-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Downtrend Pauses

HIGHLIGHTS:

- Greenback regains some poise as downtrend pauses

- Copper futures hit new decade highs for a second consecutive session

- Heavy slate of corporate earnings due including Alphabet, Microsoft and Visa

US TSYS SUMMARY: A Little Weaker, With Earnings And 7-Yr Supply Ahead

In a replay of Monday's overnight price action, Tsys have edged lower Tuesday. Volumes a little subdued (TYM1s ~230k) ahead of supply today and the FOMC decision Wednesday (2-day meeting gets underway this morning).

- The 2-Yr yield is up 0.4bps at 0.172%, 10-Yr is up 1.3bps at 1.5792%, and 30-Yr is up 1.5bps at 2.2552%. Jun 10-Yr futures (TY) down 3/32 at 132-09 (L: 132-07 / H: 132-12.5)

- Not much in way of macro / headline drivers overnight. Corporate earnings will be of some interest today, with names like UPS, GE, 3M reporting before market, Alphabet and Microsoft etc after-market.

- In supply, $28B 2Y FRN auction alongside $40B 42-day bill auction at 1130ET, with $62B 7Y Note auction at 1300ET.

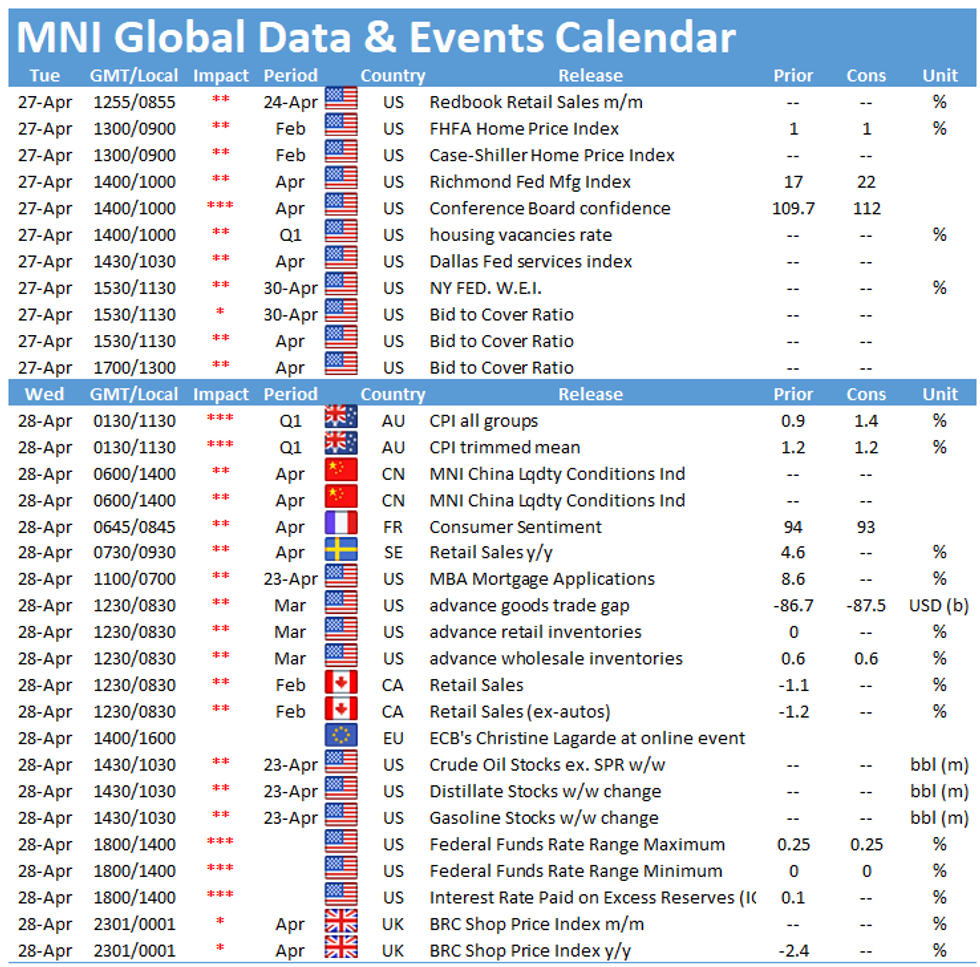

- A light schedule overall though: some house price (FHFA / S&P CoreLogic) house price data at 0900ET, followed by Conference Board consumer confidence and Richmond Fed Manufacturing at 1000ET.

- No NY Fed buy ops until Thursday on account of the Fed meeting. Our Fed preview went out yesterday,click here if you haven't seen it.

EGB/GILT SUMMARY - Mixed Start

European govies have traded mixed this morning alongside fresh downside for equities and broad dollar strength against G10 FX.

- Gilt yields are broadly 1bp higher with the curve slightly bear steepening.

- Bunds have lacked clear direction so far and trade close to flat on the day.

- OATs are similarly now little changed on the day. Last yields: 2-year -0.659%, 5-year -0.5464%, 10-year 0.084%, 30-year 0.8446%.

- BTP cash yields are 1-2bp higher with the close marginally flatter.

- The UK CBI Retailing Reported Sales updated for April came in stronger than expected (20 vs 10 survey).

- Elsewhere, Italian consumer and business confidence surveys were similarly better than expected for April.

- Supply this morning came from Germany (Bund, EUR3.253bn allotted) and Italy (BTP/BTPei, EUR5.5bn ). The UK DMO has also offered GBP6bn of a new 30-year gilt through syndication.

EUROPE ISSUANCE UPDATE: German, Italian auctions, Italian, UK Syndication

Germany allots E3.253bln 0% Nov-28 Bund, Avg yield -0.41%, Bid-to-cover 1.14x, Buba cover 1.40x

Italy sells:

E3.750bln 0% Nov-22 BTP, Avg yield -0.30% (Prev. -0.39%), Bid-to-cover 1.37x (Prev. 1.42x)

E1.000bln 0.65% May-26 BTPei, Avg yield -0.92% (Prev. -0.62%), Bid-to-cover 1.57x (Prev. 1.65x)

E0.750bln 0.15% May-51 BTPei, Avg yield 0.39% (Prev. 0.18%), Bid-to-cover 1.35x

Italy USD Dual Tranche - Final Spreads

- 3Y May-24: MS+50 (guidance MS+55 area; IPT MS+60 area)

- 30Y May-51: MS+195 (guidance MS+200 area, IPT MS+200 area)

UK Gilt Syndication: 30y final terms (1.25% Jul-51)

- Size set at GBP6bln

- Spread set earlier at 0.625% Oct-50 +1.5bps

- Books above GBP69bln

EUROPE OPTION FLOW SUMMARY

Options today, and of late, have rate hike plays in Euribor and Short Sterling.

Eurozone:

RXN1 170/169.50/169/168.50p condor, bought for 3.5 in 2.5k

3RU1 100/99.75/99.50p fly 1x2x1.5, bought for 2.5 in 4.5k

3RU1 100/99.75/99.50p fly 1x2x1.5, bought for 2.5 in 10.5k total so far.

Last night: 3RU1 99.875p/100.375c Risk reversal, bought the put for 0.25 in 28k

This combo has now traded close to 100k of late. All bearish outlook, higher interest rate play.

UK:

3LQ1 98.875/98.50 ps vs 99.25/99.375 cs, bought the ps for 0.25 in 2.5k

FOREX: Greenback Regains Some Poise

- Having traded at new multi-month lows earlier this week, the greenback has regathered some poise Tuesday, rising against most others in G10. The move coincides with renewed momentum in US equity markets, with the e-mini S&P pushing higher to touch another record level overnight. Earnings season continues, with UPS, General Electric, 3M, Visa, Alphabet, Starbucks due, among others, today.

- Yesterday's outperformers are at the bottom of the table Tuesday, with AUD and NZD mildly weaker against most others. AUD/USD has dipped back below 0.78 in recent trade.

- Sweden's Riksbank kept policy unchanged in a decision that was largely alongside expectations. While keeping the repo rate path at zero across the forecast horizon, the Riksbank warned that, while the Swedish economy will normalize toward the end of 2021, the pandemic is "not over". SEK trades weaker against most others in G10.

- Focus Tuesday turns to US consumer confidence numbers for April as well as speeches from ECB's de Cos and BoC's Macklem.

FX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1935-50(E1.0bln-EUR puts), $1.2000(E727mln), $1.2070-75(E766mln-EUR puts), $1.2100-05(E847mln-EUR puts), $1.2120-25(E886mln-EUR puts)

- USD/JPY: Y108.50($505mln), Y108.74-75($1.5bln-USD puts), Y109.00-10($1.3bln-USD puts), Y109.45-65($1.3bln-USD puts), Y109.70-85($1.8bln-USD puts)

- USD/CHF: Chf0.9225($525mln-USD puts)

- AUD/USD: $0.7695-0.7700(A$516mln), $0.7710-25(A$1.4bln-AUD puts), $0.7830-35(A$1.2bln-AUD puts)

- USD/CAD: C$1.2500($602mln-USD puts), C$1.3050($676mln)

- USD/CNY: Cny6.52($710mln)

Price Signal Summary - Gilts Remain Below Key Resistance

- In the equity space, S&P E-minis continue to push higher and have registered a fresh trend high today. The focus is on 4195.50, 1.618 projection of the Feb 1 - Feb 16 - Mar 4 price swing. Key support is unchanged at 4110.50, Apr 21 low.

- In the FX world, EURUSD remains below the bear channel resistance drawn off the Jan 6 high that intersects at 1.2116 today. Yesterday's high of 1.2117 also represents resistance and a clear break would strengthen bullish conditions. Key short-term support is at 1.1994, Apr 22 low. GBPUSD remains below last week's high of 1.4009 on Apr 20. A bearish risk dominates while this level remains intact. Support to watch is at 1.3824, Apr 22 low. USDJPY has found support at 107.48. Just below trendline support drawn off the Jan 6 low. A strong break of the 20-day EMA at 108.68 would ease bearish pressure. The bear trigger is 107.48.

- On the commodity front, Gold is consolidating but maintains a bullish tone. The focus is on $1805.7, Feb 25 high. Brent (M1) remains below last week's high. Key support to watch is $63.50, the 50-day EMA. WTI (M1) found resistance last week at $64.38 on Apr 20. The 50-day EMA at $60.15 is seen as a firm intraday support.

- In the FI space, Bunds (M1) have defined a short-term resistance at 171.15/27, the 20-day EMA and Apr 22 high. On the downside support is at 170.05, 76.4% of the Feb 25 - Mar 25 rally. Support to watch in Gilts (M1) remains 127.81, Apr 14 low. The key resistance is at 129.27, Mar 2 high and the reversal trigger.

EQUITIES: Europe Softer, US Resilient

- Global equity markets started the session well, with the Asia-Pac/European crossover resulting in further momentum for US stock futures, which touched new highs of 4192.50. Stocks have somewhat stalled since, inching lower throughout the European morning to sit in only minor positive territory ahead of the opening bell.

- European futures are underperforming their US counterparts somewhat, while Italian stocks lag (Italy's FTSE-MIB is lower by 0.5%).

- Europe's materials and finance sectors are leading losses, while only the tech and healthcare sectors trade higher.

- Focus remains on earnings, with reports from GE, UPS, 3M, Visa, Alphabet and Microsoft all due.

COMMODITIES: Copper Rolls On, Oil Stabilises

- For a second consecutive session, copper futures have hit new cycle highs, as momentum persists in industrial metals amid expectations of a global economic recovery in H2 this year. Markets are now within reach of the 2011 peak of $4.65.

- Oil markets are more stable after WTI inched lower late Monday. Prices have recovered just above the $62.50 level, with focus on the API inventory data due after-market and the ongoing OPEC discussions this week.

- Markets continue to expect no material change in OPEC policy at this week's meeting. Suggestions that the group were considering only a technical JMMC get together signalling no cause for concern on current output targets. Nonetheless, a resurgence of COVID in India remains a cause for concern and has clouded the outlook for energy demand.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.