-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Geopolitical Risk Off Reverses, Putting Yields Higher

Highlights:

- Risk off reversed as market fallout to Iran strikes seen as contained

- Oil off highs, ILS stronger on net after weekend drone/missile attack

- Retail sales in focus, with markets expecting to sales growth to slow in March

US TSYS: Friday’s Geopolitical Risk Bid Reversed, Retail Sales Ahead

- Cash Tsy yields sit 4.5-5bp higher as the unwind of some of Friday's geopolitical risk premium has dominated proceedings.

- TYM4 sits at session lows of 108-06 (- 16) on particularly high cumulative volumes of 550k. It marks a sizeable pullback from Friday’s high of 108-25+ and the trend needle points south with support at 107-27+ (Apr 11 low).

- Retail sales and NY Fed’s Williams take the initial spotlight at 0830ET. The Empire State mfg survey also lands for the first look at April sentiment, although it has continued to be wildly volatile, limiting the market impact to surprises.

- Data: Retail sales Mar (0830ET), Empire mfg Apr (0830ET), Business inventories Feb (1000ET), NAHB index Apr (1000ET)

- Fedspeak: Williams BBG interview (0830ET), Daly fireside chat (2000ET)

- Bill issuance: US Tsy $70B 13W, $70B 26W bill auctions (1130ET)

STIR: Geopol Risk Premium Recedes, Fedspeak Focus On Powell Tomorrow

- Fed Funds implied rates have unwound Friday’s geopolitical risk-driven push lower, back only just fully pricing a first cut with the September meeting.

- Cumulative cuts from 5.33% effective: 1bp May, 6.5bp Jun, 15bp Jul, 26bp Sep and 44bp Dec.

- Williams and Daly are on the docket today, both of whom have spoken since Wednesday’s surprise CPI strength. Greater focus will be on Chair Powell’s Washington appearance tomorrow and also Vice Chair Jefferson’s keynote address.

- 0830ET – Williams (voter) on Bloomberg TV. He said Apr 11 that there is no need to adjust policy in the “very near term” and will assess his confidence to cut as more data is collected.

- 2000ET – Daly (’24) speaks in a fireside chat at the Stanford Institute for Economic Policy Research (no text). She said Apr 12 that there is no urgency to cut interest rates and that there is a lot of work to do before being confident about price stability.

MNI ECB Review - April 2024: Going 'Live' In June

MNI ECB Review - April 2024: Going 'Live' In June

The ECB left policy unchanged at the April meeting, but provided the clearest indication yet of an upcoming policy rate cut. A new sentence was added to the press statement: “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” Despite President Lagarde consistently stressing that the ECB takes a ‘meeting-by-meeting’ and ‘data dependent’ approach, the revised statement provides a clear steer on policy rates at the next meeting, albeit conditionally on the data.

Given that communication from various GC members in the runup to the April meeting indicated a preference for a June cut, which similarly follows President Lagarde’s previous signal that “we will know a lot more in June”, the new sentence in the April press statement is merely reaffirming what we already know. However, some new insights materialised during the press conference. President Lagarde indicated that while domestic price pressures remain a concern, the moderation in wage growth is the more significant development, which will pave the way for cutting the policy rate. Moreover, Lagarde stressed that not every price series needs to be aligned for the ECB to lower policy rates. Given the strength of the ECB’s policy signal (forward guidance in all but name) the hurdle for remaining on hold in June is now materially higher. Even if price data did not materially improve by June, as long as there is no significant reversal, the ECB will initiate the first cut at the next meeting.

For the full publication, please see:

OI Points To Net Long Setting & Short Cover As Geopolitical Worry Picked Up On Fri

The combination of Friday's rally in Tsy futures and preliminary OI data point to a mix of net long setting (TU, TY, UXY, US & WN futures) and net short cover (FV futures) as geopolitical angst picked up ahead of the weekend.

- The swing in net curve DV01 equivalent exposure was very limited on Friday, with the size of the net short covering seen in FV futures countering most of the net long setting seen elsewhere.

| 12-Apr-24 | 11-Apr-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,954,958 | 3,942,160 | +12,798 | +470,895 |

| FV | 6,041,398 | 6,091,270 | -49,872 | -2,063,855 |

| TY | 4,418,809 | 4,416,108 | +2,701 | +171,954 |

| UXY | 2,065,071 | 2,053,942 | +11,129 | +953,744 |

| US | 1,541,040 | 1,536,257 | +4,783 | +603,919 |

| WN | 1,616,100 | 1,614,576 | +1,524 | +297,092 |

| Total | -16,937 | +433,750 |

OI Points To Mix Of Long Setting & Short Cover In SOFR Futures On Friday

Friday's geopolitical angst triggered a rally in most SOFR futures, with pricing of the Fed rate cutting cycle moving away from post-CPI shallows.

- When coupled with preliminary OI data that move points to a mix of net long setting and short cover, with the former dominating in the reds and the latter dominating in the whites and greens.

- Net pack OI for the blues had a modest bias towards net long setting.

| 12-Apr-24 | 11-Apr-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 937,802 | 948,914 | -11,112 | Whites | -29,743 |

| SFRM4 | 1,197,193 | 1,190,882 | +6,311 | Reds | +23,636 |

| SFRU4 | 946,358 | 950,172 | -3,814 | Greens | -23,848 |

| SFRZ4 | 1,201,329 | 1,222,457 | -21,128 | Blues | +1,437 |

| SFRH5 | 711,226 | 709,342 | +1,884 | ||

| SFRM5 | 817,585 | 815,653 | +1,932 | ||

| SFRU5 | 693,124 | 691,342 | +1,782 | ||

| SFRZ5 | 686,175 | 668,137 | +18,038 | ||

| SFRH6 | 493,451 | 496,761 | -3,310 | ||

| SFRM6 | 510,138 | 524,090 | -13,952 | ||

| SFRU6 | 374,721 | 374,042 | +679 | ||

| SFRZ6 | 349,312 | 356,577 | -7,265 | ||

| SFRH7 | 226,645 | 229,195 | -2,550 | ||

| SFRM7 | 204,353 | 198,432 | +5,921 | ||

| SFRU7 | 170,936 | 171,010 | -74 | ||

| SFRZ7 | 162,119 | 163,979 | -1,860 |

Markets Build JPY Net Short to Multi-Decade High, Defying Threat of Intervention

- Currency markets saw sizeable shifts to the short side in the week ending April 9th, with GBP, NZD and CHF positions deteriorating most markedly. The NZD short position built most sharply, doubling as a % of open interest to 24.1%.

- Defying the Japanese authorities’ warnings of intervention against outsized moves in the currency, CFTC data shows the JPY net short position growing to 50% of open interest – leaving markets outright short by 162,151 contracts, the largest net short since the onset of the Global Financial Crisis in 2007.

- CHF short position also grew notably, by 9,394 contracts, or 9.3% of open interest, resulting in further gains for USD/CHF above the 0.91 handle last week.

- Meanwhile, EUR, AUD and MXN positions crept higher – but at a marginal rate, keeping overall net positions within recent ranges.

- Full update here:

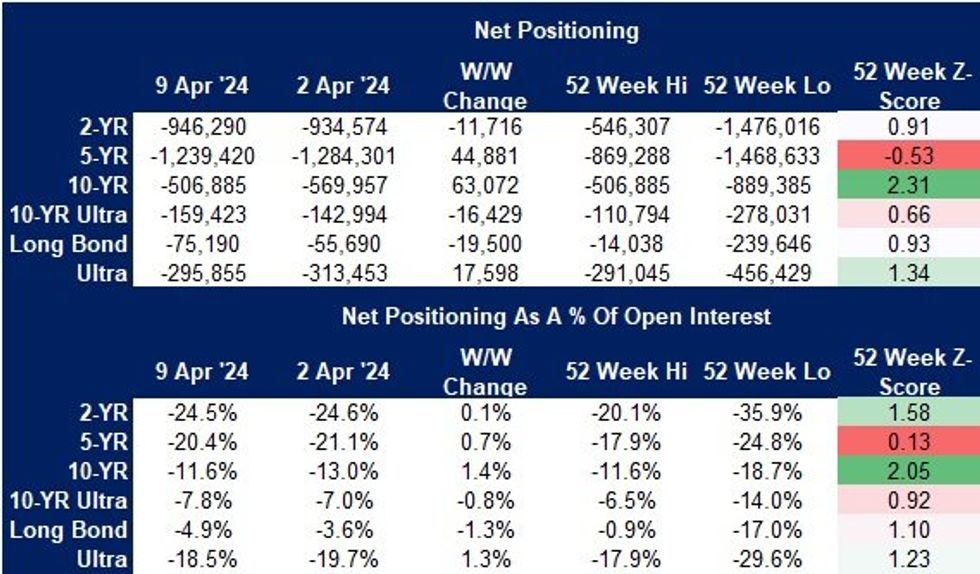

CFTC CoT Points To Mix Of Positioning Swings Ahead Of Last Week's CPI Report

The latest CFTC CoT report points to a mix of extensions (TU, UXY & US futures) and reductions (FV, TY & WN futures) of existing net short Tsy futures positions ahead of last week’s CPI release.

- The cut off for the reporting period was Apr 9, meaning that the post-CPI move higher in yields, as well as the subsequent paring of some of that move as geopolitical worry dominated ahead of the weekend, will not factor into the positioning provided here.

- Positioning in TY futures is now the least short that it has been over a 52-week period (in outright terms and as a percentage of net OI).

- A reminder that CFTC positioning covering Tsy futures will be skewed by basis trade exposure.

Source: CFTC/MNI - Market News

Source: CFTC/MNI - Market News

FOREX: Havens See No Support On Uptick in Geopolitical Risk

- Markets trade solidly despite the uptick in geopolitical tensions over the weekend and the direct Iranian attack on Israeli soil that drew support from US, British and French military assets. Haven currencies have found no support, with USD/JPY instead reverting higher - putting JPY lower against all others in G10.

- USD/JPY traded well from the open, putting the pair at fresh multi-decade highs up at 153.97 - marking another session of gains despite the background threat of intervention from the Japanese authorities.

- GBP trades more favourably on the day, but is holding the bulk of the losses posted into the Friday close. GBP/USD remains below the 200-dma, broken last week at 1.2582, and a softer-than-expected CPI release this week could open last week's lows and first support at 1.2427.

- Similarly, CAD has recovered off last week's lowest levels, keeping the near-term top at last week's 1.3787 the next upside level for USD/CAD. Any further pullback in the pair opens 1.3714 as initial support ahead of 1.3669.

- US retail sales mark the highlight Monday, with consensus looking for retail sales to slow to 0.4% from 0.6% previously. Empire manufacturing is also due, as well as speeches from BoE's Breeden, ECB's Lane & de Cos as well as Fed's Williams.

FX OPTIONS: Expiries for Apr15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0575(E562 $1.0740-50($1.7bln)

- GBP/USD: $1.2745-60(Gbp1bln)

- AUD/USD: $0.6500(A$612mln) $0.6600(A$1.3bln)

EQUITIES: Eurostoxx Dip Finds Support

- The trend condition in S&P E-Minis is unchanged and remains bullish. Near-term, the recent move down appears to be a correction and this is allowing an overbought signal to unwind. The contract has recently breached bull channel support.

- Eurostoxx 50 futures are trading closer to their recent lows. A corrective cycle remains in play and the move down this month is allowing an overbought trend condition to unwind. The break of support around the 20-day EMA suggests potential for a deeper retracement.

COMMODITIES: Bull Theme in WTI Persists, But No Breakout Despite Iran Attacks

- The trend condition in Gold remains bullish and the yellow metal traded higher Friday, extending the current impulsive bull phase. The move higher maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition.

- A bull theme in WTI futures remains intact and the contract is consolidating but trading closer to its recent highs. Recent gains reinforced current bullish conditions and confirmed a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/04/2024 | 1115/1215 |  | UK | BoEs Breeden on Payments Innovation | |

| 15/04/2024 | 1200/1400 |  | EU | ECB's Lane Lecture at University College Dublin | |

| 15/04/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/04/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/04/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/04/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/04/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/04/2024 | 0000/2000 |  | US | San Francisco Fed's Mary Daly | |

| 16/04/2024 | 0200/1000 | *** |  | CN | GDP |

| 16/04/2024 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/04/2024 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/04/2024 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/04/2024 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 16/04/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/04/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/04/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/04/2024 | 1230/0830 | *** |  | CA | CPI |

| 16/04/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/04/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 16/04/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 16/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/04/2024 | 1630/1230 |  | US | New York Fed President John Williams | |

| 16/04/2024 | 1700/1800 |  | UK | BoE's Bailey Interview On IMF Today | |

| 16/04/2024 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 16/04/2024 | 1715/1315 |  | US | Fed Chair Jerome Powell | |

| 16/04/2024 | 2000/1600 |  | CA | Canada federal budget | |

| 17/04/2024 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.