-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US MARKETS ANALYSIS - EUR Undermined by Soft PMI Data

Highlights:

- Eurozone PMIs undermine EUR currency, falls against all others in G10

- Treasuries undergo modest belly-to long-led rally on softer European PMIs

- Busy week ahead, with Fed, ECB both seen tightening policy this week

US TSYS: Modest Belly- To Long-Led Rally On Softer European PMIs

- Cash Tsys hold a modest rally, triggered by softer than expected European PMIs with the reaction led by 5-10Y tenors. 2s underperform with some relative stickiness ahead of Wednesday’s FOMC decision (implied rates out to Dec are unchanged on the day) along with today’s 2Y auction.

- 2YY -0.6bp at 4.831%, 5YY -3.2bp at 4.061%, 10YY -2.9bp at 3.805%, 30YY -1.7bp at 3.880%.

- TYU3 trades just half a tick off session highs of 112-14+ (+00-7) under subdued volumes of 225k. It has cleared Friday’s high but is well within Thursday’s range that was helped wider by initial claims coming in lower than expected. Support remains at 112-00 (Jul 20 low) whilst last week's 113-08 high is watched for a resumption of the recent bull cycle that could ultimately expose 114-00 (Jun 13 high).

- The combination of preliminary OI data and price action indicated that TU futures saw fresh shorts added, while FV, TY, UXY & US futures saw shorts cut.

- Data: Chicago Fed Nat Activity Index Jun (0830ET), S&P Global US PMIs Jul prelim (0945ET)

- Note/bond issuance: US Tsy $42B 2Y Note auction, (91282CHN4) – 1300ET

- Bill issuance: US Tsy $65B 13W, $58B 26W Bill auctions – 1130ET

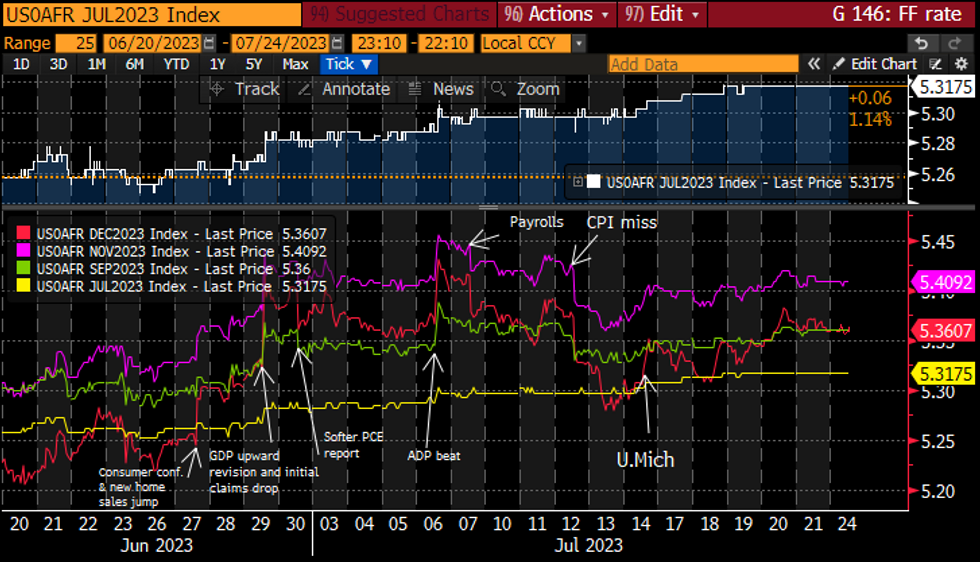

STIR FUTURES: Fed Implied Rates Treading Water

- Fed Funds implied rates are unchanged through 2023 and beyond that only marginally lower from Friday’s close, with little overnight impetus from European PMIs ahead of the US versions later on. It leaves a 25bp hike on Wednesday seen as locked in but then only about 1/3 odds of the additional hike that the median FOMC participant pencilled in for the June dots.

- Cumulative hikes from 5.08% effective: +24bp for Wed, +28bp for Sep, +33bp for 5.41% terminal

- Cuts from Nov terminal: 5bp to Dec’23 (unch), 63.5bp to Jun’24 (from 62.5bp) and 139bp to Dec’24 (from 137.5bp).

- Preliminary July PMIs for the US provide a potential driver in a session otherwise reliant on headlines/flow.

Source: Bloomberg

Source: Bloomberg

SOFR OI Suggests Short Cover Dominated In Whites On Fri, While Reds Saw Fresh Shorts Set

The combination of price action and preliminary open interest data indicate that Friday saw short cover in SFRM3 through SFRZ3, while SFRH4 saw fresh shorts added. The reds & greens saw a mix of long cover and fresh shorts added. Meanwhile, the blues saw a mix of short additions, short cover, longs added and long cover.

- A reminder that the front end of the whites and the back end of the blues firmed on Friday, while the remainder of the strip covered above cheapened, with net changes of -3.5bp to +1.0bp observed.

| 21-Jul-23 | 20-Jul-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,110,857 | 1,115,310 | -4,453 | Whites | -12,661 |

| SFRU3 | 1,108,823 | 1,109,905 | -1,082 | Reds | +13,765 |

| SFRZ3 | 1,305,039 | 1,323,584 | -18,545 | Greens | -332 |

| SFRH4 | 848,610 | 837,191 | +11,419 | Blues | +619 |

| SFRM4 | 773,816 | 777,243 | -3,427 | ||

| SFRU4 | 749,634 | 742,862 | +6,772 | ||

| SFRZ4 | 760,571 | 751,151 | +9,420 | ||

| SFRH5 | 537,312 | 536,312 | +1,000 | ||

| SFRM5 | 466,059 | 468,809 | -2,750 | ||

| SFRU5 | 405,806 | 403,484 | +2,322 | ||

| SFRZ5 | 328,761 | 329,125 | -364 | ||

| SFRH6 | 235,800 | 235,340 | +460 | ||

| SFRM6 | 178,753 | 177,618 | +1,135 | ||

| SFRU6 | 144,038 | 144,106 | -68 | ||

| SFRZ6 | 171,658 | 174,168 | -2,510 | ||

| SFRH7 | 119,900 | 117,838 | +2,062 |

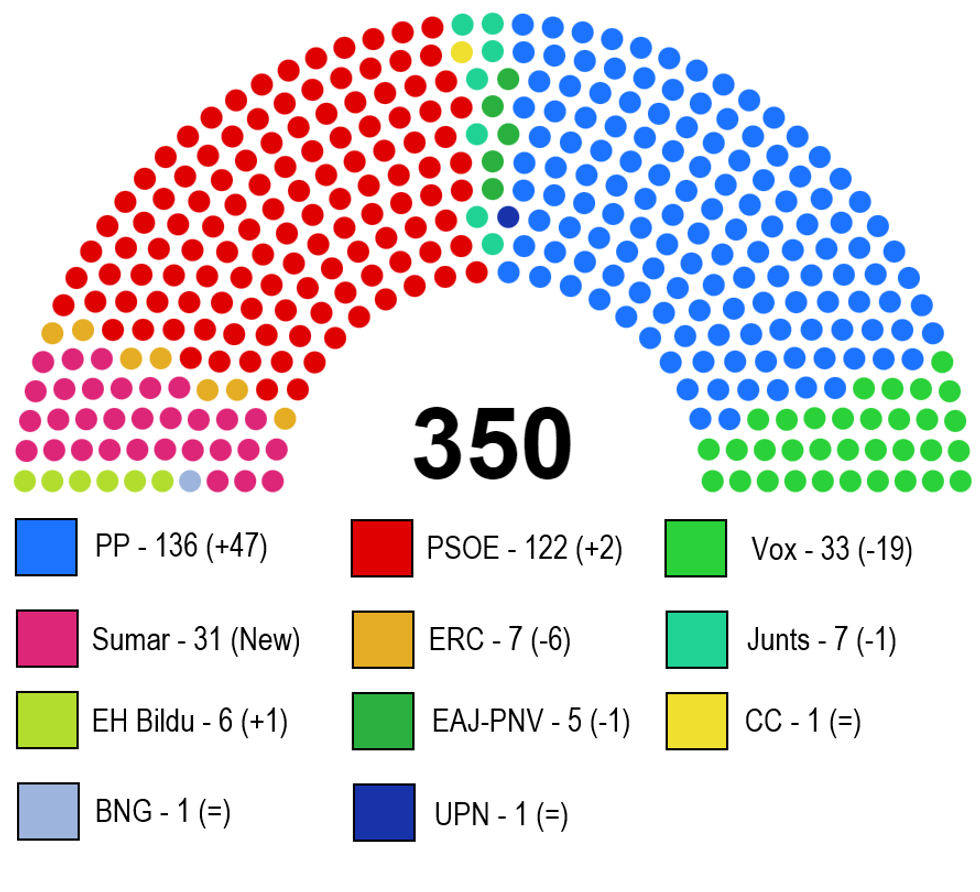

MNI POLITICAL RISK ANALYSIS-Spain Election Review

Spain’s 23 July general election delivered a hung parliament in which the formation of a majority coalition government, or even a sustainable minority administration, is not assured. A significant underperformance by the centre-right Popular Party (PP) and the right-wing nationalist Vox means that the two parties combined seat total sits short of a majority. However, despite an overperformance by incumbent Prime Minister Pedro Sanchez’s centre-left Spanish Socialist Workers’ Party (PSOE), there is no guarantee that he will be able to secure the necessary support in parliament to win an investiture vote at the head of a leftist minority government. As such there is significant risk of sustained political instability with the risk of a second snap election in late 2024/early 2025 looming.

Full article PDF attached below:

Chart 1. 2023 Congress of Deputies General Election Result, Seats (Chg. From Nov 2019)

Source: resultados.generales23j.es, MNI

Source: resultados.generales23j.es, MNI

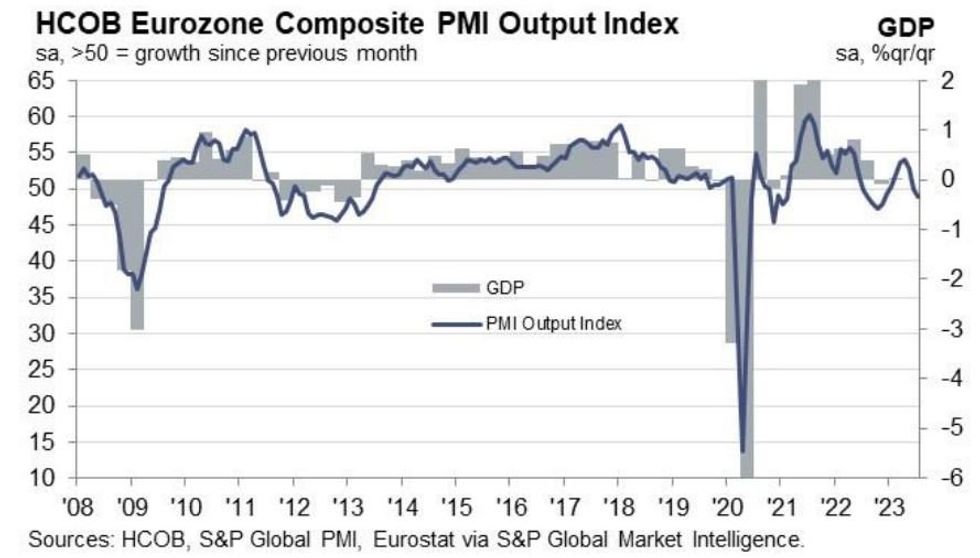

July Flash PMIs Theme: Weaker Demand, Softer Inflation

Flash July Eurozone PMIs missed expectations to the downside, with manufacturing heading even deeper into contraction and the services sector decelerating more quickly.

- Eurozone Manufacturing registered 42.7 vs 43.5 expected and 43.4 prior; Services dipped to 51.1 vs 51.6 expected and 52.0 prior, dragging composite down to 48.9 vs 49.9 prior.

- Per the HCOB/S&P Global report, the Eurozone Composite was an 8-month low, with Services at 6-month lows and Manufacturing at 38-month lows.

- The common theme across the German, French, and Eurozone-wide readings is a slowdown in price pressures (focused largely in the manufacturing sector, with services mixed), alongside weaker demand evident across softer output, new orders, and exports.

- Overall Eurozone PMI future output expectations and new order inflows weakened (to the lowest vs output since 2009), with manufacturer selling prices falling to 2009 levels, with services inflation at a 21-month low. Backlogs are falling sharply and employment was the softest since Feb 2021.

- If anything the ex-Germany/France data was a bright spot ("eked out only very modest growth" for a 2nd consecutive month for the weakest reading of 2023 "reflecting an increasingly severe downturn in manufacturing and weaker demand growth for services."

- While Services continues to be a relative bright spot vs a cratering of manufacturing, the data overall paint a picture of overall weakening Eurozone economic activity translating into softer price pressures, as we head to the ECB's decision on Thursday.

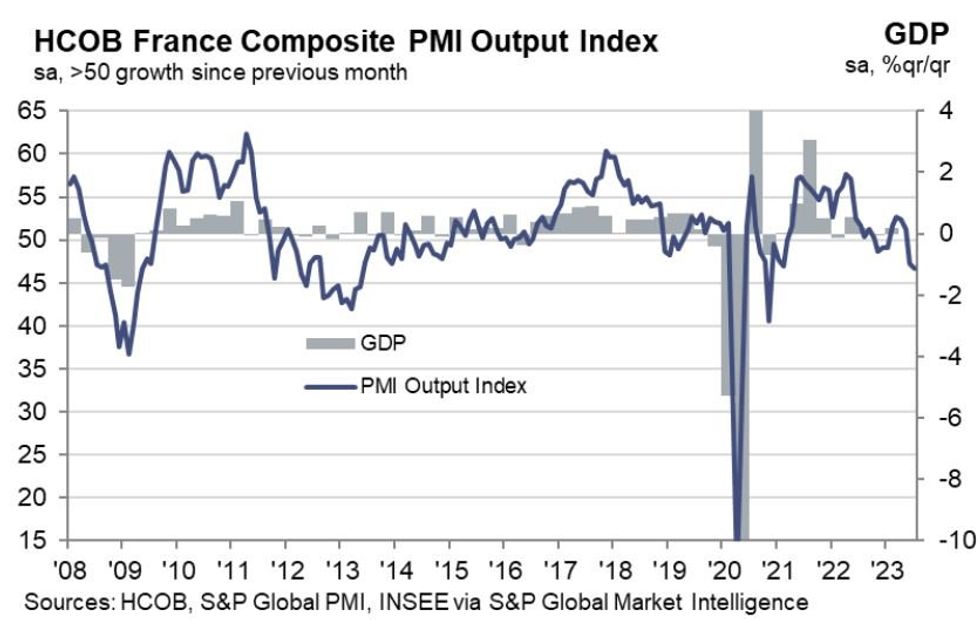

Weakest PMIs Since Nov 2020 Suggest Worsening Contraction

French July flash PMI Manufacturing came in at at 38-month low 44.5 vs 46.0 expected (and 46.0 prior), with Services at a 29-month low 47.4 vs 48.5 expected (48.0 prior), dropping Composite to 46.6 vs 48.0 prior.

- This was the worst Composite outturn since Nov 2020 and suggested that the suggested contraction in French activity at the end of Q2 was deepening going into Q3 (see chart).

- As more broadly in Europe in this round of PMIs, this was largely a weaker demand story: new business fell for a 3rd consecutive month and at the fastest rate in over 2.5 years, with backlog-clearing helping prop up activity.

- Notably export business dropped sharply, with the report noting softer Chinese demand than had been hoped.

- That meant French input/output costs falling to the lowest in over 2 years, though there appeared to be some divergence here, with manufacturers reporting lower raw material prices and service providers noting higher wage bills.

- A couple of positive areas: job growth continued (albeit at the weakest rate of 2023), while confidence strengthened vs June again led by Services firms (manufacturing sentiment remained pessimistic).

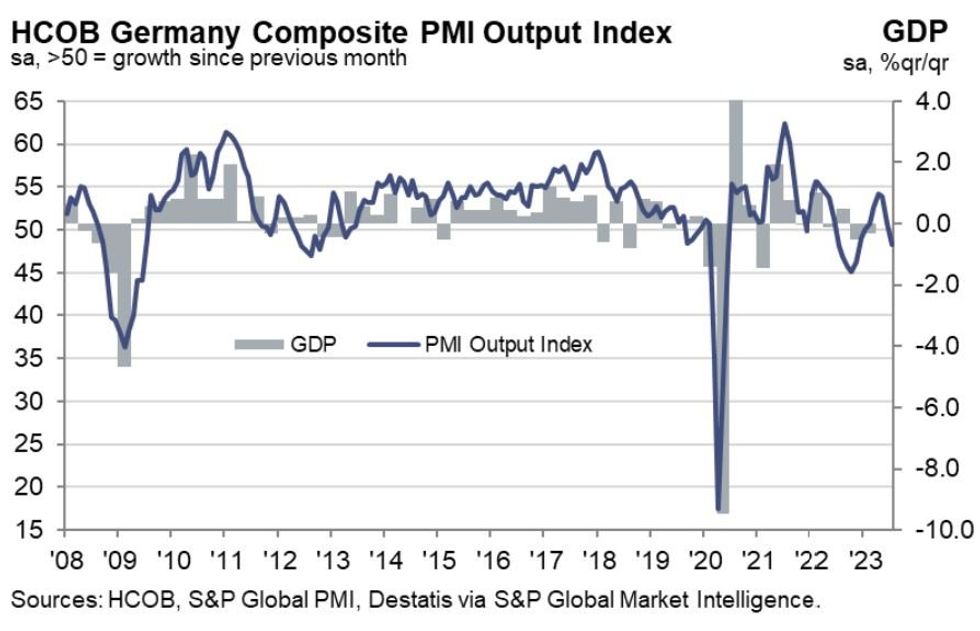

Recessionary Report, But Services Prices Still Look Stubborn

German Manufacturing activity contracted sharply per the July flash PMI reading of 38.8, which was well below the 41.0 expected and the 40.6 prior. Services also decelerated to 52.0 vs 53.1 expected (and 54.1 prior), with composite well into sub-50 territory at 48.3 vs 50.6 prior.

- While the Composite reading was merely an 8-month low, and Services a 5-month low, Manufacturing's slump represented a 38-month low with production falling at the fastest rate since May 2020 "amid rapidly declining demand for goods" (per the HCOB / S&P Global report).

- The Services outlook wasn't positive either: new business fell for the first time in 6 months and overall composite new orders posted the worst reading in 3 years amid a range of demand-hampering factors including " customer hesitancy, destocking, high inflation and rising interest rates".

- With backlogs declining quickly, expectations toward future activity were the worst since December 2022, and employment growth slowed to the joint-weakest in 2.5 years (Services hiring slowed, while manufacturing jobs dropped outright for the first time since January 2021).

- The "good" news was a continued deceleration in price pressures. The bad news is that there is a divergence here between manufacturers and the services sector. Overall costs were the lowest in nearly 3 years, but this was due entirely to a sharp drop for manufacturing prices (both input and output), vs service sector costs accelerating vs June (again, both input and output).

- This is a recessionary set of data, with the report noting that “over the last few months, we have seen a jaw dropping fall in both new orders and backlogs of work, which are now declining at their fastest rates since the initial Covid wave at the start of 2020. This doesn’t bode well for the rest of the year".

- The wrinkle here is that services inflation looks more stubborn than that of goods, which somewhat complicates the ECB's assessment of the overall inflation dynamics amid a clearly weakening demand picture.

FOREX: EUR Falters as PMIs Sink Faster Than Forecast

- The single currency underperforms all others in G10 ahead of Monday's NY crossover following a softer-than-expected set of flash PMI figures. Manufacturing was a particular weakpoint, with Germany's figures the standout. Germany's July flash manufacturing PMI fell to 38.8 vs. Exp. 41.0 (Prev. 40.6) - undermining the argument that the ECB could follow with further policy tightening after an assumed 25bps hike in July.

- EUR/USD slipped to 1.1066, the lowest level since Jul12, narrowing the gap with key support at 1.1055, the 50% retracement for the early July upleg.

- UK manufacturing and services PMIs following in kind, with GBP plumbing new daily lows on the release. GBP/USD showed just below the Friday low to touch 1.2815. A lower close Monday would mark the seventh consecutive session of declines, with 1.2801 the next support: the 61.8% retracement for the early July upleg.

- Focus Monday turns to US flash PMIs for July, ahead of the Fed, ECB decisions later in the week.

FX OPTIONS: Expiries for Jul24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0995-00(E764mln), $1.1015-25(E658mln), $1.1130(E512mln)

- USD/JPY: Y140.00($1.7bln), Y140.25($500mln), Y142.00-15($810mln)

- GBP/USD: $1.2945(Gbp782mln)

- EUR/GBP: Gbp0.8474-75(E1.0bln), Gbp0.8600(E600mln)

- AUD/USD: $0.6780-00(A$1.5bln)

- USD/CNY: Cny7.0500($1.2bln), Cny7.2500($982mln)

EQUITIES: Equity Futures Off Friday Lows Following European Open

- The E-mini S&P contract is trading below last week’s high of 4609.25 (Jul 19). Prices have tested the top of the bull channel drawn off the March 13 low - the channel top intersects at 4616.73 today. A clear channel breakout would strengthen bullish conditions.

- Eurostoxx 50 futures are in consolidation mode but continue to trade closer to their recent highs and price remains above the 50-day EMA at 4348.70. Attention is on key resistance and the bull trigger at 4447.00, the Jul 3 high.

COMMODITIES: WTI Uptrend Intact For Now

- The uptrend in WTI futures remains intact. Friday’s print above $77.15, the Jul 13 high, reinforces the bullish theme. A clear break of this resistance would confirm a resumption of the trend and open $78.10, the Apr 24 high.

- Gold conditions remain bullish for now and the latest pullback is considered corrective. Last week’s print above $1985.3, the May 24 high, reinforces current conditions. A resumption of gains would pave the way for a climb towards $1998.1.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/07/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/07/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/07/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/07/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/07/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/07/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/07/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/07/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/07/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.