-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: FOMC Comes Into Focus

MNI US Open:EXECUTIVE SUMMARY:

- Equities push higher ahead of the FOMC meeting later today.

- Evergrande strikes agreement with bondholders on interest payments for a domestic bond

- US President Joe Biden dashes UK hopes of a bilateral trade deal.

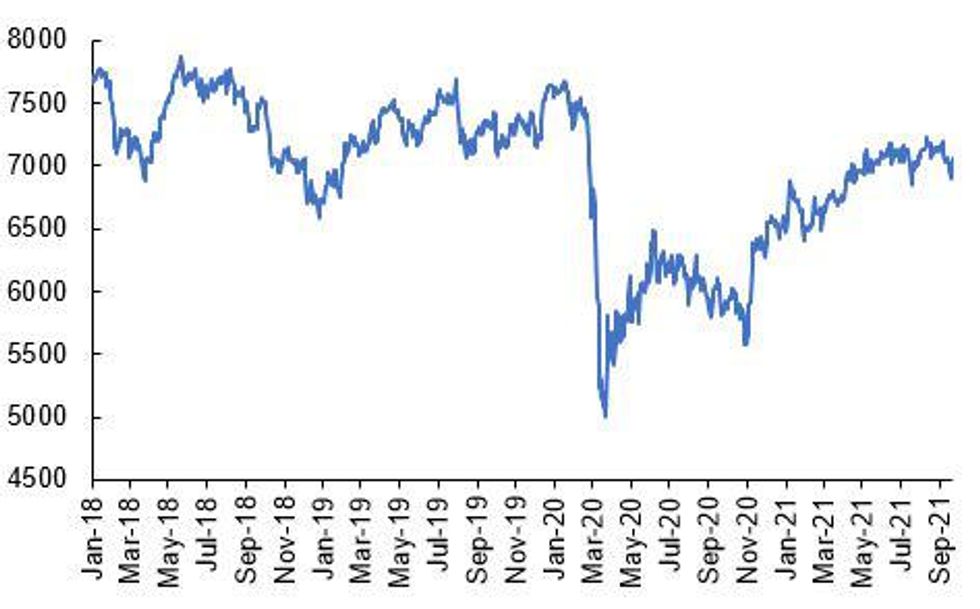

Source: MNI/Bloomberg

NEWS

CHINA (REUTERS): China Evergrande Group's main unit said on Wednesday it negotiated a deal with bondholders to settle interest payments on a domestic bond, which helped calm fears of an imminent default that could unleash global financial chaos.

UK-US (BBC): Joe Biden has played down the chances of a post-Brexit free trade deal between the US and UK, as he held talks with Boris Johnson at the White House. The US president said he would discuss the issue "a little bit" with the UK prime minister, adding: "We're going to have to work that through." Downing Street said a direct deal with the US remained the "priority". But UK ministers are pondering joining an existing North American trade pact instead, the BBC understands. Mr Biden and Mr Johnson also discussed Northern Ireland, climate change and Afghanistan during the 90-minute meeting. The UK is keen to strike free trade deals around the world in the wake of leaving the European Union's single market - including with the US, with which annual trade was worth an estimate $273bn (£200bn) in 2019.

UK (BBC): The government is set to pay out tens of millions of pounds to restart production of carbon dioxide at a key plant in the UK amid fears over food supplies and the nuclear industry. The government will meet the full operating costs to run CF Industries' Teesside plant for three weeks. US-owned CF Industries recently shut two sites that produce 60% of the UK's commercial carbon dioxide supplies. The plant in Billingham will need up to three days to start producing new CO2.

EUROPE (FT): The UK carbon dioxide shortage threatening industries from steel to food is spilling over into Europe, one of the world's largest distributors of the gas has warned. Nippon Gases, which sold almost $1.5bn of industrial gases on the continent last year, said "other countries in Europe will also suffer shortages" of CO2, estimating that its supplies had fallen 50 per cent across the region. Soaring natural gas prices have forced closures of fertiliser plants, the UK's main source of CO2 used to make drinks fizzy, stun animals for slaughter and cool nuclear power plants. Nippon's stark message was echoed by the head of Yara, the Norwegian chemicals group that announced last week it would slash 40 per cent of its European production of ammonia — an important input for one of the most commonly used fertilisers.

AUSTRALIA-EU (REUTERS): An Australian-EU trade deal would be mutually beneficial and allow EU members a greater presence in the Indo-Pacific, said Australia's trade minister, as Canberra tries to repair ties with Paris after the scrapping of a $40 billion submarine deal.

FIXED INCOME: Focus on the Fed

- Equities have rebounded following a statement from Evergrande that suggested onshore bond coupon payments would be made, but with little detail as to exactly whether this would be on time or not.

- Core fixed income has not seen the same kind of relief and is only marginally lower on the day.

- Looking ahead the focus will of course be on the Fed decision and presser due later today. November is seen by analysts are the most likely date for a taper to be announced and this meeting is likely to tee up that move. The median Fed funds rate 'dot plot' path to remain fairly static at this meeting vs the June projections, setting up hawkish risks. See the full MNI Fed Preview here.

- TY1 futures are down -0-1+ today at 133-04+ with 10y UST yields up 0.5bp at 1.329% and 2y yields up 0.1bp at 0.217%.

- Bund futures are down -0.17 today at 171.57 with 10y Bund yields up 0.2bp at -0.316% and Schatz yields up 0.5bp at -0.719%.

- Gilt futures are down -0.13 today at 127.36 with 10y yields up 0.2bp at 0.808% and 2y yields down -0.1bp at 0.275%.

FOREX: Better Bid In Equity Keeps the Lid on USD

- The Dollar has been offered during our European morning session, and this was a continuation from the Overnight/Asian session.

- Equities have been the driver of cross assets this week, following the big slump on Monday.

- Today is not different, as Equity consolidate higher, the Dollar turns offered.

- Regardless, Equities are still far away from Friday's best levels.

- The Greenback trades in the red against all G10s, besides the Yen, on Risk on flow.

- Pound continues to struggle this morning, Energy risks are still weighing, EURGBP is through the initial resistance at 0.8595 High Sep 20/21.

- And now eye 0.8614/18 High Sep 7 / 76.4% of the Jul 20 - Aug 10 sell-off.

- The Kiwi, NOK, CAD and AUD are all leading versus the USD.

- USDNOK has tested initial support noted at 8.6492, printed a 8.6484 low.

- NZDUSD resistance moves down to 0.7041, followed by yesterday's high at 0.7056. So far 0.7031 is the high.

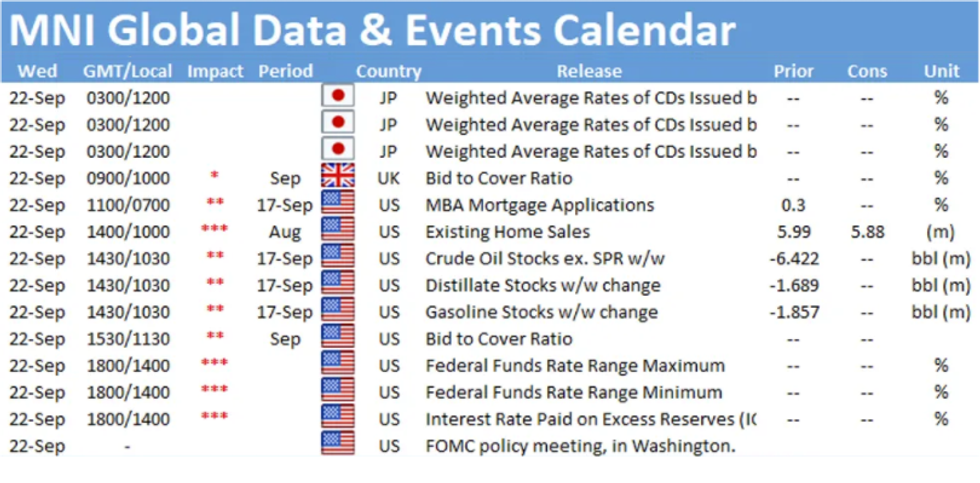

- Looking ahead, we have no tier 1 data and all the attention is on the FOMC and presser.

EQUITIES: Recovering on less Evergrande pessimism

- Japan's NIKKEI down 200.31 pts or -0.67% at 29639.4 and the TOPIX down 21 pts or -1.02% at 2043.55.

- China's SHANGHAI closed up 14.524 pts or +0.4% at 3628.49.

- German Dax up 104.05 pts or +0.68% at 15451.18, FTSE 100 up 79.47 pts or +1.14% at 7058.39, CAC 40 up 75.09 pts or +1.15% at 6626.88 and Euro Stoxx 50 up 35.49 pts or +0.87% at 4132.55.

- Dow Jones mini up 191 pts or +0.57% at 33991, S&P 500 mini up 23.5 pts or +0.54% at 4366, NASDAQ mini up 52.5 pts or +0.35% at 15074.75.

COMMODITIES: LEVELS UPDATE: Copper leading commodities higher

- WTI Crude up $1.1 or +1.56% at $71.53

- Natural Gas up $0.05 or +1% at $4.855

- Gold spot up $1.07 or +0.06% at $1775.38

- Copper up $8.75 or +2.12% at $421.25

- Silver up $0.21 or +0.95% at $22.7028

- Platinum up $17.83 or +1.86% at $973.68

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.