-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Focus On Bank of England Taper Decision

EXECUTIVE SUMMARY:

- FOCUS ON BANK OF ENGLAND'S TAPERING DECISION

- NORGES BANK SEES FIRST HIKE LATER H2 2021

- U.K. SENDS NAVY PATROL SHIPS TO JERSEY AFTER FRENCH THREATS

- E.U. READY TO DISCUSS COVID VACCINE PATENT WAIVER: VON DER LEYEN

- GERMAN MARCH FACTORY ORDERS BEAT EXPECTATIONS

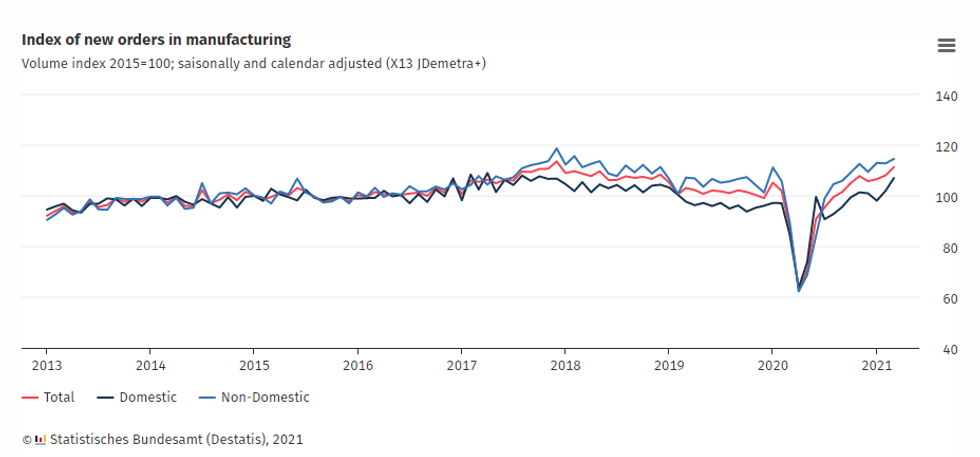

Fig. 1: German Factory Orders Beat Expectations In March

Source: Destatis

Source: Destatis

NEWS:

BANK OF ENGLAND (MNI PREVIEW): The market's main BoE focus today (decision at 0700ET/1200BST; press conference 0800ET/1300BST) is on the tapering decision. Analysts are split on whether the May meeting will be too early for the MPC to pull the trigger on slower purchases or whether a decision will be left until June or August. The MNI Markets team's base case is that the MPC waits until the June meeting, but sounds optimistic enough at this week's meeting to prepare the market for a tapering of gilt purchases when England completes its roadmap out of lockdown.

NORGES BANK: Key points from today's Norges Bank statement:

- Economic developments have been largely in line with the projections in the March Report.

- In the Committee's current assessment of the outlook and balance of risks, the policy rate will most likely be raised in the latter half of 2021

- When there are clear signs that economic conditions are normalising, it will again be appropriate to raise the policy rate gradually from the today's level.

- Full statement here: https://www.norges-bank.no/en/topics/Monetary-poli...

UK-FRANCE: The U.K. has sent two military patrol vessels to the British isle of Jersey ahead of a potential blockade by French fishermen, as a row with France over post-Brexit fishing rights deepened. Prime Minister Boris Johnson spoke with Jersey's political leaders on Wednesday and said any blockade would be "unjustified," according to a statement from the U.K. government. France responded by dispatching its own naval observation vessel, the Athos, to the area, after previously threatening to cut off electricity supplies to Jersey in protest at a lack of licenses for its fishermen.

E.U./COVID VACCINE (RTRS): The European Union is willing to discuss a proposal, now backed by the United States, to waive intellectual property rights for COVID-19 vaccines, European Commission president Ursula von der Leyen said on Thursday.The head of the EU executive said the bloc's vaccination effort was accelerating, with 30 Europeans inoculated per second, while exporting more than 200 million vaccine doses to the rest of the world."The EU is also ready to discuss any proposals that addresses the crisis in an effective and pragmatic manner," von der Leyen said in a speech to the European University Institute in Florence.

GERMANY: Mechanical and plant engineering companies saw a sharp rise in orders through March, up by 29% y/y, Germany's VDMA said Thursday. The pandemic left a first marks in the order books in March last year, so the basis for comparison is correspondingly low, VDMA chief economist Ralph Wiechers noted, but said companies are now benefiting from the fact that incoming orders are clearly accelerating," However, he warned that production hindrances have increased recently due to bottlenecks in important supplies. "This is a spanner in the works of an otherwise pleasing recovery," Wiechers warned in an article on the group's website.

CHINA-AUSTRALIA: China will indefinitely suspend all activity under the China-Australia Strategic Economic Dialogue following Canberra's increasingly hawkish tone, the National Development and Reform Commission said in a statement on its website. Some Australian officials have launched a series of measures to disrupt normal exchange and cooperation between China and Australia out of Cold War mind set and ideological discrimination, the NDRC said.

DATA:

German Mar Factory Orders Beat Expectations

GERMANY MAR IND ORD +3.0% M/M, +27.8% Y/Y; FEB +1.4% M/M

- German factory orders increased by 3.0% in Mar, showing a 5-month high and coming in at double the pace than markets expected (BBG: 1.5%)

- Feb's reading was revised up to 1.4% from 1.2% reported previously.

- Annual orders surged to 27.8% in Mar, reflecting the sharp decline seen in Mar 2020.

- Compared to Feb 2020, the last month before the start of the pandemic, orders were 9.1% higher.

- Mar's uptick was mainly led by domestic orders which rose by 4.9% in Mar.

- Meanwhile, foreign orders grew by 1.6%, with orders from the EZ rising by 0.7%, while orders from other foreign countries ticked up 2.2%.

- Orders for intermediate goods edged up 2.8% and capital goods order rose by 2.5%, while consumer goods orders jumped to 8.5% in Mar.

MNI: UK FINAL APR SERVICES PMI 61.0; FLASH 60.1; MAR 56.3

MNI: EZ APR CONSTRUCTION PMI 50.1; MAR 50.1

FIXED INCOME: Awaiting BoE

A range bound morning session for EGBs, with focus turning to the BoE, without forgetting the US NFP tomorrow.

- Bund initially ticked lower, taking its cue from the Risk on tone, with Estoxx futures (VGM1) making an attempt at 4000, printed 3999 high.

- Bund has since pared early selling with Equities drifting back towards the lower part of the range.

- Peripherals are mostly flat against the German 10yr

- A mixed start for Gilts, with 10yr trading in a tight 20 ticks range (127.98/128.18), heading into BoE at midday.

- US Treasuries trade inline with EGBs, with curve leaning bull flatter.

- Tnotes trade within overnight ranges.

- Looking ahead, BoE rate decision at 12.00BST, and presser at 13.00BST.

- UK local elections.

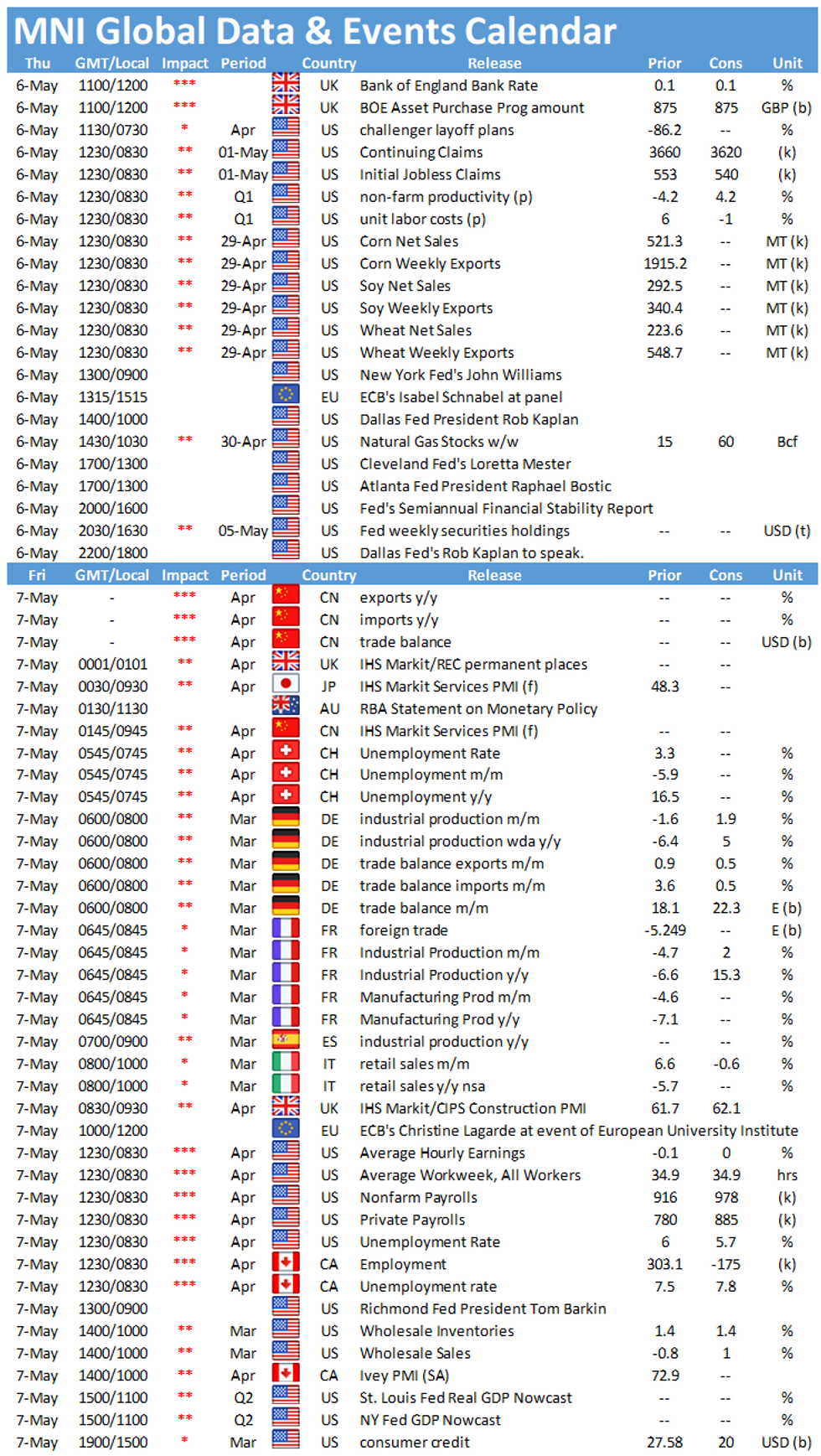

- On the data front, US IJC is the notable data.

- Speakers include ECB de Guindos, Lagarde, Schnabel, and Fed Williams, Kaplan, Mester.

- Fed also release May 2021 financial stability report

FOREX: Markets Mixed, EUR/USD The Standout

- Currency markets are mixed early Thursday, with EUR/USD strength the most notable move so far. The pair is narrowing the gap with the 100-dma resistance at 1.2049. A break and close above here opens gains towards the week's highs of 1.2076 and the 1.2087 Fib retracement.

- Norway opted to keep policy unchanged this morning, alongside expectations. The accompanying statement continued to nudge markets toward the likelihood of a rate hike in the second half of 2021. EUR/NOK was unmoved, with prices holding just below the week's highs of 10.0455.

- Focus turns to the Bank of England rate decision and Monetary Policy Report, at which markets will be watching for any clues over the future trajectory of the BoE's asset purchase programme.

- The Turkish central bank rate decision is also due, with the Bank seen keeping rates unchanged. Weekly jobless claims numbers are the data highlight.

EQUITIES: European Stocks Stronger, FTSE Gaining Pre-BoE

- China/HK stocks closed lower: China's SHANGHAI closed down 28.045 pts or -0.16% at 3443.542 and the HANG SENG ended 139.16 pts lower or -0.49% at 28545.82

- European equities are posting strong gains, with the German Dax up 198.87 pts or +1.34% at 15170.78, FTSE 100 up 81.34 pts or +1.17% at 7039.3, CAC 40 up 62.03 pts or +0.99% at 6339.47 and Euro Stoxx 50 up 50.9 pts or +1.3% at 4002.79.

- U.S. futures are higher, with the Dow Jones mini up 96 pts or +0.28% at 34167, S&P 500 mini up 14.25 pts or +0.34% at 4165.25, NASDAQ mini up 58 pts or +0.43% at 13519.5.

COMMODITIES: Oil, Copper Continue To Gain

- WTI Crude up $0.82 or +1.25% at $65.85

- Natural Gas up $0.01 or +0.44% at $2.944

- Gold spot down $4.24 or -0.24% at $1793.47

- Copper up $4.25 or +0.94% at $455.35

- Silver down $0.17 or -0.64% at $26.7552

- Platinum down $10.26 or -0.83% at $1238.13

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.