-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Rounds Out Cabinet Nominations

MNI POLITICAL RISK ANALYSIS - Week Ahead 25 Nov-1 Dec

MNI US MARKETS ANALYSIS - USD Bounce, Trump Commits to Orderly Handover

HIGHLIGHTS:

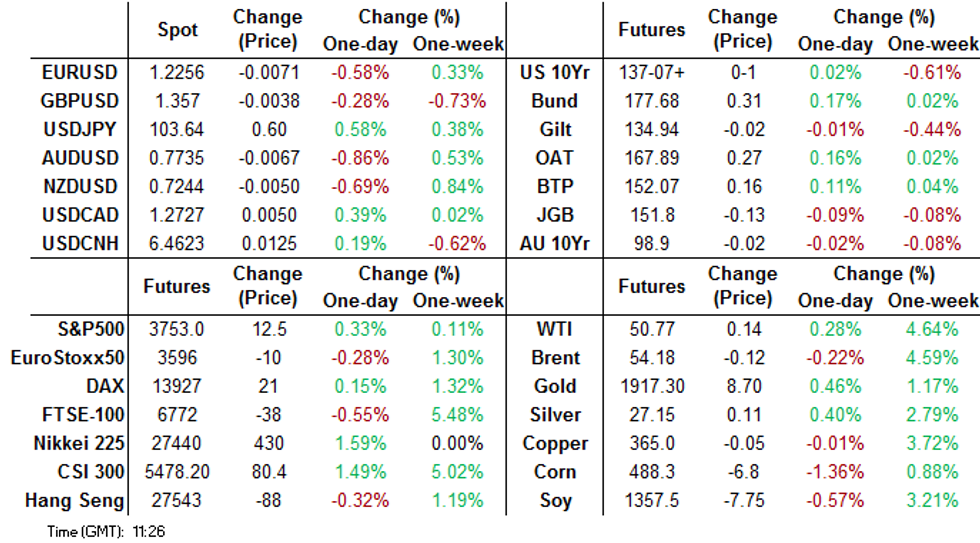

- Stocks near alltime highs as Trump pledges orderly handover on January 20th

- Dollar bouncing from Wednesday's multi-year low

- Jobless claims and deluge of Fed speak in focus

US TSYS SUMMARY: Calm After (And During) The Storm

Treasuries are a little weaker as the dust settles from deadly clashes on Capitol Hill Weds. Overnight, Congress certified the Biden-Harris election win and Trump put out a statement that pledged an "orderly transition" to the new administration on Jan 20.

- While the past 24 hours have been momentous, in truth markets have largely shrugged - front TYs currently 3 ticks above the level at the beginning of the Congressional joint session Weds; in that span, S&P futs -0.3%. USD is a winner, up 0.4%.

- The 2-Yr yield is unchanged at 0.1369%, 5-Yr is up 0.2bps at 0.4274%, 10-Yr is unchanged at 1.0355%, and 30-Yr is down 0.2bps at 1.812%. Mar 10-Yr futures (TY) up 0.5/32 at 137-07 (L: 137-00.5 / H: 137-09.5) on above-avg volumes (~350k).

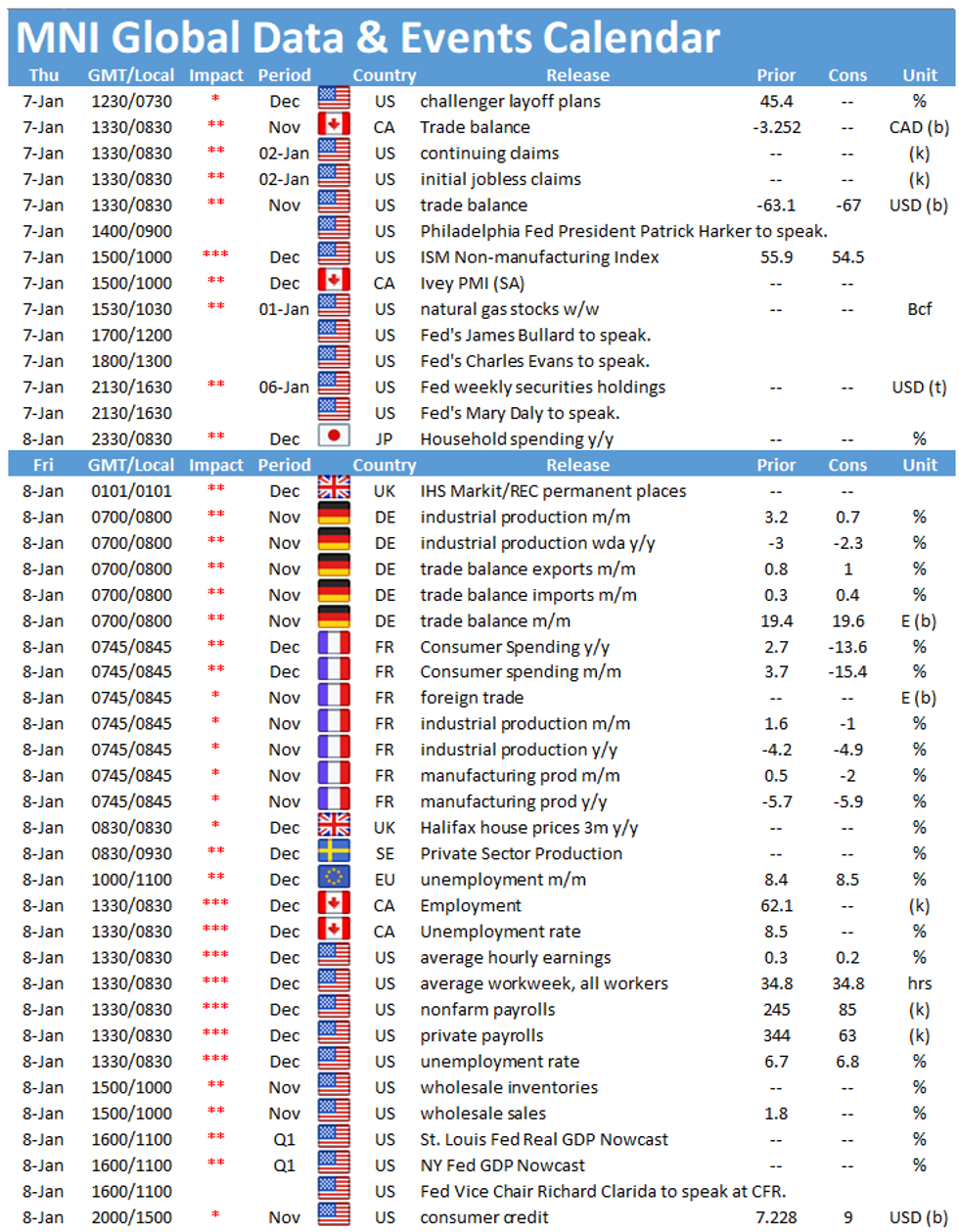

- Similarly, little reaction to FOMC minutes which showed members largely keeping options open for both tapering purchases and extending maturities. On that note, plenty of Fed speakers today: Philly's Harker (0900ET), Richmond's Barkin (0930ET), StL's Bullard (1200ET), Chicago's Evans (1300ET), and SF's Daly (1550ET).

- Challenger job cuts at 0730ET, jobless claims and trade balance at 0830ET, and ISM Services at 1000ET are the data highlights.

- 1130ET sees $65B of 4-/8-week bill auction. NY Fed buys ~$1.75bn of 20-30Y Tsys.

EGB/GILT SUMMARY: Mixed Morning

Markets trade mixed this morning with gilts weaker, EGBs firmer, equity performance uneven and the dollar inching up against G10 FX. Despite the chaotic scenes on Capitol Hill yesterday, outgoing US President Donald Trump has indicated that there will be an 'orderly transition' which should defuse the tail risk of a more conflict-ridden hand over of power.

- Gilts sold off early into the session but quickly regain composure with yields now within 1bp above yesterday's closing levels.

- The bund curve has marginally bull flattened with the 2s10s spread 1bp narrower on the day.

- OATs have slightly outperformed bunds with longer end yields down 2bp.

- BTPs are a touch firmer with yields 1-2bp lower.

- Supply this morning came from France (OATs, EUR10.995bn) and Spain (Obli/Bono, EUR5.54bn).

- Eurozone retail sales data for November missed (-2.9% Y/Y vs 0.9% survey) while the flash CPI estimate for December printed in line (-0.3% Y/Y).

Auction Results

FRANCE AUCTION RESULTS: E10.995bln of L/T OATs sold vs E9.5-11.0bln target

- E4.998bln of 0% Nov-30 OAT. Ave yld -0.33% (-0.38%), bid-to-cover 1.92x(2.36x).

- E2.999bln of 0.50% May-40 OAT. Ave yld 0.10% (0.17%), bid-to-cover 2.01x(1.99x).

- E2.998bln of 0.75% May-52 OAT. Ave yld 0.37% (0.43%), bid-to-cover 2.40x(1.81x).

SPAIN AUCTION RESULTS: E5.54bln of nominal Bono/Obli and E486mln of ObliEi

- E2.583bln of new 0% May-24 Bono. Ave yld -0.501% (-0.45%), bid-to-cover 1.85x(5.78x). (Brackets denote September auction of 0% Apr-23 Bono).

- E1.033bln of 0% Jan-26 Bono. Ave yld -0.407% (-0.41%), bid-to-cover 3.51x(2.00x).

- E1.923bln of 1.00% Oct-50 Obli. Ave yld 0.854% (1.09%), bid-to-cover 1.62x(1.25x).

- E0.486bln of 0.70%% Nov-33 ObliEi. Ave yld -0.856% (-0.39%), bid-to-cover2.16x (1.95x).

- Targets for today's auction E5-6bln nominal, E250-750mln for ObliEi.

EUROPE OPTIONS SUMMARY

Eurozone:

RXG1 177/176/175/174 p condor, sold at 21.5 in 1k

RXH1 179c, bought for 28 in 5k

UK:

L M1 100.12/25/37c ladder, bought for 1.5 in 5k

LU1 100.12/100.00/99.87p fly 1x3x2 sold at 1 in 2k

US:

EDJ1 99.875/99.75/99.625p fly 1x3x2 bought for 5 in 4k

FOREX: Trump Commits to Peaceful Transition, USD Tepid Bounce

With the challenges to certifying Biden's Presidency defeated in Congress, Trump issued a statement confirming there will be a peaceful transition of power to a Biden White House on January 20th, which looks to put an end to yesterday's civil unrest in the US capital.

Markets were largely unreactive to the final confirmation of Biden's victory and equities are broadly mixed. The e-mini S&P holds close to yesterday's highs, with a test of the record levels printed Wednesday at 3774.75 on the cards.

In currency space, the USD is modestly stronger, with GBP also trading well. JPY is on the backfoot after a Japanese MoF official reaffirmed that the government and central bank would work together "as needed".

Weekly US jobless claims data crosses later today, as well as the services ISM and November trade balance. A number of Fed speakers are due, with Harker, Barkin, Bullard, Evans and Daly all on the docket.

TECHS: Price Signal Summary - USD Bounce A Correction?

Bunds (H1) remain soft following this week's sell-off. Watch support at 177.01, Dec 23 low. A break would trigger deeper losses. 177.85, yesterday's high is the first resistance.- Gilts (H1) traded through support at 134.89, Dec 30 low. Attention turns to 134.47, 76.4% of the Dec 24 - Jan 4 rally

- Treasuries (H1) remain on the back foot having breached key support at 137.07+, Dec 4 low. From a technical standpoint, this opens 137.00 and more importantly 136.26+, Nov 11 low.

- In the equity space, the trend in the E-Mini S&P, remains bullish with the focus on 3800.00 next and 3819.10, 1.764 projection of Sep 24 - Oct 12 rally from Oct 30 low.

- On the commodity front, Gold remains in an uptrend despite yesterday's sell-off. Key resistance is at $1965.6, Nov 9 high. Watch support at $1900.9, yesterday's low. Both Brent and WTI continue to extend gains. Brent (H1) has potential for $55.14 next, the 1.382 projection of the Nov 13 - 26 rally from Dec 2 low. WTI (G1) targets $52.11, 1.00 projection of Apr - Aug rally from the Nov 2 low.

- In FX , the USD remains weak although it has found some support this morning. The EURUSD upside objective remains 1.2380, 2.00 projection of the Nov 4 - 9 rally from the Nov 11 low. Support lies at 1.2209/04, Dec 31 low and the 20-day EMA. USDJPY targets 102.02, Mar 10 low following this week's fresh low prints. For now though, and with price through the 20-day EMA, the risk is for a climb towards 103.90, Dec 28 high.

Expiries for Jan07 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2155(E1.3bln-EUR puts), $1.2250(E727mln-EUR puts), $1.2340-50(E499mln), $1.2700(E924mln-EUR puts)

USD/JPY: Y102.50-60($640mln), Y103.20-25($794mln), Y103.70($670mln), Y104.00($1.2bln)

EUR/GBP: Gbp0.8800(E1.1bln-EUR puts), Gbp0.8850(E649mln), Gbp0.9300(E510mln)

AUD/NZD: N$1.0690(A$640mln-AUD puts)

USD/CNY: Cny6.4894($500mln-USD puts), Cny6.50($555mln), Cny6.5960($500mln)

EQUITIES: US Futures Remain Within Reach of Alltime Highs

US equity futures are once again higher and remain within striking distance of yesterday's alltime highs printed at 3774.75, which could easily be tested after what's likely to be another higher open on Wall Street. VIX futures are soft, extending the pullback from the rally earlier in the week.

In Europe, the picture is more mixed as German, French names outperform (DAX and CAC-40 up 0.7% and 0.5% respectively) while UK, Spanish indices lag. Industrials and energy are strongest sectors, while healthcare and tech names are at the bottom of the pile.

COMMODITIES: Gold and Silver Dented by USD Bounce

Oil markets are mixed, with the WTI-Brent spread a touch narrower, but recent gains are largely being held amid light newsflow this morning. WTI's Feb contract hit a new cycle high of $51.28 in Asia-Pac hours, but much of the advance has been pared throughout the European morning.

The USD is modestly stronger, which has capped spot gold and silver prices - both sit a little lower ahead of the US open. Gold is now well off the Wednesday highs at $1959.35, but has also steered clear of yesterday's lows, which act as first support at $1900.88.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.