-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Market AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroCentral Bank PreviewsCentral Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: German PPI & 10-Year Gilts Finding Support Aids Core Global FI

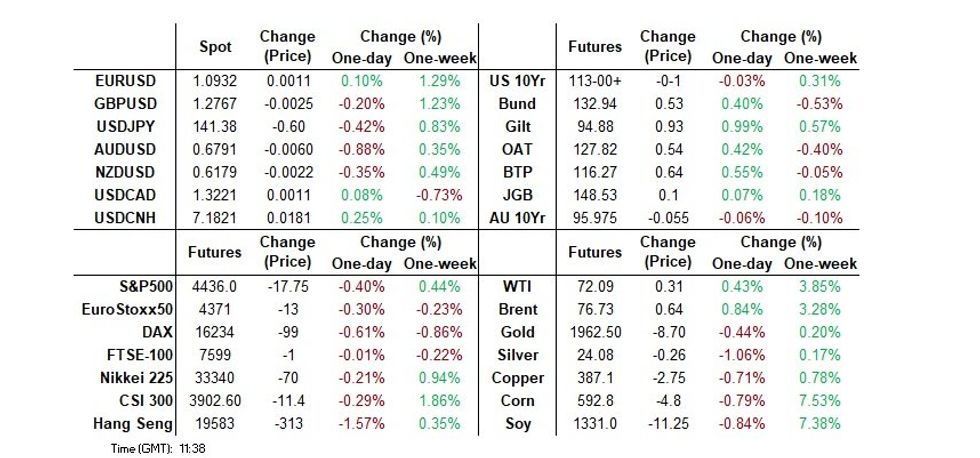

- Soft German PPI data and 4.50% holding in UK 10-Year yields allows core global FI markets to move off cheaps.

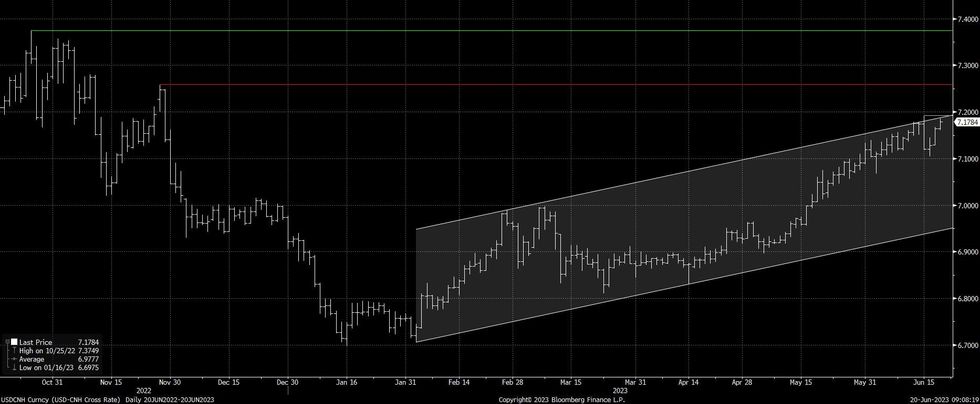

- EUR/SEK all-time highs hold, while USD/CNH remains in technical uptrend.

- Incoming central bank speak includes comments from Fed's Williams & Barr, ECB's Simkus & de Guindos and Riksbank's Thedeen.

US TSYS: Modest Bear Steepening With FOMC Speakers, Housing Data Ahead

The US curve has bear steepened Tuesday following the resumption of cash trade.

- With little in the way of impactful newsflow over the weekend, Tsy futures were dragged down Monday by bearish developments in Europe centered on a sell-off in UK rates ahead of the Bank of England meeting Thursday.

- Some of Monday's weakness has been unwound - alongside a bounce in Bunds and Gilts, and helped by dovish RBA minutes overnight - but Tsys remain cheaper this week by a few ticks.

- Attention turns to housing starts/building permits data (0830ET) following Monday's NAHB homebuilder sentiment reading that suggested a rebound in housing market activity may be underway. We also get Philly Fed non-manufacturing (also 0830ET).

- We hear from FOMC's Williams and Barr today, but focus this week is on Chair Powell's 2 days of congressional appearances, starting tomorrow.

- Supply consists of more chunky bill auctions: $50B 6-week CMB and $65B 13W/$58B 26W sales (unch from prior). We also get sizes for this week's 4/8/17W auctions at 1100ET.

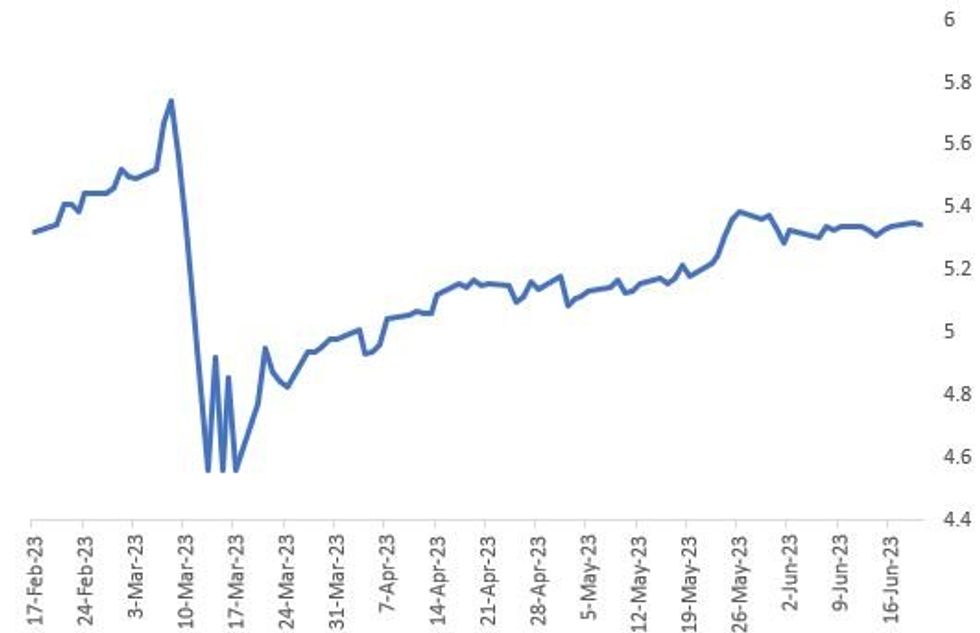

STIR: Fed Hike Pricing Steady In Return From Holiday, With Powell Eyed

The OIS-implied Fed rate hike path is little changed vs last week's close, with Fed terminal Funds rate pricing +0.5bp, implying around 22-23bp of hikes remaining in the cycle.

- That includes 18bp at July's meeting (~70% prob of a 25bp raise, ~30% unch), and a cumulative 22-23bp through Sep/Nov to an effective rate of 5.30%- reflecting skepticism that this cycle will see another hike. End-year implied rates sit only 4bp below current and 8bp below peak, so cuts aren't forcefully on the agenda either.

- We get a few Fed speakers today (Williams & Barr) and more housing data (starts / permits, after Monday's strong NAHB sentiment reading).

- But the main event of the week's US calendar is Fed Chair Powell's semi-annual Congressional testimony, which starts tomorrow - later today we'll preview what to expect.

Peak Implied Fed Funds Rate % (Midpoint of range)

Peak Implied Fed Funds Rate % (Midpoint of range)

STIR: BoE Terminal Pricing Stalls Around 6%, Over 30bp Of Tightening Still Priced For This Week

The recent bid in BoE-dated OIS runs out of steam (for now) as hawkish participants fail to press terminal policy rate pricing above 6.00%, before the measure eases back to show just below 5.95%.

- As noted elsewhere, local news flow has been limited, outside of some light relief for shoppers when it comes to the rate of grocery price inflation.

- Participants remain focused on tomorrow’s inflation report, ahead of the latest BoE monetary policy decision (Thursday). All of those surveyed by BBG look for a 25bp hike re: the latter. Market pricing remains a little more aggressive, showing ~30bp of tightening for the event.

- A reminder that a tighter than expected UK labour market and supply side constraints have been front and centre in recent sessions.

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| Jun-23 | 4.731 | +30.3 |

| Aug-23 | 5.099 | +67.1 |

| Sep-23 | 5.386 | +95.8 |

| Nov-23 | 5.618 | +119.0 |

| Dec-23 | 5.786 | +135.8 |

| Feb-24 | 5.863 | +143.5 |

| Mar-24 | 5.86 | +143.2 |

FOREX: EUR/SEK Record High Holds

- EUR/SEK has failed to break the record high, but traded very close this morning, as market participants favoured fading.

- Some of the movese in the EUR against the SEK, has been attributed to potential divergence on the rate paths for the Riksbank and the ECB, with some desks hoping for a stop after June from the Riksbank, while the door is still ajar for the ECB past July.

- The USD is down 0.24% against the Yen, after the USDJPY perfectly tested the resistance at 142.25, was the 21st and 22nd November highs.

- And USD/JPY now hovers 20 pips off the lows at the time of typing.

- The Dollar is circa flat against the EUR, SEK, CAD, GBP, and still leads against the Aussie, up 0.80%, following the Dovish RBA minutes overnight.

- Looking ahead, there's no tier 1 data, with most desks awaiting on the UK inflation tomorrow.

- There are still more scheduled speakers, which includes ECB's Simkus & de Guindos, Riksbank's Thedeen and Fed's Williams & Barr.

FX OPTIONS: Expiries for Jun20 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0980 (451mln), 1.1000 (579mln)

- USDJPY: 141.00 (1.87bn), 141.25 (330mln), 141.50 (991mln), 141.80 (315mln) 142.00 (2.14bn)

- USDCAD: 1.3230 (220mln), 1.3270 (223mln), 1.3275 (421mln)

- AUDUSD: 0.6740 (396mln), 0.6760 (308mln), 0.6775 (672mln)

- USDCNY: 7.15 (1.83bn).

CNH: Still On The Defensive

The BBDXY pulling back from best levels sees USD/CNH off highs, although the move is shallow, leaving spot ~150 pips firmer on the day at ~CNH7.1790.

- The lack of meaningful, imminent stimulus after Friday’s State Council, coupled with the lack of a larger cut for the 5-Year LPR (both the 1- & 5-Year LPR fixed 10bp lower), which could have been used to generate further support for the property sector, underpin USD/CNH, leaving the well-defined technical uptrend channel intact (upper boundary of CNH7.1874 today).

- Net northbound Hong Kong Stock Connect flows have been mixed to start the week after the two largest rounds of net daily purchases since February were seen ahead of the weekend.

- Chinese equities struggled for upward momentum given the above backdrop, with the CSI 300 -0.2% at the close, while the Hang Seng was ~1.5% lower on the day.

- 10-Year CGB yields were ~2bp lower on the day, while 5-Year IRS shed 3.5bp, providing further headwinds for the yuan.

- Tier 1 sell-side names have continued to cut their Chinese GDP projections in recent days, on the back of the recent run of economic data and lack of swift and broad policy stimulus.

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROPEAN/UK ISSUANCE UPDATE

German auction result:

E5.5bln (E4.488bln allotted) of the 2.80% Jun-25 Schatz. Avg yield 3.15% (bid-to-cover 1.18x).

UK auction result:

GBP3.75bln of the 4.50% Jun-28 Gilt. Avg yield 4.932% (bid-to-cover 2.39x, tail 0.7bp).

EQUITIES: S&P E-Minis Trend Needle Continues To Point North

S&P E-Minis traded higher last week. This confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on 4494.20, the top of a bull channel drawn from the Oct 2022 low (cont). Initial support is at 4381.75, the Jun 13 low. A firmer support lies at 4332.90, the 20-day EMA. Pullbacks are considered corrective.

- EUROSTOXX 50 futures traded higher last week. Resistance at 4380.00, May 29 high, was cleared and key resistance at 4434.00, May 19 high, has been pierced. A clear break of this hurdle would represent an important bullish development and open 4448.00, Jan 2008 high (cont). MA studies remain in bull-mode condition highlighting an uptrend. Initial firm support to watch is 4303.00, Jun 7 low. The latest pullback is considered corrective.

COMMODITIES: Gold Trend Needle Still Points South

The bear cycle in Goldremains intact. The yellow metal breached trendline support last week, drawn from the Nov 3 2022 low. The trendline intersects at $1971.2. The break of this line reinforces a bearish condition and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

- WTI futures continue to trade below resistance at $75.06, the Jun 5 high and the outlook remains bearish, despite the latest recovery. Support at $67.03, May 31 low, has recently been pierced, a clear break would open $63.90, May 4 low. Moving average studies are in a bear mode position highlighting a downtrend. A break of $75.06 would signal a reversal. S/T gains are considered corrective - for now.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/06/2023 | 1710/1910 |  | EU | ECB de Guindos Remarks at German Bernacer Prize | |

| 21/06/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.