week. This level is a key intraday pivot level - bullish above, bearish below.

- On the commodity front, Gold maintains a bullish tone. The focus is on $1918.2, 76.4% retracement of the Nov 9 - 30 sell-off. Brent (G1) targets $52.00 and $53.15 next. The latter is the 1.000 projection of the Nov 16 - 25 rally from Dec 2 low. In WTI (G1) gains have opened $50.00.

- Key support today in Bund (H1) lies at 177.21, trendline drawn off the Nov 11 low. Gilts (H1) have thus far held above support at 134.10 76.4% retracement of the Dec 2 - 11 rally. This level remains exposed.

- Finally, the equity indices needle still points north. The S&P E-Mini objective is 3728.88, 1.50 projection of Sep 24 - Oct 12 rally from Oct 30 low.

EQUITIES: Slow Progress

Stock markets are gradually progressing early Friday, with core European stocks outperforming marginally while Spanish stocks sag, shedding around 0.5% ahead of NY hours.

In Europe, healthcare and communication services names are top of the pile, while real estate, energy and utilities stocks are anchored.

US equity futures are far more muted, with the e-mini S&P sitting either side of unchanged ahead of the opening bell. Today's quadruple witching could trigger some volatility headed through the opening/closing bell Friday.

COMMODITIES: Oil Markets Pause, Precious Metals Offered

After a solid finish Thursday across both energy and precious metals products, Friday's early trade has been far more muted with both WTI and Brent crude futures in very minor negative territory, while gold and silver shed 0.3 - 1.0%.

The stronger USD this morning is largely responsible, which is paring back some of the Fed-induced losses suffered in the second half of this week.

50-dma could provide some support going forward for spot gold, crossing today at $1871.59, with yesterday's highs the initial upside target at $1896.26.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.