-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Dollar Firmer, Curve Flatter Pre-CPI

Highlights:

- CPI seen as pivotal for Fed's decision-making in December

- Dollar firmer, curve flatter pre-CPI

- China Politburo meeting retains zero covid stance

US TSYS: Bear Flattening Ahead of CPI, Fedspeak and 30Y Supply

- Cash Tsys see a bear flattening after a sharp rally into yesterday’s close, with the front-end retracing more of the move as the Fed rate path drifts higher helped by Kashkari (’23 voter) pushing back on pivot talk. China’s top leadership saying it can’t relax necessary Covid measures and urges more precise, targeted Covid control took the wind out of the cheapening and more so the long end with the reduced growth implications.

- 2YY +2.5bps at 4.606%, 5YY +1.4bps at 4.255%, 10YY +0.8bps at 4.092%, 30YY -0.1bps at 4.268%.

- TYZ2 trades 6+ ticks higher at 110-17 off a session high of 110-25+ as it came closer to resistance at 111-09 (Nov 2 high), although the trend needle still points south with support seen at 109-10+ (Nov 4 low).

- Data: CPI, real av earnings and jobless claims at 0830ET, monthly budget statement 1400ET

- Fedspeak: Harker (’23 voter, text) 0900ET, Logan (’23, text) 0935ET, Daly (’24) 1100ET, Mester (’22) 1230ET and George (’22) 1330ET with text tbd for latter two.

- Bond issuance: US Tsy $21B 30Y Bond auction (912810TL2) – 1300ET

- Bill issuance: US Tsy 13W, 26W bill auctions – 1130ET

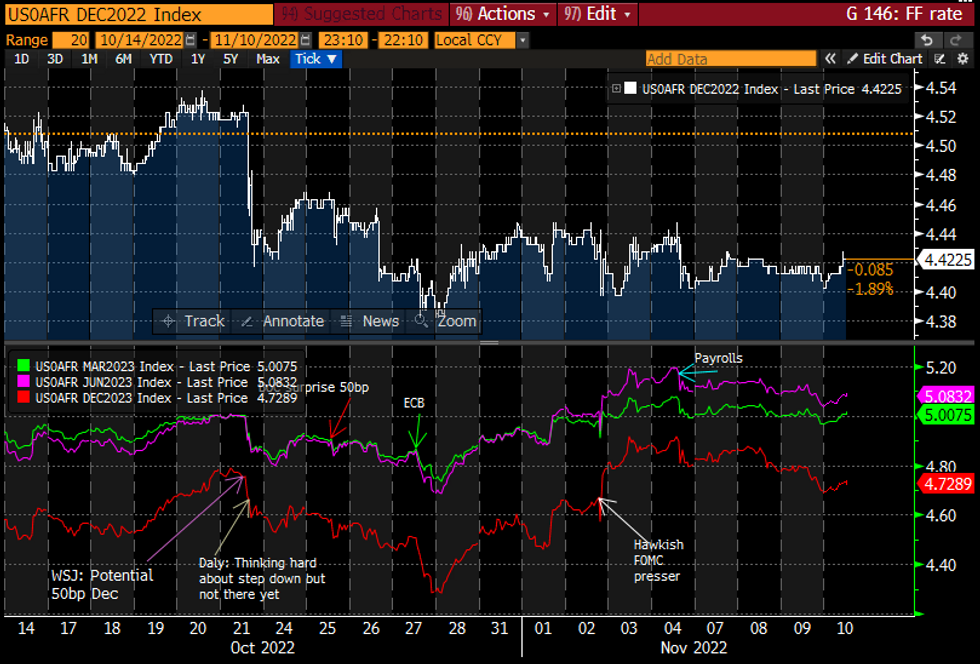

STIR FUTURES: Fed Path Re-Firms Ahead Of CPI, Stacked Fedspeak Follows

- Fed Fund implied hikes have pushed back higher overnight, retracing yesterday’s decline albeit not completely in 2H23.

- Buoyed by Kashkari (’23) saying late yesterday any talk of Fed pivot entirely premature ("There's a lot of talk in the public about will we raise rates by 50 basis points, 75 basis points [in Dec]? Those are certainly going to be on the table, but could it something beyond that? It's possible too.") with only modest net impact on terminal from China’s top leadership urging more precise, target Covid control.

- 57.5bp for Dec (+1bp), cumulative 96.5bp to 4.81% for Feb (+2.5bp), terminal 5.08% for May/Jun’23 (+4.5bp) and 4.73% for Dec’23 (+3.5bp).

- Fedspeak: Harker (’23 voter, text) 0900ET, Logan (’23, text) 0935ET, Daly (’24) 1100ET, Mester (’22) 1230ET and George (’22) 1330ET with text tbd for latter two.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

MNI CPI Preview - Can Cars Drive A Core CPI Slowdown?

- Re-sending ahead of US CPI at 0830ET.

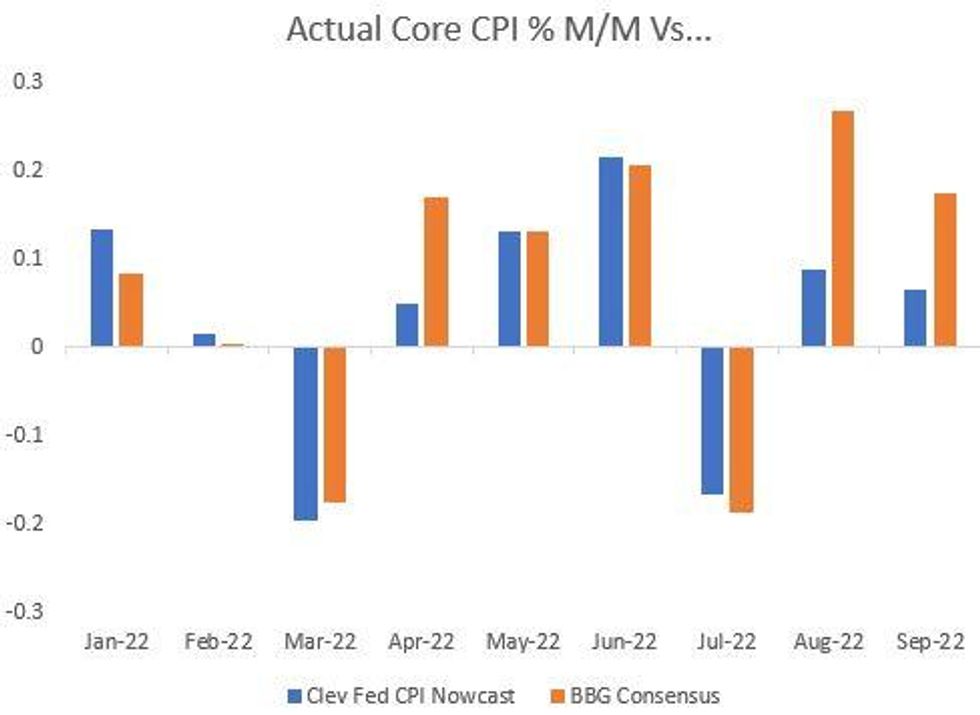

- Core CPI inflation is seen slowing slightly to 0.5% M/M in October after surprise persistence at 0.58% in Sept. The analyst survey is skewed slightly lower although the Cleveland Fed Nowcast implies upside risk.

- A similar 0.1-0.2pt beat to last month could see a delay in the Fed’s anticipated downshift to 50bp hikes into 2023 or augur a longer string of hikes, either way pushing the terminal rate higher still and driving a sharp flattening in the Treasury curve.

FULL REPORT: https://roar-assets-auto.rbl.ms/documents/20127/USCPIPrevNov2022.pdf

US: Will Consensus Underestimate Core CPI Again?

Reminder ahead of the October CPI release (0830ET) that consensus has underestimated core CPI in 5 of the last 6 months (July's reading missed to the downside).

- The Cleveland Fed's core CPI % M/M nowcast has also missed in each of those months and in the same direction as consensus.

- But the nowcast has been at least as good as the BBG median over that period (and much closer to the mark for the Aug and Sep data). See chart.

Source:BBG, Cleveland Fed, MNI

Source:BBG, Cleveland Fed, MNI

FOREX: Greenback Firmer, But Within Recent Ranges, Ahead of Critical Inflation Release

- The greenback is among the strongest currencies in G10 ahead of the CPI release later today, with markets pre-positioning and gearing for the inflation data later today.

- The single currency is softer, with the EUR lower against all others as equities remain soft. European indices are off 0.1 - 0.3%, extending the softer stocks theme after the negative Wall Street close on Wednesday.

- The EUR weakness has prompted EUR/GBP to reverse the entirety of the Wednesday gains and keep prices within range of first support at the 0.8685 50-day EMA.

- Focus rests on the US inflation release due Thursday, with markets expecting CPI to have slowed to 7.9% on the year and 0.6% M/M.

- The release is seen as pivotal for the Fed's decision-making process headed into December, with a number of FOMC members already seeing an imminent slowdown in the pace of tightening from December onwards.

- Weekly jobless claims data is also due as well as the Banxico rate decision.

FX OPTIONS: Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.3bln), $0.9800(E1.7bln), $0.9860-75(E1.2bln), $0.9900(E1.3bln), $0.9950-55(E1.1bln), $0.9990-00(E2.5bln), $1.0050-70(E968mln), $1.0090-00(E1.7bln)

- USD/JPY: Y144.30-50($1.1bln), Y145.00($1.0bln), Y146.00-05($665mln), Y147.00($1.3bln), Y150.00($1.9bln)

- GBP/USD: $1.1225-30(Gbp586mln), $1.1450(Gbp787mln), $1.1600(Gbp969mln)

- EUR/GBP: Gbp0.8790-00(E620mln)

- AUD/USD: $0.6500(A$651mln)

- USD/CNY: Cny7.1500($3.0bln), Cny7.2000($2.0bln), Cny7.2700($6.5bln), Cny7.2820($4.5bln)

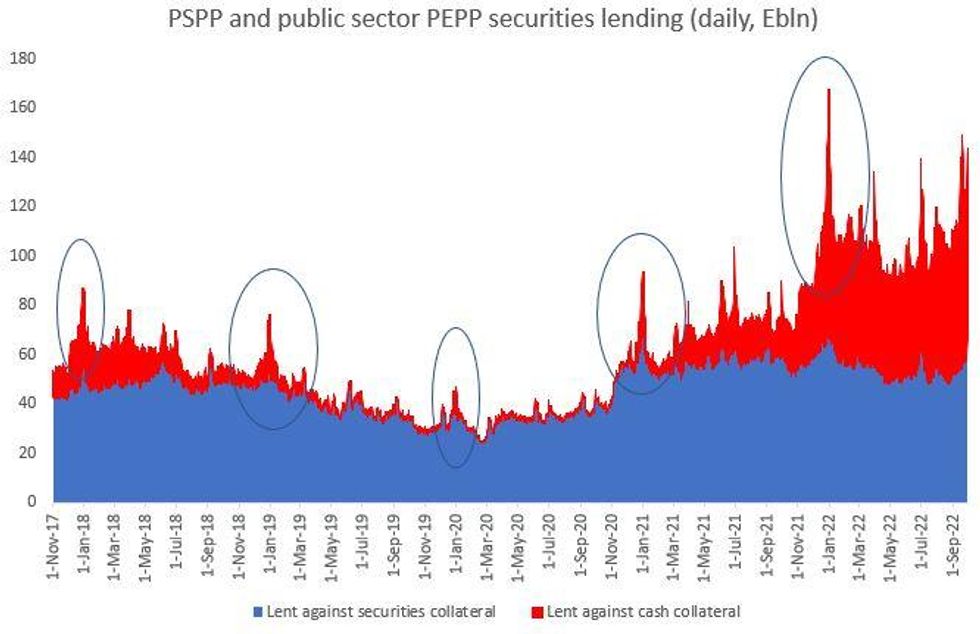

ECB: Cash Collateral Lending Takeup Has Been Elevated This Year

Further to the ECB's increase in the limit on securities lending vs cash to E250B from E150B this morning, here is a chart of the ECB securities lending against collateral (daily through Sept, Oct data will be out later this month).

- The year-end spikes in takeup are noted in the chart (as ECB's Schnabel said, this is a “precautionary measure to ease collateral scarcity and support market functioning around the year-end”), and the narrowing in ASW-bond spreads suggests that the market has taken some comfort from the announcement.

- At the last count, there was E77.1B lent against cash collateral (Sept 30th). The peak was E97.9B over year-end 2021.

- Overall, takeup has been much more elevated this year than in previous years amid collateral scarcity, averaging E60B daily over the most recent 3 months (through Sep).

Source: ECB, MNI

Source: ECB, MNI

CHINA: Politburo Standing Committee Holds Meeting On COVID-Xinhua

Chinese state outlet Xinhua reporting that the new Politburo Standing Committee, the most senior decision making body within the Chinese Communist Party, has held its first meeting with the spread of COVID-19 being the main subject.

- Xinhua: Top leadership says it is 'unwaveringly adhering to COVID dynamic zero policy', calls for 'more precise, targeted COVID control'.

- Says that leaders stressed intention to minimise impacts on the Chinese economy. Xinhua reports committee as saying the spread of COVID 'must be curbed as soon as possible so as to resume production and normal life'. 'Says it will avoid 'one-size-fits-all approaches', but that the country cannot relax 'necessary epidemic prevention measures'.

- Comes as authorities in the southern manufacturing hub of Guangzhou impose a lockdown on nearly 5mn of the city's residents until Sunday 13 November at the earliest.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/11/2022 | - |  | UK | House of Commons Recess Starts | |

| 10/11/2022 | 1300/1400 |  | EU | ECB Schnabel Discussion at at Bank of Slovenia | |

| 10/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/11/2022 | 1330/0830 | *** |  | US | CPI |

| 10/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 10/11/2022 | 1435/0935 |  | US | Dallas Fed's Lorie Logan | |

| 10/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/11/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 10/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/11/2022 | 1650/1150 |  | CA | BOC Gov Macklem speech, "The evolution of Canadian labour markets" | |

| 10/11/2022 | 1730/1230 |  | US | Fed Governor Loretta Mester | |

| 10/11/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/11/2022 | 1830/1330 |  | US | Kansas City Fed's Esther George | |

| 10/11/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/11/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 10/11/2022 | 2335/1835 |  | US | New York Fed's John Williams | |

| 11/11/2022 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 11/11/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 11/11/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/11/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/11/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/11/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/11/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/11/2022 | 1200/1300 |  | EU | ECB Panetta Speaks at ISPI | |

| 11/11/2022 | 1200/1300 |  | EU | ECB de Guindos Q&A at Encuentro de Economia en S'Agaro | |

| 11/11/2022 | 1310/1310 |  | UK | BOE Tenreyro Speech at Society of Professional Economists | |

| 11/11/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/11/2022 | 1600/1700 |  | EU | ECB Lane Panels Jacques Polak Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.