-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US MARKETS ANALYSIS - PPI Next as Inflation Data Rolls On

Highlights:

- PPI rounds off trifecta of US risk events, weekly claims also due

- USD/JPY makes light work of post-CPI weakness ahead of BoJ decision

- US 30y auction rounds off US supply this week

US TSYS: FOMC Aftermath, PPI, Weekly Claims

- Treasuries are moderately lower at the moment, upper half of narrow overnight range following yesterday's steady FOMC policy annc, tempered by split rate cut guidance between one to two by year end. Yesterday's lower than expected CPI shows progress, builds confidence, it's still not enough to warrant looser policy at this time, Chairman Powell said at the post-FOMC presser.

- Sep'24 10Y Treasury futures are currently trading -3 at 110-07 vs. 110-09 high. Initial technical resistance at 110-21.5 (June 12 high) followed by 110-27.5 (1.00 proj of the Apr 25 - May 16 - 29 price swing). On the flipside, support holds at 109-16/109-00.5 (50-day EMA / Low Jun 10 and key support).

- Cash yields are running mildly lower: 5s -.0071 at 4.3089, 10s -.0098 at 4.3063%, 30s -.0075 at 4.4677%, while curves look flatter: 2s10s -0.532 at -44.532, 5s30s -0.128 at 15.612.

- Focus turns to this morning's PPI final demand and weekly jobless claims at 0830ET. Not out of blackout until tomorrow, NY Fed Williams attends a moderated discussion w/ Tsy Sec Yellen hosted by the NY Economic Club at 1200ET.

- Rounding out the week's Treasury supply, $70B 4- and 8W bills auctioned at 1130ET followed by $22B 30Y Bond auction reopen (912810UA4) at 1300ET.

US TSY FUTURES: OI Suggests Not Long Setting Dominated On Wednesday As CPI Outweighed FOMC

The combination of yesterday’s rally in Tsys and preliminary OI data points to a mix of net long setting and short cover across the curve, as the impact of the softer-than-expected CPI data outweighed the reaction to the hawkish adjustments in the Fed’s updated dot plot.

- Net long setting was most prominent in TY futures, while only WN futures seemed to be subjected to net short cover.

- That left over $8mn of net OI DV01 equivalent added across the curve on Wednesday.

- The largest round of net long setting seemed to come in TY futures.

- Ahead of the risk events we noted that a net dovish outcome probably provided the greatest risk to markets, with positioning in futures biased short (albeit skewed by basis trades) and relatively neutral cash positioning levels observed (based on the J.P.Morgan client survey). Perceptions in the wake of the ISM services survey and NFP report also factored into our opinion.

| 12-Jun-24 | 11-Jun-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 4,013,465 | 3,982,374 | +31,091 | +1,203,334 |

| FV | 6,266,826 | 6,258,417 | +8,409 | +359,315 |

| TY | 4,378,186 | 4,306,659 | +71,527 | +4,652,108 |

| UXY | 2,037,959 | 2,019,686 | +18,273 | +1,642,679 |

| US | 1,644,239 | 1,632,761 | +11,478 | +1,517,379 |

| WN | 1,678,136 | 1,683,194 | -5,058 | -1,026,424 |

| Total | +135,720 | +8,348,391 |

STIR: OI Points To Net Long Setting & Short Cover On SOFR Strip As CPI Outweighed FOMC

The combination of yesterday’s rally in SOFR futures and preliminary OI data points to a mix of net long setting and short cover through the blues.

- The impact of the softer-than-expected CPI data outweighed the reaction to the hawkish adjustments in the Fed’s updated dot plot, with FOMC-dated OIS now fully discounting the first 25bp rate cut through the Nov FOMC.

- FOMC-dated OIS also shows ~41bp of cuts through year end vs. post-CPI extremes of ~49bp and~36bp late on Tuesday.

- The whites and reds saw short cover dominate in net pack OI terms, with meaningful net short cover seemingly apparent in SFRU4 and SFRU5. Some pockets of net long setting were also seen in those packs, most meaningfully in SFRH5.

- Meanwhile, the greens and blues saw (more modest) rounds of net long setting in pack OI terms, with the most meaningful round of net long setting coming in SFRH6. Pockets of net short cover also showed up, most notably in SFRU6.

| 12-Jun-24 | 11-Jun-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 904,757 | 905,911 | -1,154 | Whites | -65,494 |

| SFRM4 | 1,334,893 | 1,333,574 | +1,319 | Reds | -56,659 |

| SFRU4 | 1,149,519 | 1,202,449 | -52,930 | Greens | +7,329 |

| SFRZ4 | 1,082,443 | 1,095,172 | -12,729 | Blues | +1,030 |

| SFRH5 | 827,127 | 808,902 | +18,225 | ||

| SFRM5 | 763,640 | 763,603 | +37 | ||

| SFRU5 | 666,461 | 735,108 | -68,647 | ||

| SFRZ5 | 811,965 | 818,239 | -6,274 | ||

| SFRH6 | 584,400 | 564,325 | +20,075 | ||

| SFRM6 | 498,623 | 495,621 | +3,002 | ||

| SFRU6 | 409,118 | 421,668 | -12,550 | ||

| SFRZ6 | 361,526 | 364,724 | -3,198 | ||

| SFRH7 | 252,666 | 254,862 | -2,196 | ||

| SFRM7 | 200,778 | 201,938 | -1,160 | ||

| SFRU7 | 164,561 | 161,765 | +2,796 | ||

| SFRZ7 | 159,689 | 158,099 | +1,590 |

BONDS: EU-Bonds Off Early Wides As Initial MSCI Index Decision Is Digested

EU paper initially widened vs. core & semi-core EGBs following MSCI’s decision to not include EU-bonds in their government bond indices at this juncture, although spreads are already off early session wides.

- The 10-Year EU/Bund spread was ~4bp wider, while the 10-Year EU/OAT spread briefly moved back to flat after French political uncertainty allowed EU paper to trade at a near double digit bp premium to OATs earlier in the week.

- Most market participants expected MSCI to include EU-bonds in their government bond indices, although the passage of time since the end of May (when the results of the consultation were supposed to be published) had generated some discussions around the potential for a delay to MSCI index inclusion.

- Intra-EU divergences of opinion on centralised debt add a political element to related discussions

- The key question will be how this decision impacts other index providers.

- ICE enacted their consultation on the same matter ahead of MSCI, with results due in August.

- The fact that EU/EGB spreads have already moved off session wides suggests that most still expect government bond index inclusion at some point, aided by MSCI revealing that they will “re-evaluate the eligibility criteria (for EU-bonds) in Q225.”

- A reminder that a ’23 EU survey suggested that index inclusion is ““the single-most important remaining step in order for EU-Bonds to trade and price similarly to EGBs.”

- Commerzbank note that “while it is unclear whether this will serve as a blueprint for ICE, the initial reaction of EU-bonds is likely to be bearish, given how EU-bonds reacted to the MSCI's initial announcement. Versus OATs, however, we believe that politics will weigh much heavier so that EU outperformance should resume after the initial setback.”

- Citi strategists warned of a sharp repricing for EU paper, suggesting that MSCI’s decision does “not bode well” when it comes to the prospect of EU-bond inclusion in ICE’s government bond indices. Citi also warned that MSCI’s announcement may prevent other index providers from announcing similar consolations in the near-term.

EUROPE ISSUANCE UPDATE:

Italian BTP Results

- E4bln of the 3.45% Jul-27 BTP. Avg yield 3.47% (bid-to-cover 1.43x).

- E2.5bln of the 3.45% Jul-31 BTP. Avg yield 3.72% (bid-to-cover 1.43x).

- E1.25bln of the 4.15% Oct-39 BTP. Avg yield 4.27% (bid-to-cover 1.64x).

- E1.25bln of the 3.85% Sep-49 BTP. Avg yield 4.39% (bid-to-cover 1.61x).

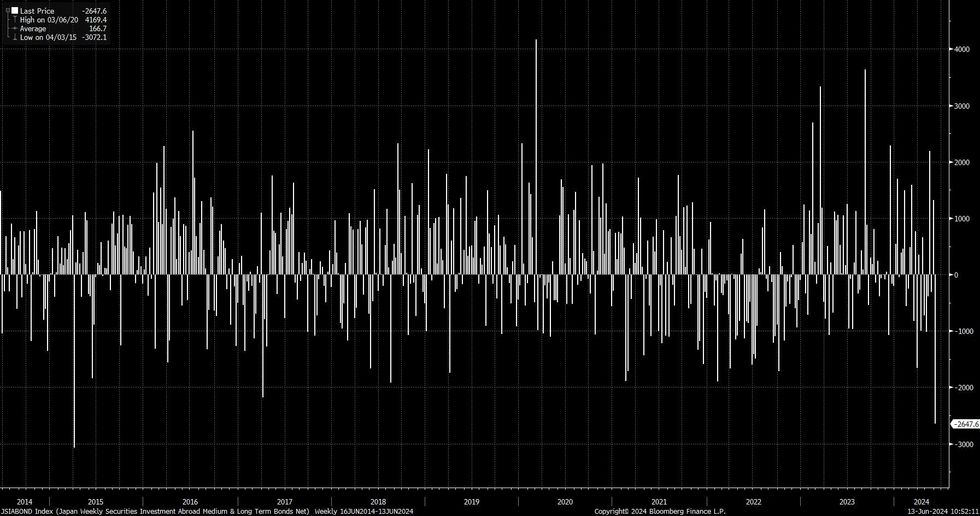

BONDS: Last Week Saw Heaviest Japanese Selling Of Foreign Bonds Since '15

The week ending June 7 saw Japanese investors sell the largest amount of offshore bonds since ’15 (~Y2.6tn).

- The major XXX/JPY FX pairs weren’t particularly volatile during that timeframe, operating a little shy of cycle highs, suggesting that FX considerations probably didn't meaningfully contribute to the flow.

- 30-Year JGBs hit fresh cycle highs last week, although paper out to 20s failed to challenge extremes registered in the prior week.

- Japanese participants may have used the rally seen in the early part of the week to offload international bond holdings.

- We also note that they may have reacted to the combination of U.S. NFPs, ISM services data and the hawkish cut from the ECB, seen in the second half of the week.

- Another potential explainer is that Japanese market participants may be lightening up on international exposure as they look to deploy fresh capital into JGBs if the BoJ chooses to reduce its JGB purchases at tomorrow’s monetary policy decision.

- A reminder that our Tokyo policy team previously suggested that “the BoJ is likely to consider a reduction in its government bonds purchases as soon as its June 13-14 meeting.”

- This idea has since been supported by similar reports from local press outlets in Japan and other major newswires.

- This comes with 30-Year JGB yields trading comfortably above 2.00%, a level that several of the major Japanese life insurers identified as an entry point in the latest round of semi-annual investment intention releases.

Fig. 1: Net Weekly Japanese Flows Into Foreign Bonds (Ybn)

UK: Labour Manifesto Delivers Few Surprises, Leaves Door Open For CGT Hike

The Labour party manifesto(launch here) has, as expected confirmed that the party will "not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT." As has been circulating in press this morning, no comment on the prospect of increases in capital gains, council (set by councils but increases capped by central gov't) taxes or fuel duty.

Headlines from the manifesto hit wires:

- Labour's fiscal rule: "Our fiscal rules are that: The current budget moves into balance, so that day-to-day costs are met by revenues, Debt must be falling as a share of the economy by the fifth year of the forecast."

- Labour 'will act to increase investment from pension funds in UK markets'.

- Labour 'will close loophole where private equity's performance-related pay is treated as capital gains'.

- Labour on energy and industry: 'will allocate GBP2.5bn to rebuild our steel industry', 'allocate GBP1.5bn to new gigafactories', provide 'GBP1.8bn to upgrade and build supply chains', and 'allocate GBP1.0bn to accelerate the deployment of carbon capture'. 'Labour will not issue new licences to explore new oil and gas fields'.

- Labour on foreign policy: 'Britain will stay outside the EU, but will reset the relationship with the EU', 'UK's financial, military and diplomatic support for Ukraine will remain steadfast' , 'Labour will bring long-term, strategic approach to managing relations with China'. Labour: 'Palestinian statehood is an inalienable right of the palestinian people...We are committed to recognising Palestinian state as a contribution to renewed peace process...Palestinian state is not in the gift of any neighbour'.

- Manifesto says Labour will remove the age bands so that all adults are entitled to the same minimum wage.

Sullivan-Biden To Measure Success On 'Tangible Progress' On Issues

White House National Security Advisor Jake Sullivan has spoken at a briefing ahead of the G7 leaders' summit taking place 13-14 June in Apulia, Italy. He says that US President Joe Biden will measure the success of the meeting "by whether or not we made tangible progress" on a range of issues including reaching agreement on Chinese 'overcapacity', the use of frozen Russian assets to fund Ukraine as well as broader military support for Kyiv, and seeking consensus on the war in Gaza. Says that "I think we're teed up for success in that regard, but we'll have to see how the next two days unfold,".

- On Israel and Gaza, Sullican says that Israel is standing behind the US ceasefire proposal, and that the 'goal is how to bridge gaps with Hamas and get to a deal as rapidly as possible'. Says that 'the world should encourage Hamas to agree to a ceasefire proposal' and 'avoid stalemate'.

- On how to use of frozen Russian assets to fund Ukraine says there has been 'good progress' and that he hopes for an agreement by the time G7 leaders meet. Says that the G7 is on the verge of a 'good outcome' and that 'we expect to have the major tentpoles of agreement in place' but that the leaders 'will leave specifics to be worked through by experts on a defined timetable.'

- Says that leaders are 'more unified than ever' on major issues, including on Chinese industrial 'overcapacity' - a major theme of US rhetoric on China at present.

- Schedule of day 1 sees working groups on Africa, climate change and development (1115CET), the Middle East (1245CET) and Ukraine (1415CET).

Summit Convenes With Leaders Under Pressure

The political optics of this G7 summit are notable by the instability faced by most of the leaders.

- UK PM Rishi Sunak is less than a month away from what polls are indicating will be a landside general election loss.

- French President Emmanuel Macron risks his centrist bloc coming in third in snap elections he called on 9 June.

- German Chancellor Olaf Scholz's centre-left Social Democrats came in third in the European Parliament elections at the weekend behind the main opposition CDU and the far-right AfD.

- Japanese PM Fumio Kishida is dealing with high disapproval ratings and could be ousted in the September leadership contest for his LDP.

- US President Joe Biden faces an extremely tight race for a second term in the White House against Donald Trump.

- Canadian PM Justin Trudeau has spoken of the potential for his resignation, and his centre-left Liberals trail the Conservative Party of Canada by a substantial margin in polls, making a change of gov't likely at the next election.

- The only leader in what can be viewed as a 'solid' position is host, Italian PM Giorgia Meloni, whose conservative Brothers of Italy (FdI) secured strong results in the EP elections, and remain popular at the national level according to opinion polling.

JPY Weakness Puts Currency on Course for Post-Intervention Lows

- JPY trades poorer against all others in G10 headed into the NY crossover, prompting USD/JPY to full reverse the move triggered by Wednesday's softer-than-expected US CPI print. Further gains for the pair would put prices on course for a test of the weekly highs at Y157.40 and the bull trigger and key resistance of 157.71. Clearance of this level would put USD/JPY at new post-intervention highs.

- While USD/JPY's rally is notable, EUR/JPY is gaining in tandem. A break and close above the Y170.00 handle opens 170.89 next - levels which will keep pressure on the trade-weighted JPY (circa 1.3% off the levels that triggered intervention), and keep the currency in focus before Friday's BoJ decision.

- GBP will be watched carefully through the release of the Labour Party manifesto later today. The plans of the presumptive winners of the July 4th election will be dissected carefully on tax and spend, as the likely incumbent government pledge not to raise taxes, while also reinvigorating the economy. GBP/USD remains either side of the 1.2800 level, with the S/T bull trend intact after yesterday's cycle high 1.2860 print.

- US PPI takes focus Thursday, rounding off a trifecta of US risk events kicked off by the CPI print yesterday. PPI numbers will be used to further gauge expectations for the next PCE release, set for June 28th. The central bank speaker slate is quieter, although Fed's Williams is set to interview the US Treasury Secretary Yellen at 1700BST/1200ET, which could elicit interest.

JPY Bounce Earlier This Week Confirmed as Corrective

- The hawkish SEP dot plot, Powell’s guarded tone and the consistent reminder of focusing on the totality of the data have prompted US yields and the greenback to reverse their US CPI inspired moves. Despite treasury yields being unable to retrace fully, USDJPY has recovered the entirety of its initial decline on Wednesday, and remains 0.3% higher on the week. The close proximity of the Bank of Japan decision on Friday may have added a short-term positioning dynamic to the retracement.

- We noted on Monday that the recent move down in EURJPY appears to be a correction, with the medium-term trend structure remaining bullish. The cross remains well underpinned by trendline support off the December 2023 low and the 50-day EMA, which now intersect around 167.70. As noted, sights remain on 171.56, the Apr 29 high and a key resistance. Clearance of this hurdle would confirm a resumption of the uptrend.

- In similar vein, bullish conditions remain firmly in place for GBPJPY. After closing back above the psychological 200 mark earlier this week, the pair has been consistently edging higher and eating into the steep declines seen back in 2008.

- Our full preview of the BOJ meeting with analyst views can be found here: https://roar-assets-auto.rbl.ms/files/64744/BOJ%20Preview%20-%20Jun%202024.pdf - Earlier this week, MNI noted that any reduction in purchases will be accompanied by a pledge to stay in the market and to ensure there is no spike in long-end yields, which in effect could equate to yield-curve control and may keep any positive reaction for the Yen in check.

Expiries for Jun13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-90(E2.1bln), $1.0740-50(E1.3bln), $1.0770-80(E3.7bln), $1.0835-40(E1.2bln), $1.0885-00(E2.4bln)

- USD/JPY: Y155.00-10($1.3bln), Y156.00-20($1.5bln), Y156.45-55($516mln), Y158.00-10($1.1bln)

- GBP/USD: $1.2750(Gbp594mln)

- AUD/USD: $0.6630(A$1.0bln)

- USD/CAD: C$1.3670-75($845mln)

- USD/CNY: Cny7.3000($1.0bln)

Trend Direction in WTI Futures Bearish Despite This Week's Recovery

- WTI futures have traded higher this week. For now, short-term gains are considered corrective and the trend direction remains bearish. However, resistance at $78.37, the 50-day EMA, has been pierced. A clear break of this average would expose the key short-term resistance at $80.62, the May 1 high, where a break is required to cancel a bear theme. On the downside, a resumption of weakness would open $71.33, the Feb 5 low.

- Gold is trading closer to its recent lows. A sharp sell-off on Jun 7 reinforces a short-term bearish theme. The yellow metal has traded below the 50-day EMA, at 2314.1. The break confirms a resumption of the reversal that started May 20 and signals scope for a deeper correction. This has opened $2277.4, the May 3 low. Clearance of this price point would strengthen a bearish theme. Initial firm resistance to watch is $2387.8, the Jun 7 high.

Move Higher Wednesday Reinforces Uptrend in E-Mini S&P

- The trend condition in Eurostoxx 50 futures remains bullish and the recent pullback is considered corrective. A resumption of gains would refocus attention on key resistance and the bull trigger at 5110.00, the May 16 high. Clearance of this level would confirm a resumption of the uptrend. On the downside, support at 4947.00, the Jun 4 low, has been pierced. A clear break of it would be bearish and instead expose 4894.90, a Fibonacci retracement.

- The uptrend in S&P E-Minis remains intact and the contract traded higher yesterday. Price has recently cleared 5368.25, the May 23 high and bull trigger. The move confirmed a resumption of the uptrend. The continuation higher has resulted in a break of the 5400.00 handle. This opens 5462.77 next, a Fibonacci projection. Key short-term support has been defined at 5205.50, the May 31 low. Initial support lies at 5322.72, the 20-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 13/06/2024 | 1230/0830 | *** | Jobless Claims | |

| 13/06/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 13/06/2024 | 1230/0830 | *** | PPI | |

| 13/06/2024 | 1230/0830 | * | Household debt-to-income | |

| 13/06/2024 | 1335/0935 | BOC Deputy Kozicki speaks on balance sheet policies. | ||

| 13/06/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 13/06/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 13/06/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 13/06/2024 | 1700/1300 | *** | US Treasury Auction Result for 30 Year Bond | |

| 14/06/2024 | 0200/1100 | *** | BOJ Policy Rate Announcement | |

| 14/06/2024 | 0430/1330 | ** | Industrial Production | |

| 14/06/2024 | 0600/0800 | *** | Inflation Report | |

| 14/06/2024 | 0645/0845 | *** | HICP (f) | |

| 14/06/2024 | 0830/0930 | ** | Bank of England/Ipsos Inflation Attitudes Survey | |

| 14/06/2024 | 0900/1100 | * | Trade Balance | |

| 14/06/2024 | 0900/1100 | ECB's Lane participates at Dubrovnik Economic Conference | ||

| 14/06/2024 | 0900/1100 | ECB's De Guindos at Carlos V European Prize Ceremony | ||

| 14/06/2024 | - | *** | Money Supply | |

| 14/06/2024 | - | *** | New Loans | |

| 14/06/2024 | - | *** | Social Financing | |

| 14/06/2024 | 1230/0830 | ** | Import/Export Price Index | |

| 14/06/2024 | 1230/0830 | ** | Monthly Survey of Manufacturing | |

| 14/06/2024 | 1230/0830 | ** | Wholesale Trade | |

| 14/06/2024 | 1330/1530 | ECB's Schnabel in European Fiscal Board Meeting | ||

| 14/06/2024 | 1400/1000 | ** | U. Mich. Survey of Consumers | |

| 14/06/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 14/06/2024 | 1730/1930 | ECB's Lagarde Speech at Dubrovnik Economic Conference | ||

| 14/06/2024 | 1800/1400 | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.