-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US MARKETS ANALYSIS - Pockets of Volatility Persist

HIGHLIGHTS:

- Turnaround in week's best FX performers continues with AUD, GBP sharply weaker

- EGBs broadly stronger, with the long-end of the curve outperforming

- Yield tumult eases, 10y yield back below 1.50%

US TSYS SUMMARY: Some Relief Ahead Of Week-End Data

We've come well off Thursday's yield highs but the tone overnight has been more of tentative stability in Treasuries than a full-on recovery.

- A drop of ~13bps from the previous session's spike high in 10Yr Tsys, but we're still 10+bps above Wednesday's close. Stock futs a bit off overnight lows, dollar up sharply.

- The 2-Yr yield is down 2.2bps at 0.1505%, 5-Yr is down 5.2bps at 0.7682%, 10-Yr is down 4.8bps at 1.4719%, and 30-Yr is down 2.5bps at 2.2484%.

- Jun 10-Yr futures (TY) up 7/32 at 132-25.5 (L: 132-08 / H: 133-05.5)

- Overnight analyst commentary assessing Thursday's market moves points to multiple factors, from Fed nonchalance to supply to convexity to SLR exemption expiry.

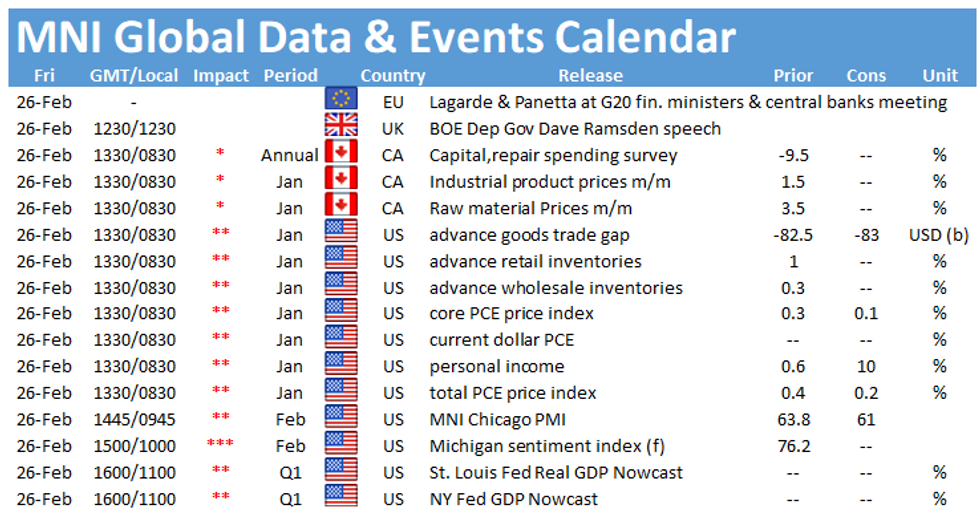

- In data: 0830ET sees Jan personal income/spending incl PCE deflator, prelim wholesale inventories, and advance goods trade; 0945ET is Feb MNI Chicago PMI, followed by 1000ET's final Feb UMichigan sentiment.

- House debates and votes today on the COVID relief package, vote could come very late tonight.

- No supply today (perhaps mercifully after Thursday's 7-Yr auction debacle). NY Fed buys ~$12.825B of 0Y-2.25Y Tsys.

EGB/GILT SUMMARY - Risk Sentiment Undermined By Inflation Concerns

Yesterday's sharp sell-off in US hours has stocked caution in this morning's Europe session with equities trading weaker and G10 FX losing ground against the dollar. EGBs have broadly rallied with the long end of the curve outperforming.

- Gilts initially firmed, in line with EGBs, but the short end sold off after the Bank of England's Andy Haldane warned that there was a risk of being complacent over the risk of inflation. The long end of the curve is holding relatively firm for now and mirroring the moves in EGBs.

- Bunds have rallied and the curve has flattened with the 2s30s spread 4bp narrower on the day.

- OATs have slightly outperformed bunds with yields 1-4bp lower and the long end of the curve close to flat.

- The BTP curve has similarly flattened.

- Supply this morning came from the UK (Bills, GBP3.5bn).

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXJ1 173.5c, bought for between 18-19 in 25k (ref 170.76, 12 delta)

RXJ1 170p sold at 86 in 10k

RXJ1 174/173ps 1x2, bought for 1 in 1k

RXM1 173/172ps 1X2, bought for 1 in 1.5k

RXM1 170.5^, bought for 309 in 1k

RXM1 169/167.5ps 1x1.5, bought for 17.5 in 6k

OEJ1 135.00/135.50cs, bought for 10 in 4k

OEJ1 133.5/135.5 RR, bought the put for 3.5 in 2.5k

DUM1 112.00^, sold at 11 in 10k

0RZ1 100.62/100.50ps 1x2, sell the 2 at half in 4.25k

UK:

0LU1 99.87/99.75ps 1x2, bought the 2 for 5 in 2k

FOREX: USD Remains Stronger Post-Yield Tumult

After a tumultuous Thursday, markets are more sanguine this morning, but the USD has retained an underlying bid tone and is outperforming all others in G10 so far Friday. This is pressuring EUR/USD into close proximity to the Wednesday low and has prompted a sizeable pullback in GBP/USD - which is now over 300 pips off the weekly high.

- ECB speakers have drawn focus this morning, with both Lane and Schnabel speaking. Schnabel stated that the ECB could act to add support should European government bond yields hinder growth in the region, while Lane stressed that the ECB has more ammo if required, but they are not engaged in yield curve control. The EUR is mixed this morning.

- Commodity-tired and growth-proxy currencies are suffering slightly in a post-US yield rally hangover. Both AUD and NZD are the poorest performers so far.

- Focus turns to another raft of US data, with January trade balance, wholesale inventories, and personal income/spending as well as the MNI Chicago Business Barometer. Central bank speakers include BoE's Haldane & Ramsden. There are no Fed speakers of note.

FX OPTIONS: Expiries for Feb26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E682mln), $1.2150(E748mln-EUR puts), $1.2175(E1.6bln-EUR puts), $1.2200-05(E1.1b-EUR puts), $1.2235-50(E894mln), $1.2275(E786mln)

- USD/JPY: Y105.00($621mln), Y105.25($750mln), Y105.80-00($1.3bln), Y106.25-35($667mln), Y106.50($755mln)

- GBP/USD: $1.3900(Gbp1.3bln), $1.3930(Gbp614mln), $1.4000(Gbp732mln), $1.4030(Gbp2.7bln-GBP puts), $1.4060(Gbp1.2bln-GBP puts), $1.4120(Gbp899mln)

- EUR/GBP: Gbp0.8600-20(E2.4bln), Gbp0.8650(E854mln), Gbp0.8665-75(E1.8bln-EUR puts), Gbp0.8700(E571mln-EUR puts)Gbp0.8750-65(E1.2bln-EUR puts)

- USD/NOK: Nok8.5375-0.8400($690mln-USD puts)

- AUD/USD: $0.7590-0.7600(A$1.2bln), $0.7665-75(A$711mln), $0.7770-80(A$1.6bln-AUD puts), $0.7800(A$788mln), $0.7825(A$847mln), $0.7850(A$1.8bln-AUD puts), $0.7870-75(A$801mln), $0.7900(A$5.3bln-AUD puts), $0.7975(A$2.2bln-AUD puts)

- NZD/USD: $0.7100(N$702mln), $0.7400(N$676mln)

- USD/CAD: C$1.2500($2.3bln), C$1.2530($2.1bln), C$1.2540-50($948mln), C$1.2630($1.7bln), C$1.2700($867mln), C$1.2750($571mln)

- USD/CNY: Cny6.41($550mln), Cny6.44($680mln). Cny6.45($1.1bln)

EQUITIES: Stocks Softer as Europe Follows Wall Street's Lead

An acute sell-off in US stock markets after the London close Thursday has set the course for European indices this morning. Continental markets are uniformly lower, with cash markets off around 0.4-0.5% apiece. Energy names are leading losses, with materials and tech firms not far behind.

- Defensive healthcare and staples firms are close to the top of the pile, echoing the risk-off tone so far Friday.

- The e-mini S&P bottomed out at 3801.50 in Asia-Pac trade, and sits within range of that mark ahead of the NY crossover. NASDAQ futures remain heavy as tech stocks lead the recent sell-off - the NASDAQ 100 futures now look comfortable below the 50-dma at 13,129.

COMMODITIES: Top or Pause?

The commodity rally this week has paused close to recent highs, with Brent and WTI crude futures in (very) minor negative territory early Friday. The bullish cycle is still in tact for now, with markets like consolidating recent gains and profit-taking while technical measures continue to point to overbought conditions.

Despite the equity pullback, there's been no haven bid in precious metals with gold and silver both lower ahead of the NY crossover. Silver is seeing particular weakness which has prompted a stall in the recent gold/silver ratio downtrend. The measure remains close to cycle and multi-year lows printed early February.

US data takes focus going forward, with the MNI Chicago Business Barometer a highlight.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.