-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: Risk Aversion Drives Curve Flattening

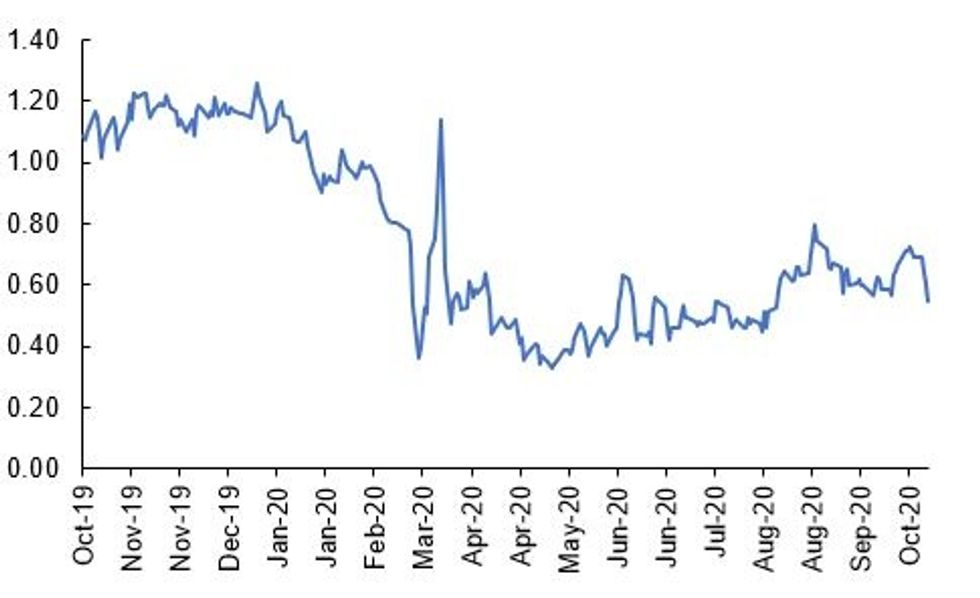

Fig 1. 50-Year Gilt Yield

Source: MNI, Bloomberg

US TSYS SUMMARY: Bull Flattening As Familiar Anxieties Re-Emerge

A familiar set of global concerns has boosted Tsys among other safe haven plays: COVID (lockdowns in Europe), Brexit (EU Summit getting underway shortly), and US fiscal (Mnuchin's comments Weds dashing most hopes of pre-election stimulus).

- Tsy futures just below session highs, with Dec TYs up 5/32 at 139-12 (L: 139-06 / H: 139-13) - decent volume too, ~275k by 0630ET.

- Textbook risk-off bull flattening as well: the 2-Yr yield is down 0.6bps at 0.133%, 5-Yr is down 1.3bps at 0.2913%, 10-Yr is down 2.8bps at 0.6975%, and 30-Yr is down 4.4bps at 1.4618%.

- Earnings weighed on equities in Europe; in the US after Wednesday's mixed bag of financials earnings, we get Morgan Stanley today at 0730ET.

- 0830ET sees most of the data slate: jobless claims, Philly Fed and Empire State mfg indices, and Sep import/export prices.

- In Fed speakers we get Atl's Bostic at 0900ET, StL's Bullard at 1010ET, Dallas' Kaplan / VC Quarles (at separate events) at 1100ET, Richmond's Barkin at 1400ET, and Minn's Kashkari at 1700ET.

- Trump / Biden election events will be eyed after hours.

- $65B in 4-/8-week bill sales at 1130ET, and NY Fed buys ~$2.425B of 1-7.5Y TIPS.

BOND SUMMARY: EGB/GILT Curve Flattening

- Gilts yields are 1-6bp lower and 2s30s is 5bp narrower.

- Bunds have similarly traded firmer with cash yields at the longer end trading down 5bp.

- OATs are only slighly lagging the bund rally. Last yields: 2-year -0.7219%, 5-year -0.6876%, 10-year -0.3422%, 30-year 0.3338%.

- BTPs have sold off and the curve has bear steepened. Yields are 2-4bp higher on the day.

- Supply this morning came from France (OATs, EUR7.2bn and Linkers, EUR1.0bn), Spain (Bono, EUR2.325bn and Ireland (Bills, EUR0.75bn).

- Mirroring the tightening of social restrictions in Northern England, London now faces additional curbs from midnight on Friday.

- The European data calendar was light again today. The final French CPI print for September was in line with the initial estimate.

DEBT SUPPLY

France Sells E7.24bn of M/T OATs Vs E6.5-7.5bn Target

- E1.900bn of the 0.0% May-25 OAT: Average yield -0.70% (0.10%), bid-to-cover 1.72x (4.1x)

- E3.155bn of the 0.0% Feb-26 OAT: Average yield -0.64% (-0.415%), bid-to-cover 1.72x (2.12x)

- E2.185bn of the 2.75% Oct-27 OAT: Average yield -0.59% (-0.38%), bid-to-cover 1.54x (2.25x)

Spain Sells E2.325bn of the 0% Jan-26 Bono Vs E2-3bn Target

- Average yield -0.345%, bid-to-cover 2.2x

Ireland sells E0.7bn of 6-Month Bills

- Average yield -0.58%, bid-to-cover 2.1x

OPTIONS

EURIBOR OPTIONS: Blue downside

3RZ0 100.37p, bought for 1.25 in 8,880 (ref 100.505, 10 del)

EURIBOR OPTIONS: Downside structure

ERZ0 100.50/100.37ps, bought for 1 in 4k

EURIBOR OPTIONS: More blue structure interest

More blue interest, and we have seen similar in Sterling and Eurodollar structures of late

- 3RH1 100.25p, bought for 1.75 in 2k (ref 100.505)

TECHS

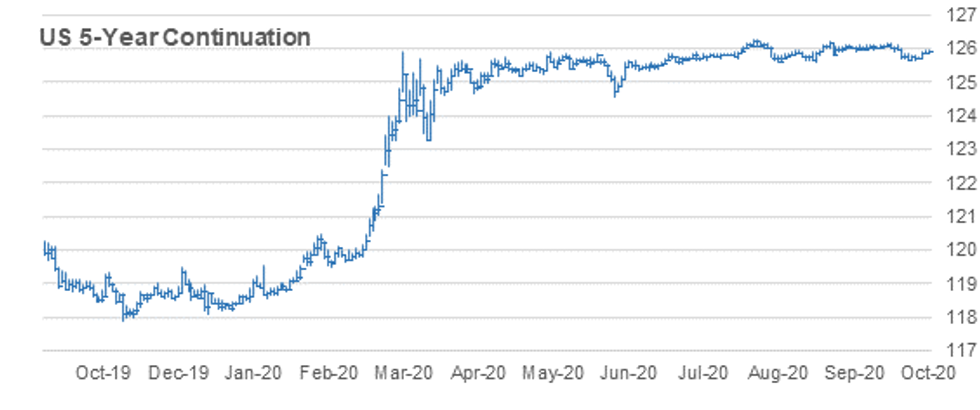

US 5YR FUTURE TECHS: (Z0) Extends This Week's Gains

- RES 4: 126-006 76.4% retracement of the Sep 30 - Oct 7 sell-off

- RES 3: 125-316 High Oct 5

- RES 2: 125-30+ 61.8% retracement of the Sep 30 - Oct 7 sell-off

- RES 1: 125-302 Intraday high

- PRICE: 125-30 @ 11:13 BST Oct 15

- SUP 1: 125-27 Low Oct 14

- SUP 2: 125-23+ Low Oct 13

- SUP 3: 125-202 Low Oct 7 and the bear trigger

- SUP 4: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

5yr futures have extended gains today and appear set to appreciate further. This week's rally marks a potential reversal of the recent decline between Sep 30 and Oct 7. Futures have traded through a resistance zone defined by the 20- and 50-day EMAs. A clear breach of this zone would strengthen a S/T bullish argument and open 125-316, Oct 5 high. Initial support is at 125-27, yesterday's low. The reversal trigger is at 125-202, Oct 7 low.

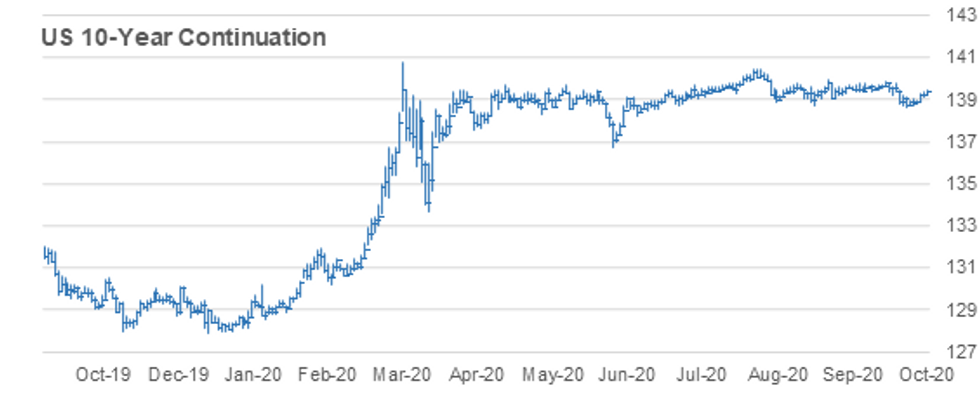

US 10Y FUTURE TECHS: (Z0) Bulls In Control

- RES 4: 139-26 High Sep 29 and a key resistance

- RES 3: 139-25 High Oct 2

- RES 2: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 1: 139-13 Intraday high

- PRICE: 139-12 @ 11:33 BST Oct 15

- SUP 1: 139-04+ Low Oct 14

- SUP 2: 138-28+ Low Oct 13

- SUP 3: 138-20+ Low Oct 7 and the bull trigger

- SUP 4: 138-18+ Low Aug 28 and the bear trigger

Treasuries remain firm following this week's gains and price is higher again today. This week's gains signal a likely reversal of the recent bearish theme and if correct, highlights scope for stronger S/T gains. Futures have traded through a band of resistance defined by the 20- and 50-day EMAs. A clear breach of these averages would strengthen a bullish argument and open 139-17 next, a retracement level. Initial support is at 139-04+

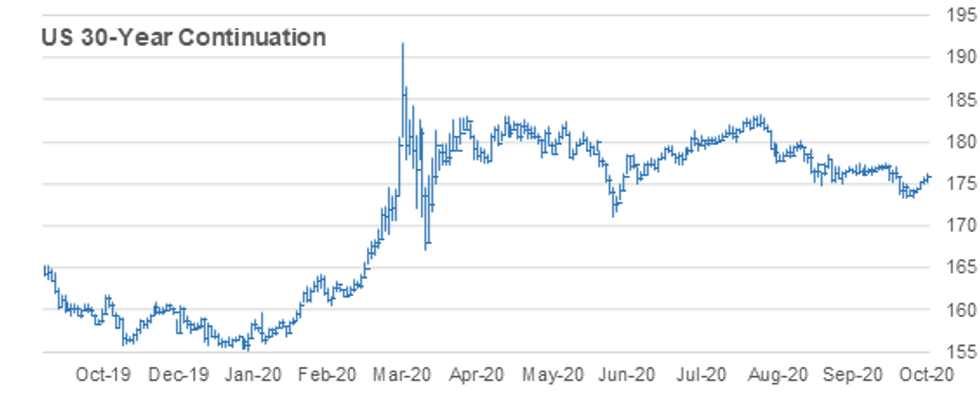

US 30Y TECHS: (Z0) Pressuring The EMA Resistance Zone

- RES 4: 177-24 High Sep 4

- RES 3: 177-14 High Sep 17 and a bull trigger

- RES 2: 177-00 High Oct 2

- RES 1: 176-09 Intraday high

- PRICE: 176-00 @ 11:46 BST Oct 15

- SUP 1: 175-01 Low Oct 14

- SUP 2: 174.08 Low Oct 13

- SUP 3: 173-10 Low Oct 7 and the bear trigger

- SUP 4: 172-13 0.764 projection of Aug 6 - 28 decline from Sep 3 high

30yr futures are extending the recovery off the Oct 7 low of 173-10. This week's gains signal a reversal of the recent decline between Sep 29 and Oct 7. Futures have entered a band of resistance highlighted by the 20- and 50-day EMAs. Clearance of this zone would strengthen the current bullish theme and open 177-00, Oct 2 high. Note too that a trendline resistance drawn off the Aug 6 high has been probed. 175-01 is first support.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.