-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US MARKETS ANALYSIS - Equities Touch Best Levels Since January

Highlights:

- Equities touch best levels since January as Russia-Ukraine ceasefire talks juice sentiment

- Germany 5y yield hits 8 year highs

- US sells $47bln 7y notes after mixed 2y, 5y sales Monday

US TSYS SUMMARY: Treasuries Sell-Off On Cease Fire Hopes

- Cash Tsy yields are up between 4.5-6bps on Russia-Ukraine ceasefire prospects, after yesterday’s sizeable twist flattening amidst large swings.

- 2YY +5.2bps at 2.417%, 5YY +5.7bps at 2.612%, 10YY +4.3bps and 30YY +4.4bps at 2.584%.

- Whilst only a small flattening on the day, 2s10s are so low at now 8bps that it takes another significant step towards inversion, off an earlier low of 5.5bps earlier in the London session. It last saw inversion in Aug-2019 and before that 2006-07.

- TYM2 is down 10+ ticks at 121-12 on average volumes. Recently off a low of 121-08, it remains off initial support of yesterday’s low of 120-30+ when Fed hiking expectations peaked, but equally off yesterday’s high of 122-06 that now forms resistance.

- Continued sizeable supply today with the $47B 7Y auction at 1300ET after yesterday's mixed 2Y and 5Y auctions, along with a return to Fedspeak with Harker (2023 voter) due to give his first post-FOMC thoughts.

- Data: second tier releases with multiple house price measures, consumer confidence from the Conference Board and JOLTS.

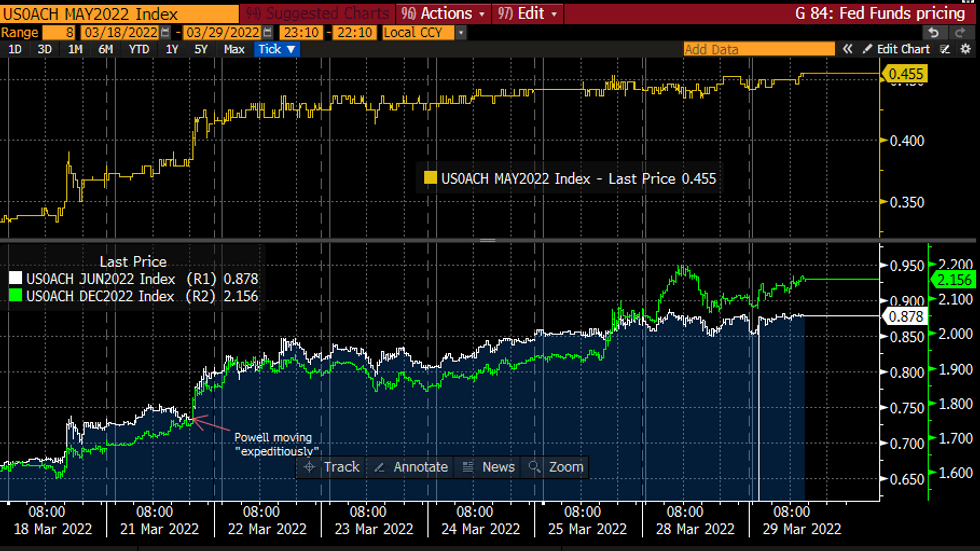

STIR FUTURES: Back To A Further 8.5+ Fed Hikes This Year

- Fed hike expectations by Dec’22 have ground higher through both Asian and European sessions with 215bp now priced in FOMC-dated Fed Funds, up from an earlier ‘low’ of 207bps but still off yesterday’s highs of 220bps.

- As with yesterday, there has been less change for immediate meetings, with May nudging up to 45.5bps but June little changed at highs of 88bps (18% chance of 75bps, 61.5% of 100bps, 20.5% of 125bps).

- Fedspeak is kicked off by NY Fed’s Williams at 0900ET but only with opening and closing remarks at a conference on banking culture, after non-committal comments around the prospects for a 50bp hike last week.

- Philly Fed’s Harker (2023 voter) provides his first post-FOMC thoughts on the economic outlook at 1045ET, followed by a CNBC interview at 1440ET.

FOMC-dated Fed Funds cumulative hikes by meetingSource: Bloomberg

FOMC-dated Fed Funds cumulative hikes by meetingSource: Bloomberg

EGB Summary: German 5yr Yield Hits Highest Since Jun'14

- Bobl is under real pressure, the 5yr Yield is now highest since June 2014.

- Next tech support will be seen at the psychological 128.000, but in yield terms, 0.614% is the next upside yield level, 76.4% retrace of the 2014/2020 fall.

- Reference 128.26, this would equate to 127.43

- German 5/30s test the March low

- German 2yr Schatz, is also nearing the 0%, now highest since December 2014, trading at -0.029%

Chart source: MNI/Bloomberg

EUROPE OPTION FLOW SUMMARY

Eurozone:

OEM2 127.50/126.50ps 1x1.5, bought for 11.5/12 in 15k

ERZ2 100.37/100.50cs bought for 1.5 in 10k

EUROPE ISSUANCE UPDATE

EFSF ISSUANCE: Sep-28 syndication: Final terms - Size set at E3bln

- Long 6Y Fixed (Sept. 5, 2028)

- Spread set earlier at MS-17bp (from guidance of MS-15bp area)

- Books: In excess of E7bln (inc JLM interest)

FOREX: Ceasefire Discussions Boost Risk Proxies, CHF Slips

- After a more placid Asia-Pac session, price action is picking up headed through the NY crossover as markets read positively into headlines concerning Russia and Ukraine. TASS newswire cites a Russian representative as saying that a statement on Ukraine talks is coming "in a few hours", adding that the main tasks of the first phase of the military operation have now been completed. Meanwhile, Ukraine's Podolyak stated that the two sides are discussing a ceasefire - headlines that have boosted risk sentiment and put equity futures at their best levels since late January.

- In currencies, this has translated into EUR strength and weakness among haven currencies - CHF is the poorest performer so far, boosting EUR/CHF back toward the 50-dma at 1.0353.

- Scandi currencies are outperforming into the NY crossover, with regional FX benefiting from the more positive tones emanating from Russia and Ukraine. As a result, NOK and SEK are the top performers so far today.

- Data highlights Tuesday include the March US consumer confidence release as well as JOLTS job openings. The speaker slate includes ECB's Vasle and Fed's Williams and Harker.

FX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E722mln), $1.0950-60(E1.2bln), $1.0975(E1bln), $1.1000(E2.5bln), $1.1086-00(E1.2bln)

- GBP/USD: $1.3400(Gbp1.3bln)

Price Signal Summary: Bear Cycle Extension Once Again In Bunds

- In the equity space, S&P E-Minis are trading higher, extending the bull cycle that started Mar 15. Resistance at 4578.50, Feb 9 high, has been breached. This opens 4663.50, the Jan 18 high. Initial support is at 4407.82, the 20-day EMA. EUROSTOXX 50 futures have continued to trade inside its current range, although futures are attempting to break higher. Recent consolidation still appears to be a bull flag - a continuation pattern that reinforces current bullish conditions. Attention remains on the 50-day EMA at 3861.40. This average represents an important resistance. If cleared, it would further strengthen a bullish short-term theme and open 3965.50, the Feb 23 high.

- In FX, EURUSD breached support at 1.0961 Monday, the Mar 22 low. The break lower reinforces short-term bearish conditions following the recent pullback from 1.1137, Mar 17 high. An extension lower would open 1.0890, the Mar 9 low and 1.0806, the Mar 7 low and bear trigger. Key short-term resistance is unchanged at 1.1137, Mar 17 high. GBPUSD traded sharply lower Monday, extending the pullback from 1.3298, Mar 23 high. Prices have breached 1.3120, the Mar 22 low and this opens 1.3000, Mar 15 low and the key support. USDJPY rallied sharply higher Monday, cresting at a new cycle high and the best levels since 2015 at 125.09. This also resulted in an extension of the extremely overbought condition (the 14-day RSI hit its highest since 2001 on Monday). Current momentum however suggests the USD still has the potential to extend this bull cycle, which would open 125.28 next, Aug 12 2015 high. Initial support is at 121.97, yesterday’s low.

- On the commodity front, Gold is trading lower. Key support is seen at the 50-day EMA that intersects at $1902.7 - just ahead of the recent low of $1895.3 on Mar 15. A break of these levels would strengthen a bearish case. In the Oil space, WTI remains in an uptrend however yesterday’s move lower does highlight potential for a deeper retracement. The contract has traded below the 20-day EMA, at $104.82. A clear break would strengthen a bearish case and signal scope for a move towards the 50-day EMA at $96.44.

- In the FI space, Bund futures remain bearish and are trading lower once again today. The focus is on 156.88, the Mar 8 2018 low (cont). The {GB} Gilts trend condition remains bearish. Futures traded to a fresh cycle low Monday but did rebound from the session low of 119.86. Gains are considered corrective. The break of 120.26, Mar 24 low, marks a resumption of the broader downtrend and the 120.00 handle has been breached. Further weakness would open 119.75, 123.6% retracement of the Feb 15 - Mar 1 climb.

EQUITIES: Cyclical Stocks Lead Europe Gains

- Asian markets closed higher: Japan's NIKKEI closed up 308.53 pts or +1.1% at 28252.42 and the TOPIX ended 18.29 pts higher or +0.93% at 1991.66. China's SHANGHAI closed down 10.564 pts or -0.33% at 3203.939 and the HANG SENG ended 242.66 pts higher or +1.12% at 21927.63

- European stocks are gaining, with the German Dax up 177.58 pts or +1.23% at 14594.5, FTSE 100 up 62.75 pts or +0.84% at 7535.02, CAC 40 up 102.33 pts or +1.55% at 6692.43 and Euro Stoxx 50 up 59.77 pts or +1.54% at 3947.17.

- U.S. futures are a little stronger, with the Dow Jones mini up 101 pts or +0.29% at 34954, S&P 500 mini up 14.5 pts or +0.32% at 4582.5, NASDAQ mini up 41.75 pts or +0.28% at 15027.

COMMODITIES: Brent-WTI Spread Widens

- Oil markets reach a weekly low overnight reacting to possible demand reduction from China.

- Brent has bounced back stronger than WTI with the tight supply picture from Russia having a greater impact on European oil markets

- Brent may be impacted from an expected Arab Light price differential increase by 5$/bbl in May. Arab Light is often a go-to substitute for Russian Urals.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/03/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/03/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 29/03/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/03/2022 | 1445/1045 |  | US | Philadelphia Fed's Patrick Harker | |

| 29/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 30/03/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/03/2022 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/03/2022 | 0130/2130 |  | US | Atlanta Fed's Raphael Bostic | |

| 30/03/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 30/03/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/03/2022 | 0800/1000 | * |  | IT | Industrial Orders |

| 30/03/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at Central Bank of Cyprus | |

| 30/03/2022 | 0810/0910 |  | UK | BOE Broadbent Speaks at NIESR | |

| 30/03/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/03/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/03/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/03/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/03/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/03/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 30/03/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2022 | 1415/1615 |  | EU | ECB Panetta Hearing on Digital Euro at ECON | |

| 30/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/03/2022 | 1700/1300 |  | US | Kansas City Fed's Esther George |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.