-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - NOK Surges as Core CPI Re-Accelerates

Highlights:

- NOK on top as core CPI unexpectedly accelerates

- Fed implied path settling slightly softer post-payrolls

- BoE's Bailey set to speak, markets watch for clues on policy

US TSYS: Twist Steepening Awaiting Fedspeak

- Cash Tsys hold a milder version of Friday’s twist steepening, leaving the major benchmarks running 3bp richer to 1.5bp cheaper, pivoting around 7s. The 2-/10-Year curve is off session highs of -84bps but holds a move through post-payrolls highs.

- Fedspeak headlines the docket after relatively few appearances last week, with VC Supervision Barr starting proceedings off before three ’24 voters. It might help frame the debate but focus is ultimately on Wednesday’s CPI release ahead of the Jul 26 FOMC decision in an increasingly data dependent world.

- 2YY -3.1bp at 4.915%, 5YY -3.0bp at 4.330%, 10YY +0.0bp at 4.062%, 30YY +1.1bp at 4.057%.

- TYU3 trades 2 ticks lower at 110-19+ just off session highs of 110-21+ but well within Friday’s range (with both high and lows seen after payrolls). The bear threat remains present with support at 110-05 (Jul 6 low), whilst volumes are on the low side at a cumulative 230k.

- Fedspeak: Barr (1000ET, text), Daly (1100ET, no text), Mester (1100ET, text), Bostic (1200ET, no text)

- Data: Wholesale trade sales/inventories May/May F (1000ET), Consumer credit (1500ET)

- Bill issuance: US Tsy $65B 13W, $58B 26W bill auctions (1130ET)

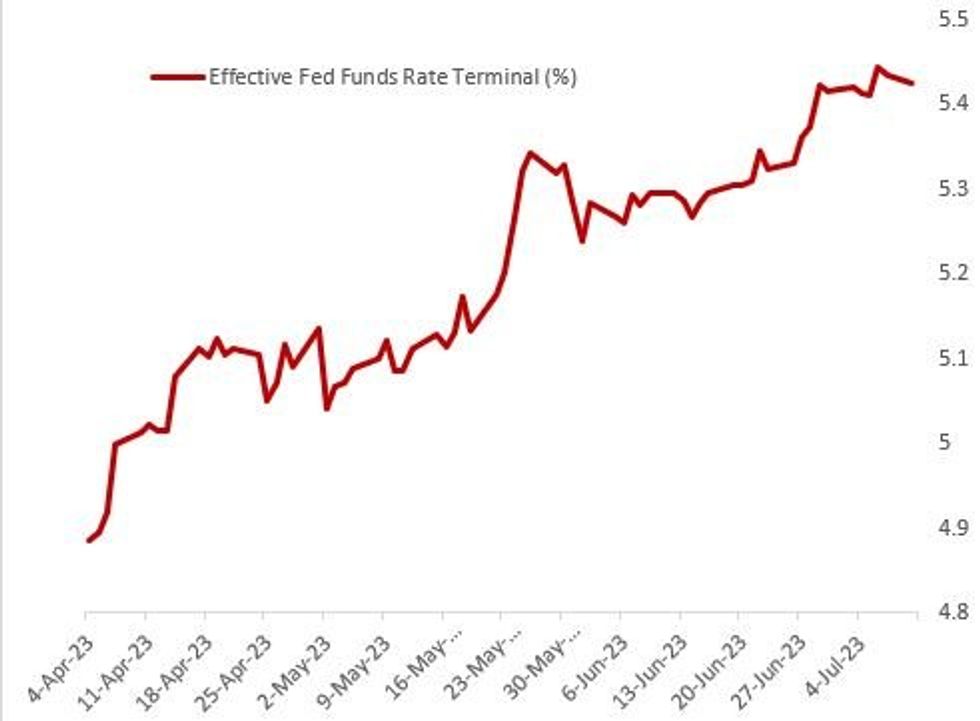

STIR FUTURES: Implied Fed Hike Path Settling Slightly Softer Post-Payrolls, Pre-CPI

Fed hike pricing is settling slightly softer after Friday's headline payrolls miss (our review here), with a quiet data slate putting attention on FOMC speakers ahead of Wednesday's CPI print.

- After dipping an implied 0.5bp overnight on OIS amid soft China inflation data, July hike pricing has regained ground and is basically where it was before Friday's employment report at 22.5bp priced (90% prob of a quarter-point raise).

- Conversely, a tick higher overnight in implied hikes for meetings beyond July has reversed: the path sees a cumulative 28.5bp to September and 34.4bp through the November peak. That peak pricing - implying effective Fed funds of 5.42% is 1.8bp lower than the overnight high and almost a full 3bp below just before the payrolls release.

- A full 25bp cut from the terminal rate doesn't materialize until the May 2024 FOMC.

- With only limited data on the agenda (wholesale inventories), there will be attention on Fed speakers including Barr, Daly, Mester, and Bostic. Note that this is the final week of communications before the pre-meeting blackout period.

Source: BBG, MNI

Source: BBG, MNI

BoE: Bailey to deliver Mansion House speech later today

- This evening the Governor will give his Mansion House speech – although we only have to wait until 4pm BST for the release of the text.

- Bailey made a number of media appearances following the 50bp June hike, but this will be the best opportunity he has had to explain in more detail the rationale behind the decision and to respond to recent market pricing.

- At the time of writing markets are pricing in a cumulative peak of 142bp priced by March 2024 (which would put Bank Rate just below 6.50%). This is up from a peak of 126bp in the February 2024 meeting at the end of the June but down from 165bp which followed the strong US ADP employment and ISM services prints on Thursday.

- The only major data that has been received since that June MPC meeting has been the PMIs (which the BOE may have had some access to), retail sales, housing data and the latest DMP data.

- Elsewhere this week there are no other MPC speakers scheduled although we will receive the Financial Stability Report on Wednesday morning with the press conference to follow later in the morning.

Public sector pay negotiations in focus

- The government’s reaction to the independent pay review body’s recommendations on public sector wages will be in close focus this week.

- The government is caught in two minds as to what to do here. The recommendations are for larger increases than last year, and the government is very concerned about stoking second round inflationary impacts.

- But if smaller increases are offered then it is almost inevitable unions will call for more disruptive strikes.

- The government will be weighing up the political costs of each scenario ahead of the next general election, likely in autumn 2024.

- The outcome and narrative of the debate will be closely watched by markets – and if 6+% pay rises are agreed in the private sector, it will probably embolden private sector employees to ask for larger pay increases, too.

FOREX: Accelerating Core CPI Provides Further Headache for Norges Bank

- NOK tops the G10 FX table following higher-than-expected CPI for June: core CPI accelerated sharply to 7.0% vs. Exp. 6.6% to print another cycle high and provide another headache for the Norges Bank, who likely now have to consider faster policy action at the August rate decision. EUR/NOK dropped sharply to touch 11.5424 before finding support at the 100-dma at 11.5295.

- AUD sits at the other end of the docket, with the currency undermined by a pullback in Chinese-listed iron ore futures. As such, AUD/USD failed to consolidate any move above the 200-dma of 0.6698, keeping the pair inside the recent range of 0.6596-0.6705.

- Outside of AUD and NOK, currency markets are more muted, with most major pairs respecting the post-NFP ranges. The USD Index holds close to last Friday's lows with 102.226 marking first support. Weakness through here would open losses toward 101.921 and levels not seen since May.

- The Monday docket is typically quiet, with just US Wholesale Inventories and Canadian building permits on the schedule. The central bank speaker slate is busier: Fed's Barr, Daly, Mester and Bostic are on the calendar as well as BoE's Bailey and ECB's Herodotou.

FX OPTIONS: Expiries for Jul10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E856mln), $1.0845-65(E752mln), $1.0920(E1.1bln), $1.0975-80(E1.3bln), $1.1000(E676mln)

- USD/JPY: Y140.00($876mln), Y143.00($1.0bln)

- GBP/USD: $1.2765-70(Gbp584mln)

- AUD/USD: $0.6685(A$895mln), $0.6700-20(A$576mln)

- USD/CNY: Cny7.2600($566mln)

BONDS: USTs and Gilts Steepen While German Curve Sees Parallel Shift

- There have been some mixed moves in core fixed income markets this morning. The UST and gilt curve have steepened but USTs through the 2-year yields moving lower and 10-year steady while gilts have been through 2-year yields moving up less than 10-year yields. While the German curve has seen a parallel shift with yields 1.5bp or so higher across maturities.

- There have been no huge headline drivers this morning, with probably the biggest talking point the lower-than-expected Chinese inflation released during the Asian session.

- Today's highlight is likely to be the release of the text of Governor Bailey's Mansion House speech at 16:00BST / 11:00ET today, which comes ahead of tomorrow's UK labour market data. Elsewhere today we also have Fed's Daly, Mester, Barr and Bostic as well as ECB's Herodotou and Nagel. The big event of the week globally will be the US inflation print on Wednesday.

EUROZONE ISSUANCE UPDATE:

EUROZONE ISSUANCE: EU-bond syndication: 2.50% Oct-52 tap tomorrow

- The EU has mandated banks as Joint Lead Managers for its upcoming EUR Fixed Rate RegS Bearer tap of the existing 2.5% benchmark due 4 October 2052 bond (EU000A3K4DT4). The transaction will be launched tomorrow, subject to market conditions.

EGB SYNDICATION: Greece 15-year with switch/tender auction

- Bloomberg has reported that Greece has released a mandate for a 15-yearsyndication alongside a switch/tender offer.

EQUITIES: Eurostoxx 50 Futures Remain Close to Friday Lows

- Eurostoxx 50 futures traded sharply lower last week, clearing a number of key support levels in the process. The contract has breached 4241.00, the May 31 low. This highlights a potential reversal and signals scope for weakness towards 4208.50, a Fibonacci retracement point. On the upside, key short-term resistance is seen at 4332.30, the 50-day EMA. A break of this average would ease bearish pressure.

- A bull theme in S&P E-minis remains intact and the pullback last week appears to be a correction - for now. Attention is on the first support 4411.98, the 20-day EMA. Clearance of this level would strengthen a bearish threat and expose 4368.50, the Jun 26 low and a key support. The bull trigger is at 4498.00, the Jun 16 high. A clear breach of this level would confirm a resumption of the uptrend and open 4532.08, a Fibonacci projection.

COMMODITIES: WTI Futures Technically Bearish Despite Recent Move Higher

- WTI futures remain in a bear mode condition, however, a corrective cycle remains in play and the contract has breached resistance at $72.72, the Jun 21 high, This strengthens a short-term bullish condition and a continuation would expose key resistance at $75.70, the Jun 5 high. A break of this level would highlight an important bullish break. On the downside, key short-term support is at $66.96, the Jun 12 low.

- Gold is consolidating. The trend condition is unchanged and remains bearish. Recent fresh lows reinforce bearish conditions, confirming a resumption of the downtrend and extending the price sequence of lower lows and lower highs. Moving average studies are in a bear mode position highlighting current sentiment. The focus is on $1885.8, the Mar 15 low. Key resistance is $1985.3, the May 24 high. Initial resistance is $1945.1, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/07/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/07/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 10/07/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/07/2023 | 1500/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/07/2023 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/07/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 10/07/2023 | 1900/2000 |  | UK | BOE Bailey Speech at Financial & Professional Services Dinner | |

| 11/07/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/07/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/07/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/07/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 11/07/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 11/07/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 11/07/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/07/2023 | 1500/1100 |  | US | New York Fed's John Williams | |

| 11/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 11/07/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.