-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - ECB Hawks Sink Stocks

Highlights:

- Equities and rates sell off again as this week's hawkish central bank outcomes continue to be digested

- Weakness extended this morning as ECB hawks touted higher terminal rates and further 50bp hikes

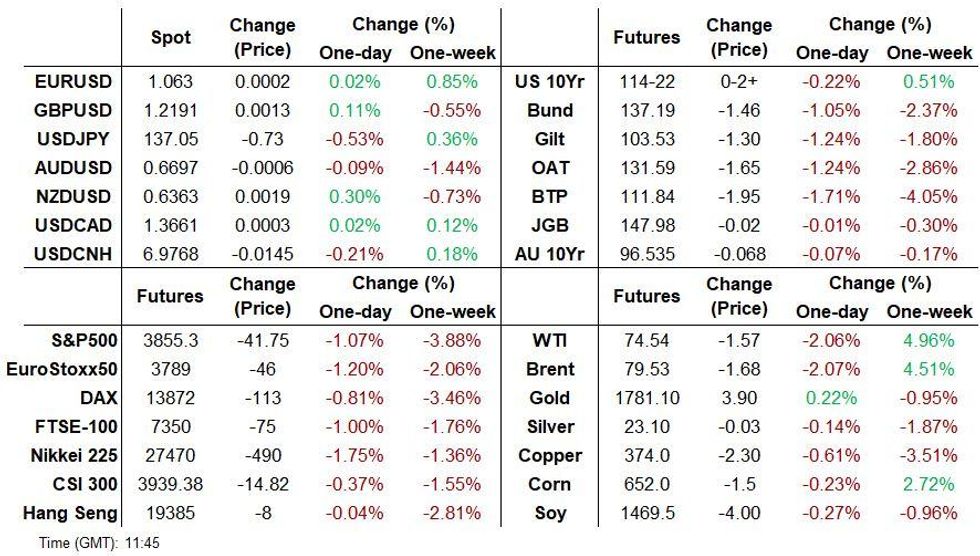

- Commodity prices are mostly lower, with oil off 2+%; USD is off overnight lows, now flat

- Attention turns to US PMIs and the first post-meeting FOMC commentary, including NY Fed's Williams

US TSYS AND RATES: Tsys Bear Steepen, But Outperform Europe

Treasuries have bear steepened overnight Friday, but only modestly compared to European counterparts which have been beaten down by continued hawkish ECB rhetoric this morning.

- Cash 10Y Tsys are about 10bp richer to Gilts this morning, and 7bp to Bunds.

- The 2-Yr yield is up 1.8bps at 4.2539%, 5-Yr is up 3.2bps at 3.6502%, 10-Yr is up 4.5bps at 3.4913%, and 30-Yr is up 4.2bps at 3.537%.

- In rates, Peak Fed funds are seen coming in May, at 4.89%, fairly steady vs Thursday's close, with a full 25bp cut priced by the Nov meeting.

- That's up from lows of around 4.80% pre-FOMC, but below the close to 5% peak seen just prior to the Nov CPI release.

- The Feb FOMC sees 32bp of hikes priced, roughly 72%/28% in favor of a 25bp vs 50bp move.

- We get the first post-December meeting FOMC communications this morning with a BBG TV appearance by NY Fed's Williams (0830ET), followed by a moderated discussion with SF Fed's Daly at 1200ET, and back on BBG TV at 1530ET, Cleveland's Mester.

- The only data is prelim PMIs at 0945ET.

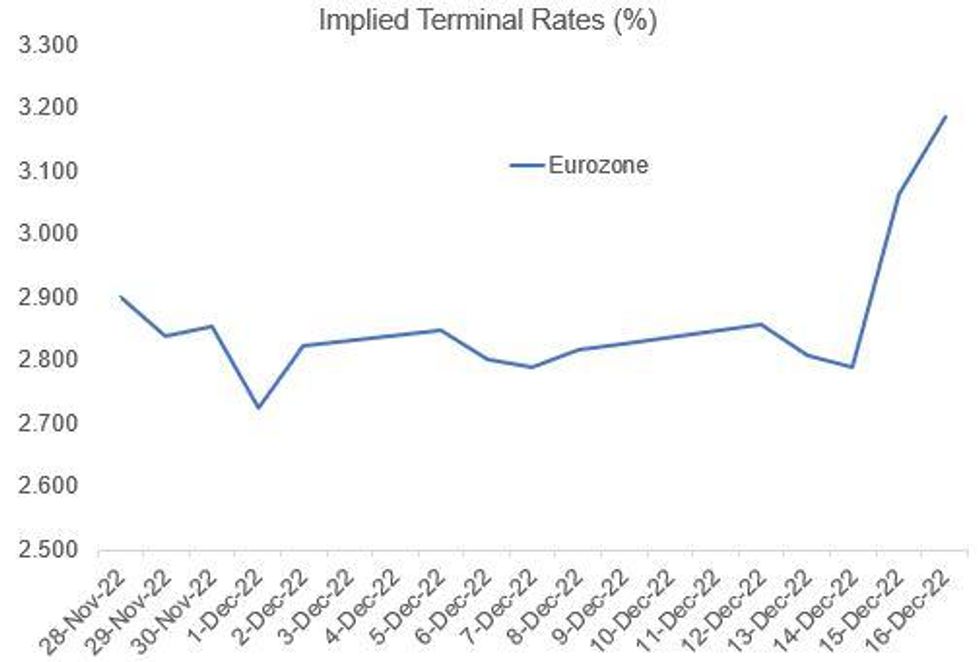

ECB: Markets Price Another 140bp In Hikes, Incl 100bp Through Next 2 Meetings

The ECB hawks sound triumphant this morning - with Rehn saying 50bp hikes likely In Feb and Mar, and he's "not convinced" markets are correctly pricing the terminal rate, echoes Lagarde's comments yesterday.

- It's not clear whether he's seen the latest pricing, which implies another 140bp in hikes from here to next September implying 3.40% terminal depo rates (and rising, as Rehn is speaking), as opposed to around 100bp pre-ECB meeting yesterday. But would guess he'd be happy with even more.

- Cumulative pricing through the next 2 meetings is a little under 100bp.

EGBs-GILTS: Europe Still Reeling From Hawkish ECB Signals

The ECB's hawkish messaging continues to sink European core FI, with Bunds underperforming early Friday.

- With ECB hawk commentary this morning (Holzmann, Rehn and others) pushing up the eurozone terminal rate to well above 3.

- The German curve has sharply bear steepened, with the UK's bear flattening. Most yields across Europe are up double-digits of basis points.

- Periphery EGBs are underperforming, with 10Y BTPs and GGBs another 12-13bp wider of Bunds.

- Also contributing to the weakness was stronger-than-expected overall Eurozone PMIs (Germany easily beat, France missed). UK Services PMI beat but manufacturing was on the weak side.

- US prelim PMIs are up later, and speaking later today are ECB's Knot and Centeno. SF Fed's Daly is our first scheduled post-FOMC speaker.

Latest levels:

- Mar 10-Yr US futures (TY) down 8/32 at 114-21.5 (L: 114-21 / H: 114-30.5)

- Mar Bund futures (RX) down 153 ticks at 137.12 (L: 137.06 / H: 138.62)

- Mar Gilt futures (G) down 146 ticks at 103.37 (L: 103.35 / H: 104.31)

- Italy / German 10-Yr spread 11.8bps wider at 220.1bps

FOREX: USD pares overnight losses

- The Dollar was trading in the red overnight and in early European trading, but the Greenback has pared losses given the continued Risk Off tone.

- The USD is now mostly in the green against G10, although the Yen and the Kiwi are still holding gains.

- Looks like the Yen has benefited from safe haven flow, given the collapse in Equities.

- The EUR is mixed despite one of the most Hawkish meeting from the ECB yesterday.

- Market participants are more concerned about faster recession risks as more ECB speakers join Lagarde for more 50bps hike going forward.

- ECB Rehn said that it is likely that Rates will rise by 50bps in February and in March.

- While Rate traders are pricing a 3.35% rate by September.

- Looking ahead, US prelim PMIs are the notable releases as we head into year end.

- ECB Centeno, Knot and Fed Daly are the remaining speakers.

FX OPTION EXPIRY

Of note:

EURUSD 1.45bn at 1.0600, 1.37bn at 1.0650, 1.52bn at 1.0700.

USDJPY 1.1bn at 137.00.

AUDUSD 1.98bn at 0.6700.

USDCAD 2.2bn at 1.3650/1.3715.

USDCNY 3.84bn at 7.00.- EURUSD: 1.0600 (1.45bn), 1.0650 (1.37bn), 1.0675 (300mln), 1.0700 (1.52bn).

- GBPUSD: 1.2100 (407mln), 1.2150 (477mln), 1.2200 (500mln).

- USDJPY: 136.00 (1.44bn), 137.00 (1.81bn).

- EURGBP: 0.8700 (526mln).

- USDCAD: 1.3600 (615mln), 1.3650 (439mln), 1.3690 (275mln), 1.3700 (869mln), 1.3710 (334mln), 1.3715 (289mln).

- AUDUSD: 0.6700 (1.98bn).

- NZDUSD: 0.6300 (444mln).

- USDCNY: 6.95 (550mln), 7.00 (3.84bn), 7.05 (894mln).

Price Signal Summary - E-Minis Candle Pattern And A Break Of Support Highlights A Reversal

- In the equity space, a strong rally in the S&P E-Minis Tuesday stalled at 4180.00. Thursday’s sell-off has reinforced a bearish threat and note that this also highlights the importance of a shooting star candle formation on Tuesday - a reversal signal. A continuation lower would open 3855.13, 50.0% retracement of the Oct 13 - Dec 13 uptrend. EUROSTOXX 50 futures traded sharply lower Thursday to extend the pullback from Tuesday’s 4037.00 high. This suggests potential for a deeper retracement with sights on the 50-day EMA, at 3794.10. A break of this average would signal scope for a continuation lower.

- In FX, EURUSD traded higher again Thursday, extending this week’s gains, before pulling back. The climb this week has confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. The focus is on 1.0736 next, the 2.382 projection of the Sep 28 - Oct 4 - 13 price swing. GBPUSD trend conditions remain bullish, however, Thursday’s strong sell-off signals a possible short-term top. Attention is on the first key support at 1.2107, the Dec 7 low. Clearance of this level would pave the way for a move towards 1.1901, the Nov 30 low. On the upside, key short-term resistance has been defined at 1.2446, the Dec 14 high. USDJPY traded higher Thursday and in the process, pierced resistance at 137.97, Tuesday’s high. The pair has also tested resistance at 138.02, the 20-day EMA. A clear break of this average, if seen, would signal scope for stronger recovery. This would open 140.00 and 140.34, the 50-day EMA. The bear trigger lies at 133.63.

- On the commodity front, trend signals in Gold remain bullish despite Thursday’s sell-off. Pullbacks are considered corrective and key short-term support to watch is $1765.9, Dec 5 low. The uptrend remains intact and scope is seen for gains towards $1842.7, 50.0% retracement of the Mar - Sep bear leg. In the Oil space, recent gains in WTI futures have highlighted a bullish corrective cycle and this resulted in a test of the 20-day EMA, at $77.50. A clear break of this hurdle would signal scope for an extension and open $80.82, the 50-day EMA. On the downside, a stronger reversal lower would refocus attention on the bear trigger which lies at $70.08, the Dec 9 low.

- In the FI space, the Bund futures traded lower Thursday to extend the current bear phase that started Dec 7. The contract is weak once again today. Support at 139.13, Nov 28 low has been cleared and this suggests scope for a deeper retracement. The focus is on 136.48 next, 76.4% retracement of the Nov 8 - Dec 7 bull cycle. Gilt futures remain below last week’s highs following the latest retracement. The break of 104.79 this week, Nov 30 low, exposed the firmer support at 103.54, the Nov 21 low. This level has been pierced, A clear break would strengthen a bearish threat and signal scope for a deeper pullback towards 103.00.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/12/2022 | - |  | US | 'Continuing Resolution On US Government Funding Expires | |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 16/12/2022 | 1700/1200 |  | US | San Francisco Fed's Mary Daly | |

| 16/12/2022 | 1800/1800 |  | UK | BOE Announce Q1 Active Gilt Sales Schedule | |

| 19/12/2022 | 0800/0900 |  | EU | ECB de Guindos Speech at Economia Forum | |

| 19/12/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 19/12/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 19/12/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 19/12/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/12/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.