-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Thursday, November 21

MNI BRIEF: China To Enhance Support For Foreign Trade - MOFCOM

MNI BRIEF: China To Step Up Trade Bloc Negotiations

MNI US MARKETS ANALYSIS - Stocks Moderate After Solid '21 Start

HIGHLIGHTS:

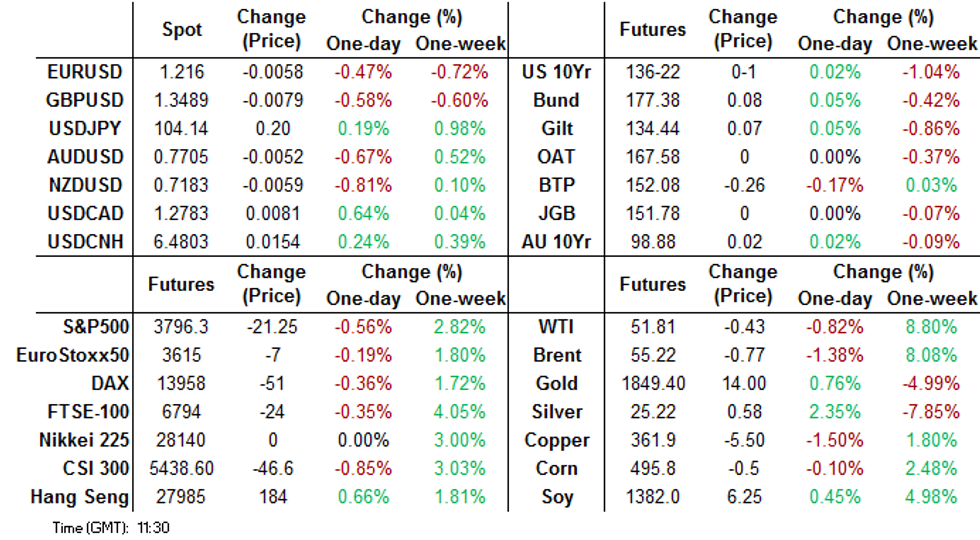

- Global stocks soften on likely profit-taking, e-mini S&P 25 points off alltime high

- USD bouncing, US curve slightly flatter

- Focus turns to speeches from BoE, ECB, Fed, Q1 earnings season

US TSYS SUMMARY: Politics, FOMC Speakers, 3-Yr Note Supply Eyed

Tsys have enjoyed modest upside and are well off Asia-Pac session lows early Monday, with the dollar stronger and equities on the back foot (largely on profit-taking / COVID lockdown concerns). Political developments, 3-Yr Supply and Fed speakers eyed.

- Mar 10-Yr futures (TY) up 1/32 at 136-22 (L: 136-14.5 / H: 136-24)on average volume (~250k).

- The 2-Yr yield is flat at 0.133%, 5-Yr is down 1.1bps at 0.4722%, 10-Yr is down 1.4bps at 1.1018%, and 30-Yr is down 1.6bps at 1.857%. (Note late cash open due to Tokyo holiday.)

- With the Biden inauguration 9 days away, attention remains on Congress and attempts to oust Pres Trump: Democratic leadership to have a conference call Mon afternoon on options; possible initial House resolution put forward on invoking 25th amendment today, w roll call vote Tuesday.

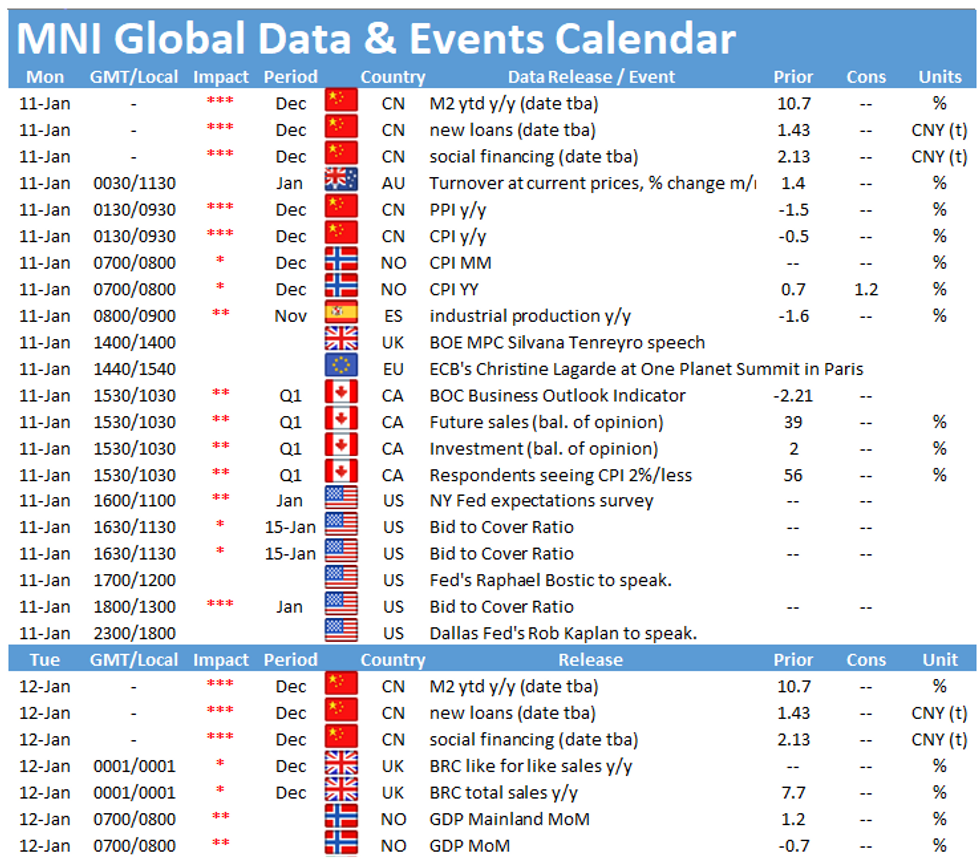

- No data out today. Fed speakers though: Atlanta's Bostic at 1200ET and Dallas' Kaplan at 1800ET; both speaking specifically on the economy / monetary policy.

- 1130ET, we get $105bn of 13-/26-week bill sale, and then at 1300ET: $58bn 3Y Note auction. NY Fed buys ~$2.425B of 1-7.5Y TIPS.

EGB/GILT SUMMARY: Mixed EGBs Amid Softer Stocks

It has been a mixed start to the week for European sovereign bonds, while equities have inched lower and the dollar has gained against G10 FX.

- Gilts have lacked direction and trade close to unch on the day with the curve similarly flat.

- Bunds started the session on a stronger footing but gave up early gains to trade within 1bp of Friday's close.

- The OAT curve has flattened 2bp on the back of the shorter end trading a touch weaker. Last yields: 2-year -0.3994%, 5-year -0.0102%, 10-year 0.5429%, 30-year 1.3993%.

- BTPs have sold off slightly with cash yields 1-2bp higher on the day.

- The UK's chief medical officer, Chris Whitty, has warned that the NHS could soon be overwhelmed if social restrictions are not adhered to.

- Supply this morning came from Germany (Bubills, EUR4.265bn allotted).

- The data calendar was relatively light this morning. Norwegian CPI data for December printed in line with expectations (1.4% Y/Y).

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXG1 178/176.50/175p fly, sold at 48.5 in 1.5k

RXG1 176.50/175.5/175.00p fly, sold at 9.5 in 1.5k

ERM1 100.75c, sold at 0.5 in 17k

UK:

L M1 100.00/12/25c ladder, bought for 2.5 in 2k

LH1100.00/10025/100.50c flfy vs LM1 100.12/100.37/100.62c fly, sold the March at 0.25 in 2.5k

US:

TYH1 136.00/134.5ps 1x2, bought for 10 in ~1.1k

FOREX: USD Bouncing as Stocks, Risk Appetite Moderate

After an impressive rally into the Friday close, stock futures have moderated in the US in likely profit-taking after a strong start to 2021. With equities still the driver, currencies are taking the risk-off queue, boosting the USD and other haven currencies throughout Asia-Pac and European hours.

USD strength has pressured EUR/USD through Friday's lows of 1.2193 to hit the lowest level since mid-December. 1.2130 marks next support, the Dec 21 low.

Commodities are moderately softer, leading NOK and other oil-tied FX lower. Nonetheless, USD/NOK remains well within range of the multi-year lows posted Friday at 8.3626.

Data is few and far between Monday, keeping focus on the central bank speakers slate. Speeches from BoE's Tenreyro, ECB's Lagarde and Fed's Bostic & Kaplan will take particular focus.

OPTIONS: Expiries for Jan11 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1960-70(E2.3bln-EUR puts), $1.2000(E864mln), $1.2095-1.2110(E1.6bln), $1.2125-35(E831mln), $1.2150(E669mln), $1.2200(E879mln), $1.2250-60(E1.1bln), $1.2295-1.2300(E3.8bln-EUR puts), $1.2310-15(E2.1bln-EUR puts)

GBP/USD: $1.3150(Gbp597mln), $1.3290-1.3300(Gbp626mln), $1.3700-15(Gbp1.2bln-GBP puts)

EUR/GBP: Gbp0.8950-65(E524mln-EUR puts), Gbp0.9000-04(E807mln-EUR puts), Gbp0.9105-10(E756mln-EUR puts), Gbp0.9300(E610mln)

AUD/USD: $0.7625(A$1.2bln-AUD puts), $0.7724-25(A$1.3bln-AUD puts)

USD/CAD: C$1.2550($550mln), C$1.2700($690mln-USD puts), C$1.2775-1.2800($905mln-USD puts)

USD/CNY: Cny6.5000-20($580mln)

TECHS: Price Signal Summary - USD Enters Corrective Phase

- The USD is weaker and appears to have entered a much needed corrective phase. If correct, this is allowing a recent oversold USD condition to unwind.

- Support levels to watch in EURUSD are:

- 1.2130 Low Dec 21 and 1.2083, the 50-day EMA. A break of both would signal scope for a deeper pullback.

- USDJPY attention is on key resistance at 104.38, the bear channel top drawn off the Mar 24 high. A break would highlight a stronger reversal.

- On the commodity front, Gold appears vulnerable following last week's sell-off. Watch support at $1810.7 - 76.4% retracement of the Nov 30 - Jan 6 rally. Oil contracts remain bullish but are off overnight highs. Support levels to watch are:

- Brent (H1) - $53.94, the Jan 7 low and 52.46, Dec 18 high.

- WTI (G1) - $50.39, Jan 7 low and $49.43, Dec 18 high.

- In the equity space, the trend in the E-Mini S&P contract remains bullish. Focus is on 3824.50, Friday's high. Further out, scope exists for a climb towards 3.900.00.

- A bearish risk still prevails in the FI space.

- Treasuries (H1) targets 136-04+ 1.00 proj of the Nov 5 - 11 sell-off from Nov 30 high.

- Bunds (H1) focus is on support at 177.01, Dec 23 low.

- Gilts (H1) focus is on 134.01, Dec 24 low and a key support.

EQUITIES: Profit-taking Leads to Lull in European Equities

After a formidable start to 2020, European equity markets are modestly lower early Monday in likely profit-taking after last week's ~3% rally in the Stoxx 600. Core European indices are lower by 0.3-0.5%, with German stocks slightly underperforming while Swiss equities trade more favourably.

Energy and utilities names are leading losses on the continent, with materials and consumer discretionary not far behind. Defensive healthcare sector is one of the sole sectors in the green.

In US futures space, the e-mini S&P is off around 20 points, opening a small gap with the alltime highs posted Friday at 3824.50. Nonetheless, the downside pressure is mild, with Friday's lows still a way off at 3775.00, the first intraday support.

COMMODITIES: Broad Risk-Off Leads Oil Lower, Gold Stabilises

A vague sense of risk-off has led global equity markets lower, in likely profit-taking after a strong start to 2021. Resulting USD strength has weighed on the broader commodity complex, leading to underperformance in oil and industrial metals. Brent crude futures are off around $0.80 at pixel time, opening a gap with cycle highs printed in early Asia-Pac trade at $56.39.

Precious metals have stabilised after last week's weakness, but not before spot gold showed again below the 200-dma at $1839.79. A solid break and close below this support would be bearish, opening levels not seen since early December.

On commodities, Goldman Sachs this morning wrote that they see a circa 10% return in the S&P GSCI index over the next 12 months, although markets are likely to consolidate in the near-term given the magnitude of the recent rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.