-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

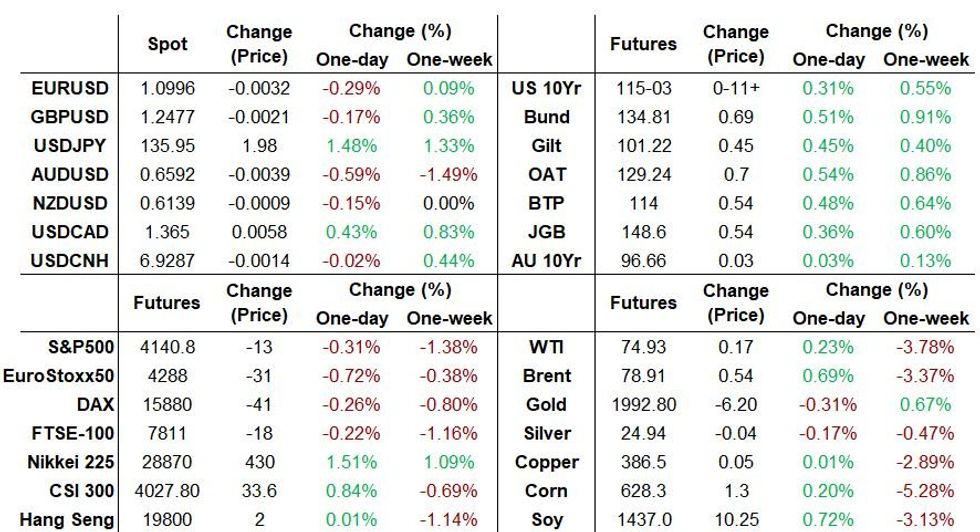

Free AccessMNI US MARKETS ANALYSIS - Risk-Off Tone Ahead Of Key Data

Highlights:

- Softer-than-expected German inflation data sees ECB hike pricing dialled back and Bunds bid

- Dollar stronger, Yen underperforming after the BoJ left policy settings unchanged overnight

- Key US data ahead includes MNI Chicago PMI, the Employment Cost Index and March PCE

US TSYS: Holding Richer Ahead Of Key Pre-FOMC Data

- Cash Tsys have seen a reasonable retracement of a bid seen after softer than expected German regional CPI readings but still sit richer on the day. The front end only trims yesterday’s post-Q1 PCE sell-off but with greater reversal further out the curve, driving a net flattening over the two days with 2s10s at -56bps.

- It comes ahead of an important data docket landing shortly before next week’s FOMC decision, plus additional interest in pre-market earnings releases including Aon, Chevron and Exxon Mobil as well as the Fed issuing its report on SVB’s supervision at 1100ET.

- 2YY -2.7bp at 4.041%, 5YY -4.8bp at 3.543%, 10YY -4.7bp at 3.473% and 30YY -4.7bp at 3.703%.

- TYM3 trades 11 ticks higher at 115-02+ with decent cumulative volumes of 440k. It’s off a session low of 114-17+ just below the 50-day EMA of 114-18+, which combined are seen as support, whilst resistance is seen at the high of 115-08+ before 115-30+ (Apr 26 high).

- Data: ECI Q1 (0830ET), Core PCE & incomes/spending Mar (0830ET), MNI Chicago PMI Apr (0945ET), U.Mich consumer survey Apr final (1000ET), KC Fed services activity (1100ET).

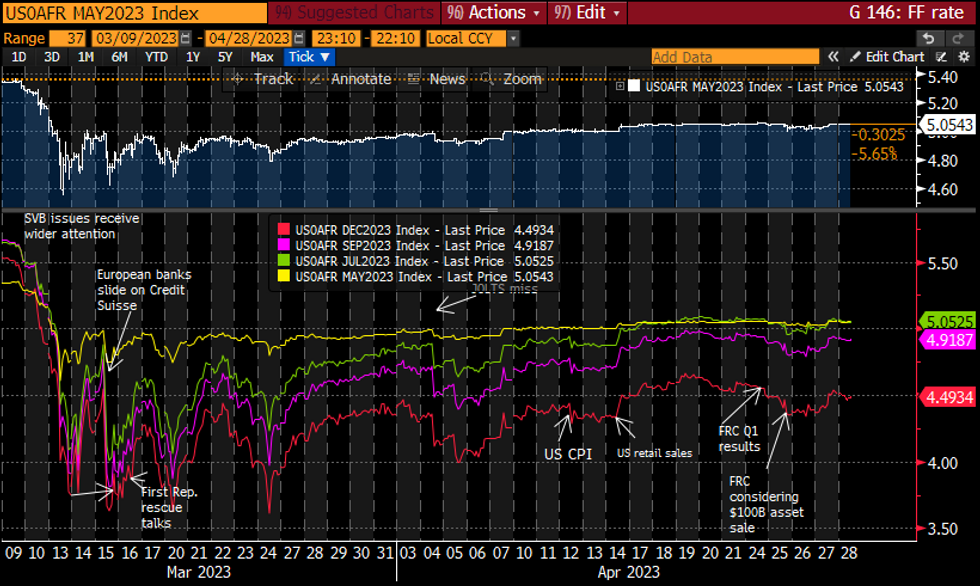

STIR FUTURES: Slight Trimming Of Yesterday's Rate Path Lift Ahead Of ECI and Monthly PCE

- Fed Funds implied rates have cooled overnight, helped by lower than expected regional German inflation, but still sit close to levels after yesterday’s core PCE beat having only unwound yesterday’s late second wind.

- 22.5bp hike for Wed (unch) and cumulative 27.5bp for Jun (-1bp), before 12bp of cuts from current levels to 4.71% for Nov (-2bp) and 34bp of cuts to 4.49% for Dec (-2.5bp).

- Ahead, March core PCE inflation which will show how the Q1 beat was distributed and the eagerly anticipated ECI for Q1 plus the MNI Chicago PMI and finalised U.Mich consumer survey after the surprise preliminary surge in near-term expectations.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

GERMAN DATA: MNI Projects CPI Cooling to +7.21%, Evidence for Softer Core

We have now received state data that equates to 88.0% weighting of the national German CPI print (due at 1300 BST / 1400 CET).

- MNI calculations estimate that CPI rose by +0.47% m/m, and by +7.21% y/y. This is based on the published index values for available state data. This implies a 0.2pp deceleration on the annualised figure from +7.4% y/y in March, as German headline inflation distances itself further from the October/November peak of +8.8% y/y.

- For both m/m and y/y, our estimate is around 0.1pp below the current Bloomberg consensus forecast.

- Note: this is in relation to the national CPI print - not the HICP print (which feeds into the Eurozone HICP print that the ECB targets). The magnitude of surprises to consensus can sometimes be different due to the different methodologies and weights used in national CPI vs HICP - but the direction of the surprise is normally the same.

- Today's state data points towards a marginal reduction in core CPI for Germany, after having risen to a fresh euro-era high of +5.8% y/y in March. Core CPI data excluding both energy and food is only available for six states which account for 50% of the headline index. These all saw core CPI easing by 0.1 to 0.3pp on the headline annualised prints, with core CPI remaining expansive albeit softer at +0.5 to +0.6% m/m.

| M/M | Apr (reported) | Mar (reported) | Difference |

| North Rhine Westphalia | 0.5% | 0.6% | -0.1% |

| Hesse | 0.3% | 0.8% | -0.5% |

| Bavaria | 0.4% | 0.7% | -0.3% |

| Brandenburg | 0.4% | 1.0% | -0.6% |

| Baden-Wuerttemberg | 0.5% | 0.9% | -0.4% |

| Berlin | 0.7% | 0.9% | -0.2% |

| Saxony | 0.3% | 0.9% | -0.6% |

| Rhineland-Palatinate | 0.4% | 0.8% | -0.4% |

| Lower Saxony | 0.4% | 0.9% | -0.5% |

| Saxony-Anhalt | 0.3% | 0.9% | -0.6% |

| Weighted average: | 0.47% | for | 88.0% |

| Y/Y | Apr (reported) | Mar (reported) | Difference |

| North Rhine Westphalia | 6.8% | 6.9% | -0.1% |

| Hesse | 6.9% | 7.1% | -0.2% |

| Bavaria | 7.2% | 7.2% | 0.0% |

| Brandenburg | 7.6% | 7.8% | -0.2% |

| Baden-Wuerttemberg | 7.3% | 7.8% | -0.5% |

| Berlin | 7.5% | 7.7% | -0.2% |

| Saxony | 7.6% | 8.3% | -0.2% |

| Rhineland-Palatinate | 7.1% | 7.4% | -0.3% |

| Lower Saxony | 7.5% | 7.8% | -0.3% |

| Saxony-Anhalt | 7.3% | 7.9% | -0.6% |

| Weighted average: | 7.21% | for | 88.0% |

EUROPE ISSUANCE UPDATE

1/3/6-month UK Treasury Bills results:

| Tenor | 1-month | 3-month | 6-month |

| Maturity | May 30, 2023 | Jul 31, 2023 | Oct 30, 2023 |

| Amount | GBP0.5bln | GBP1.5bln | GBP2.5bln |

| Previous | GBP0.5bln | GBP1.5bln | GBP2.5bln |

| Avg yield | 4.2536% | 4.5193% | 4.7326% |

| Previous | 4.2634% | 4.4819% | 4.7000% |

| Bid-to-cover | 2.95x | 3.19x | 2.7x |

| Previous | 3.44x | 2.84x | 2.29x |

| Next week | GBP0.5bln | GBP1.5bln | GBP2.5bln |

FOREX: Risk Off drives the USD higher

- Risk off has been the main driver for the Dollar strength, with Banks coming under considerable pressure, especially for Spanish Banks, after Spanish lawmakers pass country’s 1st-ever housing law.

- Similar pressures in Italians Banks, on the back of Italy working on levy on banks to fund family relief -source (Reuters).

- The USD is in the Green against all the majors, and leads against the Yen, after the BoJ Delivered its expected unchanged rate.

- European inflation data eased throughout Europe, but for the exception of France, which beat expectations, but overall German Regional all came below their last readings, but this was largely ignored by Equities, taking their cues from Banks stocks, and desks likely lightening some risk ahead of the long weekend.

- Risk off is putting the AUD under renewed pressure, and AUDUSD now targets 0.6565 the April low and lowest print since November.

- Looking ahead, US PCE core deflator, MNI Chic PMI, final Michigan.

FX OPTIONS EXPIRY

- Notable: EURUSD 3.27bn at 1.1000.AUDUSD 1.3bn at 0.6600.

- EURUSD; 1.0950 (472mln), 1.0960 (251mln), 1.0970 (206mln), 1.0975 (500mln), 1.1000 (3.27bn), 1.1025 (486mln), 1.1040 (738mln).1.1050 (413mln).

- GBPUSD: 1.2500 (343mln).

- USDJPY: 135.00 (423mln).

- USDCAD: 1.3600 (809mln), 1.3625 (388mln).

- AUDUSD: 0.6550: 880mln), 0.6600 (1.3bn).

EQUITIES: EUROSTOXX50 Futures Breach Support At The 20-Day EMA

- S&P E-Minis rallied Thursday to erase the sell-off earlier this week. A continuation higher would expose key resistance and the bull trigger at 4198.25, the Apr 18 high. Clearance of this level would confirm a resumption of the uptrend that started Mar 13. On the downside, key short-term support has been defined at 4068.75, the Apr 26 low.

- A key short-term support in EUROSTOXX 50 futures at 4282.10 has been breached - the 20-day EMA. This highlights an extension of the pullback from 4363.00, the Apr 21 high and a key resistance. A continuation lower would signal scope for weakness towards 4210.40, the 50-day EMA. On the upside, a break of 4363.00 is required to cancel any developing bearish threat and highlight a resumption of the uptrend.

COMMODITIES: Bear Threat In Oil Futures Remains Present

- Gold remains in consolidation mode. The broader trend condition is bullish, however, the yellow metal has recently entered a short-term corrective cycle. Price has pierced support at $1988.1, the 20-day EMA, highlighting potential for a deeper retracement. A move lower would open $1949.9, the 50-day EMA. Key short-term resistance has been defined at $2048.7, the Apr 5 high.

- In the oil space, the outlook in WTI futures remains bearish and Wednesday's strong sell-off reinforces the current theme. $73.98 has been pierced today, the 50.0% retracement of the Mar 20 - Apr 12 rally. A clear break would open $72.76, the Mar 30 low. On the upside, a key short-term resistance has been defined at $79.18, the Apr 24 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/04/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/04/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/04/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 28/04/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/04/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.