-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US MARKETS ANALYSIS - JPY Firms as Dovish Amamiya Turns Down BoJ Governorship

Highlights:

- JPY on front foot as dovish Amamiya turns down BoJ governorship

- UK narrowly avoids recession, but still signs of concern

- NOK fails to find bid despite surging January inflation

US TSYS: Renewed Cheapening With CPI Revisions and U.Mich Ahead

- Cash Tsys have seen a resumption of cheapening pressure seen after yesterday’s 30Y tail sparked a large sell-off, coming through the European session after a pause through Asia hours with focus on BoJ leadership. It’s part of a broader higher for longer trend that continues as 2023 rate cut expectations are trimmed further.

- 2YY +3.3bp at 4.515%, 5YY +4.5bp at 3.903%, 10YY +4.6bp at 3.703% and 30YY +3.8bp at 3.773%. The relatively parallel shift across the curve sees 2s10s at -81bps consolidate a pull back off yesterday’s fresh multi-decade lows of -87bps.

- TYH3 trades 5 ticks lower at 112-28 as it moves off session lows of 112-25. It has pushed through support at both 113-05+ (Feb 7 low) and 112-29 (76.4% retrace of Dec 30 – Jan 19 bull run), opening 112-18+ (Jan 5 low) as it plays on the bear threat seen.

- Data: CPI SA revisions (0830ET - see here), U.Mich preliminary consumer survey for Feb (1000ET), Monthly budget statement Jan (1400ET)

- No further issuance after yesterday’s 30Y tail sparked a large sell-off across the curve.

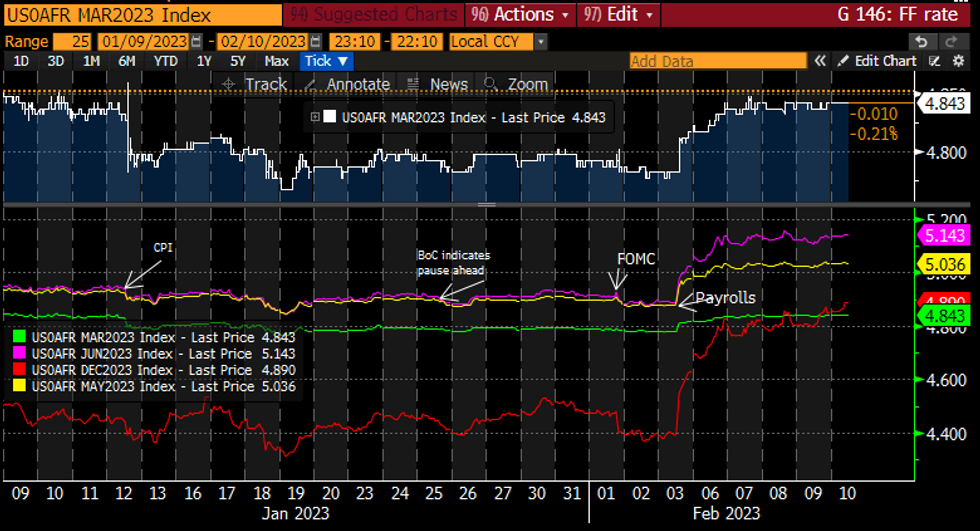

STIR FUTURES: Another Day, A Further Trimming Of Rate Cuts

- Fed Funds implied hikes are unchanged for immediate meetings but push higher further out with 2H23 cuts now at 27bps vs 50bps prior to payrolls.

- 26bp for Mar, cumulative 45bp for May, 58bps to a terminal 5.16% in Jul (+2bp) before cutting to 4.89% in Dec (+4bp). The Dec rate pushes more earnestly above the Mar rate for the first time this cycle.

- Gov. Waller (voter) and later Harker (’23 voter) both speak with text but at a crypto conference. Harker for the first time post-FOMC/payrolls. Waller two days ago “farther to go… might be a long fight, with interest rates higher for longer than some are currently expecting”.

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

BOJ: Japanese Government to Nominate Kazuo Ueda for BoJ Governor

- Various outlets reporting Kazuo Ueda will be nominated for the BoJ governor role after Amamiya rejected the role.

- Kazuo Ueda not a name that had been raised in previous reports - currently a professor at University of Tokyo and had been a BoJ board member 1998 - 2005. The reports add that Uchida and Himino are to be nominated for deputy governor positions.

- Ueda has form writing on BoJ policy academically - wrote at length on BoJ policy for the BIS (see here) as well as for the BoJ's research department on wage formation mechanisms.

BOJ: Himino, Uchida Nominees For Deputy Governor Position

- Himino (former FSA commissioner) and Uchida (current exec director of Monetary Policy at the BoJ) make up the deputy governor spots.

- Little known about Himino's policy views, but Uchida has been quoted as saying:

- "The Bank of Japan won’t rule out raising interest rates before adjusting the size of its balance sheet when the time comes to exit from monetary easing"

- "It’s too early to explain the central bank’s exit strategy, The stability of financial markets is a key point for any future exit"

US: CPI Seasonal Adjustment Revisions

- The BLS from 0830ET releases its annual recalculation of seasonal adjustment factors and their resulting SA indexes for the CPI basket through Jan’18-Dec’22. [Separate to the new weights that will come with the January data on Tue]

- There’s obviously no guarantee of the same pattern this time but looking at last year’s recalculation for perspective, the latest three months of core inflation were unrevised on a rounded basis although the two months prior were revised a tenth higher in M/M – see table using values provided by Bloomberg.

- BLS notice on the matter: https://www.bls.gov/cpi/notices/2023/seasonal-adjustment.htm

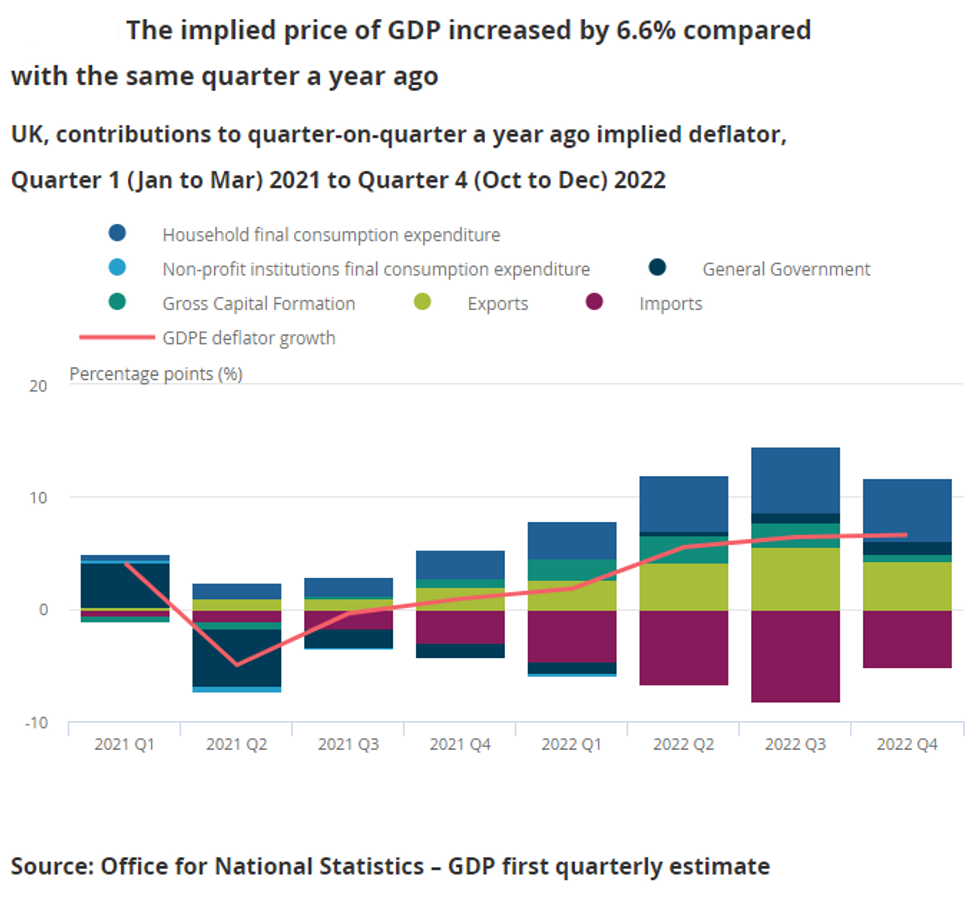

UK: Economy Closely Avoids Recession Despite Weak Services

UK GDP contracted by -0.5% m/m, more sharply than anticipated, implying a flat Q4 GDP q/q reading (+0.01% q/q to 2dp) in line with expectations. Q4 2022 GDP was -0.8% below pre-pandemic Q2 2019 levels.

- Services largely accounted for the downside surprise in December, falling -0.8% m/m (vs -0.3% exp).

- Public services were hit by fewer operations and GP visits, lower school attendance and arts/entertainment (partly due to strike action). Meanwhile, hospitality slowed from the World Cup momentum.

- All up, services were flat on the quarter and private consumption recorded a minor +0.1% q/q, after contracting in Q3.

- In December, industrial and manufacturing production were more robust than forecast, at +0.3% m/m and 0.0% m/m after November contractions. Manufacturing was solely boosted by pharmaceuticals and transport, contracting elsewhere. Overall production declined by -0.2% q/q in Q4, driven by a fall in energy as consumers cut back usage.

- The trade gas prices increased substantially, driving the trade deficit wedge deeper to GBP -19.3B after -14.7B in November.

- All up, Q4 growth was marginally weaker than BOE forecasts but largely in line with expectations, with Q1 2023 expected to be negative. The BOE hinted that it needed data to outperform its modal forecast for more hikes to be needed. We didn't see that in the data today, but this won't stop a hike if we see upward surprises in wage, services CPI or inflation expectations data.

NORWAY: Inflation Release Bolsters March Hike, But Will More Be Needed

- CPI coming in higher than expected will bolster the already-consensus view for a March 25bps hike (infitting with January Norges communications), but may raise questions about whether more tightening is required beyond Q1.

- Q1 inflation was projected at 5.86% in December, 5.76% in Q2.

- NOK has strengthened marginally, and FRA pricing is relatively unscathed so far, but the print could be a cause for concern in the next wave of wage bargaining, set to kick off over spring.

- The TBU (Norwegian Technical Calculation Committee for Wage Settlements) are set to outline their expectations for 2023 inflation in February, which will form a basis of negotiations across the coming months. While NB still see no wage-price spiral, today's data remains uncomfortable.

RATINGS: A couple of AAA, Stable Ratings on a Thin Slate

Sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on Germany (current rating: Aaa; Outlook Stable)

- S&P on Switzerland (current rating: AAA; Outlook Stable)

FOREX: JPY The Focal Point as Markets Gear for New BoJ Governor

- JPY has been the focal point of the Friday session, rallying on the back of local press reports that University of Tokyo academic and former BoJ board member Kazuo Ueda is to be nominated as the BoJ governor next week. The reports added that Amamiya - former frontrunner for the role - had turned down the nomination, to which markets responded by bidding JPY higher.

- USD/JPY slipped over 150 pips in the initial response, putting the pair at 129.81, before staging a recovery as wires cited Ueda comments in favour of policy continuity in the short-term.

- SEK sits at the other end of the G10 table, weaker against most others as markets very modestly backtrack the Thursday post-Riksbank strength.

- NOK found a minor bid on the back of higher-than-expected inflation figures. CPI-ATE rose to 6.4% - uncomfortably higher than the Norges Bank's December projections. The release bolsters the case for a March 25bps rate hike, and raises concerns over the need for further tightening beyond this quarter.

- Focus Friday turns to the Canadian jobs report, with markets expecting a net change in employment of +15k and a higher unemployment rate at 5.1%. Prelim University of Michigan sentiment also crosses, at which markets expected 1yr inflation expectations to tick higher to 4.0% from 3.9%.

FX OPTIONS: Expiries for Feb10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0750(E1.2bln), $1.0775-80(E615mln), $1.0800(E921mln), $1.0850-60(E636mln)

- USD/JPY: Y130.00($1.6bln)

- GBP/USD: $1.2150(Gbp529mln)

- EUR/GBP: Gbp0.8800(E506mln)

- AUD/USD: $0.7000(A$505mln)

- USD/CAD: C$1.3400-20($1.4bln)

EQUITIES: Equity Futures Pull Back From Thursday Peaks

- The EUROSTOXX 50 futures traded higher Thursday and breached 4265.00, Feb 3 high. Despite the pullback from yesterday’s peak, the fresh cycle high confirms a resumption of the uptrend and opens 4303.20, the 2.382 projection of the Sep 29 - Oct 4 rise from the Dec 20 low. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. Short-term support levels remain intact. Initial support lies at the 20-day EMA, at 4069.52. The more important level is at the 50-day EMA, at 4006.63. A resumption of gains would refocus attention on 4208.50, the Feb 2 high and bull trigger. A break would resume the uptrend. On the downside, a clear break of the 50-day EMA would alter the picture.

COMMODITIES: WTI Spikes to $80.22 Fib Retracement After Russia Signals Oil Output Cut

- WTI futures are holding on to this week’s gains. The contract has pierced resistance at the 50-day EMA - at $78.34. A clear break of this hurdle would strengthen the latest recovery and open $80.22, a Fibonacci retracement. Clearance of $80.22 would expose the key resistance at $82.66, the Jan 18 high. On the downside, a break below $72.25, the Feb 6 low, would reinstate a bearish theme.

- Trend conditions in Gold are bearish for now, and the yellow metal remains in a corrective cycle. This follows the strong sell-off on Feb 2 / 3 and sights are on the 50-day EMA, at $1855.5. The average represents a key support and has been pierced. A clear break would strengthen a bearish case and suggest scope for a deeper pullback - towards $1825.2, the Jan 5 low. On the upside, key resistance and the bull trigger is at $1959.7, the Feb 2 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/02/2023 | 1400/1400 |  | UK | BOE Pill Panellist at BIS SUERF Workshop | |

| 10/02/2023 | 1400/1500 |  | EU | ECB Schnabel Twitter Q&A | |

| 10/02/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/02/2023 | 1730/1230 |  | US | Fed Governor Christopher Waller | |

| 10/02/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2023 | 2100/1600 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.