-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Markets Analysis: Gilts rally; markets look to US CPI

Highlights:

- Gilts outperform in core FI space on optimism surrounding the BOE's purchase operations.

- The main event of the day will be the release of US CPI.

US TSYS: Treasuries Rally Broadly Across The Curve Ahead Of CPI

- Cash Tsys have reversed a cheapening seen with and after the Asia open to leave them little changed on the day ahead of US CPI, with the long end lagging larger moves in EU FI and once again especially Gilts.

- Yesterday’s session saw a further pulling back in 10Y yields from the latest attempt above the 4% mark, which sees solid resistance with a triple top drawn from 2009, 2010 and ytd highs, whilst 2s10s sits in the middle of its post-Sep FOMC range, currently -40bps having touched -58bp shortly after the FOMC and highs of -24bps.

- 2YY -0.4bps at 4.287%, 5YY -1.6bps at 4.102%, 10YY -1bps at 3.886%, and 30YY -0.5bps at 3.87%.

- TYZ2 trades 2+ ticks higher at 111-18 with gains considered corrective amidst a bearish outlook. Support is seen at the bear trigger of 110-19 (Sep 28 low) whilst to the upside lies resistance at 112-25+ (20-day EMA).

- Data: CPI inflation dominates the session at 0830ET with core seen 0.4% M/M in Sep after 0.57% in Aug - full preview here. Also see real earnings and jobless claims at the same time.

- Bond issuance: US Tsy $18B 30Y Bond re-open auction (912810TJ7) – 1300ET

- Bill issuance: US Tsy $60B 4W, $50B 8W bill auctions – 1130ET

MNI CPI Preview: Upside Risk To Solid Core CPI Consensus

Core CPI inflation is seen slowing only moderately to 0.4% M/M after the surprise jump to 0.57% in August, with analysts seeing some upside risk.

- Full MNI preview here.

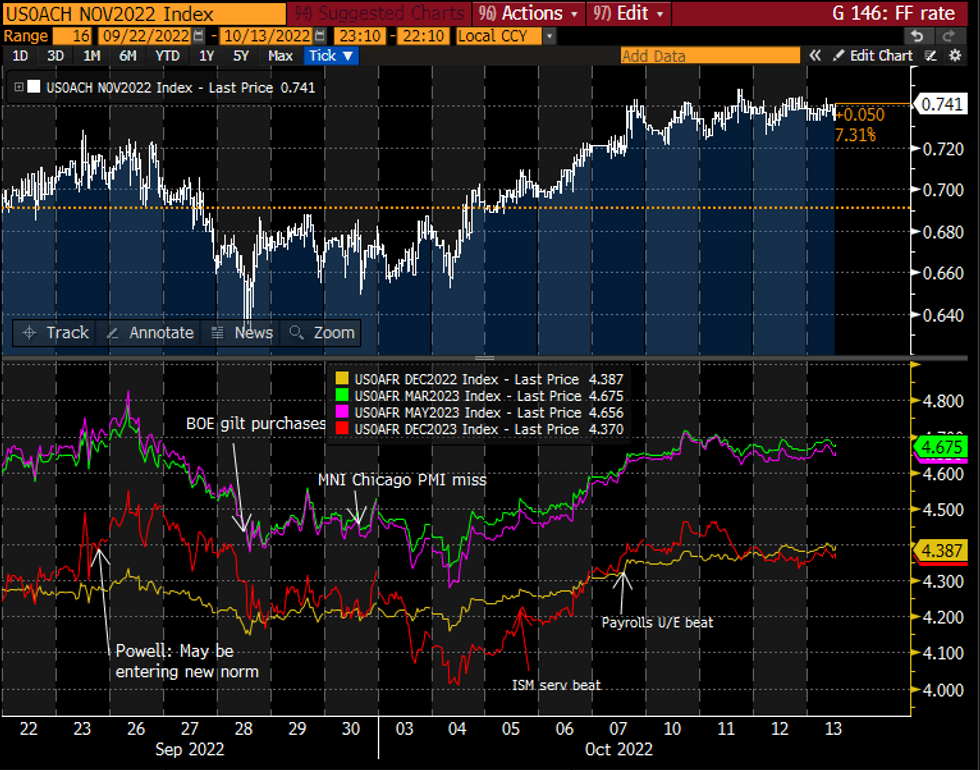

STIR FUTURES: Fed Terminal Seen Little Under 4.7% Ahead Of CPI

- Fed Funds implied hikes are unchanged to slightly higher overnight, largely keep to the week’s range ahead of CPI after the strong climb last week.

- 74bp for Nov (unch), 4.39% for Dec (+0.5bp), a terminal 4.67% for Mar’23 (+1bp) and 4.36% Dec’23 (+1bp).

- Gov Bowman followed the minutes late yesterday seeing continued sizeable hikes on the table if inflation doesn’t ebb. First post-CPI Fedspeak scheduled for tomorrow with George (’22) and then Governors Cook & Waller.

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

GILTS: Still higher on the day - but off the highs

- Gilts are still higher on the day but are off their highs.

- Futures hit a high of 94.85 but at the time of writing we are more than 100 ticks lower at 93.80 (which itself is 100 ticks higher than yesterday's high).

- The curve remains flatten with 2s10s 5.0bp flatter on the day and 10s30s 6.3bp flatten at 42.1bp and 31.7bp respectively.

- The focus will now be on where US CPI comes in and the linker and long-dated BOE purchase ops due later (see post below).

BOE: Have the goalposts moved again?

- The goalposts appeared to move in yesterday's long-dated conventional gilt purchase operations by the Bank of England.

- In the early days of the operations, the Bank appeared to be buying at the operations at a reasonable bid-ask spread above the mid-price. At operations at the beginning of last week, the Bank started only accepting offers that were a little below mid-price. It then confirmed on Friday 7 October the best unallocated offer "was at a spread of -0.1bps to market-mid yields at the close of the auction". On Tuesday 11 October, it was confirmed that this spread had changed to -0.2bps.

- Yesterday's operation saw the Bank reject no offers and saw some offers accepting at a decent premium to the mid-price. This may well entice further offers to be submitted today - which would likely help market sentiment further if the vast majority of offers were accepted again.

- Today's operation was set with an upper size limit of GBP5bln again and there has been no official guidance released from the Bank regarding the offers that will/won't be accepted.

- Note also that today's linker operation will be set with a limit of GBP5bln again too. The Bank announced this morning that it will "not allocate offers for index-linked gilts at real yields below the mid-levels observed, as quoted by Tradeweb, at close of business on 10 October 2022." However, real yields are currently trading below these levels, so linker offers may not see a substantial increase - but if there is demand from pension funds to delver there will likely still be some usage at least.

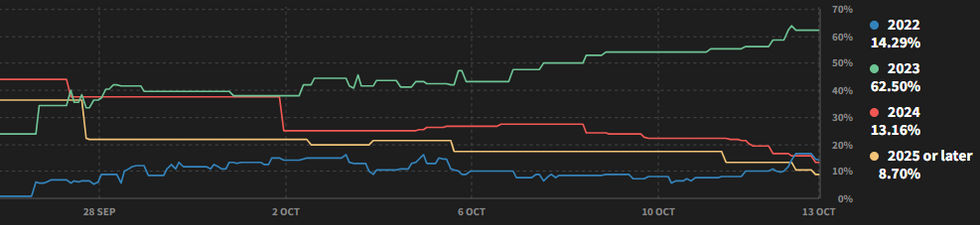

UK: Bettors: +75% Probability PM Out In 2022/23; Backbench Rumblings Grow Louder

Political betting markets are showing over a 75% implied probability that PM Liz Truss leaves office in 2022 or 2023, ahead of the next general election due in 2024. This comes as Westminster rumours of backbench Conservative MPs considering ways to remove the PM grow louder.

- Data from Smarkets shows a 14.3% implied probability that Truss is replaced in 2022, a massive 62.5% chance she leaves office in 2023, falling to a 13.2% probability of an exit in 2024, and just an 8.7% chance that she leaves office in 2025 or later (i.e. that she wins the next election).

Source: Smarkets

Source: Smarkets

- Despite being in office just over a month, Truss is already supposedly facing a potential mutiny on the Conservative benches. Alexander Brown at The Scotsman, "Hearing multiple MPs have submitted letters of no-confidence in Liz Truss..."

- Kay Balls in The Spectator on last night's difficult meeting between PM & backbenchers: "It means there is increased talk about Truss's position with her party."

- Any attempt to remove Truss would need change in party rules, but given the poor polling for the Conservatives, market turbulence, and potential for a U-turn on fiscal event, this scenario is not an unthinkable one.

FI Option Recap

- RXX2 133/132ps, bought for 13 in 1kRXX2 132.00/130.00/129.00 broken put fly, bought for 8 in 4k.RXX2 141.5/143.5cs, bought for 7.5 and 8 in 5k

- DUZ2 106.9/106.8/106.6p ladder 1x0.5x0.75, sold at flat in 7.5k

- SX5E (21st Oct) 3300^ Traded 130.2 and 130.1 in 15k vs 15k VGZ2SX5E (20/12/24) 2500^, traded 1124.5 in 4k

FOREX: The British Pound reverses early weakness

- The Dollar moves back in the red against G10s, led by the bounce in Govies and Equities.

- Volumes and Turnovers are still on the low side, with most Investors and market participants waiting on the US inflation data.

- The NOK is in the lead against the Greenback, 0.60%, but price action for the Dollar has mostly been mixed.

- Nothing too surprising with ALL EYES on the US CPI.

- The British Pound was the early worst performer, but has fully reversed and is on the front foot across most G10s.

- SEK weakened so far this morning, and despite a beat on the CPI headline, the headline CPIF was in line with the Riksbank forecast. And CPIF ex energy was below both the Riksbank and market expectation.

- So SEK sits in the red against G10, besides versus the USD and the CHF, although just up 0.08% at the time of typing.

- Looking ahead, it's all about the US CPI, and the only speaker is ECB Nagel.

FX OPTION EXPIRIES

Noteworthy:

- EURUSD 1.16bn at 0.9650.

- USDJPY 1.9bn at 147.25.

- USDCNY 1.47bn at 7.20.

Today:

- EURUSD: 0.9610 (458mln), 0.9615 (406mln), 0.9640 (311mln), 0.9650 (1.16bn), 0.9700 (452mln), 0.9735 (235mln), 0.9750 (453mln), 0.9755 (220mln), 0.9800 (753mln).

- USDJPY: 146 (516mln), 146.25 (410mln), 147.25 (1.9bn).

- USDCAD: 1.3800 (475mln).

- USDCNY: 7.15 (850mln), 7.20 (1.47bn).

- USDNOK: 10.80 (360mln).

Price Signal Summary - Path Of Least Resistance In S&P E-Minis Remains Down

- In the equity space, the S&P E-Minis broader trend direction remains down and attention is on the bear trigger at 3571.75, the Oct 3 low. A break of this level would confirm a resumption of the downtrend and open 3558.97, 1.382 projection of the Aug 16 - Sep 7 - 13 price swing.

- The EUROSTOXX 50 futures trend direction remains down too and a continuation lower would open the key support and bear trigger at 3236.00, the Oct 3 low. For bulls, a break above the 50-day EMA is required to highlight a stronger reversal. The average intersects at 3481.50.

- In FX, EURUSD remains in a bear cycle inside the channel drawn from the Feb 10 high. The focus is on 0.9645, 76.4% of the Sep 28 - Oct 4 bull cycle and further out, 0.9536, the Sep 28 low and key support. Resistance is at 0.9815, the 20-day EMA. GBPUSD maintains a softer tone but has managed to find some support - for now. At this stage, the recent move lower appears to be a correction of the rally between Sep 26 - Oct 5. A continuation lower would open 1.0922 and 1.0787, 50.0% and 61.8% of the Sep 26 - Oct 5 bull cycle. Initial resistance is at 1.1204, the 20-day EMA. USDJPY maintains a bullish tone and the pair is holding on to this week’s gains. Yesterday’s break of 145.90, the Sep 22 high, confirms a resumption of the primary uptrend. Attention is on 147.25 next, the 3.00 projection of the Aug 2 - 8 - 11 price swing.

- On the commodity front, the recent strong reversal in Gold signals the end of the recovery between Sep 28 - Oct 4 and note that price has moved below the trendline resistance drawn from the Mar 8 high. A continuation lower would expose the key support at $1615.0, the Sep 28 low. In the Oil space, the reversal in WTI futures this week threatens the recent bullish theme. The contract has traded below the 50-day EMA and attention is on the 20-day EMA at $86.25. A continuation lower would open $89.94 and $82.89 - the 50.0% and 61.8% retracement points of the Sep 26 - Oct 10 rally.

- In the FI space, the broader bearish theme in Bund futures remains intact. The focus is on 135.52, the Sep 28 low and key support. This level was probed yesterday, a clear break would confirm a resumption of the downtrend and open the 135.00 handle. Gilt futures remain bearish following the reversal from last week’s high. The focus is on 90.99, Sep 28 low and bear trigger. This level has been pierced, a clear break would open the psychological 90.00 handle. Short-term gains are considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 13/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/10/2022 | 1230/0830 | *** |  | US | CPI |

| 13/10/2022 | 1300/1400 |  | UK | BOE Mann Speech at Peterson Institute for Internat. Economics | |

| 13/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/10/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 13/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/10/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/10/2022 | 1700/1300 |  | US | Atlanta Fed Raphael Bostic | |

| 13/10/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 14/10/2022 | 0130/0930 | *** |  | CN | CPI |

| 14/10/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 14/10/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/10/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/10/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/10/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 14/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 14/10/2022 | - | *** |  | CN | Trade |

| 14/10/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/10/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/10/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/10/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/10/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/10/2022 | 1400/1000 |  | US | Kansas City Fed's Esther George | |

| 14/10/2022 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 14/10/2022 | 1615/1215 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.