-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

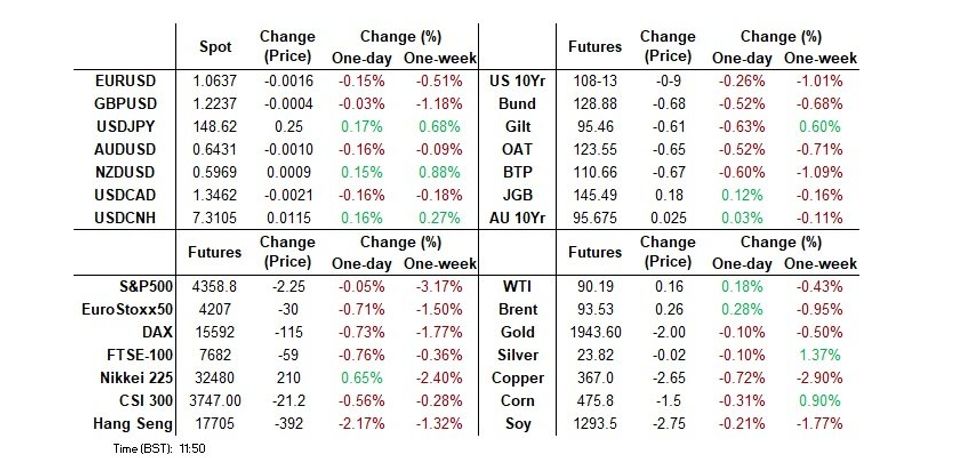

Free AccessMNI US MARKETS ANALYSIS: Higher For Longer Reverberates, China Property Worry Intensifies

- Higher for longer narrative weighs on core global FI markets ahead of NY hours, with deeper Chinese property market jitters also eyed.

- BBDXY biased higher, but falters above 1,260. SEK the G10 FX outperformer.

- Looking ahead, there's no tier 1 data out of the U.S., focus will be on speakers, with ECB's Lagarde, & Schnabel, as well as Fed's Goolsbee & Kashkari scheduled to speak.

US TSYS: 2s10s Pushes Highs Since May

- Cash Tsys have extended earlier bear steepening, with the front end paring some earlier small losses with Fed rate expectations unswayed overnight and the longer end holding closer to more notable lows.

- Pressure continues to come from Fed forecasts pushing the ‘longer’ part of the “higher for longer” theme as well as seemingly increasing odds of a government shutdown.

- Cash Tsys trade between +0.4bps (2Y) and +6.9bps (30Y), with 2s10s +5.5bps at -62bps for highs since May.

- TYZ3 trades at 108-13, off an earlier low of 103-10+ in another push towards support at 108-08 (Sep 21 low) after which lies the round 108-00. Volumes are near average at 265k.

- Ahead sees Fedspeak from ’23 voters Goolsbee and Kashkari, as well as lower tier data from Chicago Fed and Dallas Fed activity indicators.

- Bill issuance: US Tsy $69B 13W, $62B 26W Bill auctions (1130ET)

Source: Bloomberg

Source: Bloomberg

US TSY FUTURES: Short Cover Seemed To Dominate On Friday

The combination of Friday’s richening and preliminary open interest data point to short cover as the dominant positioning swing during the final trading session of last week.

- TU, FV, TY & US futures seemingly saw sort cover, while UXY and WN seemingly saw modest fresh net longs added.

| 22-Sep-23 | 21-Sep-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,857,284 | 3,875,425 | -18,141 | -687,317 |

| FV | 5,514,599 | 5,525,849 | -11,250 | -473,375 |

| TY | 4,728,898 | 4,753,843 | -24,945 | -1,604,441 |

| UXY | 1,848,163 | 1,846,061 | +2,102 | +189,451 |

| US | 1,377,296 | 1,384,034 | -6,738 | -877,500 |

| WN | 1,535,389 | 1,534,818 | +571 | +112,360 |

| Total | -58,401 | -3,340,822 |

STIR: Fed Rate Path Treads Water Before Fedspeak-Led Docket

- Fed Funds implied rates are little changed from Friday’s close, with a terminal still flickering around the Dec and Jan meetings and cut expectations on the low side but off post-FOMC mid-week lows.

- Cumulative hikes from 5.33% effective: +5bp and Nov, +12bp to Dec and +12bp to Jan for a terminal 5.45%.

- Cuts from terminal: 22bp to Jun’24 and 76bp to Dec’24. The latter closed at a recent low of 71bp after Wednesday’s FOMC decision although remains notably tighter than the >100bps seen a month ago.

- Fedspeak: Goolsbee (’23 voter) offers his first post-FOMC views in a CNBC interview at 0830ET. Kashkari (’23) follows late on at 1800ET in a moderated discussion after very little policy-related content on Friday. Gov. Bowman has already implied she was the top 6.1% 2024 dot from last week’s SEP.

STIR: SOFR Sees Mixed Positioning Swings On Friday, Short Cover Seemed To Dominate

The combination of Friday’s richening and preliminary open interest data point to net long setting in the white and reds.

- Still, larger net short cover was seemingly seen across the greens and blues, leaving that as the dominant factor on the strip on the day.

| 22-Sep-23 | 21-Sep-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,067,114 | 1,060,828 | +6,286 | Whites | +4,849 |

| SFRU3 | 1,302,855 | 1,302,814 | +41 | Reds | +12,699 |

| SFRZ3 | 988,270 | 997,746 | -9,476 | Greens | -26,544 |

| SFRH4 | 893,223 | 885,225 | +7,998 | Blues | -1,295 |

| SFRM4 | 780,522 | 768,785 | +11,737 | ||

| SFRU4 | 920,775 | 926,795 | -6,020 | ||

| SFRZ4 | 536,514 | 528,108 | +8,406 | ||

| SFRH5 | 575,257 | 576,681 | -1,424 | ||

| SFRM5 | 501,109 | 505,748 | -4,639 | ||

| SFRU5 | 505,880 | 518,969 | -13,089 | ||

| SFRZ5 | 318,043 | 324,460 | -6,417 | ||

| SFRH6 | 248,662 | 251,061 | -2,399 | ||

| SFRM6 | 196,801 | 196,462 | +339 | ||

| SFRU6 | 183,188 | 186,587 | -3,399 | ||

| SFRZ6 | 131,020 | 131,490 | -470 | ||

| SFRM7 | 134,365 | 132,130 | +2,235 |

BONDS: European Issuance Update

EU auction results:

- E2.148bln of the 3.25% Jul-34 EU-bond. Avg yield 3.480% (bid-to-cover 1.81x).

- E1.312bln of the 3.00% Mar-53 EU-bond. Avg yield 3.780% (bid-to-cover 1.53x)

FOREX: USD is on the front foot

- The Dollar is mostly in the Green across most of the majors, benefitting from the Risk Off tone and higher US Yields.

- Only the Scandies and the CAD are trading flat, given higher energy prices.

- The standout this morning, is the SEK, which is up 0.58% against the Dollar, despite the Risk Off tone and the broader base bid in the Dollar.

- The move in SEK has possibly been helped , after SBB's shares and bond rose, after the Swedish property group secured an 8 billion crown ($719 million) cash boost and said it would reorganise its business.

- USDJPY continues to make fresh 2023 high, and next resistance is at 148.85 High Oct 31 2022, before the 149.00 figure.

- Looking ahead, there's no tier 1 data out of the US, focus will be on speakers, with ECB's Lagarde & Schnabel, as well as Fed's Goolsbee & Kashkari scheduled to speak.

FX OPTIONS: Expiries for Sep25 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0540 (695mln), 1.0670 (281mln)

- USDJPY: 149.00 (643mln)

- GBPUSD: 1.2275 (545mln)

- USDCAD: 1.3405 (538mln), 1.3425 (565mln), 1.3472 (557mln)

- AUDUSD: 0.6400 (731mln), 0.6485 (341mln)

- AUDNZD: 1.0858 (400mln)

- USDCNY: 7.3000 (1.32bn)

- EURNOK: 11.40 (592mln)

EQUITIES: S&P E-Minis Trend Needle Points South

- A bear cycle in the E-mini S&P contract remains in play and price is trading lower today. Last Thursday’s sell-off resulted in a break of support at 4397.75, the Aug 18 low, reinforcing bearish conditions. Sights are on 4318.00 next, the Jun 2 low. Initial firm resistance is 4496.68, the 50-day EMA.

- EUROSTOXX 50 futures maintain a softer tone following last week’s move lower and, today’s extension lower reinforces current conditions. The focus is on 4163.00, the 1.00 projection of the Aug 10 - 18 - 30 price swing. Key short-term resistance has been defined at 4359.00, the Sep 15 high. Initial firm resistance is at 4288.70, the 20-day EMA.

COMMODITIES: Corrective Cycle In WTI Still In Play

- Gold traded higher last Wednesday but quickly pulled back from the session high. The recent breach of the 50-day EMA does highlight a possible developing bullish threat. Key resistance is at $1953.0, the Sep 1 high where a break is required to confirm a bullish theme. $1901.1, the Sep 14 low, marks a key near-term support. A breach of this level would strengthen a bearish theme and expose $1884.9, the Aug 21 low.

- In the oil space, the uptrend in WTI futures is intact, however, the contract remains in a short-term bearish corrective cycle. The trend condition is overbought and a move lower would allow this to unwind. The first key support is at $86.90, the 20-day EMA and is a potential short-term objective. On the upside, clearance of $92.43, the Sep 19 high, would confirm a resumption of the uptrend and open $93.31, the 1.00 projection of the Jun 28 - Aug 10 - 24 price swing.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/09/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Lagarde speaks at ECON Hearing | |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Schnabel speaks at JHvT Lecture | |

| 25/09/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/09/2023 | 2200/1800 |  | US | Minneapolis Fed's Neel Kashkari | |

| 26/09/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/09/2023 | 0700/0900 |  | EU | ECB's Lane speaks at CEPR conference | |

| 26/09/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/09/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/09/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/09/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/09/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2023 | 1730/1330 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.