-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equity Sell-Off Extends

HIGHLIGHTS:

- Equity sell off extends, with markets halfway to correction

- FX more stable, with USD Index hovering just below recent highs

- PCE and ISM Manufacturing data the highlights

US TSYS SUMMARY: PCE And ISM Manufacturing Take Focus

The Treasury curve is fairly flat, having retraced both a jump higher in Asia-Pac trade (as equities fell sharply), and a drop to session lows in the European morning.

- Stock futures now off worst levels (though still down), and dollar near session lows.

- The 2-Yr yield is up 0.4bps at 0.2796%, 5-Yr is up 0.2bps at 0.9666%, 10-Yr is up 0bps at 1.4875%, and 30-Yr is up 0.1bps at 2.0456%.

- Dec 10-Yr futures (TY) up 9.5/32 at 131-29 (L: 131-24 / H: 132-00.5), strong volume (~480k).

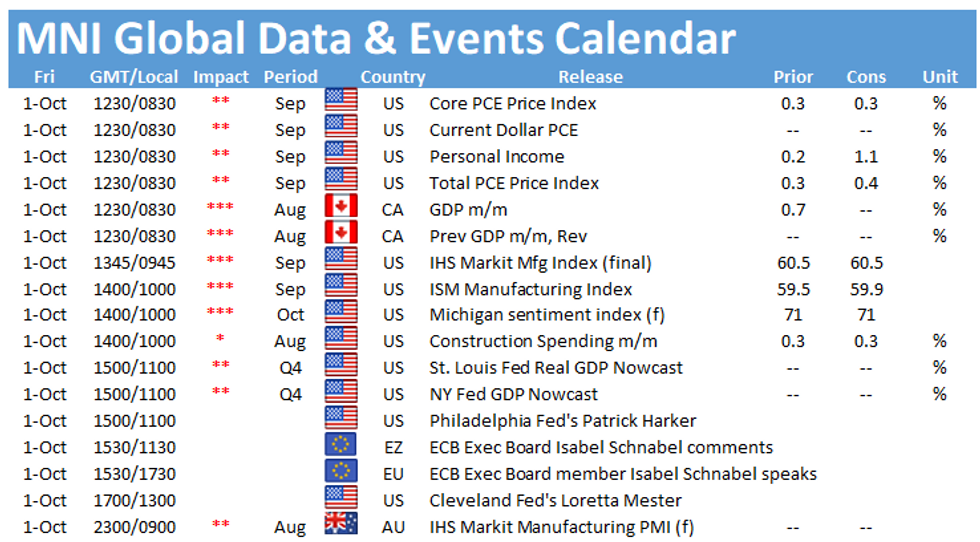

- Data includes personal income/spending and PCE prices at 0830ET, with ISM manufacturing alongside construction spending at 1000ET

- In between, we get finals for manufacturing PMI at 0945ET and UMichigan Sentiment at 1000ET.

- Philly Fed's Harker speaks at 1100ET, Cleveland's Mester at 1300ET.

- With gov't shutdown postponed for now, attention turns toward a potential infrastructure bill today.

- No supply. NY Fed buys ~$8.425B of 2.25-4.5Y Tsys.

EGB/GILT SUMMARY: Govies Gain Ground As Equities Struggle

European sovereign bonds have rallied this morning with EGBs outperforming gilts and equities still under pressure.

- Gilts yields have edged down 1-2bp with the curve marginally flatter.

- The UK fuel crisis continues to rumble on alongside continued warnings of goods shortages later in the year which has stoked concerns about a slowdown in growth.

- The bund curve has bull flattened with the 2s30s spread 2bp narrower.

- OAT yields are broadly 1-3bp lower on the day.

- BTPs have slightly outperformed core EGBs with cash yields 2-4bp lower and the curve 1-2bp flatter.

- Supply this morning came from the UK (UKTBs, GBP2bn).

- The ECBs Isabel Schnabel is due to speak on a panel for a Federal Reserve conference later today.

EUROPE OPTION FLOW SUMMARY

Eurozone:

OEZ1 135.25/135.50/135.75c ladder, bought for 5 in 1k

UK:

SFIZ1 99.80/99.85/99.90c fly, bought for 1 in 2.5k

SF1H2 99.75/99.80/99.85/99.90c condor, bought for 1 in 3k

SFIG2 with SFIH2 99.60/99.50/99.40/99.30p condor strip, bought for 4in 1k

2LZ1 99.25/99.37cs 1x2, bought for half in 5k3

LZ1 99.25/99.00ps, sold at 18 in 10k

Eurozone:

SX7E 18/03/22 105c, bought for 3.75 in 10k

FOREX: A More Stable Start, But Vol Remains Supported

- Following acute volatility this week across EUR, GBP and USD rates, markets are far more stable early Friday, with the USD Index remaining in a holding pattern below this week's multi-month highs. Nonetheless, front-end implied vols remain supported, with the EUR/USD 1m contract holding back above 5 points having touched new post-pandemic lows of 4.4 points last week.

- NOK and JPY are the sole outperformers early Friday, but recoveries are shallow, with markets largely consolidating following the outsized moves in the first half of the week.

- Equity markets across Europe are following the negative Wall Street close, with the EuroStoxx50 and FTSE-100 leading with losses of 0.9% or so. US futures are following suit and indicate another negative open Friday, possibly providing an underlying bidtone to the JPY.

- Market focus turns to Canadian GDP data, US personal income/spending metrics for August and the ISM Manufacturing release. Central bank speakers include Harker and Mester of the Fed and ECB's Schnabel.

FX OPTIONS: Expiries for Oct01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E886mln)

- USD/JPY: Y110.50-70($1.6bln)

- AUD/USD: $0.7200(A$1.4bln)

- USD/CAD: C$1.2400-15($1.3bln); C$1.2600($1.8bln), C$1.2670-90($620mln), C$1.2700-20($1.3bln), C$1.2800($1.4bln), C$1.2850($2.0bln)

Price Signal Summary - S&P E-Minis Key Support Cleared

- In the equity space, S&P E-minis have weakened once again today and cleared key support at 4293.75, Sep 20 low. The break strengthens a bearish case and confirms a resumption of the bear cycle that started Sep 3. This opens 4214.50, Jul 19 low. EUROSTOXX 50 futures remain weak and registered a print below 3974.00, Sep 20 low - today's low has been 3961.00. Further downside is likely towards 3951.50, 1.00 projection of the Sep 6 - Sep 20 - Sep 24 price swing.

- In FX, EURUSD remains in a downtrend. The pair has this week cleared key support at 1.1664, Aug 20 low to confirm a resumption of its downtrend. The focus is on 1.1493 next, 50.0% retracement of the Mar '20 - Jan '21 bull phase. GBPUSD remains vulnerable following this week's sell-off. The focus is on 1.3354 next, Dec 23, 2020 low. USDJPY has traded through key resistance at 111.66, Jul 2 high and the bull trigger. The clear break strengthens a bull case and opens 112.23, Feb 20, 2020 high. Near-term however, attention is on yesterday's price pattern - a bearish engulfing candle - that highlights the risk of a deeper corrective pullback, potentially towards 110.12, the 50-day EMA.

- On the commodity front, the Gold trend needle still points south. The focus is on $1690.6, Aug 9 low and the bear trigger. Note though that yesterday's price pattern is a bullish engulfing candle and highlights the potential for a stronger short-term corrective bounce. A climb would open $1787.4 - High Sep 22. WTI futures remain below Tuesday's high of $76.67. Dips are considered corrective and firm support is seen at $73.58, Jul 6 high and a recent breakout level.

- In the FI space, short-term gains are considered corrective. Bund futures remain in a clear downtrend with the focus on 169.46, 1.50 projection of the Sep 9 - 17 - 21 price swing. Resistance is seen at 170.81, Sep 17 and a recent breakout level. Gilt futures remain heavy. The focus is on 124.64, 1.382 projection of the Aug 31 - Sep 17 - 21 price swing.

EQUITIES: Stocks Sour as Markets Halfway to Correction

- Equity markets across both side of the pond are in negative territory, pressing the likes of the e-mini S&P and DAX through yesterday's lows. The losses in the e-mini S&P put the index overhalfway to entering correction territory, marked at 4095 on the charts.

- The break lower for the e-mini S&P strengthens a bearish case and confirms a resumption of the bear cycle that started Sep 3. Furthermore, the move lower today establishes a bearish price sequence of lower lows and lower highs on the daily chart and this reinforces bearish conditions, opening 4214.50, Jul 19 low.

- The energy and financials sectors are leading the decline on the continent, with just utilities and real estate in the green. The much-watched tech sector also remains lower, with Europe's tech names off over 1% on aggregate.

COMMODITIES: Prospect of OPEC+ Output Hike Still Adding Weight

- WTI remains below Tuesday's high of $76.67. Dips are considered corrective and a bullish theme remains intact. The recent break of resistance at $73.58, the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards the psychological $80.00 level further out. On the downside, firm support is seen at $73.58.

- The prospect of OPEC+ supply remains a key driver for prices, with prices topping out yesterday as sources reports suggested the group could front-load supply with an 800,000bpd increase in production across November.

- Gold is more rangebound, but is holding on to the bulk of the Thursday gains. Price action formed a bullish engulfing candle. A rally would suggest scope for a stronger corrective bounce, perhaps towards $1787.4.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.