-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - House Vote on Debt Bill As Soon As Today

Highlights:

- June Fed pricing firms on Mester comments, but softer further out the curve

- Slowing Eurozone inflation works against the single currency

- House vote on debt ceiling bill could be as soon as today

US TSYS: Bull Flattening On External Factors, US Data In Play Later

- Cash Tsys have seen a bull flattening so far today, coming as the front end to belly trades off highs whilst the long end and very long end in particular press towards highs as oil slides. Cleveland Fed’s Mester (’24 voter) sees no compelling reason for a June pause but on balance softer implications for Eurozone core inflation and another round of weaker data out of China in the shape of official PMIs weigh.

- No real reaction to Bloomberg recently reporting House GOP debt limit negotiator McHenry saying we have the votes to pass the debt-limit bill today.

- US data should help set the tone later in the session, first with the MNI Chicago PMI and then JOLTS, referenced by Richmond Fed’s Barkin (’24 voter) as the data he’s looking to this week along of course with payrolls on Friday. Heavy Fedspeak is also on the docket.

- 2YY -2.5bp at 4.425%, 5YY -3.5bp at 3.772%, 10YY -3.8bp at 3.648%, 30YY -3.3bp at 3.857%.

- Following the roll, TYU3 trades 10+ ticks higher at 114-11+, off an earlier high of 114-14+ that forms initial resistance. With yesterday's price pattern a bullish engulfing candle, attention is on further resistance at the 20-day EMA of 114-29+ and ultimately 115-07+ (50-day EMA), whilst to the downside sits support at 114-00 (intraday low).

- Data: Weekly MBA mortgage data (0700ET), MNI Chicago PMI May (0945ET), JOLTS Apr (1000ET), Dallas Fed Services May (1030ET)

- Fedspeak: Collins & Bowman (0850ET), Collins (1220ET), Harker (1330ET), Jefferson (1330ET), Beige Book (1400ET).

- Bill issuance: US Tsy $44B 17W Bill auction – 1130ET

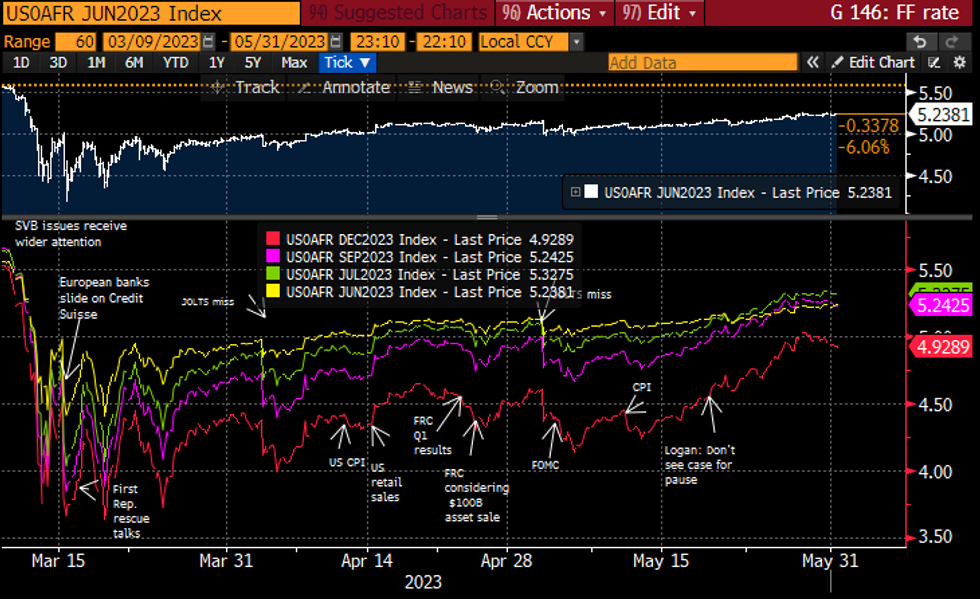

STIR FUTURES: June Fed Hike Supported By Mester But Softer Further Out

- Fed Funds implied hikes for the June FOMC have firmed through European hours after mixed European inflation (GS modestly revised up EZ headline but core down), leaving it slightly higher than yesterday’s close with +16bp priced.

- The June lift was helped by Mester (’24 voter) telling the FT she sees “no compelling reason” to pause rate hikes, particularly in the wake of the debt-limit deal.

- Subsequent meetings remain lower on the day though, continuing the rolling over seen this week with the Dec’23 rate currently at 4.93% having touched highs of 5.05% in Monday’s holiday thinned trade.

- Cumulative changes from 5.08% effective: +16bp Jun (+1bp on the day), +24bp Jul (-1bp), +16.5bp Sep (-2bp), +1bp Nov (-3bp), -15bp Dec (-2.5bp) and -34bp Jan (-2.5bp).

- Plenty of Fedspeak ahead with Collins (non-voter) and Gov Bowman (voter) bookending remarks at a Fed Listens Event, Harker (’23 voter) with a no text fireside chat on monetary conditions (note speech starts 1330ET vs event start 1230) and Vice Chair nominee Jefferson (voter) on financial stability including text at 1330ET before the Beige Book. Harker has seen the longest gap since he last spoke, on Apr 21 saying rates are “pretty close” to where we need to be.

Source: Bloomberg

Source: Bloomberg

MNI Projects CPI Cooling to +6.12% in Downside Surprise

We have now received state data that equates to 88.0% weighting of the national German CPI print (due at 1300 BST / 1400 CET).

- MNI calculations estimate that CPI fell by -0.07% m/m, and eased to +6.12% y/y in May. This is based on the published index values for available state data. This implies a substantial 1.1pp deceleration on the annualised figure from +7.2% y/y in April, as German headline inflation distances itself further from the October/November peak of +8.8% y/y.

- For m/m and y/y, our estimate is around 0.3pp and 0.4pp below the current Bloomberg consensus forecast.

- Today's state data also points towards a decent reduction in core CPI for Germany, after holding close to the euro-era high at +5.8% y/y in April. Core CPI data excluding both energy and food is only available for six states which account for 50% of the headline index. These all saw core CPI easing by 0.2pp to 0.7pp on the headline annualised prints, with a weighted average reduction of -0.47pp.

- Note: this is in relation to the national CPI print - not the HICP print (which feeds into the Eurozone HICP print that the ECB targets). The magnitude of surprises to consensus can sometimes be different due to the different methodologies and weights used in national CPI vs HICP - but the direction of the surprise is normally the same.

| M/M | May (reported) | Apr (reported) | Difference | Weighting |

| North Rhine Westphalia | -0.2% | 0.4% | -0.6% | 21.1% |

| Hesse | 0.0% | 0.3% | -0.3% | 7.7% |

| Bavaria | -0.1% | 0.4% | -0.5% | 16.9% |

| Brandenburg | 0.1% | 0.4% | -0.3% | 2.9% |

| Baden Wuert. | 0.1% | 0.5% | -0.4% | 14.1% |

| Berlin | -0.3% | 0.7% | -1.0% | 4.0% |

| Saxony | -0.3% | 0.3% | -0.6% | 4.6% |

| Rhineland-Palatinate | 0.0% | 0.4% | -0.4% | 4.9% |

| Lower Saxony | -0.1% | 0.4% | -0.5% | 9.4% |

| Saxony-Anhalt | 0.2% | 0.3% | -0.1% | 2.4% |

| Weighted average: | -0.07% | for | 88.0% |

| Y/Y | May (reported) | Apr (reported) | Difference | Weighting |

| North Rhine Westphalia | 5.7% | 6.7% | -1.0% | 21.1% |

| Hesse | 5.9% | 6.9% | -1.0% | 7.7% |

| Bavaria | 6.1% | 7.2% | -1.1% | 16.9% |

| Brandenburg | 6.3% | 7.6% | -1.3% | 2.9% |

| Baden Wuert. | 6.6% | 7.3% | -0.7% | 14.1% |

| Berlin | 6.0% | 7.5% | -1.5% | 4.0% |

| Saxony | 6.5% | 7.6% | -0.2% | 4.6% |

| Rhineland-Palatinate | 6.1% | 7.1% | -1.0% | 4.9% |

| Lower Saxony | 6.4% | 7.5% | -1.1% | 9.4% |

| Saxony-Anhalt | 6.4% | 7.3% | -0.9% | 2.4% |

| Weighted average: | 6.12% | for | 88.0% |

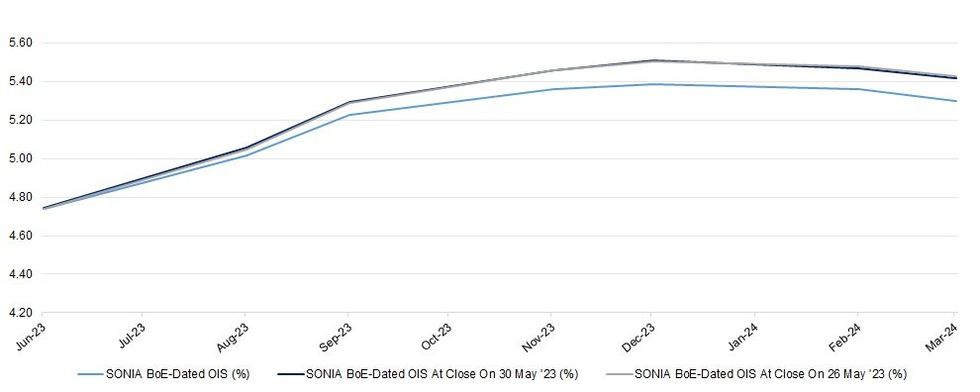

UK STIR: BoE Pricing Back From Recent Highs, BoE’s Mann Due To Speak Later

The general bias in wider core global FI markets has taken some of the edge off of last week’s move in UK rates. That leaves BoE-dated OIS market indicating a further ~96bp of tightening in the current cycle, 10-15bp below Friday’s closing levels. This equates to just below 5.50% in BoE policy rate terms (~5.46%).

- Lower tier domestic data will be aiding the direction of travel (or at least not hindering it), with the latest Citi/YouGov inflation expectations metrics easing and the Lloyds Business barometer moving lower.

- Participants look ahead to comments from BoE’s Mann, who will speak on a panel covering the topic of central banks, inflation & monetary policy this afternoon. Mann has been one of the more hawkish voices on the MPC.

- A quick reminder that last week saw Mann note that the BoE has underestimated the persistence in inflation. This came before the firmer than expected round of CPI data covering April.

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| Jun-23 | 4.736 | +30.8 |

| Aug-23 | 5.015 | +58.7 |

| Sep-23 | 5.224 | +79.6 |

| Nov-23 | 5.359 | +93.1 |

| Dec-23 | 5.386 | +95.8 |

| Feb-24 | 5.359 | +93.1 |

| Mar-24 | 5.296 | +86.8 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Greenback at May Highs, NOK Slips on Persistent FX Sales

- The greenback trades firmer in early Europe, helping tip the USD Index to new multi-month highs on the final trading day of May. For now, prices remain capped ahead of the 76.4% retracement for the March - April downleg, crossing at 104.68. Progress through here would open the best levels since early March for the currency.

- The clearance of the first hurdle for the debt ceiling deal has been a boon for the US currency, while signs of slipping inflationary pressures in Europe are working against the single currency. Regional German CPI data is generally suggesting downside risks to the national headline later today, while French inflation also came in well below median consensus. Italy provided the only fly in the ointment, with HICP ahead of expectations, helping slow the EUR's decline and help EUR/USD off lows of 1.0659.

- NOK is again the weakest currency in G10, with market focus on this morning's update from the Norges Bank on their planned daily FX purchases for June. The quantity of daily NOK sales are to slow from NOK 1.4bln to NOK 1.3bln - a number clearly falling short of market expectations that are eventually expecting a switch to NOK buying later this year. EUR/NOK spiked upon the release, touching 12.061 before fading back to pre-data levels. This keeps yesterday's cycle highs intact for now at 12.1064.

- Focus for the session ahead turns to prelim German CPI reading for May, the MNI Chicago PMI and Canadian GDP data for March. The central bank speaker slate consists of appearances from Fed's Collins, Harker & Jefferson as well as BoE's Mann.

FX OPTIONS: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-85(E1.3bln), $1.0750(E2.2bln), $1.0831-50(E787mln)

- USD/JPY: Y138.00-10($1.7bln), Y140.00($1.8bln)

- AUD/USD: $0.6450(A$571mln), $0.6550(A$743mln)

EQUITIES: Stock Futures Point to Lower Open Wednesday

- S&P E-minis trend conditions remain bullish and the latest pullback is -for now - considered corrective. Last week’s bounce from 4114.00, May 24 low, means that support around the 50-day EMA remains intact.

- Eurostoxx 50 futures managed to find support last week at 4252.00, the May 25 low. This means that for now, support at the 50-day EMA, at 4272.40, remains intact. The contract is trading lower today.

COMMODITIES: Oil Bear Cycle Persists, Weaker for Second Session

- The bear cycle in Gold remains intact and short-term gains are - for now - considered corrective. The yellow metal has pierced $1940.2, trendline support drawn from Nov 3 2022.

- WTI futures remain in a bear mode position. The strong sell-off yesterday resulted in print below support at $69.39, the May 15 low. A clear break of this level would strengthen bearish conditions and pave the way for weakness towards $63.90, the May 4 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/05/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 31/05/2023 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2023 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2023 | 1230/1430 |  | EU | ECB Lagarde Q&A at Generation Euro Students' Awards | |

| 31/05/2023 | 1250/0850 |  | US | Boston Fed's Susan Collins | |

| 31/05/2023 | 1250/0850 |  | US | Fed Governor Miki Bowman | |

| 31/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/05/2023 | 1315/1415 |  | UK | BOE Mann Panellist at Pictet Family Forum | |

| 31/05/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 31/05/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/05/2023 | 1730/1330 |  | US | Philadelphia Fed's Pat Harker | |

| 31/05/2023 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 31/05/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 01/06/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/06/2023 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 01/06/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 01/06/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 01/06/2023 | 0930/1130 |  | EU | ECB Lagarde Speech at German Savings Banks Conference | |

| 01/06/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/06/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 01/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/06/2023 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 01/06/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/06/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/06/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 01/06/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/06/2023 | 1700/1300 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.