-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets on Inflation Watch

HIGHLIGHTS:

- Core bonds slip, with markets on inflation watch

- Chinese factory gate prices rising at fastest pace in quarter-century

- US CPI takes focus, with both core and headline metrics seen jumping

US TSYS SUMMARY: Bear Steepening Pre-CPI And 30Y Supply

Cash yields have risen with the curve steepening in the overnight session, with 30Ys underperforming ahead of supply today. Higher-than-expected Chinese inflation data set a bearish tone in Asia-Pac hours, with US CPI eyed warily.

- The 2-Yr yield is up 3bps at 0.4509%, 5-Yr is up 3.6bps at 1.1169%, 10-Yr is up 3.0bps at 1.4813%, and 30-Yr is up 3.8bps at 1.8553%.

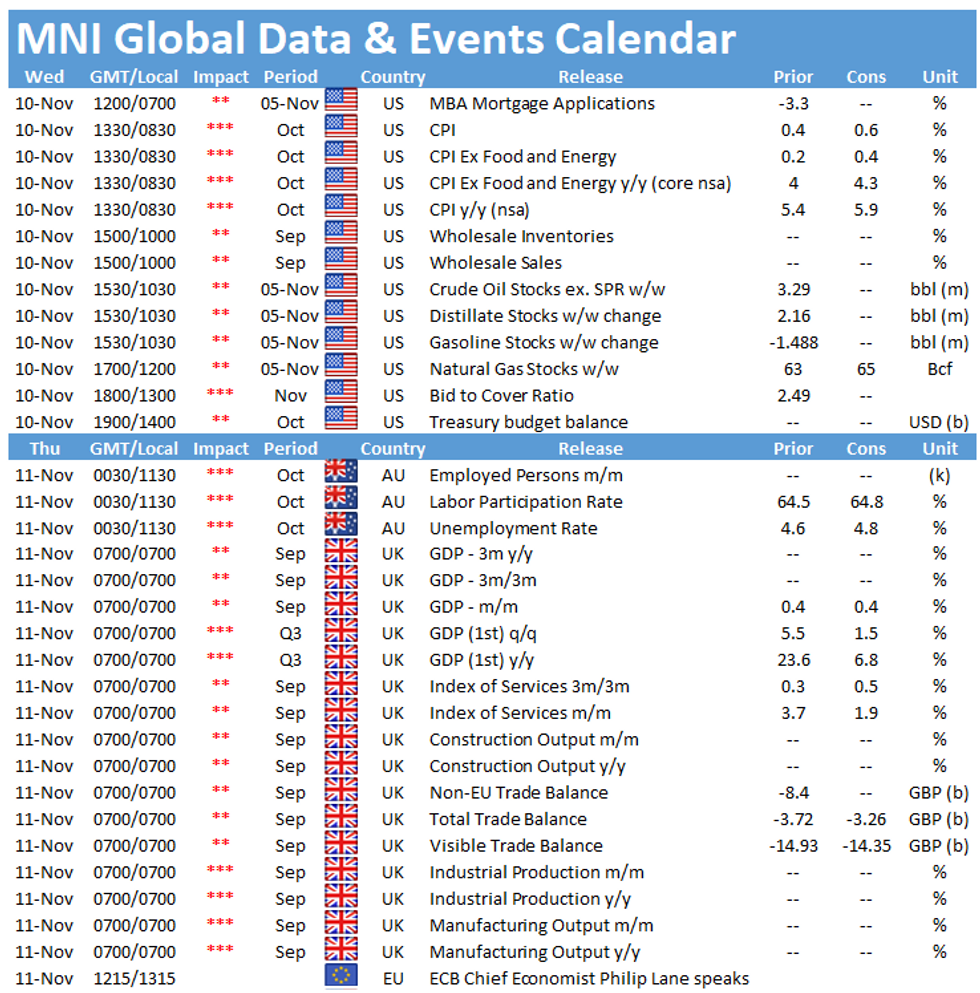

- The highlight of Wednesday's schedule is the 0830ET release of October CPI. Headline is seen re-accelerating to 0.6% M/M vs 0.4% in Sep, with core up to +0.4% vs +0.2% prior. Additionally we get jobless claims at the same time.

- 1000ET sees wholesale inventories data, with the monthly budget statement out at 1400ET.

- The other notable event is $25B 30Y Bond auction at 1300ET. We also get $35B combined in 4-/8-week bills at 1130ET, plus $40B in 119-day bills alongside the 30Y auction.

- NY Fed buys ~$3.225B of 7-10Y Tsys.

EGB/GILT SUMMARY: Core Bonds Slip, With Markets on Inflation Watch

- Core bond futures trade under pressure across the Eurozone, UK and US, with inflationary concerns compounded by the convincingly higher than expected Chinese PPI (and, to a lesser extent, CPI) data. Y/Y Factory gate prices in China rose to 13.5%, the highest level since the mid-1990s.

- Peripheral spreads trade wider, with the likes of Italy, Portugal and Spain underperforming to lead yields 2-3bps wider so far Wednesday.

- The Gilt curve trades similarly higher, taking the lead from core bond space, with 10y yields climbing 4bps to 0.860%.

- Auctions this morning include bond auctions from Germany and Portugal, while the UK DMO sold an index-linked line.

- Focus turns to US CPI data, with price pressures expected to notch higher to push the Y/Y rate to 5.9%, the highest level since the early 1990's.

EUROPE ISSUANCE UPDATE

UK DMO sells GBP900mln 0.125% Aug-31 linker, Avg yield -3.242% (Prev. -3.009%), Bid-to-cover 2.25x (Prev. 2.33x), Avg price 138.970 (Prev. 136.534)

Germany allots E3.052bln 0% Aug-31 Bund, Avg yield -0.29% (Prev. -0.22%), Bid-to-cover 0.93x (Prev. 0.86x), Buba cover 1.14x (Prev. 1.13x)

Portugal sells:

- E686mln 0.30% Oct-31 OT, Avg yield 0.314% (Prev. 0.387%), Bid-to-cover 1.46x

- E314mln 4.10% Apr-37 OT, Avg yield 0.622% (Prev. 0.479%), Bid-to-cover 2.10x

FOREX: Greenback Makes Modest Advance Pre-CPI

- Markets are mixed early Wednesday as traders await the US inflation data later today as well as the day-advanced initial jobless claims numbers, shifted due to Thursday's market holiday.

- USD/JPY has bounced off the Tuesday lows of 112.73 snapping the four session losing streak as the pair recovers back above the 113.00 handle.

- CAD is stronger for a second session, pressing USD/CAD to its lowest levels of the week and further off the 1.2476 200-dma, which remains a key resistance. The solid rally in oil prices late Tuesday remains the key driver, with Brent futures just below the $85.50/bbl weekly high printed overnight.

- JPY, SEK and NZD are among the weakest in G10, while CAD, USD and EUR are slightly firmer.

- US inflation data takes focus going forward, with M/M CPI expected to ratchet higher to +0.6% from +0.4% previously, taking the Y/Y rate to 5.9% - the highest rate since 1990.

FX OPTIONS: Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1400(E641mln), $1.1495-00(E1.2bln), $1.1550-55(E1.1bln), $1.1565-75(E2.1bln), $1.1595-00(E1.2bln)

- USD/JPY: Y111.40-55($1.1bln), Y111.80-85($501mln), Y112.20-30($643mln), Y113.00($810mln), Y113.65-85($992mln), Y114.00($1.3bln)

- GBP/USD: $1.3400(Gbp784mln), $1.3550(Gbp787mln), $1.3595-00(Gbp628mln)

- EUR/GBP: Gbp.0.8490-00(E587mln)

- AUD/USD: $0.7340-50(A$866mln), $0.7375(A$635mln)

- USD/CAD: C$1.2450-55($1bln), C$1.2500($1bln)

- USD/CNY: Cny6.4000($820mln), Cny6.5000($1.1bln)

Price Signal Summary - Shallow Correction, Bull Flag In The Equity Space

- In the equity space, the uptrend in the S&P E-minis remains intact and this week's pullback is likely a correction. Thus far, it is a shallow one. The focus is on 4717.00 next, 1.50 projection of the Jul 19 - Aug 16 - Aug 19 price swing. EUROSTOXX 50 futures are consolidating below recent highs and this week's activity appears to be a bull flag. The trend needle continues to point north and the focus is on 4371.00, 1.236 projection of Jul 19-Sep 6-Oct 6 2020 swing (cont)

- In FX, EURUSD outlook remains bearish. Last week's print below 1.1524 Friday, the Oct 12 low reinforces this theme. The focus is on 1.1493, 50.0% retracement of the Mar '20 - Jan '21 bull phase. Initial resistance this morning is at 1.1617, Nov 4 high. GBPUSD remains vulnerable. Yesterday's candle pattern - a doji - is a bearish pattern and signals the end of the most recent corrective bounce. Attention is on the key support at 1.3412, Sep 29 low. USDJPY has breached support at 113.00, the Oct 12 low but is back above this level. The break lower yesterday nevertheless signals scope for a deeper pullback and has opened 112.08, Sep 30 high.

- On the commodity front, Gold reversed course late last week and maintains a firmer short-term tone. Attention is on resistance at $1834.0, Sep 3 high, a break would improve conditions for bulls. WTI is approaching the bull trigger at $85.41, Oct 25 high. A break would confirm a resumption of the uptrend and open $87.45, a Fibonacci projection. On the downside, key short-term support has been defined at $78.25 Nov 4 low.

- In the FI space, Bund futures maintain a a bullish short-term tone. The break of 169.83, Oct 27 high and clearance of the 50-day EMA, opens 171.95, 61.8% of the Aug - Nov sell-off. Gilts maintain a firmer tone and the recent double bottom reversal continues to play out. The focus is on 127.69 next, Sep 21 high.

EQUITIES: Progress in Energy Sector Countered by Weak Discretionary Names

- European indices are mixed ahead of the NY crossover, with UK, Spanish and Italian markets in the green while the EuroStoxx50 and France's CAC-40 are in negative territory.

- Energy names are leading the way higher, better bid on the back of the buoyant crude price into the Tuesday close. Markets have been further flattered by the lack of imminent action from the White House, who confirmed there would be no immediate reserve release from the SPR yesterday.

- Tech and consumer discretionary names are erring less favourably, leading the weakness on the continent.

- US futures are softer, with the e-mini S&P lower by 10 points or so ahead of the US CPI release. S&P E-minis maintain a bullish tone and this week's pullback is likely a correction. Another all-time high print was registered Nov 5. Continued gains confirm a resumption of the uptrend and the focus is on 4717.00 next, a Fibonacci projection.

COMMODITIES: WTI, Brent Off Highs After Solid Tuesday Gain

- WTI and Brent crude futures sit in minor negative territory, but are holding the bulk of the Tuesday rally, with a modest advance in the greenback and profit-taking easing the energy complex this morning.

- Focus remains on possible US action to combat high gas and fuel prices, after the White House yesterday confirmed there would be no imminent release from the Strategic Petroleum Reserve to quell prices.

- Additionally, broad action using the SPR was made more difficult as the EIA forecast a pullback in prices headed into December, while also projecting arise in oil stocks early next year, against an expected draw at the prior month's report.

- Gold is holding onto the bulk of recent gains and the outlook remains positive following last week's bounce from $1759.0, Nov 3 low. The turnaround reinstates a potential bullish outlook and the yellow metal has traded above $1813.8, Oct 22 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.