-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI US MARKETS ANALYSIS - Treasuries Calmer Ahead of Busy Week

Highlights:

- USD dipping ahead of key CPI release and start of earnings cycle

- Treasury markets calmer after volatile Friday finish

- CB speakers back in focus, with BoE's Pill, Fed's Bostic & Daly

US TSYS: A Calm Before The Week's Storm?

- Cash Tsys slightly pare Friday’s surge on the back of softer than expected average hourly earnings growth in the payrolls report before a significant downside miss in ISM service, with front end yields still more than 20bps down from Friday’s pre-data high. A relatively calm start to the week that includes Powell speaking tomorrow and CPI on Thursday.

- 2YY +2.9bps at 4.276%, 5YY +3.1bps at 3.729%, 10YY +4.1bps at 3.599% and 30YY +4.6bps at 3.734%.

- TYH3 trades 5 ticks lower at 114-02 on average volumes, fading at the start of the London session before broadly tracking sideways. It remains close to Friday’s late high of 114-11+ after which sits resistance at 114-17 (76.4% retrace of Dec 13 – 30 bear leg).

- Fedspeak: Bostic (’24) 1230ET, Daly in WSJ interview (’24) 1230ET

- Data: Limited to Consumer credit, Nov (1500ET)

- Bill issuance: US Tsy $57B 13W, $48B 26W bill auctions (1130ET)

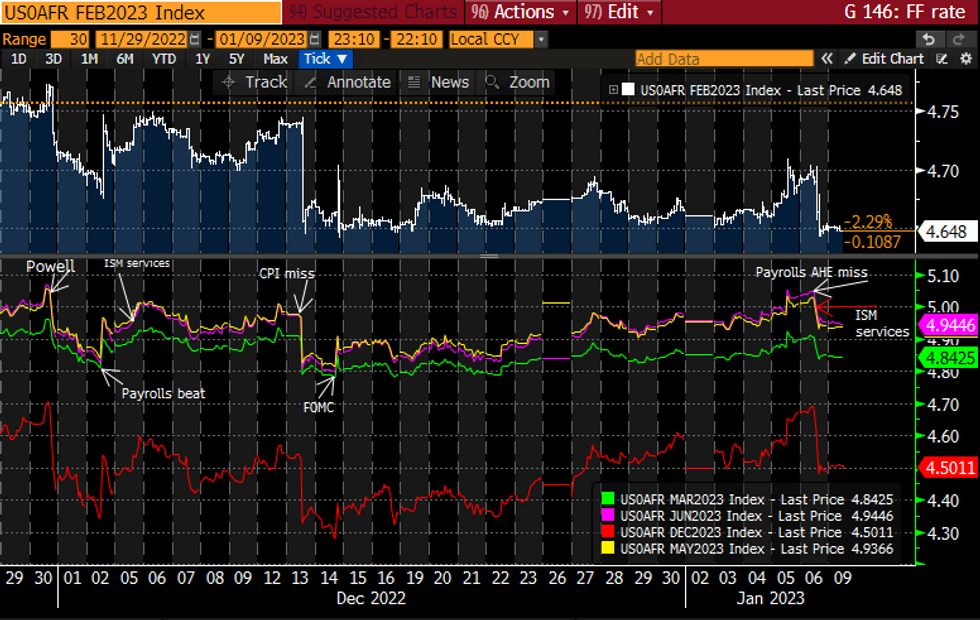

STIR FUTURES: Consolidating AHE/ISM Services Downside Surprise

- Fed Funds implied hikes have overnight consolidated Friday’s two-step shift lower after payrolls and ISM services.

- 31.5bp for Feb 1, cumulative 51bp to 4.84% Mar, terminal 4.95% Jun and 4.50% end-2023.

- Bostic (’24) and Daly (’24) speak at separate events at 1230ET, Daly for the first time since just after the Dec FOMC. Near-term focus on Powell's appearance at a Riksbank event tomorrow.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE:

EU-bond auction results- E2.796bln of the 0.80% Jul-25 EU NGEU. Avg yield 2.827% (bid-to-cover 1.4x)

- E1.885bln of the 0.45% Jul-41 EU NGEU. Avg yield 3.128% (bid-to-cover 1.22x)

- E2bln of the new Aug-26 EFSF. Spread set at MS-24bps

- E4bln of the new Feb-33 EFSF. Spread set at MS+6bps

EGB mandate announcements:

- Latvia 5-year

FOREX: USD Edges Lower Still Ahead of Critical Week

- EUR/USD has extended the recovery off the Friday lows ahead of the NY crossover, hitting European morning highs at the 1.07 handle. The USD is among the poorest performers in G10 ahead of a critical week, with both the US CPI release as well as the beginning of the US earnings season to come.

- JPY is the sole currency falling against the USD so far, with USD/JPY bouncing off overnight lows to erase a small part of the Friday decline. Tech levels of note remain somewhat unchanged, with 133.73 marking the 20-day EMA. Resistance seen stiffer headed into 134.77/81, the High Jan 6 / 23.6% Oct - Jan Downleg.

- At the other end of the table, AUD and NZD are outperforming, gaining a tailwind from a more solid session for Chinese equities. AUD/USD has now traded close to 4% above last week's lows, keeping momentum tilted in favour of the bulls for now. Prices now hold within range of the $0.69 handle, which marks a sizeable expiry for Wednesday's NY cut, with A$1.6bln notional set to roll off.

- Datapoints are few and far between Monday, keeping focus on the central bank slate. BoE's Pill and Fed's Bostic & Daly are all scheduled.

BONDS: Moving Off Of Friday's Data-Induced Highs

- Core fixed income has been gradually moving lower through the European session, moving off the highs seen after the weaker-than-expected US wage numbers and soft ISM services print on Friday.

- The Euribor strip is down up to 6 ticks, the Eurodollar strip down up to 5.5 ticks and the SONIA futures strip is also up to 6 ticks lower (although the latter has seen more moves lower further out the curve in the Blue area with more limited moves in Whites / Reds / Greens).

- The highlight of the day may well come from a speech by BOE Chief Economist Huw Pill in New York entitled "The UK Economic and Monetary Policy Outlook" with the text due to be released today at 15:30GMT / 10:30ET. We will also hear from the Fed's Bostic and Daly today.

- Looking ahead there will be huge interest in US CPI on Thursday with only tier 2 data due for release until the second half of the week.

- TY1 futures are down -0-4+ today at 114-02+ with 10y UST yields up 4.1bp at 3.601% and 2y yields up 2.9bp at 4.282%.

- Bund futures are down -0.87 today at 136.56 with 10y Bund yields up 5.7bp at 2.264% and Schatz yields up 5.5bp at 2.621%.

- Gilt futures are down -0.59 today at 102.12 with 10y yields up 4.7bp at 3.516% and 2y yields up 5.1bp at 3.445%.

EQUITIES: Quarterly Earnings Cycle Kicks Off Friday

- This week marks the beginning of the quarterly US earnings cycle, with big banks and financials first up from Friday. Full MNI Schedule here: https://roar-assets-auto.rbl.ms/files/50444/MNIUSE...

- Earnings season begins in earnest in the w/c 24th Jan, with both the number of reports picking up as well as the cumulative market cap of the S&P 500. Financials and large cap US banks are the initial focus, with markets watching for headlines on provisions, costs and capital plans.

- Morgan Stanley write that the market's attention is to shift from inflation & the Fed to earnings growth and recession concerns. They write that the earnings outlook has worsened, with corporate confidence at historically depressed levels. Meanwhile biz surveys have rolled over while supply chains/backlogs have eased.

- They retain a 2023 price target of 3,900 for the S&P500 (bull case: 4,200, bear case: 3,500). They recommend overweight healthcare, staples, utilities. Underweight discretionary & tech hardware.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/01/2023 | - |  | UK | House of Commons Returns | |

| 09/01/2023 | 1330/0830 | * |  | CA | Building Permits |

| 09/01/2023 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 09/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 09/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/01/2023 | 1730/1230 |  | US | Atlanta Fed's Raphael Bostic | |

| 09/01/2023 | 2000/1500 | * |  | US | Consumer Credit |

| 10/01/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 10/01/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/01/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 10/01/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 10/01/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 10/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/01/2023 | 1010/0510 |  | CA | Governor Macklem appears at Sveriges Riksbank’s International Symposium on Central Bank Independence | |

| 10/01/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/01/2023 | 1400/0900 |  | US | Fed Chair Jerome Powell | |

| 10/01/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/01/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.