-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: China Equity Jitters Underpin Cautious Mood

EXECUTIVE SUMMARY:

- Chinese Tech Stocks Still In Focus

- EZ GDP Stronger Than Expected In Q2

- Focus Shifts To US PCE & Uni Michigan Consumer Confidence Data Later Today

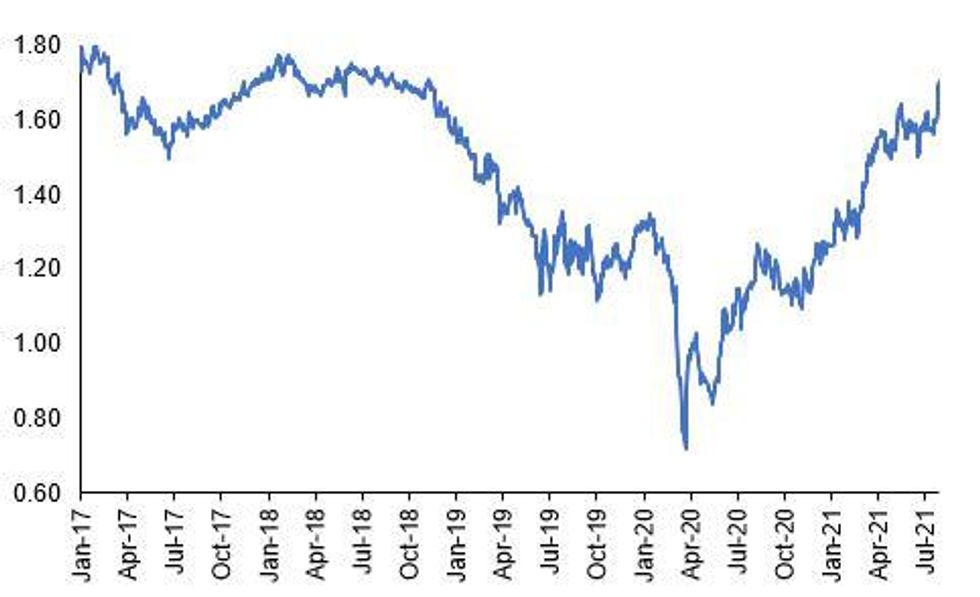

Source: MNI, Bloomberg

NEWS

CHINA (FT): Chinese technology stocks listed in the US are set for their worst month since the global financial crisis after investors dumped shares following a regulatory crackdown by Beijing. The Nasdaq Golden Dragon China index, which tracks Chinese tech stocks listed in New York, has fallen 22 per cent in July, putting it on course for its biggest monthly fall since 2008. Shares in Chinese internet groups Tencent and Alibaba have dropped about 16 per cent and 10 per cent respectively. The sharp declines come as Beijing has launched a regulatory assault on companies that handle large amounts of data and education businesses, as well as an overhaul of how Chinese groups list on stock markets outside the country.

UK (BLOOMBERG): Businesses in the U.K. say there are signs the "pingdemic" of workers told to self-isolate after contact with a Covid-19 case is starting to ease as infection rates fall, while more staff may be deleting the tracing app. Almost 690,000 people in England and Wales were alerted by the official Covid-19 mobile phone app and told to isolate in the week to July 21 -- a record high, according to the latest data released Thursday. But the new numbers cover the period when cases hit a recent peak of 54,674 on July 17, and not the significant reduction since. Daily cases fell for seven days to Tuesday before rising again, reaching 31,117 on Thursday. Some business leaders are now noticing a drop in the number of contact-tracing alerts among their employees. And while that is strongly linked to a period of lower infections, it's also thought many workers are deleting the app or switching off its tracing function to avoid being "pinged."

INDIA (REUTERS): India reported 44,230 new COVID-19 cases on Friday, the most in three weeks, the latest evidence of a worrying trend of rising cases that has forced one state to lock down amid fears of another wave of infections. India was battered by the Delta variant of the virus in April and May but the rate of spread of infections later eased off. It has again been rising, with higher numbers in seven of the past eight days. The nationwide tally of infections has reached 31.57 million, according to health ministry data. Deaths rose by 555 overnight, taking the overall toll to 423,217.

HONG KONG (REUTERS): The first person convicted under Hong Kong's national security law was jailed for nine years on Friday for terrorist activities and inciting secession, judges said, in a watershed ruling with long-term implications for the city's judicial landscape. Former waiter Tong Ying-kit, 24, was accused of driving his motorcycle into three riot police last year while carrying a flag with the protest slogan "Liberate Hong Kong. Revolution of our times." Tong's lawyer, Clive Grossman, told reporters outside the court the defence would appeal both the verdict and the sentence. He made no further comment.

GERMANY DATA: GDP Rebounded in Q2, But Lower Than Expected

GERMANY FLASH Q2 GDP +1.5% Q/Q SA, -9.2% Y/Y WDA

GERMANY Q1 GDP -2.1% Q/Q, -3.1% Y/Y

- The German economy expanded by 1.5% in Q2, coming below market expectations (BBG: +2.2%).

- While Apr was characterized by strict restrictions, May and June saw a rapid loosening of restrictions, which provided a boost to business activity.

- Q1 growth was revised down to -2.1% q/q from -1.8% reported previously.

- The annual rate surged to 9.2% in Q2, after falling by 3.1% in the previous quarter, reflecting the sharp decline seen in Q2 2020.

- Compared to Q4 2019, the last quarter before the crisis, GDP is still 3.4% lower in Q2 2021.

- Destatis noted that Q2's increase was mainly driven by private and government consumption.

FRANCE DATA: Q2 GDP Outpaces Expectations

FLASH Q2 GDP +0.9% Q/Q SA, +18.7% Y/Y WDA

Q2 HH CONSUMPTION EXPENDITURE +0.9% Q/Q

Q2 GOVT CONSUMPTION EXPENDITURE +0.6% Q/Q

Q2 EXPORTS +1.5% Q/Q; IMPORTS +1.9% Q/Q

- The French economy expanded by 0.9% in Q2 after stagnating in the first quarter of 2021.

- Q2 growth came in stronger than market expectations (median 0.8%).

- Annual GDP rose by 18.7% in Q2 following Q1's uptick by +1.7% and reflecting the sharp decline seen in Q2 2020 at the start of the pandemic.

- Despite the Q2 uptick, GDP remains 3.3% below the level seen in Q4 2019, the last quarter before the pandemic impacted GDP.

- Q2's gain was driven by an increase of government and household spending, up 0.6% and 0.9%, respectively, amid an easing of restrictions and falling infection rates in Q2.

- Meanwhile, exports increased by 1.5% and imports rose by 1.9% in Q2, as a result foreign trade contributed negatively to GDP growth, shaving off 0.1pp.

ITALY DATA: GDP Beats Expectations On Upside

- Preliminary 2Q21 GDP +2.7% q/q, +17.3% y/y, beating expectations looking for an uptick to 1.3% q/q

- 1Q21 GDP real SA WDA revised up to +0.2% q/q; -0.7% y/y

- 2Q21 q/q industry, services up; ag., forestry/fishing flat--ISTAT

- Italy prelim GDP +4.8% 'acquired' net growth for 2021--ISTAT

SPAIN DATA: GDP Rose in Q2

SPAIN Q2 FLASH GDP +2.8% Q/Q SA, +19.8% Y/Y WDA

SPAIN Q1 GDP UNREVISED -0.4% Q/Q; -4.2% Y/Y

- Spanish economic growth increased by to 2.8% in Q2, beating market expectations looking for an uptick by 2.2%.

- The second quarter was characterized by falling infection rates, a loosening restrictions and progress in vaccinations, which boosted economic activity.

- The annual rate surged by 19.8% in Q2 after recording -4.2% in the previous quarter and reflecting the sharp fall in Q2 2020.

- Q1 growth was unrevised at -0.4% Q/Q and -4.2% Y/Y.

- Household consumption rose markedly by 6.6% in Q2 after falling by 0.4% in Q1, reflecting the reopening of the economy.

FRANCE DATA: Flash Inflation At 1.6%

JUL FLASH HICP +0.1% M/M, +1.6% Y/Y; JUN +1.9% Y/Y

JUL FLASH CPI +0.1% M/M, +1.2% Y/Y; JUN +1.5% Y/Y

- Annual inflation decelerated to 1.6% in Jul, down from 1.9% seen in Jun, hitting a 3-month low.

- The headline HICP came in stronger than markets expected (median 1.4%).

- Jul's drop was led by a sharp decline of prices for manufactured products, falling by 1.1% after increasing by 0.7% in Jun.

- Service inflation slowed to 0.7% in Jul, its weakest reading since Dec 2020, where the index also rose by 0.7%, while tobacco prices edged lower to 5.1%.

- Food and energy prices accelerated to 0.8% and 12.4%, respectively, with energy prices rising to the highest level since Oct 2018.

ITALY DATA: Italian Inflation Edged Higher in Jun

- Prel Jul HICP -1.1% m/m, +0.9% y/y (Jul +1.3% y/y), falling short of market expectations (BBG: +1.1%)

- Main domestic index (NIC) Jul +0.3% m/m, +1.8% y/y (Jun+1.3% y/y)

- Jul core HICP inflation -0.6% y/y vs Jun+0.3% y/y.

- Net-of-energy Jul HICP index -0.5% y/y vs Jun +0.1% y/y

- Flash Jul HICP data provides +1.0% "acquired" inflation.

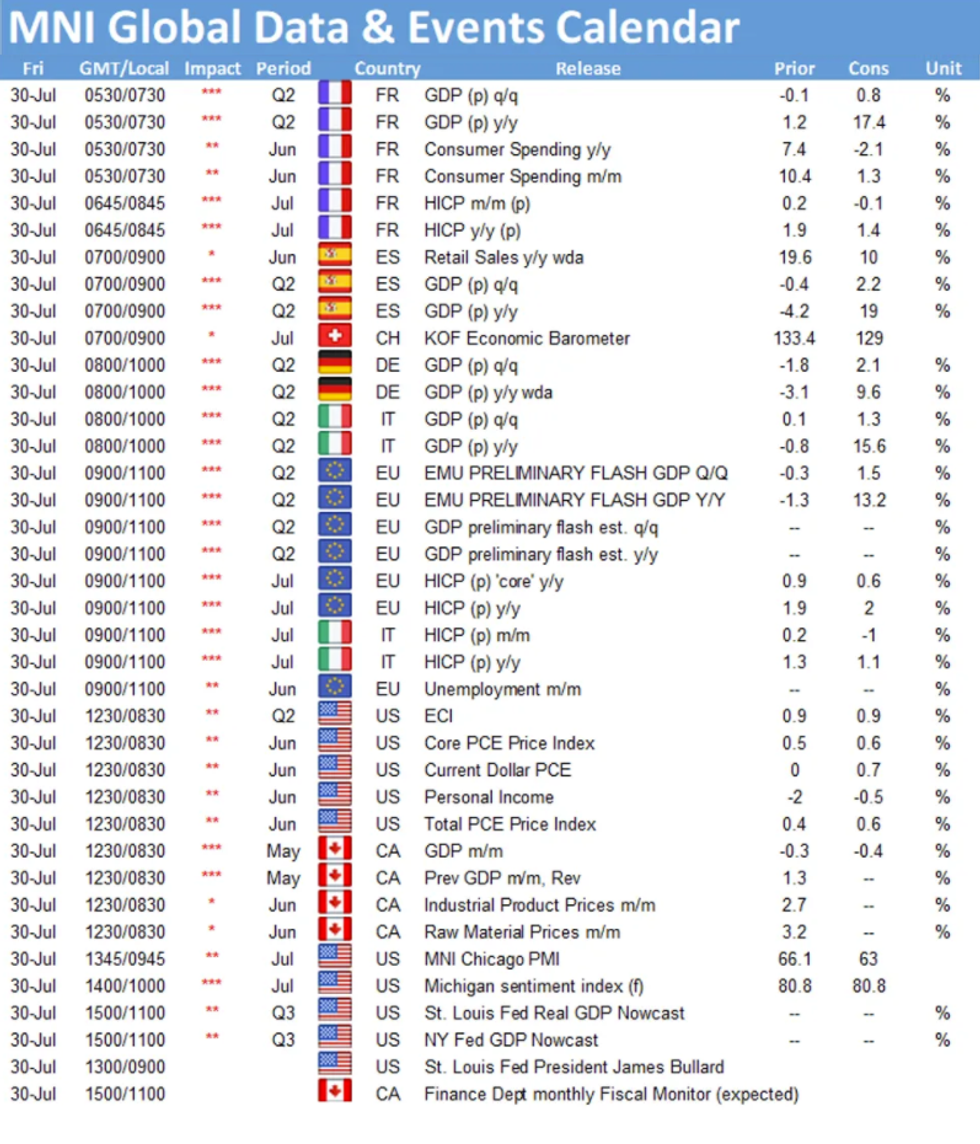

FIXED INCOME: EU data beat. Attention turns to US inflation

EGBs have faded some of the early open bids, on better European data, and underpinned Equities.

- French and EU CPI beat expectations, and so did Spanish, German, Italian GDP.

- Bund is down 11 but well within yesterday's range, on low liquidity.

- Peripherals are a touch tighter, Greece and Italy by 0.5bp.

- Gilts are trading mostly in line with bund, although outperforming by 0.7bp.

- UK 5/30s lean steeper and trade around yesterday's high, now at 71.59.

- US treasuries are better bid, following the risk off overnight, after the disappointing earnings from Amazon yesterday.

- Despite the better bid in the long end, US 5/30 leans bull steeper, edging above yesterday's high, now at 119.242.

- Looking ahead, all the attention turns to US inflation.

- Other release include MNI Chicago PMI, Michigan, and Canadian GDP

- SPEAKERS: Fed Bullard on US economy

FOREX: Greenback Lower for a Fifth Session

- The greenback is softer for a fifth consecutive session, with USD index showing below yesterday's lows to touch the poorest level since late June. Major support undercuts at the 50-, 100- and 200-dmas that cross between 91.35-91.54.

- This morning's Eurozone data had little market impact, but confirmed a slow down in core price growth across the Euroarea, with Core Y/Y slowing to 0.7% from 0.9%. EUR remains bid, with EUR/USD topping 1.19 to touch a new July high at month-end.

- GBP, CHF and CAD are the strongest currencies in G10, while NOK, USD and JPY are the weakest.

- Focus turns to the upcoming US PCE release, expected to tick slightly higher from the previous, while the MNI Chicago PMI is seen slowing to 64.1. Canada's monthly GDP data is also due, with Y/Y growth expected to slow to 14.8% from 20.0% previously. Fed's Bullard is due to comment on policy and the economy at 1400BST/0900ET, the first Fed member to speak since Wednesday's rate decision.

EQUITIES China Bounce Fades, Hang Seng Closes Lower

- Japan's NIKKEI down 498.83 pts or -1.8% at 27283.59 and the TOPIX down 26.35 pts or -1.37% at 1901.08.

- China's SHANGHAI closed down 14.367 pts or -0.42% at 3397.357 and the HANG SENG ended 354.29 pts lower or -1.35% at 25961.03

- German Dax down 127.47 pts or -0.82% at 15524.58, FTSE 100 down 53.53 pts or -0.76% at 7028.39, CAC 40 down 7.11 pts or -0.11% at 6632.22 and Euro Stoxx 50 down 19.27 pts or -0.47% at 4098.1.

- Dow Jones mini down 107 pts or -0.31% at 34878, S&P 500 mini down 29.5 pts or -0.67% at 4383.75, NASDAQ mini down 171.75 pts or -1.14% at 14872.75.

COMMODITIES: Gold Still Inching Higher, Testing 50-dma

- WTI Crude down $0.23 or -0.31% at $73.4

- Natural Gas down $0.07 or -1.77% at $3.986

- Gold spot up $0.09 or +0% at $1828.78

- Copper up $0.65 or +0.14% at $453.3

- Silver up $0.04 or +0.17% at $25.573

- Platinum down $8.32 or -0.78% at $1056.8

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.