-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Gilt U-Turn Continues

Highlights:

- Gilt rally extends as UK government set to amend fiscal plans, with reports Chancellor Kwarteng will be replaced

- Stocks remain on the front foot following Thursday's interday rally; US bank earnings in focus before the bell

- U.S. data in focus following Thursday's CPI beat, including retail sales and prelim UMich survey

Key link: MNI PODCAST: FedSpeak- Months Before Inflation Responds To Fed

US TSYS: UK Politics, Bank Earnings, Data and Fedspeak All In Focus

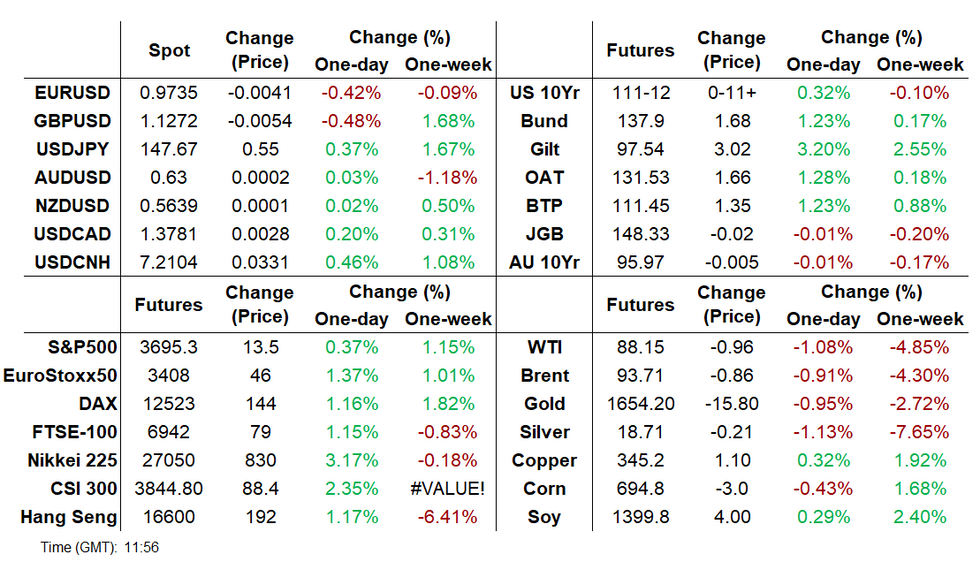

- Cash Tsys have currently seen a broadly parallel rally across 2-10Y tenors (-5.5.5bp) with only the very long end lagging (30YY -3.5bps), with the long end lagging large rallies in EU FI and especially Gilts on fiscal u-turn and Chancellor replacement expectations. Bank earnings in focus before the open, with JPM and Wells Fargo hitting currently and more to come including Citi and Morgan Stanley.

- 2YY -5.2bps at 4.411%, 5YY -5.3bps at 4.148%, 10YY -5.2bps at 3.891%, and 30YY -3.4bps at 3.883%. The 2Y pulls further off yesterday post-CPI highs of 4.529% and 10Y off highs of 4.075%.

- TYZ2 trades 11 ticks higher at 111-11+, remaining vulnerable despite today’s bounce. Support is seen at the psychological 111-00 and then 109-23+ (Nov 30, 2007 low cont). To the upside, resistance at 111-28+ (Oct 12 high).

- Data: Retail sales (0830ET), International trade prices (0830ET), U.Mich Oct prelim (1000ET) and business inventories (1000ET).

- Fedspeak: George (1000ET), Cook (1030ET), Waller (1215ET), with Bullard to follow Saturday at the IMF.

- No issuance.

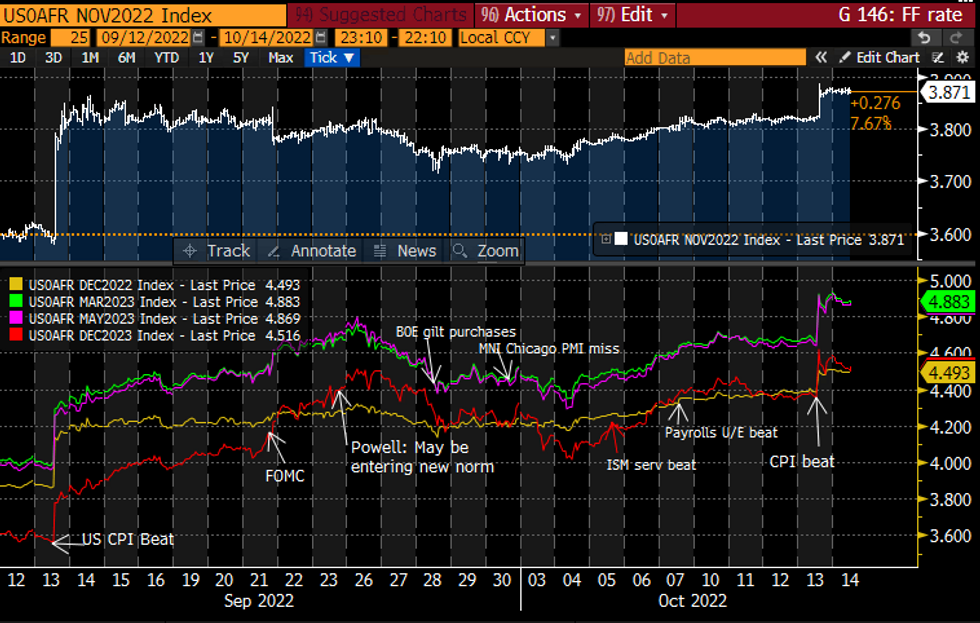

STIR FUTURES: Holding Onto Lurch Higher In Fed Rate Path

- Fed Funds implied hikes remain off yesterday highs but still see very large increases on pre-CPI levels.

- 79bp Nov (+4bp), cumulative 141bp to 4.49% Dec’22 (+11bp), terminal 4.88% Mar’23 (+22bp) and 4.51% Dec’23 (+15bp).

- Compared with post Sep FOMC levels, it sees the Dec'23 at joint highs but the terminal some 10bps higher.

- George (’22, text tbd) and Cook (Gov, no text) discuss econ outlook then Waller (Gov, text) on digital currency, with reminder that Bullard (’22) discusses inflation on Sat.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

UK: Gilts move higher but GBP rally contained on announcement of Truss presser

- Few thoughts on the moves following the confirmation that Truss is holding a press conference later:

- If basic rate income tax cut / NIC hike reversal are not reversed we still have at least 50-60% of the original Growth Plan intact.

- In terms of the part that will impact the BOE's policy decision the income tax cut and lack of NIC hike are the measures most likely to directly increase consumers' disposable income - and hence most likely to drive more aggressive rate hikes.

- However, this will mean less borrowing over the medium-term, and is further confirmation that the govt is willing to back down and listen. So gilts have moved higher on the lower borrowing concerns, but the plan is still inflationary and underlines the uncertainty in UK policy - which is probably stopping the pound rally as much as it otherwise would.

US: Analyst CPI Reaction Snapshot

Analyst | Summary |

Barclays | Now expect a fifth 75bp hike in Dec (50bp prior), hitting 5.0-5.25% in Feb (4.5-4.75% prior) |

BofA | Strengthens case to stay hawkish – clear signal with labor market to raise rates significantly further |

BMO | Cements expectations of at least 75bp in Nov, heightens speculation on another 75bp in Dec |

BNP | A red-hot US CPI release tilts the risks toward the need for a more aggressive Fed response |

CIBC | Fed could front load rate hikes by more than previously thought in Nov |

Commerz | Continue to expect 75bp in Nov, and forecast rates to peak at 5% |

GS | Unchanged rate path: Still expect 75bp hike in Nov before slowing to 50bp Dec and 25bp Feb |

ING | Ensures at least another 75bp rate hike in Nov and 50bp in Dec |

JPM | May not see noticeably softer CPI rents for at least several months |

MS | Unlikely to alter path but more sustained rents pressure could see 75bp Dec hike contemplated |

NatWest | 75bp Nov hike sealed, keeps up pressure to stay aggressive into Dec meeting |

RBC | See Fed Funds reaching 4.5-4.75% early 2023 as price pressures stand too high and broad |

Scotia | Market pricing a terminal 5% in Q1 makes sense with information to date |

TD | Continue to expect 4.75-5% in Mar’23, above terminal implied by Sept dot plot |

Unicredit | No compelling evidence of monthly core CPI consistent with inflation moving to target |

Wells Fargo | Locks in another 75bp in Nov but still believe inflation will slow enough for 50bp in Dec |

FOREX: Big focus on the UK

- The Dollar has reversed its overnight weakness during the early European session, following some pullbacks from the highs in Equities.

- The USD is up against all G10, besides the NOK, and after being one of the best performer overnight, the British Pound is now the worst performer, down 0.7%.

- GBP remains the key focus for investors, especially given the imminent early return of the Chancellor from the G20 finance ministers meeting in Washington and headlines surrounding his likely departure. With markets eagerly awaiting developments over a potential U-turn in policy, GBP volatility set to remain heightened as we approach the weekend close. GBP is the worst performer against the greenback with immediate support residing at 1.1215, the 20-day EMA.

- Main focus for the UK PM Truss's press conference at 1400BST.

- Also focus on USDJPY, which has printed 147.78, highest since August 1990.

- Yesterday saw a 167 pips drop after the pair tested 147.67, no such move so far.

- Looking ahead, US Retail Sales, but more focus on the Prelim Michigan.

- Speakers, include, ECB Holzmann, Fed George, Cook, Waller.

FX OPTION EXPIRY

Of note:

EURUSD 1.12bn at 0.9800.

USDJPY 1.07bn at 147.

EURSEK ~1bn at 11.0000 (thu).- EURUSD: 0.9700 (732mln), 0.9750 (502mln), 0.9790 (509mln), 0.9800 (1.12bn), 0.9825 (298mln). 0.9850 (210mln), 0.9900 (966mln).

- GBPUSD: 1.1250 (201mln), 1.1280 (302mln).

- USDJPY: 147 (1.07bn).

- USDCAD: 1.3800 (309mln).

- USDCNY: 7.20 (285mln).

Price Signal Summary - Reversal Higher In S&P E-Minis Signals The Start Of A Corrective Cycle

- In the FI space, the broader bearish theme in Bund futures remains intact. The focus is on 135.52, the Sep 28 low and key support. This level was probed Wednesday, a clear break would confirm a resumption of the downtrend and open the 135.00 handle. Resistance is at 139.21, the 20-day EMA.

- Gilt futures remain bearish following the reversal from last week’s high. The focus is on 90.99, Sep 28 low and bear trigger. This level has been pierced, a clear break would open the psychological 90.00 handle. Short-term gains are considered corrective. Resistance is at 97.65, the 20-day EMA. This EMA has been pierced - a clear break is required to expose 100.92, the Oct 4 high and a key resistance.

- In the equity space, a volatile session on Thursday in S&P E-Minis resulted in a strong bounce from the day low as well as the trend low of 3502.00. The recovery suggests the contract has entered a corrective phase and if correct, this will allow an oversold trend condition to unwind. Attention is on 3737.94, the 20-day EMA. A break would reinforce a bullish theme. Key support and the bear trigger lies at 3502.00.

- The EUROSTOXX 50 futures traded in a volatile manner Thursday, rebounding sharply from the day low of 3251.00. The contract has traded above the 20-day EMA and this is a positive development. The focus is on the 50-day EMA at 3476.80 and resistance at 3492.00, the Oct 6 high. On the downside, the key support zone to watch is at 3251.00-3236.00, the Oct 13 / 3 lows.

- In FX, EURUSD traded to a fresh weekly low Thursday. Gains are considered corrective and the pair remains in bear mode. The reversal from 0.9999 on Oct 4 marked a failure at the top of the bear channel drawn from the Feb 10 high. The focus is on 0.9536, the Sep 28 low.

- GBPUSD traded higher Thursday. A continuation would signal scope for a test and possible breach of 1.1495, the Oct 5 high and bull trigger. The pair is through the 20-day EMA and this has improved short-term conditions for bulls. A resumption of weakness would instead expose 1.0922 and 1.0787, the 50.0% and 61.8% retracement of Sep 26 - Oct 5 bull cycle.

- USDJPY maintains a bullish tone. This week's climb has resulted in a break of 145.90, Sep 22 high, confirming a resumption of the primary uptrend. Attention is on 147.66, the Aug 1998 high. The level has been pierced, a clear break would open 148.42, the 1.382 projection of the May 24 - Jul 14 - Aug 2 price swing.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 14/10/2022 | - | *** |  | CN | Trade |

| 14/10/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/10/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/10/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/10/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/10/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/10/2022 | 1400/1000 |  | US | Kansas City Fed's Esther George | |

| 14/10/2022 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 14/10/2022 | 1615/1215 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.