-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US OPEN: BoE Set To Hike On "Super Thursday"

EXECUTIVE SUMMARY:

- BANK OF ENGLAND SEEN HIKING RATES 25BP TODAY; ECB TO HOLD

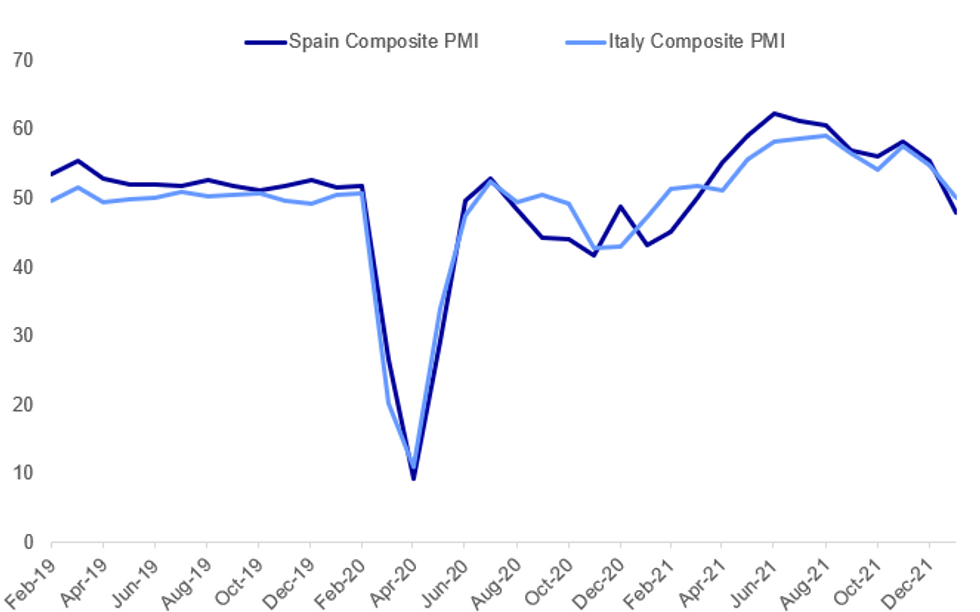

- SPAIN, ITALY PMIS SLUMP IN JANUARY; EUROZONE DEC PRODUCER PRICES SOAR

- UK HALTING CHECKS ON N IRELAND BORDER "ABSOLUTE BREACH" OF INT'L LAW: EU COM

- NATO CHIEF WARY OF RUSSIAN TROOP BUILDUP IN BELARUS

Fig. 1: Spain, Italy PMIs Much Weaker Than Expected In January

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

BANK OF ENGLAND: The BOE policy decision, Minutes and MPR are all due for release at middayGMT with a press conference at 12:30GMT. The MNI Markets team expects a 25bp hike this week, along with the 26 sell-side analysts in our survey. Assuming a hike, the gilt maturing in March will almost certainly not be reinvested. For the full MNI Preview including summaries of 26 sell-side analyst views and the questions for MNI Instant Answers, click here.

EUROPEAN CENTRAL BANK: The ECB policy decision will be at 12:45GMT (i.e. during the BOE press conference) with the ECB press conference due at 13:30GMT. Given the policy announcements in December, no material policy innovations are expected at the February meeting. However, today's meeting will present a communication challenge for the ECB as it attempts to affirm the baseline scenario (subsiding inflation this year, no near-term rate hikes) at a time when the Fed and BoE have become more hawkish and inflation fears have been rising globally. For the full MNI Preview, click hereFor the full MNI Preview, click here.

UK/EU/N IRELAND: Speaking to RTE's Morning Ireland, European Commissioner Mairead McGuinness states that the proposed halting of some checks on goods coming into Northern Ireland from the British mainland is an 'absolute breach' of international law. * McGuinness states that "It's very unhelpful. We're working tirelessly with the UK to find solutions." Adds that she will hold a call with Commissione rMaros Sefcovic and UK Foreign Secretary Liz Truss on the issue later today.

RUSSIA-NATO (AP): NATO Secretary-General Jens Stoltenberg expressed concern Thursday that Russia is continuing its military buildup around Ukraine, and that it has now deployed more troops and military equipment to Belarus that at any time in the last 30 years.Russia now has more than 100,000 troops stationed near Ukraine’s northern and eastern borders, raising concern that Moscow might invade again, as it did in 2014, and destabilize the Ukrainian economy. Russian officials deny that an invasion is planned.“Over the last days, we have seen a significant movement of Russian military forces into Belarus. This is the biggest Russian deployment there since the Cold War,” Stoltenberg told reporters at NATO headquarters in Brussels.

RUSSIA-US (RTRS): The deployment of additional United States troops in Eastern Europe is escalating tensions in the region, the Kremlin said on Thursday, after Washington said it would send 3,000 extra troops to Poland and Romania. Russia has amassed tens of thousands of troops near the borders of Ukraine, demanding that the United States and NATO promise not to allow Kyiv join the Western military bloc, but denying any plans to invade its neighbour. The White House said this week extra troops would shield Eastern Europe from a potential spillover from the Ukrainian crisis.

FED: Fed Governor nominees Raskin, Cook and Jefferson are due to testify before the House at 13:45GMT. The pre-released initial comments from the three didn't reveal any major talking points with a summary provided by our policy team here.

GERMANY FISCAL (BBG): German ruling coalition plans more than EU11 billion tax relief program over the next 5 years, RND reports, citing a draft bill on Covid-19 assistance prepared by the finance ministry. Citizens and businesses to get EU235 million benefit in 2022, EU3.5 billion in 2023, EU4.7 billion in 2024, EU2.7 billion in 2025 and EU440 million in 2026

DATA:

MNI: SPAIN JAN SERVICES PMI 46.6; DEC 55.8

Spanish Services PMI slumps 9.2 points

SPAIN JAN SERVICES PMI 46.6; DEC 55.8

SPAIN JAN COMPOSITE PMI 47.9; DEC 55.4

- Spain's services PMI reading dropped 9.2 points in January, dipping significantly below the consensus forecast of 51.9.

- The composite reading slid 7.5 points to 47.9 in January, over five points weaker than the January forecast of 52.7.

- Surging Omicron cases coupled with inflationary price pressures hit the Spanish service sector particularly hard in January.

- Output prices grew at a record-high pace and demand fell for new business due to high market uncertainty.

MNI: ITALY JAN SERVICES PMI 48.5; DEC 53.0

MNI: FRANCE FINAL JAN SERVICES PMI 53.1; DEC 57.0

MNI: GERMANY FINAL JAN SERVICES PMI 52.2; DEC 48.7

MNI: EURZONE FINAL JAN SERVICES PMI 51.1r; DEC 53.1

Eurozone PMIs slump, Germany recovers

- Spanish services dipped 9.2 points to the lowest reading since February 2021, with both services and composite PMIs fallen five points below forecasts. Spain's services and composite PMIs fell below the breakeven point to 46.6 and 48.5 respectively, implying a contraction for both.

- Italy PMIs dipped about 2.5 points lower than forecasts.

- France confirmed flash estimates, which saw both services and composite readings weaken by a few points.

- Germany confirmed the services flash number, which saw a rebound of 3.5 points, whilst the composite softened 0.5 points from the flash estimate.

- The Eurozone aggregate readings were 0.1 points softer and moderated by 1-2 points on the December prints.

- Chief economist at IHS Chris Williamson stated: “Businesses are reporting subdued demand and ongoing constraints in terms of both labour shortages and raw material supply issues resulting from the pandemic."

- “The slowdown coincides with virus-fighting containment measures having been tightened to the highest since last May across the eurozone amid the surge in COVID-19 cases linked to Omicron."

- “Having been hit to a greater extent by Omicron late last year, service sector activity is already picking up again in Germany and manufacturing output is surging higher."

MNI: EUROZONE DEC PPI +2.9% M/M, +26.2% Y/Y, NOV +23.7% Y/Y

EZ DEC PPI Skyrockets On Rising Energy Prices

- Eurozone producer prices skyrocketed in December, surging by 2.9% over November, taking the annual pace of increase to a staggering 26.2% from 23.7% in November.

- This is slightly above market forecasts, +0.1% above both readings.

- Energy prices surged by 7.0% between November and December for a 73.4% annual pace as natural gas prices jumped in the final month of the year.

- Excluding energy, PPI rose by 0.5% over the month for a 10.0% gain over the final month of 2020.

- However, pipeline inflation was elevated across the board. PPI for intermediate goods accelerated to an annual rate of 18.6% from 18.3% in November, while prices for durable consumer goods rose to 4.8% from 4.7% a month earlier. Non-durable goods PPI accelerated to an annual rate of 4.5% form 3.8% previously.

- Ireland saw the largest jump in industrial prices, jumping +99.2% on the year. This was followed by Denmark at +58.9 and Romania at +42.3%.

FIXED INCOME: Super Thursday: BOE / ECB both due to announce policy

It's a huge day for markets with both the BOE and ECB meetings due this afternoon as well as the three Fed nominees testifying before Congress.

- So far this morning we have seen mixed moves in core fixed income. STIR futures are down around 1-1.5 ticks through Whites and Reds for Eurodollar, Euribor and SONIA futures.

- Bunds and Treasuries are moving in sync with some bull steepening, with 2-year yields down 1.8bp and 1.7bp respectively. Gilts have bear steepened.

- The focus of the BOE meeting will be whether there is a hike, the vote breakdown and the inflation forecasts (particularly the 3-year forecast at market rates). If that forecast is below 2% it would be an implicit signal from the BOE that market pricing is too high.

- Elsewhere for the UK, Northern Irelend issues are coming back into focus, the Ofgem price cap will be announced at 11:00GMT (important for inflation) and Chancellor Sunak will address the House at 11:30GMT.

- For the ECB, today's meeting will present a communication challenge for the ECB as it attempts to affirm the baseline scenario (subsiding inflation this year, no near-term rate hikes) at a time when the Fed and BoE have become more hawkish and inflation fears have been rising globally.

- Fed Governor nominees Raskin, Cook and Jefferson are due to testify before the House. The pre-released initial comments from the three didn't reveal any major talking points but their appearances will be closely analysed none-the-less.

- TY1 futures are unch today at 128-04 with 10y UST yields down -0.6bp at 1.771% and 2y yields down -1.6bp at 1.139%.

- Bund futures are up 0.06 today at 168.72 with 10y Bund yields down -0.2bp at 0.036% and Schatz yields down -1.6bp at -0.483%.

- Gilt futures are down -0.14 today at 122.28 with 10y yields up 1.7bp at 1.272% and 2y yields up 0.6bp at 1.030%.

FOREX: EUR Vols Climbing Ahead of ECB Decision

- Front-end vols across both EUR and GBP are climbing, with overnight implieds for both EUR/USD and GBP/USD at fresh 2022 highs. Moves come ahead of rate decisions from both the ECB and the Bank of England, at which both committees will be quizzed on their tightening plans for this year in the face of hot inflation.

- EUR/USD has drifted back below the 1.13 handle, with GBP/USD either side of 1.3550. The USD is reversing the last few sessions of weakness, most evidently against the JPY, with USD/JPY nearing yesterday's highs of 114.80 despite the late pullback in US equities.

- EUR/CHF is extending the recovery off the late January multi-year lows of 1.0300, topping the 50-dma at 1.0405 ahead of NY hours. 1.0441 marks next resistance - the Jan31 high.

- Outside of the ECB, BoE decisions, central banks remain in focus, with new Fed nominees Raskin, Cook and Jefferson appearing in front of lawmakers. Markets will look to gauge their views on policy in the new inflationary environment post-COVID.

EQUITIES: Tech Reeling From Weak Facebook Earnings

- Japanese markets closed weaker (China remains closed for holidays): Japan's NIKKEI closed down 292.29 pts or -1.06% at 27241.31 and the TOPIX ended 16.64 pts lower or -0.86% at 1919.92.

- European stocks are weaker, with the German Dax down 84.95 pts or -0.54% at 15528.82, FTSE 100 down 7.88 pts or -0.1% at 7575.31, CAC 40 down 27.6 pts or -0.39% at 7088.91 and Euro Stoxx 50 down 30.15 pts or -0.71% at 4191.96.

- U.S. futures are weaker, led by tech, with the Dow Jones mini down 88 pts or -0.25% at 35404, S&P 500 mini down 46.5 pts or -1.02% at 4530.75, NASDAQ mini down 316.25 pts or -2.09% at 14798.25.

COMMODITIES: Weaker Across The Board

- WTI Crude down $0.88 or -1% at $87.39

- Natural Gas down $0.31 or -5.64% at $5.191

- Gold spot down $3.48 or -0.19% at $1803.34

- Copper down $5 or -1.11% at $444.6

- Silver down $0.21 or -0.94% at $22.4417

- Platinum down $5.34 or -0.52% at $1031.57

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/02/2022 | 1230/1230 |  | UK | BOE post-MPC Press Conference | |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 03/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/02/2022 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/02/2022 | 1330/1430 |  | EU | ECB post-policy meeting presser | |

| 03/02/2022 | 1345/0845 |  | US | Senate hearing on Federal Reserve nominees | |

| 03/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/02/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/02/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 04/02/2022 | 0745/0845 | * |  | FR | industrial production |

| 04/02/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/02/2022 | 0900/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 04/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/02/2022 | 1000/1100 | ** |  | EU | retail sales |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.