-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoE, ECB Rate Hikes Look Nailed On

Highlights:

- BoE, ECB look nailed on for a 50bps hike

- USD holding post-Fed downtick, as markets watch Fed rate cut pricing

- Weekly jobless claims, factory orders make up rest of the schedule

US TSYS: Awaiting BoE and ECB, With Earnings Deluge Adding To The Mix

- Cash Tsys pause for breath in the short gap between yesterday’s FOMC decision and its perceived dovish press conference (which saw 2YY close ~10bps lower on the day), followed quickly by both the BOE (0700ET) and ECB (0815ET) decisions today.

- Earnings should add to the mix as well, with reports today alone accounting for 18.4% of the S&P 500 total market cap, the most significant session of the quarter (including Apple, Amazon, Alphabet after the bell).

- 2YY +0.2bp at 4.108%, 5YY -1.7bp at 3.498%, 10YY -1.1bp at 3.406% and 30YY -0.6bp at 3.560%.

- TYH3 trades 2 ticks lower at 115-13+ on modestly above average volumes, remaining close to yesterday’s high of 115-19 after which sits 115-21 (Jan 20 high).

- Data: Preliminary Q4 data for ULCs/productivity headline the docket (0830ET) but also see challenger job cuts for Jan (0730ET) and factory orders for Dec (1000ET) plus usual weekly jobless claims (0830ET).

- Bill issuance: US Tsy $75B 4W, $60B 8W bill auctions (1130ET)

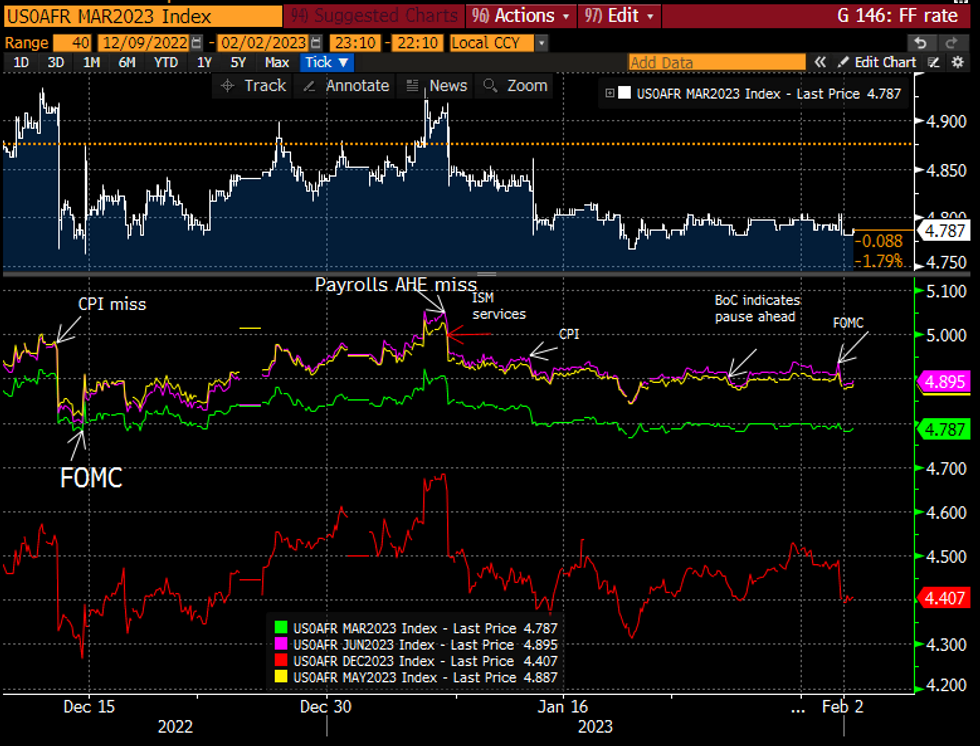

STIR FUTURES: Fed Rate Path Holds Post-FOMC Renewed Cut Expectations

- Fed Funds implied hikes have only chipped away at yesterday’s push lower with the press conference.

- 20.5bp for Mar, a cumulative 30bp for May and 31bp to technically a terminal 4.90% Jun before cutting to 4.40% in Dec.

- The more notable move remains increased cut expectations in 2H23, shifting from 44bps to 49bps from the June peak to Dec. However, this is still similar to levels seen in days after last month’s payrolls & ISM services miss (ahead of both reports due tomorrow).

- First though, clear potential for spillover from the BoE and then ECB decisions.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

EUROPE ISSUANCE UPDATE

SPAIN AUCTION RESULTS: Relatively strong auctionThe Spanish auction saw a relatively strong result with the LAP above the pre-auction mid-prices for all bonds on offer. In fact, the LAP was higher than at any time during the last 55 minutes ahead of the auction close for all of the bonds sold.

In terms of bid-to-covers these were generally in line with prior auctions. All in all, a relatively strong auction with close to the mid-point of the target amount sold. Overall, we would say a bit stronger than the second January auction but weaker than the first auction of the year.

- E2.4bln of the 2.80% May-26 Bono. Avg yield 2.919% (bid-to-cover 2.33x).

- E1.611bln of the 1.40% Apr-28 Obli. Avg yield 2.887% (bid-to-cover 2.1x).

- E1.983bln of the 3.45% Jul-43 Obli. Avg yield 3.649% (bid-to-cover 1.84x).

- E505mln of the 1.00% Nov-30 Obli-Ei. Avg yield 0.876% (bid-to-cover 2.14x)

A strong LT OAT auction with the stop prices above the price seen at any point during the auction window and with the full E11.5bln sold (top of target range). There was also decent bid-to-covers seen across all three OATs on offer.

- E4.144bln of the 0% Nov-31 OAT. Avg yield 2.59% (bid-to-cover 1.74x).

- E4.568bln of the 2.00% Nov-32 OAT. Avg yield 2.68% (bid-to-cover 2.09x).~

- E2.775bln of the 0.50% Jun-44 Green OAT. Avg yield 2.94% (bid-to-cover 1.98x).

EQUITIES: Most Consequential Session of the Quarter For Earnings

- The most significant session of the quarter for the US earnings cycle today, with reports from Bristol-Myers Squibb, Conocophillips, Eli Lilly & Merck due pre-market, while Apple, Amazon, Alphabet, Qualcomm and Starbucks are due after the bell (among others).

- Reports today alone account for 18.4% of the S&P 500 total market cap.

- Most notable pre-market mover after earnings Wednesday is Meta Platforms, up 19% at typing, and looking to add $75bln in market cap at the open today.

- Full schedule including timings, EPS & revenue expectations here: https://roar-assets-auto.rbl.ms/files/50900/MNIUSE...

FOREX: Greenback Remains Underwater Post-Fed, With Attention Shifting to Lagarde

- The greenback is maintaining the post-Fed losses, with the USD Index holding underwater for much of the European morning. The index is around 0.8% off the Powell press conference highs, but has clawed back a small part of the losses posted overnight.

- Growth proxies and high beta currencies are favoured this morning, putting NZD and SEK at the top of the G10 pile. NZD/USD's overnight print of 0.6538 marked the highest level since early June last year, opening next resistance at $0.6576.

- Meanwhile, EUR/SEK sits lower but holds close to the cycle highs printed this year at 11.4022. A hawkish turnout for the ECB could tilt the cross back above this level, putting EUR/SEK on track to test the pandemic high at 11.4262.

- Focus rests on central banks for the rest of the Thursday session, with the Bank of England decision due first at 1200GMT/0700ET, followed by the ECB at 1315GMT/0815ET. Both banks are seen raising rates by a 50bps clip today, with attention turning to their subsequent press conferences for clues on the future trajectory for rates.

- Outside of central banks, weekly US jobless claims data is also due, as well as factory orders for December.

EUR/GBP: Overnight Vols At Highest Since Truss Budget Event

- EURGBP overnight vols add to yesterday's gains as the market captures the potential fallout from both the ECB and BoE decisions later today. Implied vols are now either side of 17 points, and the highest level since the Truss budget event in September/October last year.

- ATM straddle now breaks even on a swing of ~65pip swing in the cross, a move that would put EUR/GBP at fresh multi-month highs (narrowing the gap with 0.9266 resistance) or, alternatively, on track to test 0.8845 Fibonacci support.

- Cross is currently pinned between relatively small expiries at 0.8900(E187mln) and 0.8925(E150mln), with greater interest at 0.8840 at Friday's NY cut (E673mln) and 0.8850 on Tuesday (E521mln).

NOK: EUR/NOK YTD Gains Highest Since 2004 ex-Pandemic

- EUR/NOK continues to push to fresh cycle highs this week, making 2023 the poorest start to the year for NOK ex-pandemic since 2004. The move lower for NOK coincides with markets pricing a lower peak rate for the Norges Bank in 2023, with 3m FRAs factoring out over 50bps in tightening since peak pricing in September last year.

- The cross also received a notable boost from the higher-than-expected FX purchase op timetable on Tuesday, with NOK 1.9bln in FX to be bought per day across February, vs. Exp. NOK 1.5bln

- March 23rd's Norges Bank rate decision will be accompanied by fresh path projections and could mark the final tightening step of this cycle (January guidance: "we will most likely raise the policy rate in March"). Focus will turn to the expected pivot point for the policy rate, with December projections eyeing Q1 2024 for possible rate cuts.

- Next upside levels cross at the 11.00 figure, 11.1748, the 1.00 projection of the Aug 25 - Sep 30 - Nov 4 price swing as well as the late 2020 recovery highs at 11.2113.

FX OPTIONS: Expiries for Feb02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0580-00(E1.1bln), $1.0750(E669mln), $1.0855-60(E586mln), $1.0895-10(E1.1bln), $1.0925-50(E741mln), $1.1150(E744mln)

- USD/JPY: Y127.00($1.4bln), Y128.90-05($1.0bln), Y129.30-50($1.3bln), Y130.00($1.8bln), Y131.55-75($1.0bln)

- GBP/USD: $1.2315(Gbp560mln)

- USD/CNY: Cny6.9500($1.2bln)

EQUITIES: E-Mini S&P Trend Points North Ahead of Key CBs and Earnings Reports

The EUROSTOXX 50 futures trend needle points north. The contract has pierced resistance at 4206.00, the Jan 18 high. A clear break would confirm a resumption of the current uptrend and pave the way for gains towards 4230.50, the Feb 1 2022 high. Note that the trend remains overbought. A pullback, if seen, would represent a healthy correction. A break of 4097.00 would signal the start of a short-term bear cycle. S&P E-Minis traded higher Wednesday and in the process cleared recent highs to confirm a resumption of the current bull cycle that started Dec 22. The break exposes the key resistance and bull trigger at 4180.00, the Dec 13 high. Clearance of this level would confirm resumption of a broader uptrend and open 4250.00, the Aug 26 2022 high. Initial firm support has been defined at 4007.50, the Jan 31 low.

- Japan's NIKKEI closed higher by 55.17 pts or +0.2% at 27402.05 and the TOPIX ended 7.06 pts lower or -0.36% at 1965.17.

- Elsewhere, in China the SHANGHAI closed higher by 0.749 pts or +0.02% at 3285.67 and the HANG SENG ended 113.82 pts lower or -0.52% at 21958.36.

- Across Europe, Germany's DAX trades higher by 206.81 pts or +1.36% at 15441.34, FTSE 100 higher by 25.74 pts or +0.33% at 7798.09, CAC 40 up 39.53 pts or +0.56% at 7147.51 and Euro Stoxx 50 up 42.34 pts or +1.02% at 4227.22.

- Dow Jones mini down 42 pts or -0.12% at 34113, S&P 500 mini up 20.25 pts or +0.49% at 4152.75, NASDAQ mini up 171.25 pts or +1.38% at 12584.75.

COMMODITIES: Gold Clears January Resistances, Reaches Near 10-Month High Post-Fed

A sharp sell-off on Wednesday in WTI futures has reinforced current bearish conditions. The contract has breached support at $78.45 this week, the Jan 19 low. The move lower undermines the recent bull theme and a continuation would signal potential for an extension towards $72.74, the Jan 5 low. On the upside, the bull trigger has been defined at $82.66, the Jan 18 high. A break of this level is required to reinstate the recent bullish theme. Trend conditions in Gold remain bullish and the yellow metal traded higher Wednesday, clearing resistance at 1949.20, the Jan 26 high. This confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. The focus is on $1963.0, a Fibonacci retracement. Initial firm support to watch lies at $1906.8, the 20-day EMA and $1900.9, the Jan 31 low. A break of this zone would signal a short-term reversal.

- WTI Crude up $0.2 or +0.26% at $76.35

- Natural Gas up $0.03 or +1.22% at $2.503

- Gold spot up $6.56 or +0.34% at $1955.4

- Copper up $4.55 or +1.11% at $415.95

- Silver up $0.33 or +1.37% at $24.2015

- Platinum up $9.87 or +0.98% at $1015.56

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 02/02/2023 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/02/2023 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/02/2023 | 1345/1445 |  | EU | ECB Press Conference following Rate Decision | |

| 02/02/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/02/2023 | 1830/1930 |  | EU | ECB Lagarde Speech at Franco-German Business Awards | |

| 03/02/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 03/02/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/02/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/02/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/02/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/02/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/02/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/02/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2023 | 1215/1215 |  | UK | BOE Pill & Shortall MPR National Agency Briefing | |

| 03/02/2023 | 1300/1400 |  | EU | ECB Elderson Speech at Climate Outreach Event | |

| 03/02/2023 | 1330/0830 | *** |  | US | Employment Report |

| 03/02/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.