-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI US MARKETS ANALYSIS - NZD Gains as RBNZ Opts for Hawkish OCR Track

Highlights:

- NZD gains as RBNZ opt for hawkish OCR track

- Fed implied rate path tilts to highest since CPI

- Front-loaded US data ahead of Thanksgiving, with Durables, weekly jobless claims and prelim PMIs due

US TSYS: Twist Flattening With China Covid Rules & EA PMI Beat, Heavy Docket Ahead

- Cash Tsys have seen a limited twist flattening after the late open with the Tokyo holiday, with the pivot out in the very long end. Moves are relatively subdued ahead of a solid docket with Thanksgiving tomorrow.

- Various factors at play, including the RBNZ with a hawkish 75bp hike, a beat for the Eurozone PMI (which included a beat for Germany but miss for France) ahead of the US equivalent later and China tightening Covid rules in Beijing and Shanghai. Chinese state television reporting the need to cut banks’ RRR and use other mon pol tools has seen little impact on the space.

- 2YY +2.3bps at 4.537%, 5YY +1.4bps at 3.958%, 10YY +0.7bps at 3.763%, and 30YY -0.9bps at 3.816%.

- TYZ2 trades 2+ ticks lower at 112-16+ on below average volumes. There is a technical bullish outlook with resistance at 113-11 (Nov 16 high) and support at 111-25 (20-day EMA).

- FOMC minutes at 1400ET.

- Data: Durable goods (0830ET), S&P Global PMI (0945ET), U.Mich Nov final (1000ET), plus weekly MBA mortgage apps (0700ET) and jobless claims pulled forward to a Wednesday (0830ET).

- Bill issuance: US Tsy $55B 4W, $50B 8W bill auctions (1000ET), US Tsy $33B 17W bill auction (1130ET)

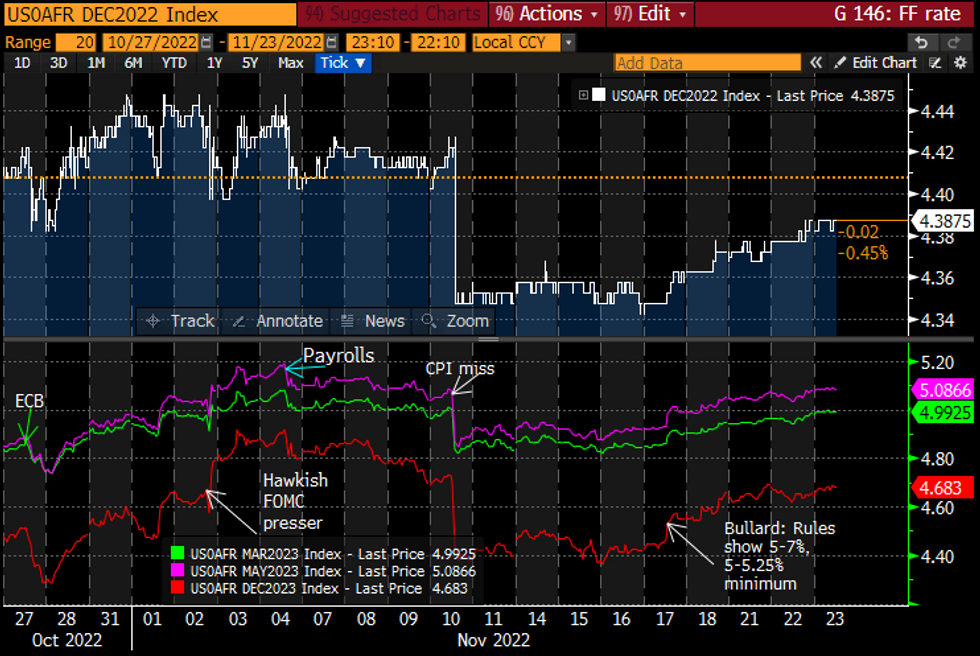

STIR FUTURES: Fed Rate Path Sits At Post CPI Highs

- Fed Funds implied hikes sit have ground higher overnight to 52bp for Dec (unch), 92.5bp to 4.79% Feb’23 (+0.5bp), a terminal 5.09% in May/Jun’23 (+1bp) and 4.68% Dec’23 (+3bp).

- The terminal has picked up off a low of 4.85% shortly after the US CPI miss but remains off prior highs of almost 5.20%.

- No scheduled Fedspeak today with FOMC minutes later but potential pop-ups ahead of Thanksgiving holiday.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

EU/RUSSIA: EU Parl't Backs Resolution Calling Russia State Sponsor Of Terrorism

MEPs have voted in favour of a resolution labelling Russia a 'state sponsor of terrorism', with 494 voting in favour, 58 against and 44 abstaining. The European Parliament has sought to encourage all member states to adopt the same designation.

- At present, only individuals or organisations can be blacklisted by EU sanctions. The Parliament is backing a legal change to allow entire countries to be placed on the sanctions list, in a similar system to that used in the United States. This would hugely restrict the level of interaction on a trade and diplomatic level (already largely cut off) and punish third-party nations engaging in trade with Russia, particularly those supposedly supplying weapons to Moscow (i.e. Iran).

- However, this change would require unanimous approval from EU member states. The prospect of getting perennial holdout Hungary to back such a change at present remains an unlikely prospect.

EUROPE ISSUANCE UPDATE:

German auction result

- E1bln (E908mln allotted) of the 1.80% Aug-53 Bund. Avg yield 1.94% (bid-to-cover 1.66x)

Gilt auction result

- GBP3.5bln of the 0.25% Jan-25 Gilt. Avg yield 3.347% (bid-to-cover 1.89x, tail 1.8bp).

FOREX: Hawkish OCR Track Puts NZD Above Most Others in G10

- G10 currencies trade largely subdued early Wednesday, with EUR/USD strength over Asia-Pac hours resulting in a 1.0348 print before prices faded across Europe. PMI data across Europe has been mixed, with French data weaker, but German figures coming out ahead of forecast.

- Equities continue to provide a generally risk-on backdrop, with the e-mini S&P and EuroStoxx future both holding inside short-term uptrend. JPY is offered, with modest European hours USD strength pressing USD/JPY against 141.50 resistance.

- NZD is among the strongest performers in G10, with NZD/USD approaching clustered resistance layered between 0.6200 - 0.6206 following the RBNZ decision. The bank raised rates by 75bps, alongside expectations, and hiked the OCR track markedly, putting the new peak rate at approximately 5.50% for next year - implied a further 125bps of rate hikes this cycle.

- NOK, SEK and NZD are the firmest in G10, while JPY and CAD are at the bottom of the pile.

- Focus turns to the raft of US data, with releases clustered to the Wednesday session to accommodate for Thursday's Thanksgiving holiday. Prelim October durable goods data, weekly jobless claims, new home sales and the prelim November PMI cross.

- Final Michigan sentiment data will be watched for any markdown for inflation expectations, with the survey data now including the lower-than-expected October CPI release. Fed minutes also cross, with markets watching for any indications of a step-down in the pace of rate rises at the December meeting.

FX OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.5bln), $0.9750(E1.5bln), $1.000-10(E766mln), $1.0050(E1.3bln), $1.0280(E756mln), $1.0300(E1.3bln), $1.0350(E805mln)

- USD/JPY: Y140.00($900mln), Y141.75-00($1.3bln), Y144.50-70($2.7bln)

- USD/CNY: Cny7.05-07($1.2bln)

BONDS: Bunds Underperforming As European PMIs Mostly Beat

Global core FI is weaker early Wednesday, ahead of a heavy data slate in the pre-holiday US session.

- Bunds are underperforming global peers. Across the US, German and UK cash curves, underperformance is in the short end, with mixed moves further along.

- European PMIs were mostly been above expected (French Services PMI a notable miss to the downside), with price pressures still easing. German 2s10s continued flattening to cycle lows following the data release.

- Gilts weakened slightly following a UK Supreme Court ruling against another Scottish independence referendum.

- A heavy US data schedule ahead of Thanksgiving's closure includes durable goods orders alongside jobless claims; flash PMIs; and UMich prelim sentiment alongside new home sales.

- Nov FOMC minutes are released at 1400ET (previews here and here).

- Dec US 10-Yr futures (TY) down 2/32 at 112-17.5 (L: 112-12 / H: 112-21.5)

- Dec Bund futures (RX) down 7 ticks at 140.32 (L: 139.77 / H: 140.59)

- Dec Gilt futures (G) up 37 ticks at 107.08 (L: 106.51 / H: 107.32)

- Dec BTP futures (IK) up 25 ticks at 119.12 (L: 118.31 / H: 119.42)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/11/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/11/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/11/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/11/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/11/2022 | 1500/1000 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/11/2022 | 1500/1000 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/11/2022 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2022 | 1900/1900 |  | UK | BOE Pill Speech at Beesley Lecture Series | |

| 23/11/2022 | 2130/1630 |  | CA | Governor Macklem testifies at House finance committee | |

| 24/11/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/11/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/11/2022 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 24/11/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 24/11/2022 | 0945/0945 |  | UK | BOE Ramsden Speech at BOE Watchers’ Conference | |

| 24/11/2022 | 1030/1030 |  | UK | BOE Pill Panelist at BOE Watchers’ Conference | |

| 24/11/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 24/11/2022 | 1115/1215 |  | EU | ECB de Guindos Speech at Analysis Forum in Milan | |

| 24/11/2022 | - |  | SK | South Korea BoK Rate Decision | |

| 24/11/2022 | - |  | ZA | SARB Rate Decision | |

| 24/11/2022 | 1300/1400 |  | EU | ECB Schnabel Speech at BOE Watchers' Conference | |

| 24/11/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 24/11/2022 | 1345/1345 |  | UK | BOE Mann Panelist at BOE Watchers’ Conference | |

| 24/11/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/11/2022 | 2330/0830 |  | JP | Tokyo Nov CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.